- Home

- »

- Medical Devices

- »

-

China Coronary Stents Market Size, Industry Report, 2030GVR Report cover

![China Coronary Stents Market Size, Share & Trends Report]()

China Coronary Stents Market Size, Share & Trends Analysis Report By Product (Bare Metal Stents (BMS), Drug Eluting Stents (DES), Bioresorbable Vascular Scaffold), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-447-7

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

China Coronary Stents Market Size & Trends

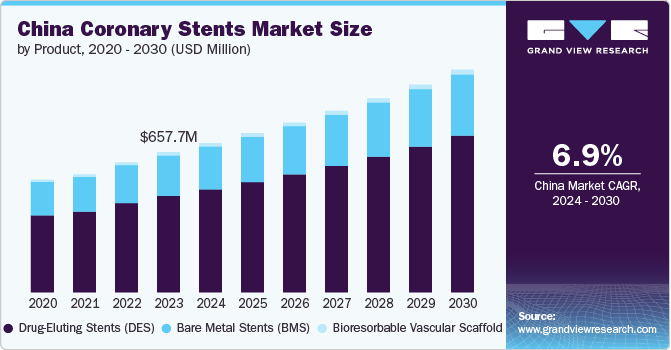

The China coronary stents market size was estimated at USD 657.7 million in 2023 and is projected to grow at a CAGR of 6.9% from 2024 to 2030. The market is experiencing significant growth driven by a combination of factors including the rising prevalence of cardiovascular diseases, an aging population, advancements in medical technology, and increasing healthcare expenditure. As lifestyle-related risk factors such as obesity, diabetes, and hypertension become more prevalent among the Chinese population, the demand for effective interventional cardiology solutions has surged. The Chinese government’s initiatives to improve healthcare infrastructure and access to advanced medical devices have facilitated market expansion.

The rapid pace of technological advancements in the medical device sector is a significant driver for the coronary stents market in China. Innovations such as drug-eluting stents (DES) and bioresorbable vascular scaffolds (BVS) have transformed treatment options for patients with coronary artery disease (CAD). These advanced stents offer improved performance, reduced risk of restenosis, and enhanced patient outcomes. In April 2024, the RESOLUTE ONYX China Single Arm Study evaluated the safety and efficacy of the Medtronic Resolute Onyx zotarolimus-eluting coronary stent system in patients eligible for percutaneous transluminal coronary angioplasty (PTCA), focusing on de novo lesions treatable with the Resolute Onyx Stent System in China. As manufacturers invest in research and development to create more effective and safer products, the adoption of these technologies is expected to increase, thereby driving market growth. China has seen a notable rise in cardiovascular diseases due to lifestyle changes, urbanization, and an aging population. In June 2023, a study in the Journal of Geriatric Cardiology showed that cardiovascular diseases affect about 330 million Chinese, with major conditions including 13 million strokes, 11.39 million with coronary heart disease, 8.9 million heart failures, and others such as pulmonary heart disease, atrial fibrillation, rheumatic heart disease, and congenital heart disease. Factors such as poor dietary habits, sedentary lifestyles, and increased stress levels contribute to this trend. The growing incidence of conditions such as hypertension, obesity, and diabetes further exacerbates the situation. Consequently, there is an increasing demand for effective treatment options such as coronary stenting procedures.

The Chinese government has been actively promoting healthcare reforms aimed at improving access to medical services and enhancing the quality of care. Initiatives such as favorable reimbursement policies for cardiac procedures and investments in healthcare infrastructure are encouraging hospitals and clinics to adopt advanced medical technologies, including coronary stents. Regulatory bodies are streamlining approval processes for new devices, making it easier for manufacturers to bring innovative products to market. This supportive environment fosters growth within the coronary stents sector. In March 2024, the National Healthcare Security Administration noted that China's initiative to centralize procurement significantly reduced heart stent prices by over 90%, simultaneously fostering the uptake of cutting-edge products and broadening the availability of stent implantation procedures. This initiative culminated in an average 93 percent reduction in prices, bringing the cost of each stent down to between USD 98.31 to USD 112.35.

