- Home

- »

- Medical Devices

- »

-

China Diabetes Devices Market Size, Industry Report, 2030GVR Report cover

![China Diabetes Devices Market Size, Share & Trends Report]()

China Diabetes Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (BGM Devices, Insulin Delivery Devices), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies), By End-use (Hospitals, Diagnostic Centers), And Segment Forecasts

- Report ID: GVR-4-68040-458-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

China Diabetes Devices Market Trends

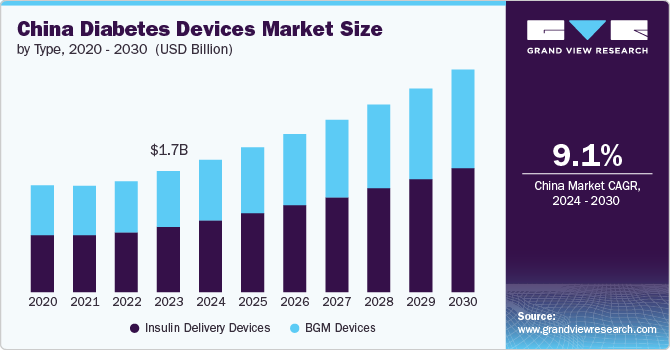

The China diabetes devices market size was estimated at USD 1.73 billion in 2023 and is expected to grow at a CAGR of 9.11% from 2024 to 2030. The growing prevalence of diabetes, driven by urbanization, lifestyle changes, technological advancements, strategic initiatives undertaken by the government, and an aging population, are major factors contributing to the market growth. According to the World Health Organization (WHO), the elderly population of China aged 60 years and above is expected to reach 402 million or around 28% of the country’s population by 2040.

According to the International Diabetes Federation 10th edition 2021, the number of Chinese people living with diabetes is expected to increase from 140.87 million to 164, 07 million from 2021 to 2030. This further is expected to reach 174.43 million in 2045. This increasing diabetes trend is increasing the demand for innovative devices, including glucose meters, insulin pumps, and continuous glucose monitoring systems. The increasing demand for these devices is driving the demand for innovation and availability of diabetes management tools that can improve patient outcomes and quality of life, thereby contributing to market growth.

This increasing demand for advanced devices is offering growth opportunities for the local and international market players in the country’s market, which has significantly contributed to the increasing activity by the companies operating in the market to enhance their market presence. For instance, in January 2024, Trinity Biotech entered into a non-binding Letter of Intent with Bayer to launch a CGM biosensor device in China. The collaboration aims to address the growing diabetes prevalence in China by increasing access to CGM technology and providing innovative, data-driven healthcare solutions for patients and physicians. Such initiatives by the market payers are expected to increase the availability of advanced devices in the market, thereby driving market growth.

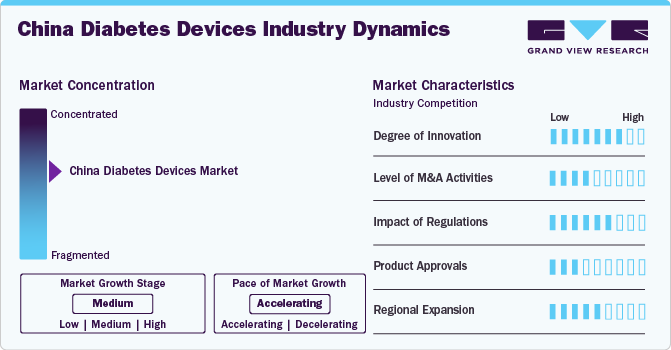

Market Concentration & Characteristics

The market growth stage is high, and the pace of the industry growth is accelerating. The China diabetes devices industry has seen significant innovation, characterized by advancements in technology, growing awareness regarding diabetes care, and efficient results. This transformative shift is evident in the emergence of technologically advanced products such as continuous glucose monitoring (CGM) systems, smart insulin pumps, and advanced insulin delivery devices. These innovations improve the accuracy and effectiveness of diabetes management and provide greater convenience and ease of use for patients.

To expand their customer base and gain a larger industry share, the companies operating in the industry are continuously working on innovation and increasing their product offerings. These initiatives involve upgrading their products, exploring acquisitions, obtaining government clearances, and engaging in important cooperation activities.

China's diabetes deviceshave a high degree of innovation, owing to increasing efforts by industry players to introduce innovative devices to address their increasing demand. This has significantly increased the R&D activities, thereby enhancing the degree of innovation. For instance, in May 2023, Oramed Pharmaceuticals announced that its Chinese partner, HTIT, had completed a Phase 3 clinical trial for its oral insulin product. This milestone marks a significant advancement in the development of oral insulin therapies, which aim to provide a more convenient alternative to traditional injectable insulin for diabetes management.

