- Home

- »

- Medical Devices

- »

-

China Condom Market Size & Share, Industry Report, 2030GVR Report cover

![China Condom Market Size, Share & Trends Report]()

China Condom Market (2024 - 2030) Size, Share & Trends Analysis By Material Type (Latex, Non-latex), By Product (Male Condom, Female Condom), By Distribution Channel (Mass Merchandizers, Drug Stores), And Segment Forecasts

- Report ID: GVR-4-68040-279-5

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

China Condom Market Size & Trends

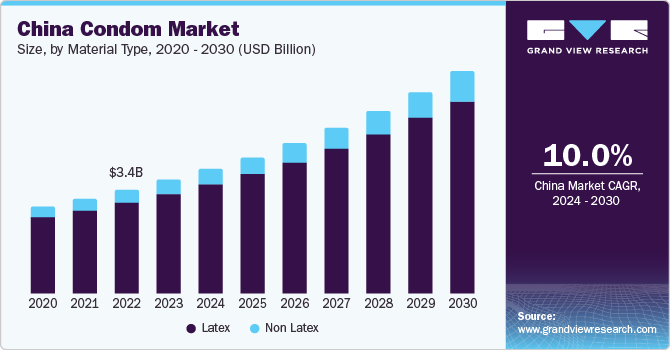

The China condom market size was estimated at USD 3.69 billion in 2023 and is projected to grow at a CAGR of 10.0% from 2024 to 2030. The increasing health and safety concerns, growing consumer awareness about sexual health, availability of a variety of products, and supportive government initiatives are some of the factors driving the growth of the market.

According to a report by Scientific Research Publishing Inc., various initiatives are undertaken by the Chinese government for sex education among youth. For instance, the Article 40 of the Law of the People’s Republic of China on the Protection of Minors was implemented in June 2021, ordering provision of age-appropriate sex education for minors in schools and kindergartens.

According to UNFPA China, in 2022, China reported an increased abortion rate and increased need for contraception in the population that is still unmet. The government is undertaking initiatives to raise awareness and promote the use of contraceptives in the younger generation to control the spread of HIV and other STIs, unintended pregnancies, and to educate regarding sexual awareness and sexual harassment in the country

The prevalence of STDs in China is increasing with time creating an urge to control the spread of STDs and maintain sexual well-being in the Chinese population. According to Wisevoter, in 2023, China had approximately 17,000 cases of STDs per 100,000 inhabitants with a 0.04% HIV prevalence rate. This is expected to increase the demand for condoms in the market for the prevention of sexually transmitted diseases and AIDS. The increasing prevalence of STDs in China is attributed to factors such as a growing sex industry, increased sexual activity among young people, and a lack of comprehensive sex education. Additionally, the use of social media and online dating platforms has made it easier for individuals to engage in casual sexual encounters, potentially increasing the risk of contracting STDs.

According to the International Journal of Dermatology and Venereology, in 2019, 50,874 new cases of genital chlamydial infection were reported in China, with an incidence rate of 55.32 cases per 100,000 inhabitants, comprising about a 9.98% increase from 2018. To address the growing concern of STDs, the Chinese government has launched various campaigns and initiatives. These include free or subsidized STD screening programs, public awareness campaigns, and efforts to improve sex education in schools.

The government has also been working on strengthening the surveillance and reporting systems for STDs to better understand the epidemiology and trends in the country. Although the prevalence of HIV/AIDS in China has been relatively stable in recent years, the country still faces a significant burden due to the large number of people living with the virus.

Market Concentration & Characteristics

The market growth stage is high and the pace is accelerating. The China condom market is characterized by a moderate degree of innovation owing to the increasing research and development with economic product prices driving the market. The research on high-quality materials with capability to control birth and prevent transmission of STDs is driving the R&D activities in the market.

The threat of substitutes is expected to be moderate in the market. Substitutes for condoms include birth control pills, IUDs, and emergency contraceptive pills. While condoms are considered an effective contraceptive, majority of the adult population prefers long-term contraceptives. However, the threat of substitutes is reduced due to factors such as increasing prevalence of HIV infection.

Material Type Insights

The latex condoms segment held the largest revenue share of 87.7% in 2023. The launch of new products and rising demand from aging baby boomers are expected to boost the market for these condoms over the forecast period. Latex condoms are highly effective in prevention of transmission of STDs and birth control; hence, the majority of the brands available in the market are made with latex, a form of natural rubber. It is more durable, flexible, and provides effective contraception and protection, providing safe sex.

The non-latex condoms segment is estimated to witness the fastest growth during the forecast period. This is attributed to some of the benefits of these condoms over latex condoms such as relatively lesser thickness, odorless, and non-allergic properties. Non-latex condoms evolved from the need for latex alternatives due to the number of allergy cases reported for latex condoms. However, non-latex condoms are more expensive than latex condoms and are less effective in preventing viral infections, such as STDs and HIV, compared to latex condoms, which may restrain the segment growth.

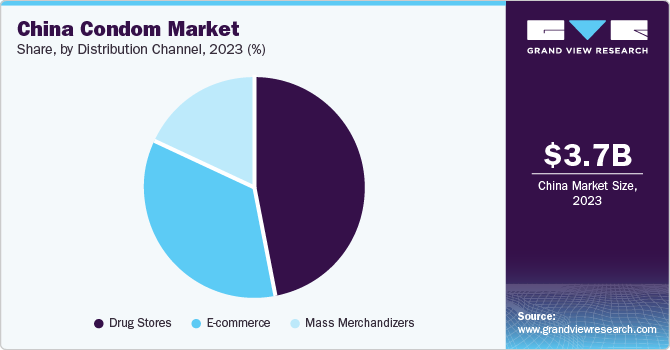

Distribution Channel Insights

The drug stores segment dominated the market with the largest revenue share in 2023. The growth is attributed to factors such as the easy availability and access to drug stores. However, the trend is moving towards e-commerce due to closed markets and restrictions on physical movement during the pandemic. E-commerce is expected to exhibit the fastest growth during the forecast period. Discrete delivery services and freedom to choose on e-commerce platforms are anticipated to fuel the segment growth.