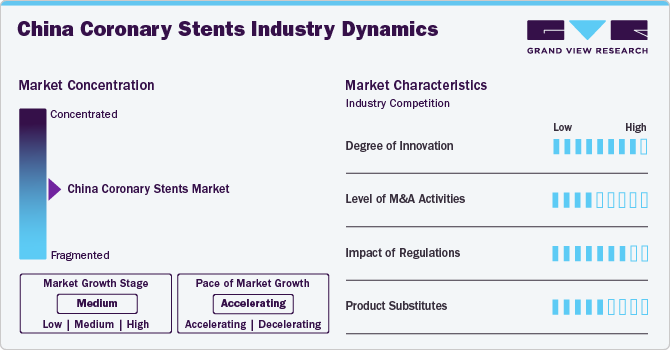

Market Concentration & Characteristics

The degree of innovation in the China coronary stents market is considered high. This is primarily due to the rapid advancements in medical technology and an increasing focus on developing bioresorbable stents, drug-eluting stents with improved efficacy, and materials that enhance biocompatibility. In July 2024, MicroPort in Shanghai announced that its biodegradable cardiovascular stent, Firesorb, had approved by the National Medical Products Administration. This stent is designed to treat coronary artery disease and can fully degrade in the body, significantly reducing the risk of clot-related complications to 0.34 percent.

The level of merger and acquisition (M&A) activity in the China coronary stents market is assessed as moderate. While notable acquisitions have been aimed at consolidating resources and expanding product portfolios, the market remains fragmented with numerous players. Larger companies often seek strategic partnerships or acquisitions to enhance their technological capabilities or gain access to new markets. However, regulatory hurdles and varying regional dynamics can impact the pace of M&A activities.

The impact of regulations on the coronary stents market in China is categorized as high. The Chinese government has stringent regulations governing medical devices, including coronary stents, which require rigorous clinical trials and approvals before products can be marketed. These regulations aim to ensure safety and efficacy but can also slow down the introduction of new technologies into the market. Compliance with both national standards and international guidelines is crucial for manufacturers looking to operate successfully within this space.

Product expansion in the China coronary stents market is viewed as high due to increasing demand for advanced cardiovascular treatments driven by rising incidences of heart diseases among the population. Companies are actively expanding their product lines by introducing various types of stents tailored to specific patient needs, such as those with diabetes or complex lesions. This trend is supported by a growing healthcare infrastructure facilitating broader distribution channels for innovative products.

Product Insights

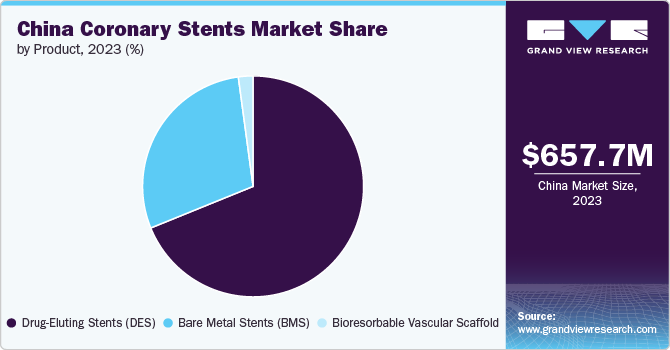

The drug-eluting stents (DES) segment dominated the market in terms of revenue with 68.9% share in 2023. The growing aging population, coupled with lifestyle changes leading to higher rates of conditions such as hypertension and diabetes, has significantly contributed to the demand for DES. Technological advancements in stent design and drug delivery mechanisms have enhanced efficacy and safety profiles of DES, making them a preferred choice among healthcare providers. In February 2024, Frontiers in Cardiovascular Medicine released an article indicating the significant impact of Drug-eluting stents (DES) on the management of coronary artery disease (CAD). These stents are designed with medication carriers that dispense antiproliferative drugs into the blood vessel, thus preventing restenosis.