Companies that manufacture diabetes devices are undertaking merger and acquisition activities. This strategic approach seeks to improve technological capabilities, expand industry reach, and maintain competitiveness. For instance, in March 2024, MTD, a leading medical technology group, acquired the pen needle and blood glucose monitoring (BGM) businesses of Ypsomed, a Switzerland-based diabetes care solution provider in the Chinese industry. The acquisition enables MTD to accelerate growth and enter into new strategic markets such as China and India and strengthen its position in important industries worldwide.

China's diabetes devices industry is regulated by the National Medical Products Administration (NMPA). The NMPA is responsible for regulating drugs and medical devices in the country. The regulatory process for medical devices in China is strict and can be challenging for foreign companies. Manufacturers must obtain NMPA approval before their devices can be marketed and sold in China, which requires extensive clinical data and testing. In recent years, China has made efforts to streamline the regulatory process and encourage innovation in the medical device industry. However, the regulatory environment can offer challenges for companies interested in entering the industry.

New product launches by manufacturers to stay competitive in the industry and the growing demand and adoption of medical imaging devices for orthopedic applications is an important factor driving industry growth. For instance, in June 2024, Novo Nordisk received approval from China's National Medical Products Administration (NMPA) for its type 2 diabetes treatment, Ozempic (semaglutide). The drug, a GLP-1 receptor agonist, has demonstrated effectiveness in controlling blood sugar levels and aiding weight loss.

The growth opportunities offered by the aging population coupled with the high diabetes prevalence in the country are anticipated to attract several global industry players, which can increase their regional presence in the forecast period.

Type Insights

The insulin delivery devices segment accounted for the largest revenue share of over 54.2% in 2023 and is anticipated to grow at the fastest CAGR over the forecast period. Insulin pens are favored for their convenience and ease of use compared to traditional syringes. The increasing focus on patient-centric care has led to innovations in insulin delivery devices, including smart pens that offer features such as dose tracking and reminders, enhancing patient compliance and overall diabetes management. For instance, in February 2023, the China NMPA approved Medtronic's MiniMed 670G BLE, a Hybrid Closed Loop Insulin Delivery System. This innovative device combines an insulin pump, transmitter, and glucose sensor, utilizing advanced algorithms for automatic insulin delivery. It aims to enhance blood glucose control for type 1 diabetes patients aged 14 and older. Such integration of technology is also driving market growth, as it provides comprehensive solutions for diabetes management.

Blood Glucose Monitoring (BGM) devices are expected to witness significant growth from 2024 to 2030. Self-monitoring and continuous glucose monitoring (CGM) devices are witnessing significant demand as they allow patients to track their blood sugar levels in real-time and make informed decisions regarding their diet and medication. The introduction of advanced features in these devices, such as data integration with mobile applications, further enhances patient engagement and adherence to treatment protocols.

Distribution Channel Insights

The hospital pharmacies segment held the largest revenue share of more than 50% in 2023, owing to the important role of hospital pharmacies as primary access points for patients undergoing diabetes care in these healthcare facilities. As hospitals increasingly adopt advanced diabetes device technologies for both inpatient and outpatient care, hospital pharmacies have become essential in providing timely access to crucial diabetes management tools. Moreover, the high compliance of hospital pharmacies with the regulatory standards and quality control measures to ensure the safety and reliability of the devices offered by these facilities further increases the authenticity of devices offered at these distribution channels.

The retail pharmacy segment is expected to witness the fastest growth from 2024 to 2030, owing to the accessibility and convenience offered by retail pharmacies to patients. Retail pharmacies offer a wide range of diabetes care products including medications, self-monitoring glucose devices, insulin delivery equipment, and over-the-counter products. This ease of accessing a wide range of products at one facility increases the reference towards these facilities. Additionally, these facilities stock devices based on factors such as physician preference, profit margin, patient preference, and insurance coverage, ensuring a better availability of products preferred by the patients.

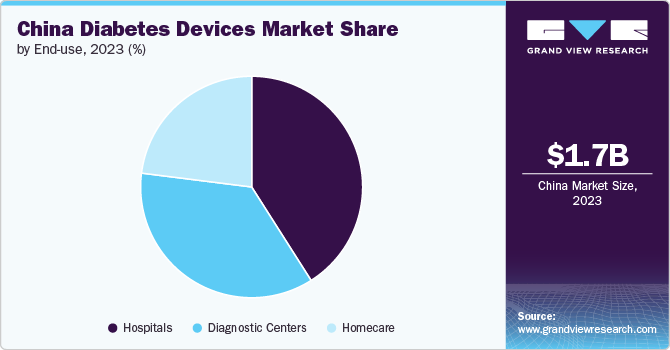

End-use Insights

The hospital segment dominated the market with a share of over 40% in 2023. Patients prefer hospitals for diabetes management because they provide immediate access to a range of diabetes devices, medications, and professional consultations. The Chinese government has also introduced favorable healthcare policies, which have made diabetes care more affordable and accessible within hospital settings. For instance, in November 2021, insulin was added to the country’s bulk buying program by NHSA, which is aimed at increasing the affordability of hospital expenses and increasing the availability of essential medication in the country’s hospitals. As hospitals continue to invest in advanced diabetes technologies and improve their service offerings, they are expected to dominate the market.

