China Business-to-Business E-commerce Market Size, Share & Trends Analysis Report, By Deployment Model (Supplier-oriented, Buyer-oriented), By Product (Home & Kitchen Application, Consumer Electronics), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-203-0

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

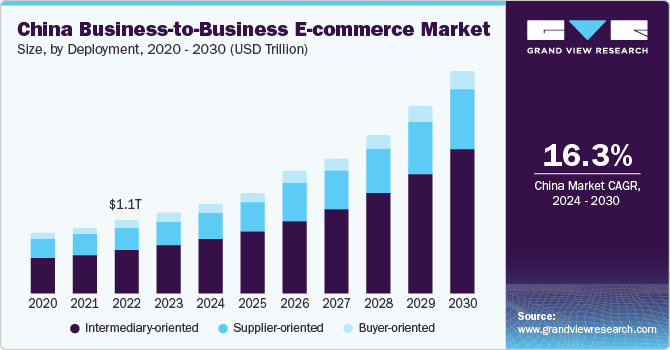

The China business-to-business e-commerce market size was estimated at USD 1,264.17 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 16.3% from 2024 to 2030. China's B2B e-commerce market is experiencing significant growth due to increased demand for consumer goods, electronics, healthcare, pharmaceuticals, and beauty products, among others, which has been further accelerated post-pandemic. Moreover, the rapid use of cutting-edge technologies such as automation, machine learning, and data analytics are increasing the production capabilities of manufacturing business entities and pushing the growth of B2B E-commerce platforms.

The rise of B2B e-commerce in China is primarily driven by the desire of global businesses to obtain affordable goods and services along with improving customer experiences worldwide. With the increasing availability of online marketplaces and platforms, businesses are witnessing a significant increase in the volume of B2B transactions in the country. Furthermore, as businesses strive to remain competitive in their respective industries, they are looking for ways to reduce costs and increase efficiency, which is another reason why B2B e-commerce has become so popular in China. Overall, businesses can benefit from B2B e-commerce by streamlining their operations, reducing interdependence among their business operations, increasing profitability, and providing better customer value.

In recent years, China's E-commerce industry has been growing exponentially, with an increasing number of global buyers opting for online shopping through ERP software, automated import methods, transparent supply chain models, e-invoices, secure transits, and increased customer support through CRM. These technologies have made it easier than ever before for companies to conduct business in China and have opened up new opportunities for businesses of all sizes to tap into this lucrative market. As a result, the future of E-commerce in China looks promising.

In addition, Chinese B2B marketers are putting their efforts through the adoption of innovative approaches. Companies are effectively leveraging on facilities such as integrated communication and network channels and optimizing business operations; these manufacturers are able to gain access to a large and skilled workforce. With these resources at their disposal, they are able to pitch and sell their products to global audiences through e-commerce, resulting in increased growth and success for the China B2B market.

Moreover, their central and provincial government agencies are also enabling domestic manufacturers and entrepreneurs through low-interest business loans, start-up seed findings, and availing facilities such as angel investments. For instance, the government is promoting new tech business entities (small and medium enterprises) by implementing preferential tax policies and supporting domestic startups by providing easy licenses and permissions for particular tech companies. According to the Global Startup Ecosystem Index 2022 by StartupBlink, which evaluates the startup economies of countries, China was ranked 10th globally. Here are some of the big cities where tech companies are growing, including e-commerce for B2B. For example, Beijing, Shanghai, and Shenzhen are among the top Chinese cities for startups, along with Hangzhou, Guangzhou, Chengdu, and Nanjing.

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of the market growth is accelerating. The growth of e-commerce platforms across the globe and it is widely known that China is the manufacturing hub of the world. Therefore, it has created new sales channels in China’s B2B e-commerce domain. Manufacturers are using online platforms to promote their products in bulk quantities. Due to technological advancement, domestic as well as international companies are buying large consignments of finished goods which is driving China’s B2B E-commerce market.

