China Companion Animal Health Market Size, Share & Trends Analysis Report By Animal Type (Dogs, Cats, Equine), By Product (Pharmaceuticals, Diagnostics), By Distribution Channel (Retail, E-commerce), By End-use (Hospitals & Clinics), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-679-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

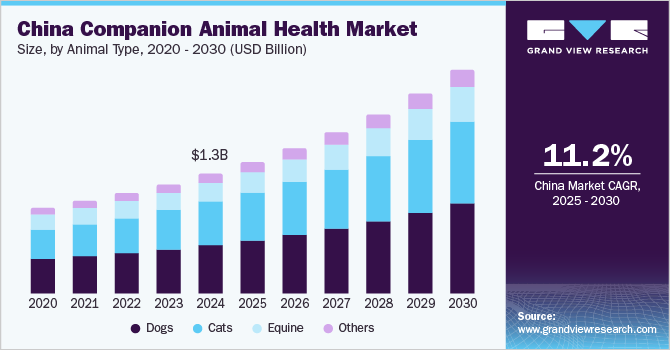

The China companion animal health market size was estimated at USD 1.26 billion in 2024 and is expected to grow at a CAGR of 11.22% from 2025 to 2030. The growing companion animal population and increasing incidence of diseases in animals are key drivers contributing to market growth in the country. For instance, according to the data published in August 2024, China's urban pet population is projected to surpass 70 million by 2030, nearly double the number of children under the age of four, which is expected to drop below 40 million.

This sharp demographic shift is attributed to the reluctance of young Chinese to start families, a trend influenced by economic pressures, changing social norms, and urban lifestyles. This surge in pet ownership is driving the need for vaccines, medications, preventive care, and advanced treatments to ensure the health and well-being of pets. Furthermore, the growing middle class and the humanization of pets are amplifying this trend, making pet healthcare an integral part of household spending in urban China.

Chinese pet parents spent about USD 40 billion annually on their pets, and this trend was anticipated to increase over time. According to the “2023-2024 China Pet Industry White Paper”, China has become one of the largest consumer of pet health products in the world. This factor combined with growing initiatives by market players is expected to propel the market growth. For instance, in January 2024, Zoetis, Inc. introduced an expansion to its Vetscan Imagyst diagnostics platform, incorporating AI urine sediment analysis, enabling swift and precise in-clinic analysis for veterinarians to expedite treatment decisions, enhancing care for canine & feline patients.

In addition, infectious diseases caused by virulent pathogens may seriously affect the animals way of life and lifespan. The demand for various preventive and treatment options, such as vaccines and pharmaceuticals, is anticipated to increase with growing pet health awareness. Many veterinarians and clinicians recommend screening pets for infectious diseases annually. This can enable timely detection of communicable diseases, ensure treatment, and may also contribute to prevention of complex cases. The growing incidence of zoonoses, pet health concerns, and product developments by market players is expected to fuel the segment.

Market Concentration & Characteristics

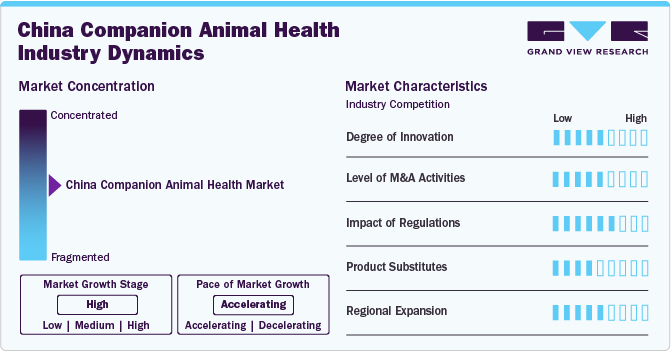

The China companion animal health industry exhibits a high market concentration. The market growth stage is high, and the pace of the market growth is accelerating. One major factor propelling the market growth is rising government initiatives. These initiatives are aimed at enhancing animal welfare, and preventing the spread of diseases. Governments establish regulations and standards for the approval, manufacturing, distribution, and use of veterinary pharmaceuticals, vaccines, & feed additives. For instance, in October 2024, China National Medical Products Administration (NMPA) announced a plan that allows the production of biologics to encourage foreign and domestic manufacturers to relocate or expand operations in China. This initiative is expected to boost innovation and efficiency in the biopharmaceutical industry, making it easier for companies to produce critical products such as, vaccines, monoclonal antibodies, and other innovative treatments. It will lead to more accessible and cost-effective veterinary biologic and strengthen the country’s role as a global hub for biologics production for the companion animal health market, further driving market growth.

Degree of innovation in the market is moderate, driven by technological advancements, research, and consumer demand for more effective and convenient solutions for their pets. For instance, in 2024 Zoetis expanded its R&D facility by creating the Automation & Data Sciences group. The company has plans to utilize advance AI tools to discover new drugs and assist in faster diagnostic and effective treatments in animal health.