The diagnostic centers segment is expected to witness significant growth over the forecast period. This can be attributed to the increasing focus on early disease detection and prevention in the country’s population. Moreover, as people become more conscious about their well-being, they are increasingly accessing these facilities for comprehensive screening tests, including those related to diabetes.

Key China Diabetes Devices Company Insights

The key players operating in the market are working to improve their product offerings by upgrading their products, leveraging important cooperative drives, as well as considering acquisitions and government approvals to increase their client base and get a larger part of the market share. Some major market players operating in the market are Abbott, F. Hoffmann-La Roche Ltd, Medtronic, BD, and others.

Key China Diabetes Devices Companies:

- Abbott

- F. Hoffmann-La Roche Ltd

- Medtronic

- Dexcom, Inc.

- BD

- Ascensia Diabetes Care Holdings AG

- Novo Nordisk A/S

- AstraZeneca

- Sanofi

- Sinocare

Recent Developments

-

In June 2024, Novo Nordisk received approval from China's National Medical Products Administration (NMPA) for its type 2 diabetes treatment, Ozempic (semaglutide). The drug, a GLP-1 receptor agonist, has demonstrated effectiveness in controlling blood sugar levels and aiding weight loss.

-

In June 2023, AstraZeneca's Xigduo XR, a once-daily fixed-dose combination of the SGLT2 inhibitor dapagliflozin and metformin extended-release, was approved by China's NMPA for treating adults with type 2 diabetes. This approval offers a new therapy to address the significant unmet need for effective and convenient treatments that can help reduce complications and improve adherence in this patient population.

-

In November 2021, Microtech Medical Co., Ltd. received approval for its Continuous Glucose Monitoring (CGM) system device, AiDEX G7 from the National Medical Products Administration in China. This innovative device aims to enhance diabetes management by providing real-time glucose monitoring, improving patient outcomes, and facilitating better blood sugar control for individuals with diabetes.

-

In October 2021, EOFlow, a leading developer of wearable drug delivery systems, and Medtronic, a global leader in healthcare technology, announced a joint venture “SINOFLOW Co., Ltd.” to increase the presence of this companies in the country’s large diabetes management market, which includes various medical devices.

-

In May 2021, Metronom Health and Dinova Medtech formed a joint venture to launch a continuous glucose monitoring (CGM) device in China. This CGM system utilizes proprietary Opto-enzymatic technology, offering a minimally invasive alternative to traditional fingerstick meters, providing continuous glucose data with high accuracy. The device aims to enhance patient comfort and reduce infection risks, with a sensor lifespan of up to 14 days.

China Diabetes Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.89 billion

Revenue forecast in 2030

USD 3.18 billion

Growth rate

CAGR of 9.11% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, end-use

Key companies profiled

Abbott; F. Hoffmann-La Roche Ltd; Medtronic; Dexcom, Inc.; BD; Ascensia Diabetes Care Holdings AG; Novo Nordisk A/S; AstraZeneca; Sanofi; Sinocare

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

China Diabetes Devices Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the china diabetes devices market report based on the type, distribution channel, and end-use:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Blood Glucose Monitoring (BGM) Devices

-

Self-monitoring Devices

-

Blood Glucose Meters

-

Testing Strips

-

Lancets

-

-

Continuous Glucose Monitoring Devices

-

Sensors

-

Transmitters

-

Receiver

-

-

-

Insulin Delivery Devices

-

Insulin Pumps

-

Insulin Pens

-

Insulin Syringes

-

Insulin Jet Injectors

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Diabetes Clinics/Centers

-

Online Pharmacies

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Homecare

-

Diagnostic Centers

-

Frequently Asked Questions About This Report

b. The China diabetes devices market size was estimated at USD 1.73 billion in 2023 and is expected to reach USD 1.89 billion in 2024.

b. The China diabetes devices market is expected to grow at a compound annual growth rate of 9.11% from 2024 to 2030 to reach USD 3.18 billion by 2030.

b. Insulin delivery devices dominated the China diabetes devices in type segment market with a share of 54.2% in 2023. This is attributable to their convenience and ease of use compared to traditional syringes.

b. Some key players operating in the China diabetes devices market include Abbott; F. Hoffmann-La Roche Ltd; Medtronic; Dexcom, Inc.; BD; Ascensia Diabetes Care Holdings AG; Novo Nordisk A/S; AstraZeneca; Sanofi; Sinocare

b. Key factors that are driving the China diabetes devices market growth include growing prevalence of diabetes, driven by urbanization, lifestyle changes, technological advancements, strategic initiatives undertaken by the government, and an aging population

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.