B2B Market entities are implementing mobile-first strategies for their E-commerce platforms to target smartphone users. Similarly, there is a huge scope for innovation in website UI/UX to enhance the consumer base. As a result, businesses are incorporating new ideas for innovation in cross-border treading, like e-invoicing, insurance facilities, currency exchange, website payment getaways, and shipping services, among others.

With the rising number of start-ups and existing market players in B2B, e-commerce is facing competitive challenges in business operations. An increased web presence is diverting web traffic and making companies lose revenue. Due to that, companies are putting their efforts into mergers and acquisitions (M&A). Local and international clients prefer better service-oriented companies, so companies focus on branding and marketing. As a result, big brands are enlarging their umbrella to acquire new regional players to expand their business.

The presence of central and provincial regulations is affecting the B2B online market. However, new ventures are getting some subsidies while starting their business. However, some companies need help to meet the standards while navigating through local as well as central compliance with laws and regulations. However, tech advancements such as AI/ML are helping businesses to adjust with compliances like e-contracts, data privacy, e-invoicing, and digital signatures to settle a large number of transactions and shipping goods.

Service substitution is present in products, pricing models, and customer support, where B2B companies in China are competing while dealing with different economies in the world. However, the Chinese economy is highlighting online shopping growth, which is vital for all business entities operating in the B2B space.

As a result, marketers are trying to come up with new marketing techniques to boost sales in China's B2B e-commerce market. They are offering free samples and credit margins to attract customers. Additionally, marketers are working on improving their supply chain models, building storage facilities, and opening new chain stores across different parts of China. This will help them counter product and service alternatives and create more opportunities to enhance the efficiency of China's B2B e-commerce market.

Deployment Model Insights

Intermediary-oriented B2B e-commerce players led the market and accounted for the highest revenue in 2023. Marketers can use this model to communicate and transact with buyers and sellers. For instance, Alibaba. The flow of goods and services in intermediary-oriented e-commerce exceeds that in buyer- and supplier-oriented models due to the presence of numerous suppliers and buyers. Moreover, intermediary-oriented model-based platforms cover vertical and horizontal marketing, which helps business entities to reduce operational and logistics costs.

The supplier-oriented segment is anticipated to witness the fastest CAGR from 2024 to 2030 in the market. Several suppliers set up their online marketing platforms to serve their buyers domestically as well as internationally. In the supplier-focused model, a systematic sales channel is established to sell products to numerous business entities. Furthermore, this model empowers potential buyers to construct their website, ask for bids, and obtain the most competitive price for any product or service they want. These aspects drive the expansion of the supplier-focused model category in China’s B2B e-commerce industry.

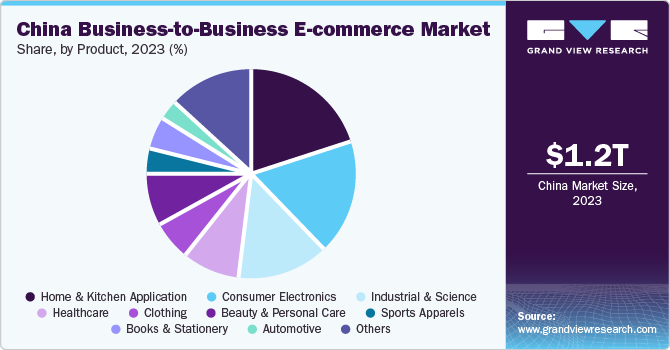

Product Insights

Home and kitchen appliances led the market and accounted for more than 22.0% of the revenue in 2023. Technologies such as AR & VR are helping B2B e-commerce entities grow in this market, as China is known for kitchens and food. More visualization of kitchen products helps buyers make a purchase decision, and sellers pitch products through technologies like 3D visuals. In addition, increasing healthy lifestyles is also helping the market to increase the demand, and B2B marketers are managing to meet the end-user's expectations of domestic as well as international buyers.