Level of merger and acquisition activities in the market is moderate, with companies strategically acquiring or merging with others to expand their product portfolios, enhance their market presence, and gain competitive advantages. For instance, in April 2024, Kirkland & Ellis LLP suggested Phibro Animal Health Corporation to acquire portfolio of medicated feed additives and water-soluble products from Zoetis Inc. for USD 350 million. This portfolio includes over 37 product lines and one manufacturing facility in China along with five others in different countries.

Since strict laws control the creation, production, marketing, and distribution of veterinary products, regulations have a significant impact on the market. Animal drug approvals are supervised by regulatory agencies like the Ministry of Agriculture and Rural Affairs (MARA) to guarantee that safety and efficacy requirements are satisfied before goods are released onto the market.

Level of product substitute in the market is moderate to high. Substitutes for pharmaceutical drugs, such as herbal supplements, CBD-based treatments, and homeopathic remedies, are gaining popularity for managing pain, anxiety, or inflammation in pets. Moreover, health-monitoring devices, such as smart collars or trackers, offer preventive care by detecting early signs of health problems, reducing the need for frequent vet visits or medications.

Regional expansion in the market is moderate as companies seek opportunities to broaden their geographical footprint through strategic partnerships, collaborations, or establishing subsidiaries abroad. For instance, in May 2023, Kuehne+Nagel partnered with Elanco to healthcare logistics presence in the region and address the growing need for animal healthcare in Greater China.

Animal Type Insights

The dogs segment accounted for the largest revenue share of 40.57% in 2024. These high numbers can be attributed to increasing population of pet dogs in China. According to recent statistics, China is home to 54.29 million pet dogs. This trend is anticipated to increase in coming years, owing to growing consumption and commercial penetration of dog products & services. Pet owners are also more willing to spend on their pet’s health due to changing perceptions and societal shifts. As more pet parents treat their pet dogs as family members, the demand for timely and preventive veterinary care products & services is expected to increase over time.

The cat segment is expected to grow at the fastest CAGR over the forecast period. According to a whitepaper on China’s pet industry by PwC, 88% of pet parents in the country are female. About 50% were estimated to be single and 50% were estimated to be millennials born after 1990. Also, according to the data published by CHINA SCIO in June 2023, Tianjin-based pet food company Yuanchuangpinzhi has been operating two automated production lines, including one for canned cat food, running at full capacity since September 2022. Such initiatives by the local players and growing awareness about pet health is expected to fuel the market, presenting opportunities for players.

Product Insights

The pharmaceuticals segment accounted for the largest revenue share of 44.45 % in 2024. Advancements in pet medicine, including new drugs and treatments, provide more options to manage health conditions and are expected to drive pharmaceutical demand. Positive FDA assessments for drugs and manufacturing sites in the country will probably increase demand for pharmaceuticals, further boosting market growth. For instance, in April 2024, Boehringer Ingelheim Biopharmaceuticals China received approval for supply in EU and US markets for its OASIS manufacturing site in Shanghai. This advancement in regulatory compliance highlights the country's increasing alignment of pharmaceutical production with global quality standards, including ICH and GxP regulations.

The diagnostic segment is anticipated to grow at the fatsest CAGR over the forecast period. Growing awareness about animal diseases, pet expenditure, developing veterinary healthcare infrastructure, and initiatives by key market players are expected to fuel the market over the coming years. NRP Group in China (now a part of Boehringer Ingelheim) has set up more than 1,400 central hospitals, referral centers, specialist hospitals, and community hospitals in 80+ core cities across the country. It owns over 50% of high-end MRI/CT facilities in the industry. In addition, the NRP Group serves a large customer base of over 10 million pet-owning households annually. The Veterinary Specialty Hospital of Hong Kong, for instance, provides a range of services, such as imaging and diagnostic services. These include MRI, CT, radiography, ultrasound, and endoscopy.

Distribution Channel Insights

Hospital/ clinic pharmacies dominated the market with a share of 58.87% in 2024. This segment represents the revenue generated by veterinary hospitals & clinics, which directly provide medications, vaccines, customized therapies, and diagnostic test kits to pet owners. The China companion animal health industry is anticipated to grow as a result of significant companies expanding their networks of vet pharmacies. For instance, as per an article published by Xinhuanet.com in October 2021, there were about 12,000 pet hospitals in China and growing number of students were opting for veterinary medicine. This is anticipated to fuel demand for pet medicine and diagnostic products in the coming years.

The e-commerce segment is expected to register the fastest CAGR over the forecast period. Rising digitalization of healthcare, including animal health market; growing R&D projects in pipeline, and increasing incidence of chronic conditions in animals are expected to fuel market growth over the forecast period. For instance, MyElanco is an online portal of Elanco to access product information, pricing and dispensing options as the company reported a shift in purchasing behavior of veterinarians, farmers, and pet parents through online channels.