Digitalization in recent times has resulted in improving access to the internet in urban and rural parts of the country, resulting in scope for significant growth for e-commerce platforms. Key players such as Church & Dwight and Sagami are focusing mostly on aggressive online marketing strategies to promote their condom brand, thus reflecting the importance and potential of e-commerce.

Product Insights

The male condom segment dominated the market with largest revenue share in 2023. The growth of this segment can be attributed to factors such as manufacturers' focus on the production of male condoms, open-mindedness regarding their use as compared to female condoms, and diverse portfolio. Further, the evolving sexual norms in rural China have led to a rapid increase in high-risk sexual behavior among young rural residents. To combat the spread of HIV/AIDS, prevention strategies must encompass comprehensive education aimed at encouraging a delayed initiation of sexual activity, promoting safer sexual practices, and advocating for consistent condom use among the youth.

The female condom segment is estimated to witness the fastest growth during the forecast period. Female condoms are being increasingly accepted for reducing the risk of STIs and unplanned pregnancy. In January 2019, a female condom was given a genderless rebranding by the FDA and was assigned a generic name “single-use internal condom.” It was classified as an over-the-counter device. The World Health Organization (WHO) has set a stringent prequalification procedure for female condoms that is expected to hinder the supply of female condoms in the market, simultaneously creating a huge scope for companies to enter this segment in the market.

Key China Condom Company Insights

Some of the key players operating in the market include Church & Dwight Co, Inc.; Okamoto; Sagami; Beilile; Elasun, Guangdong Nox Technology Co, Ltd., and Guangzhou Double One Latex Products Co, Ltd. among others

-

Church & Dwight Co., Inc. is the parent company of the well-known condom brand Trojan and is a major player in the sexual wellness sector.

-

DONLESS, is a Chinese condom brand that provides users with high-quality condoms made from natural latex, offering a variety of options to cater to different preferences and needs.

-

Guangdong Nox Technology Co., Ltd. is a Chinese company involved in the production of condoms and other products.

-

Guangzhou Double One Latex Products Co., Ltd. is a Chinese company specializing in the production of latex condoms.

Key China Condom Companies:

- Beilile

- Church & Dwight Co, Inc. (Trojan)

- Daxiang

- Donless

- Elasun

- Guangdong Nox Technology Co, Ltd.

- Guangzhou Double One Latex Products Co, Ltd.

- Guilin Latex Factory

- Momohanqing

- Okamoto

- Qingdao Double Butterfly Group Co, Ltd.

- Qingdao London Durex Co, Ltd.

- Regenex Pharmaceuticals, Ltd.

- Sagami

- Shanghai Mingbang Rubber Products Co, Ltd.

- Shenyang Tiandi Latex Co, Ltd.

- Shenzhen Wisdom Trade Co, Ltd.

- Shenzhen Zishi Technology Co, Ltd.

- Sixsex

- Wuhan Jissbon Sanitary Products Co, Ltd.

Recent Developments

- In June 2022, Winner Medical Co., Ltd. announced that it had acquired Guilin Latex (Guilin Zizhu Latex Products Co., Ltd.). With this transaction, Winner Medical aimed to expand its products into the medical latex industry.

China Condom Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.06 billion

Revenue forecast in 2030

USD 7.24 billion

Growth rate

CAGR of 10.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material type, product, distribution channel

Country scope

China

Key companies profiled

Beilile; Church & Dwight Co; Inc. (Trojan); Daxiang; Donless; Elasun; Guangdong Nox Technology Co, Ltd.; Guangzhou Double One Latex Products Co, Ltd.; Guilin Latex Factory; Momohanqing; Okamoto; Qingdao Double Butterfly Group Co, Ltd.; Qingdao London Durex Co, Ltd.; Regenex Pharmaceuticals; Ltd.; Sagami; Shanghai Mingbang Rubber Products Co, Ltd.; Shenyang Tiandi Latex Co, Ltd.; Shenzhen Wisdom Trade Co, Ltd.; Shenzhen Zishi Technology Co, Ltd.; Sixsex; Wuhan Jissbon Sanitary Products Co, Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

China Condom Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest vertical trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the China condom marketreport based on material type, product, and distribution channel:

-

Material Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Latex

-

Non Latex

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Male Condoms

-

Female Condoms

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Mass Merchandizers

-

Drug Stores

-

E-commerce

-

Frequently Asked Questions About This Report

b. The China condom market size was estimated at USD 3.69 billion in 2023 and is expected to reach USD 4.06 billion in 2024.

b. The China condom market is projected to grow at a compound annual growth rate (CAGR) of 10.0% from 2024 to 2030 to reach USD 7.24 billion by 2030.

b. The latex condoms segment held the largest revenue share of more than 85% of in 2023. Latex and non-latex material type are key type segments in the China condom market. The launch of new products and rising demand from aging baby boomers are expected to boost the market for latex and non-latex condoms over the forecast period.

b. Some of the key players operating in the market include Church & Dwight Co, Inc.; Okamoto; Sagami; Beilile; Elasun, Guangdong Nox Technology Co, Ltd., Guangzhou Double One Latex Products Co, Ltd.

b. The increasing health and safety concerns, growing consumer awareness about sexual health, availability of variety of products, and supportive government initiatives are some of the factors driving the growth of the China condom market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.