The bioresorbable vascular scaffold segment is anticipated to be the second fastest growing segment over the forecast period. The market is gaining traction due to its innovative approach to treating coronary artery disease. Growing emphasis on patient-centric care, where there is a shift towards devices that promote natural healing processes without leaving permanent implants is driving the market growth. Bioresorbable scaffolds offer advantages such as reduced risk of late thrombosis and improved vessel function post-implantation. In June 2024, an article in Frontiers in Cardiovascular Medicine highlighted that Bioresorbable scaffolds (BRS), utilized for post-percutaneous coronary intervention (PCI) vascular restoration, and are crafted from either biodegradable polymers or dissolvable metals. The ideal BRS benefits include its gradual absorption, fostering adaptive vascular remodeling, restoring cyclic pulsatility and vessel regulation, normalizing shear stress and strain, and bringing back the normal curvature of the vessels.

Key China Coronary Stents Company Insights

Key players operating in the China coronary stents market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are playing a key role in propelling the market growth.

Key China Coronary Stents Companies:

- Abbott

- Medtronic

- Boston Scientific Corporation

- Biotronik

- MicroPort Scientific Corporation

- Lepu Medical Technology(Beijing) Co.,Ltd

- Biosensors

- Sino Medical Science and Technology Co., Ltd

- Terumo Corporation

- Shenzhen Salubris Pharmaceuticals Co., Ltd

Recent Developments

-

In July 2024, MicroPort Scientific Corporation disclosed that its wholly-owned subsidiary, Shanghai MicroPort Medical (Group) Co., Ltd. (Shanghai MicroPort), was given official clearance by the National Medical Products Administration (NMPA) to market Firesorb, introducing the first of its kind fully bioresorbable cardiac stent to the global market.

-

In July 2022, ahead of the 6th China International Import Expo, Medtronic showcased its Endurant Stent Graft System among its advanced medical technologies, emphasizing its commitment to improving healthcare in China with innovative, precision-driven solutions.

-

In September 2020, OrbusNeich Medical Co. Ltd. had received approval from the National Medical Products Administration (NMPA) in China for its combo bio-engineered sirolimus eluting stent. This stent, the first of its kind, promotes faster endothelial recovery and manages neointimal growth by merging effective pro-healing technology with an abluminal sirolimus release from a biodegradable polymer that entirely disappears within 90 days.

China Coronary Stents Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 700.4 million

Revenue forecast in 2030

USD 1045.4 million

Growth rate

CAGR of 6.9% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product

Key companies profiled

Abbott; Medtronic; Boston Scientific Corporation; Biotronik; MicroPort Scientific Corporation; Lepu Medical Technology(Beijing)Co.,Ltd; Biosensors; Sino Medical Science and Technology Co., Ltd; Terumo Corporation; Shenzhen Salubris Pharmaceuticals Co., Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

China Coronary Stents Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the China coronary stents market report based on product:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Bare Metal Stents (BMS)

-

Drug-Eluting Stents (DES)

-

Biodegradable

-

Non-Biodegradable

-

-

Bioresorbable Vascular Scaffold

-

Frequently Asked Questions About This Report

b. The China coronary stents market size was estimated at USD 657.7 million in 2023 and is expected to reach USD 700.4 million in 2024.

b. The China coronary stents market is expected to grow at a compound annual growth rate of 6.9% from 2024 to 2030 to reach USD 1045.4 million by 2030.

b. The drug-eluting stents (DES) segment dominated the market in terms of revenue with 68.86% share in 2023. The growing aging population, coupled with lifestyle changes leading to higher rates of conditions such as hypertension and diabetes, has significantly contributed to the demand for DES.

b. Some prominent players in the China coronary stents market include: • Abbott • Medtronic • Boston Scientific Corporation • Biotronik • MicroPort Scientific Corporation • Lepu Medical Technology(Beijing) Co.,Ltd • Biosensors • Sino Medical Science and Technology Co., Ltd • Terumo Corporation • Shenzhen Salubris Pharmaceuticals Co., Ltd

b. The coronary stents market in China is experiencing significant growth driven by a combination of factors including the rising prevalence of cardiovascular diseases, an aging population, advancements in medical technology, and increasing healthcare expenditure

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."