Consumer electronics is anticipated to witness a significant CAGR from 2023 to 2030 in the market. The increased demand for chargers, batteries & power supplies, computer hardware & software, audio devices & accessories, auto electronics, smartphones, laptops, and smart TVs, are driving this segment. Post COVID-19, the market has led to a notable rise in consumer electronics. This is expected to fuel future demand, and vendors are ready with new technologies like AR, VR, and Internet of Things (IoT) to attract new consumers, and it will boost China’s B2B e-commerce market growth in the near future.

Key China Business-to-Business E-commerce Company Insights

Some of the key players operating in the market include Alibaba, AliExpress, ChinaAseanTrade.com

-

Alibaba, operates through various business segments, including China commerce, international commerce, local consumer services, digital media and entertainment, innovation initiatives and others, logistics, and cloud services. Alibaba's China commerce segment offers a wide range of products that are available in bulk and shipped worldwide.

-

ChinaAseanTrade.com is a platform for international trade that aims to foster economic cooperation between China and ASEAN countries. In addition, the company provides supply-demand information, communicates with buyers to understand their requirements, provides third-party authentication for enterprises, provides a secure payment platform, attends industry exhibitions on behalf of users, and invites enterprises to attend bilateral trade negotiation meetings.

DIYTrade.com, JD.com, Inc. Global Sources, Made-in-China.com, and DHgate.com are some of the emerging market participants in the China B2B E-commerce market.

-

JD.com is an e-commerce platform offering a B2B marketplace to around 580 million active customers, offering access to a wide range of authentic and genuine products by helping local and international brands tap into the fast-growing e-commerce market. It provides a wide variety of products across categories such as electronics, apparel, home furnishings, FMCG, appliances, and fresh food.

-

DHgate.com is a Chinese B2B and B2C cross-border e-commerce platform that connects suppliers with small and medium retailers to facilitate the sale of manufactured products in China and global buyers.

Key China B2B E-commerce Companies:

- Alibaba Group Holding Limited

- ChinaAseanTrade.com

- DHgate.com

- DIYTrade.com

- eWorldTrade.

- Global Sources

- JD.com, Inc.

- Made-in-China.com

- Pinduoduo

- Vipshop

Recent Developments

-

In April 2023, Alibaba Group Holding Limited, a B2B service provider in China, partnered with the International Trade Centre (ITC) to help small and medium enterprises enhance e-commerce practices, increase marketing skills, and facilitate new exports. The partnership provides these enterprises with the skills and training required to contribute to digital trade growth in their countries. In Africa and Central Asia, the initiative facilitates business support organizations (BSOs) with B2B e-commerce capacity-building services.

-

In February 2023, Alibaba.com, a B2B e-commerce marketplace, announced a strategic partnership with TÜV Rheinland, a global independent test provider, to drive sustainable e-commerce growth for SMEs in Europe. The two parties have joined hands to promote B2B e-commerce, facilitate digitization, and reduce the challenges and complexities of international sourcing.

-

In June 2022, JD.com, Inc. renewed its strategic cooperation with Tencent for the next three years. The partnership calls for Tencent to provide JD.com with prominent access points for its Weixin platform. Both companies will also continue to cooperate in technology services, marketing, advertising, membership services, and communication, among others.

China Business-to-Business E-commerce Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1,409.01 billion |

|

Revenue forecast in 2030 |

USD 3,480.43 billion |

|

Growth rate |

CAGR of 16.3% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Deployment model, product |

|

Country scope |

China |

|

Key companies profiled |

Alibaba Group Holding Limited; ChinaAseanTrade.com; DHgate.com; DIYTrade.com; eWorldTrade; Global Sources; JD.com, Inc.; Made-in-China.com; Pinduoduo; Vipshop |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

China Business-to-Business E-commerce Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the China business-to-business e-commerce market report based on deployment model, and product.

