- Home

- »

- Beauty & Personal Care

- »

-

China Contrast Media Injectors Market Size, Report, 2030GVR Report cover

![China Contrast Media Injectors Market Size, Share & Trends Report]()

China Contrast Media Injectors Market Size, Share & Trends Analysis Report By Product (Injector Systems, Consumables), By Type (Single Head Injectors, Dual Head Injectors), By Application, By End Use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-407-3

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

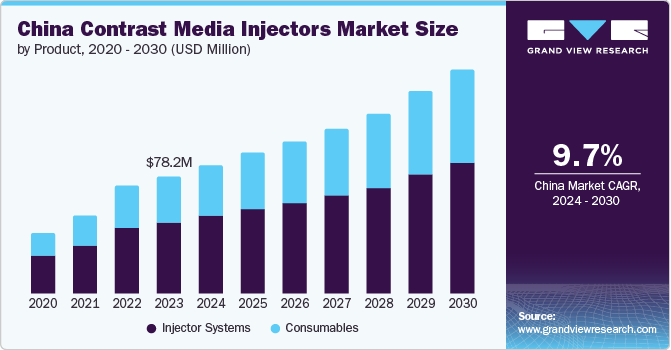

The China contrast media injectors market size was estimated at USD 78.2 million in 2023 and is projected to grow at a CAGR of 9.7% from 2024 to 2030. Several vital factors primarily drive the market growth, including the increasing prevalence of chronic diseases, advancements in medical imaging technologies, a growing geriatric population, and rising healthcare expenditures. According to the World Health Organization (WHO), 28% of China's population is estimated to be individuals aged 60 and older by 2040. Each of these drivers plays a crucial role in shaping the demand for contrast media injectors, essential for enhancing diagnostic imaging procedures' quality. As healthcare systems evolve and prioritize early diagnosis and treatment, the need for effective contrast agents and delivery systems becomes more pronounced.

One of the most significant drivers for contrast media injectors market is the rising incidence of chronic diseases such as cancer, cardiovascular diseases, and diabetes. According to a report from the WHO, non-communicable diseases accounted for approximately 74% of all deaths in China in 2023. This alarming statistic highlights the need for advanced diagnostic tools to facilitate early detection and treatment. Using contrast media injectors enhances imaging techniques such as MRI and CT scans, making it easier to visualize internal structures and identify abnormalities associated with these chronic conditions.

Technological innovations in medical imaging have significantly contributed to the growth of contrast media injectors market. Developing high-resolution imaging modalities such as 3D imaging and functional MRI increased the demand for sophisticated contrast agents to provide more explicit images. As hospitals and clinics invest in state-of-the-art equipment to enhance patient care, they are also likely to upgrade their contrast media injector systems to ensure compatibility with new technologies.

Finally, rising healthcare expenditures across China is fostering an environment conducive to growth within the contrast media injectors market. The Chinese government actively invests in healthcare infrastructure as part of its commitment to improving public health services. According to a report, China’s healthcare spending reached approximately USD 1 trillion, reflecting a year-on-year increase driven by policy reforms to expand access to quality care. This investment surge supports technological advancements and encourages hospitals and clinics to procure modern medical devices including contrast media injectors that enhance diagnostic capabilities.

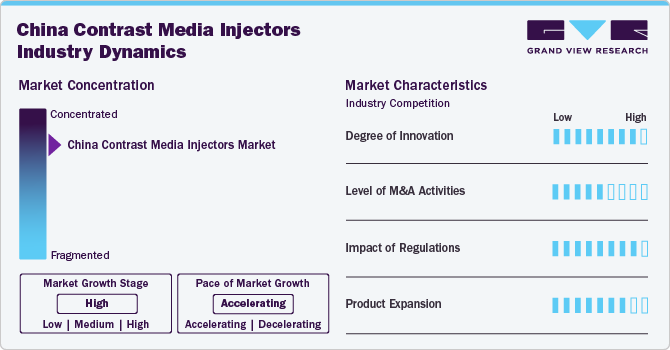

Market Concentration & Characteristics

Degree of innovation in China contrast media injectors market is high, driven by technological advancements and the increasing demand for precision in medical imaging. Companies focus on developing intelligent injectors that integrate with imaging systems, enhancing patient safety and workflow efficiency. For instance, automated contrast media injectors such as Guerbet offer Optiray injector systems, also gaining popularity in China. These systems provide automated contrast delivery and are integrated with various imaging modalities, enhancing workflow efficiency in hospitals and diagnostic centers.