End-use Insights

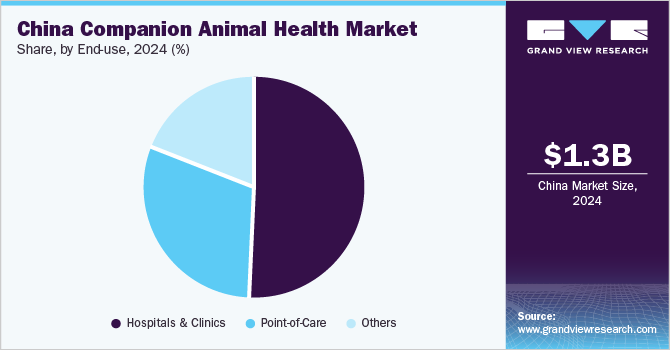

Hospitals & clinics dominated the market with a share of 50.68% in 2024. As people increase expenditure on pets, companion animal health market is expected to expand to include not just clinics but also products and services, such as magnetic resonance imaging in hospitals and clinics This presents opportunity for new market entrants. With increasing demand for animal health care in the country, several veterinarians find opportunity in hopitals and clinics contributing to the growth of the segment. For instance, China is a hub for many veterinary hospitals and clinics such as, PAW Veterinary Clinic (Huangpu), Advanced Vet Care Veterinary Hospital, Doctors Beck & Stone (Minghang), and many others.

Point-of-care segment is anticipated to grow with the fastest CAGR during the forecast period. Point of care testing in veterinary medicine involves using various products to conduct preventive or diagnostic tests at the site where the pet receives care, such as a veterinary clinic or a pet’s home. It allows tests to be performed at the site where the pet receives care, eliminating the need to visit a separate laboratory or clinic. By establishing a continuous spectrum of veterinarian treatment, particularly for non-urgent illnesses, lessens the anxiety that comes with in-clinic visits.

Key China Companion Animal Health Company Insights

The key players undertake extensive mergers and acquisitions, product portfolios, geographical expansions, and collaborative research initiatives. Global multinational companies and several local players dominate the market. For instance, Bimeda, has a manufacturing facility and R&D lab in the country. Bimeda’s Chinese product portfolio includes a range of medicines for dogs, cats, and pigs. China is a key market for Zoetis and estimated to be the 5th largest market for the company by annual revenue worldwide. Zoetis’ products cover five main categories, such as parasiticides, anti-infectives, vaccines, medicated feed additives, and other pharmaceutical products.

Key China Companion Animal Health Companies:

- Boehringer Ingelheim International GmbH

- Elanco

- Merck & Co., Inc.

- Zoetis

- Ceva

- Virbac

- Bimeda, Inc.

- IDEXX Laboratories

- Thermo Fisher Scientific

- Randox Laboratories

View a comprehensive list of companies in the China Companion Animal Health Market

Recent Developments

-

In April 2024, Boehringer Ingelheim International GmbH entered into a partnership with Sino Biopharmaceutical, a China based, Beijing-headquartered drug maker to develop better innovative products and comprehensively improve the health of human and animals.

-

In November 2023, Bimeda, Inc. expanded its presence in China by introducing a state-of-the-art sterile injectable manufacturing plant in the country. The company spent USD 26.44 million on the facility in Shijiazhuang.

China Companion Animal Health Market Report Scope

|

Report Attribute |

Details |

|

Revenue forecast in 2030 |

USD 2.36 billion |

|

Growth rate |

CAGR of 11.22% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Animal type, product, distribution channel, end-use |

|

Key companies profiled |

Boehringer Ingelheim International GmbH; Elanco; Merck & Co., Inc.; Zoetis; Ceva; Virbac; Bimeda, Inc.; IDEXX Laboratories; Thermo Fisher Scientific; Randox Laboratories |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

China Companion Animal Health Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the China companion animal health market report based on animal type, product, distribution channel, end-use:

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Equine

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Biologics

-

Vaccines

-

Modified/ Attenuated Live

-

Inactivated (Killed)

-

Other Vaccines

-

-

Other Biologics

-

-

Pharmaceuticals

-

Parasiticides

-

Anti-infectives

-

Anti-inflammatory

-

Analgesics

-

Others

-

-

Supplements

-

Diagnostics

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

E-commerce

-

Hospital/ Clinic Pharmacies

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals & Clinics

-

Point-of-Care

-

Others

-

Frequently Asked Questions About This Report

b. The China companion animal health market size was estimated at USD 1.26 billion in 2024 and is expected to reach USD 1.39 billion in 2025.

b. The China companion animal health market is expected to grow at a compound annual growth rate of 11.22% from 2025 to 2030 to reach USD 2.36 billion by 2030.

b. Dogs dominated the China companion animal health market with a share of 40.57% in 2024. This is attributable to the rising prevalence of diseases in animals and product launches by market players.

b. Some key players operating in the China companion animal health market include Boehringer Ingelheim International GmbH; Elanco; Merck & Co., Inc.; Zoetis; Ceva; Virbac; Bimeda, Inc.; IDEXX Laboratories; Thermo Fisher Scientific; and Randox Laboratories, among others.

b. Key factors that are driving the China companion animal health market growth include the growing companion animal population, pet humanization, initiatives by key companies, and the incidence of diseases in animals are key drivers contributing to market growth in the country.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."