-

Deployment Model Outlook (Revenue, USD Billion, 2018 - 2030)

-

Supplier-oriented

-

Buyer-oriented

-

Intermediary-oriented

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Home & Kitchen Application

-

Consumer Electronics

-

Industrial & Science

-

Healthcare

-

Clothing

-

Beauty & Personal Care

-

Sports Apparels

-

Books & Stationery

-

Automotive

-

Others

-

Frequently Asked Questions About This Report

b. The China business-to-business e-commerce market size was estimated at USD 1,264.17 billion in 2023 and is expected to reach USD 1,409.01 billion in 2024.

b. The China business-to-business e-commerce market is expected to witness a compound annual growth rate of 11.0% from 2024 to 2030 to reach USD 3,480.43 billion by 2030.

b. The Home & Kitchen Application segment held the largest revenue share of over 20.0% in 2023. increasing healthy lifestyles is also helping the market to increase the demand, and B2B marketers are managing to meet the end-user's expectations of domestic as well as international buyers.

b. Alibaba Group Holding Limited; ChinaAseanTrade.com ; DHgate.com ; DIYTrade.com; eWorldTrade.; Global Sources; JD.com, Inc. ; Made-in-China.com; Pinduoduo; and Vipshop are some of the other players driving the market growth.

b. China business-to-business e-commerce market is experiencing significant growth due to increased demand for consumer goods, electronics, healthcare, pharmaceuticals, and beauty products, among others, which has been further accelerated post-pandemic. Moreover, the rapid use of cutting-edge technologies such as automation, machine learning, and data analytics are increasing the production capabilities of manufacturing business entities and pushing the growth of B2B E-commerce platforms.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.3.1. Information Procurement

1.3.2. Information or Data Analysis

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. China Business-to-Business (B2B) E-commerce Market Variables, Trends, & Scope

3.1. Market Introduction/Lineage Outlook

3.2. Industry Value Chain Analysis

3.3. Market Dynamics

3.3.1. Market Drivers Analysis

3.3.2. Market Restraints Analysis

3.3.3. Market Opportunity Analysis

3.4. China Business-to-Business (B2B) E-commerce Market Analysis Tools

3.4.1. Porter’s Analysis

3.4.1.1. Bargaining power of the suppliers

3.4.1.2. Bargaining power of the buyers

3.4.1.3. Threats of substitution

3.4.1.4. Threats from new entrants

3.4.1.5. Competitive rivalry

3.4.2. PESTEL Analysis

3.4.2.1. Political landscape

3.4.2.2. Economic and Social landscape

3.4.2.3. Technological landscape

3.4.2.4. Environmental landscape

3.4.2.5. Legal landscape

Chapter 4. China Business-to-Business (B2B) E-commerce Market: Deployment Model Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. China Business-to-Business (B2B) E-commerce Market: Solution Movement Analysis, 2023 & 2030 (USD Billion)

4.3. Supplier-oriented

4.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.4. Buyer-oriented

4.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.5. Intermediary-oriented

4.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 5. China Business-to-Business (B2B) E-commerce Market: Product Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. China Business-to-Business (B2B) E-commerce Market: Product Movement Analysis, 2023 & 2030 (USD Billion)

5.3. Home & Kitchen Application

5.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.4. Consumer Electronics

5.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.5. Industrial & Science

5.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.6. Healthcare

5.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.7. Clothing

5.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.8. Beauty & Personal Care

5.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.9. Sports Apparels

5.9.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.10. Books & Stationery

5.10.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.11. Automotive

5.11.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.12. Others

5.12.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 6. Competitive Landscape

6.1. Recent Developments & Impact Analysis by Key Market Participants

6.2. Company Categorization

6.3. Company Market Share Analysis

6.4. Company Heat Map Analysis

6.5. Strategy Mapping

6.5.1. Expansion

6.5.2. Mergers & Acquisition

6.5.3. Partnerships & Collaborations

6.5.4. New Product Launches

6.5.5. Research And Development

6.5.6. Company Profiles

6.5.7. Alibaba Group Holding Limited

6.5.7.1. Participant’s Overview

6.5.7.2. Financial Performance

6.5.7.3. Product Benchmarking

6.5.7.4. Recent Developments

6.5.8. ChinaAseanTrade.com

6.5.8.1. Participant’s Overview

6.5.8.2. Financial Performance

6.5.8.3. Product Benchmarking

6.5.8.4. Recent Developments

6.5.9. DHgate.com

6.5.9.1. Participant’s Overview

6.5.9.2. Financial Performance

6.5.9.3. Product Benchmarking

6.5.9.4. Recent Developments

6.5.10. DIYTrade.com

6.5.10.1. Participant’s Overview

6.5.10.2. Financial Performance

6.5.10.3. Product Benchmarking

6.5.10.4. Recent Developments

6.5.11. eWorldTrade.