Level of merger and acquisition (M&A) activity within China's contrast media injectors market is medium. This is primarily driven by the increasing demand for advanced imaging technologies and need for companies to enhance their product portfolios through strategic partnerships. Major companies in the medical device sector are pursuing strategic alliances and acquisitions to expand their product portfolios and strengthen their market presence.

Impact of regulations on the Chinese contrast media injectors market is high, as stringent guidelines govern the approval and use of medical devices. The National Medical Products Administration (NMPA) enforces rigorous standards for safety and efficacy, influencing product development timelines. Recent regulatory updates have streamlined approval processes for innovative devices, yet compliance remains a significant hurdle for new entrants aiming to penetrate the market.

Product expansion, the level of activity can be classified as high. Companies are continuously innovating and launching new products to meet the evolving needs of healthcare providers and patients. For example, Siemens Healthineers launched a new line of automated contrast media injectors designed explicitly for outpatient settings in early 2023. This product expansion is supported by a growing focus on enhancing patient safety and improving workflow efficiency within radiology departments.

Product Insights

Injector systems held the largest revenue share of 60.8% in 2023, primarily driven by several key factors. The increasing prevalence of chronic diseases such as cancer and cardiovascular disorders necessitates advanced imaging techniques, which rely heavily on contrast media for accurate diagnosis. This led to a surge in demand for high-quality injector systems that deliver precise doses of contrast agents safely and efficiently. Additionally, technological advancements in injector systems, including automated features and improved safety mechanisms, enhanced their usability and reliability, further propelling market growth. For instance, dual-head injectors such as SinoPower-D by Sino MDT, a double-channel CT injector compatible with any brand of CT scanners, allow for simultaneous administration of multiple contrast agents, optimizing imaging procedures and reducing patient wait times.

The consumables segment is expected to grow at the fastest CAGR of 10.6% over the forecast period. The rising number of diagnostic imaging procedures, fueled by an aging population and greater awareness of early disease detection, significantly contributes to this growth. Consumables include syringes, tubing, and other disposable items essential for effectively operating contrast media injectors. . For instance, disposables for Ulrich Medical's CT and MRI contrast injectors consist of the pump tubing or Easy-Click-Cassette and the patient tubing, allowing for a single daily injector setup.

Type Insights

The single-head injectors segment held the largest revenue share of 43.8% in 2023. Single-head injectors are known for their simplicity and ease of use, making them a preferred choice in various medical settings, particularly in hospitals and diagnostic imaging centers where efficiency is paramount. Their design allows precise control over injection process, which is crucial for ensuring accurate imaging results during procedures such as CT scans and MRIs. Single-head injectors are used in angiography; for instance, the Illumena Néo single-head injector from Guerbet offers power, performance, and versatility. It allows users to easily switch between ANGIO-CARDIAC, ANGIO-PERIPHERAL, and CT modes.

The syringeless injectors segment is expected to grow at the fastest CAGR of 10.9% during the forecast period. Syringeless power injectors have recently become popular to cut down on contrast media waste. These devices offer enhanced patient comfort and reduced pain during administration, which is increasingly important in a healthcare environment that prioritizes patient experience. Technological advancements in syringeless injectors, such as needle-free delivery systems, significantly improved their efficiency and reliability, making them more appealing to healthcare providers and patients. For instance, GE Healthcare's CT Motion injector allows for direct injection from a contrast media container, eliminating the need for traditional syringes.

Application Insights

The radiology segment led the market and accounted for more than 46.9% of the revenue share in 2023. The increasing prevalence of chronic diseases such as cancer and cardiovascular disorders necessitates advanced imaging techniques, which rely heavily on contrast media for accurate diagnosis and treatment planning. Additionally, the rising number of radiological procedures performed annually underscores this trend; for example, the Chinese healthcare system saw a marked increase in CT and MRI scans over recent years, reflecting a shift towards more sophisticated diagnostic practices. According to the National Center for Biotechnology Information (NCBI), the use of CT scans in Taiwan increased consistently from 2000 to 2013, rising from 24,257 to 60,351 scans per million people annually, with an average yearly growth rate of 7.4 ± 5.9%.

The interventional cardiology segment is anticipated to witness the fastest growth at a CAGR of 10.7% over the forecast period. The rising prevalence of cardiovascular diseases in China necessitates advanced diagnostic and therapeutic interventions. This leads to increased demand for contrast media injectors that enhance imaging quality during procedures such as angiography and stenting. Technological advancements, in contrast to media formulations and injector systems, also improved safety profiles and patient outcomes, further propelling the market growth.

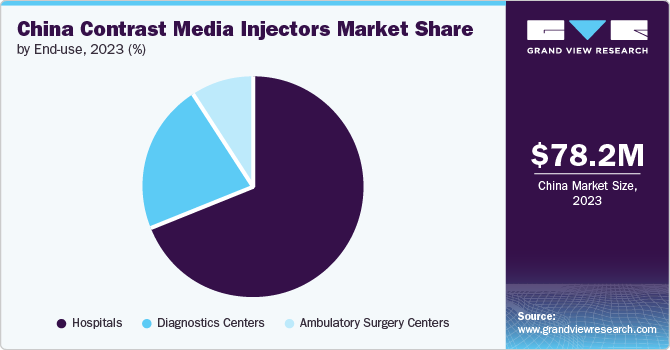

End Use Insights

The hospitals segment dominated the China contrast media injector market with a revenue share of 68.8% in 2023, driven by factors such as the growing prevalence of chronic diseases, increasing demand for diagnostic imaging procedures, and rising adoption of advanced technologies. Hospitals' increasing adoption of advanced imaging modalities, such as MRI and CT scans, has driven the demand for contrast media injectors. Additionally, the growing incidence of chronic diseases, such as cancer and cardiovascular diseases, has led to an increase in the number of diagnostic imaging procedures performed in hospitals, further boosting the demand for contrast media injectors.

The diagnostics centers segment is expected to witness the fastest growth at a CAGR of 9.2% from 2024 to 2030, driven by increasing demand for advanced imaging techniques and a rise in chronic diseases requiring diagnostic imaging: enhanced healthcare infrastructure and government initiatives promoting early disease detection fuel this growth. For instance, expanding private diagnostic facilities and technological advancements in imaging modalities such as MRI and CT scans are pivotal.

Key China Contrast Media Injectors Company Insights

The Chinese contrast media injectors market is characterized by a competitive landscape dominated by several key players holding a significant market share. These companies are developing and manufacturing advanced contrast media injectors, essential for enhancing imaging quality in medical diagnostics such as CT and MRI scans. The market is witnessing a trend towards technological advancements, including integrating automation and digital solutions to improve efficiency and patient safety.

Key China Contrast Media Injectors Companies:

- Bracco Group

- Bayer HealthCare LLC

- GE Healthcare

- Ulrich Medical

- Guerbet Group

- Medtron AG

- Nemoto Kyorindo Co., Ltd.

- Hong Kong Medi Co Limited

Recent Developments

-

In May 2022, Bayer Korea launched the MEDRAD Centargo, a CT injection device approved by the Ministry of Food and Drug Safety in January. This reflects increasing use of contrast media injectors in Chinese hospitals to improve imaging quality and patient outcomes.

China Contrast Media Injectors Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 149.3 million

Growth rate

CAGR of 9.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, application, end use

Key companies profiled

Bracco Group; Bayer HealthCare LLC; GE Healthcare; Ulrich Medical; Guerbet Group; Medtron AG; Nemoto Kyorindo Co., Ltd.; Hong Kong Medi Co Limited

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

China Contrast Media Injectors Market Report Segmentation

This report forecasts revenue growth in China and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the China contrast media injectors market report based on product, type, application and end use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Injector systems

-

CT Injector Systems

-

MRI Injector Systems

-

Cardiovascular/Angiography Injector Systems

-

-

Consumables

-

Syringes

-

Tubing

-

Others

-

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Single Head Injectors

-

Dual Head Injectors

-

Syringeless Injectors

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Radiology

-

Interventional Cardiology

-

Interventional Radiology

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostics Centers

-

Ambulatory Surgery Centers

-

Frequently Asked Questions About This Report

b. The China contrast media injectors market size was estimated at USD 78.2 million in 2023 and is expected to reach USD 85.5 million in 2024.

b. The China contrast media injectors market is expected to grow at a compound annual growth rate of 9.7% from 2024 to 2030 to reach USD 149.3 million by 2030.

b. Injector systems dominated the China contrast media injectors market with a share of 60.8% in 2023. This is attributable to their widespread use in the detection and treatment of vascular disease, cancer, orthopedic injuries, and disorders. Moreover, technological advancements and the launch of new products are expected to propel market growth further.

b. Some key players operating in the China contrast media injectors market include B. Braun Melsungen AG; Becton, Dickinson and Company (BD); GE Healthcare; Siemens Healthineers; Medtron AG; Canon Medical Systems Corporation; Shimadzu Corporation; Hologic Inc.; Hitachi Ltd.; and Bracco Diagnostics Inc.

b. Key factors that are driving the market growth include growing Healthcare Infrastructure, Rising Prevalence of Chronic Diseases and the growing number of diagnostic imaging procedures, including CT scans and MRIs, propel the need for efficient and accurate contrast media injection systems.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."