6.5.11.1. Participant’s Overview

6.5.11.2. Financial Performance

6.5.11.3. Product Benchmarking

6.5.11.4. Recent Developments

6.5.12. Global Sources

6.5.12.1. Participant’s Overview

6.5.12.2. Financial Performance

6.5.12.3. Product Benchmarking

6.5.12.4. Recent Developments

6.5.13. Made-in-China.com

6.5.13.1. Participant’s Overview

6.5.13.2. Financial Performance

6.5.13.3. Product Benchmarking

6.5.13.4. Recent Developments

6.5.14. Pinduoduo

6.5.14.1. Participant’s Overview

6.5.14.2. Financial Performance

6.5.14.3. Product Benchmarking

6.5.14.4. Recent Developments

6.5.15. Vipshop

6.5.15.1. Participant’s Overview

6.5.15.2. Financial Performance

6.5.15.3. Product Benchmarking

6.5.15.4. Recent Developments

List of Tables

Table 1 China Business-to-Business (B2B) E-commerce market 2018 - 2030 (USD Billion)

Table 2 China Business-to-Business (B2B) E-commerce Market estimates and forecasts by deployment model, 2018 - 2030 (USD Billion)

Table 3 China Business-to-Business (B2B) E-commerce Market estimates and forecasts by product, 2018 - 2030 (USD Billion)

List of Figures

Fig. 1 China Business-to-Business (B2B) E-commerce Market Segmentation

Fig. 2 Market landscape

Fig. 3 Information Procurement

Fig. 4 Data Analysis Models

Fig. 5 Market Formulation and Validation

Fig. 6 Data Validating & Publishing

Fig. 7 Market Snapshot

Fig. 8 Segment Snapshot (1/2)

Fig. 9 Segment Snapshot (2/2)

Fig. 10 Competitive Landscape Snapshot

Fig. 11 China Business-to-Business E-commerce Market: Industry Value Chain Analysis

Fig. 12 China Business-to-Business E-commerce Market: Market Dynamics

Fig. 13 China Business-to-Business E-commerce Market: PORTER’s Analysis

Fig. 14 China Business-to-Business E-commerce Market: PESTEL Analysis

Fig. 15 China Business-to-Business (B2B) E-commerce MarketShare by Deployment Model, 2023 & 2030 (USD Billion)

Fig. 16 China Business-to-Business (B2B) E-commerceMarket, by Deployment: Market Share, 2023 & 2030

Fig. 17 Supplier-oriented Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 18 Buyer-oriented Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion) Intermediary-oriented Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 19 China Business-to-Business E-commerce Market Share by Product, 2023 & 2030 (USD Billion)

Fig. 20 China Business-to-Business E-commerce Market, by Product: Market Share, 2023 & 2030

Fig. 21 Home & Kitchen Application Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 22 Consumer Electronics Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 23 Industrial & Science Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 24 Healthcare Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 25 Clothing Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 26 Beauty & Personal Care Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 27 Sports Apparels Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 28 Books & Stationery Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 29 Automotive Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 30 Others Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 31 Key Company Categorization

Fig. 32 Company Market Positioning

Fig. 33 Key Company Market Share Analysis, 2023

Fig. 34 Strategic Framework

Market Segmentation

- China Business-to-Business (B2B) E-commerce Deployment Model Outlook (Revenue, USD Billion, 2018 - 2030)

- Supplier-oriented

- Buyer-oriented

- Intermediary-oriented

- China Business-to-Business (B2B) E-commerce Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Home & Kitchen Application

- Consumer Electronics

- Industrial & Science

- Healthcare

- Clothing

- Beauty & Personal Care

- Sports Apparels

- Books & Stationery

- Automotive

- Others

Report content

Qualitative Analysis

- Industry overview

- Industry trends

- Market drivers and restraints

- Market size

- Growth prospects

- Porter’s analysis

- PESTEL analysis

- Key market opportunities prioritized

- Competitive landscape

- Company overview

- Financial performance

- Product benchmarking

- Latest strategic developments

Quantitative Analysis

- Market size, estimates, and forecast from 2018 to 2030

- Market estimates and forecast for product segments up to 2030

- Regional market size and forecast for product segments up to 2030

- Market estimates and forecast for application segments up to 2030

- Regional market size and forecast for application segments up to 2030

- Company financial performance

Research Methodology

Grand View Research employs a comprehensive and iterative research methodology focused on minimizing deviance to provide the most accurate estimates and forecasts possible. The company utilizes a combination of bottom-up and top-down approaches for segmenting and estimating quantitative aspects of the market. In Addition, a recurring theme prevalent across all our research reports is data triangulation which looks market from three different perspectives. Critical elements of the methodology employed for all our studies include:

Preliminary data mining

Raw market data is obtained and collated on a broad front. Data is continuously filtered to ensure that only validated and authenticated sources are considered. In addition, data is also mined from a host of reports in our repository, as well as a number of reputed paid databases. For a comprehensive understanding of the market, it is essential to understand the complete value chain, and to facilitate this; we collect data from raw material suppliers, distributors as well as buyers.

Technical issues and trends are obtained from surveys, technical symposia, and trade journals. Technical data is also gathered from an intellectual property perspective, focusing on white space and freedom of movement. Industry dynamics with respect to drivers, restraints, and pricing trends are also gathered. As a result, the material developed contains a wide range of original data that is then further cross-validated and authenticated with published sources.

Statistical model

Our market estimates and forecasts are derived through simulation models. A unique model is created customized for each study. Gathered information for market dynamics, technology landscape, application development, and pricing trends are fed into the model and analyzed simultaneously. These factors are studied on a comparative basis, and their impact over the forecast period is quantified with the help of correlation, regression, and time series analysis. Market forecasting is performed via a combination of economic tools, technological analysis, industry experience, and domain expertise.

Econometric models are generally used for short-term forecasting, while technological market models are used for long-term forecasting. These are based on an amalgamation of the technology landscape, regulatory frameworks, economic outlook, and business principles. A bottom-up approach to market estimation is preferred, with key regional markets analyzed as separate entities and integration of data to obtain global estimates. This is critical for a deep understanding of the industry as well as ensuring minimal errors. Some of the parameters considered for forecasting include:

• Market drivers and restraints, along with their current and expected impact

• Raw material scenario and supply v/s price trends

• Regulatory scenario and expected developments

• Current capacity and expected capacity additions up to 2030

We assign weights to these parameters and quantify their market impact using weighted average analysis, to derive an expected market growth rate.

Primary validation

This is the final step in estimating and forecasting for our reports. Exhaustive primary interviews are conducted, on face to face as well as over the phone to validate our findings and assumptions used to obtain them. Interviewees are approached from leading companies across the value chain including suppliers, technology providers, domain experts, and buyers to ensure a holistic and unbiased picture of the market. These interviews are conducted across the globe, with language barriers overcome with the aid of local staff and interpreters. Primary interviews not only help in data validation but also provide critical insights into the market, current business scenario, and future expectations and enhance the quality of our reports. All our estimates and forecast are verified through exhaustive primary research with Key Industry Participants (KIPs) which typically include:

• Market-leading companies

• Raw material suppliers

• Product distributors

• Buyers

The key objectives of primary research are as follows:

• To validate our data in terms of accuracy and acceptability

• To gain an insight into the current market and future expectations

Data Collection Matrix

|

Perspective |

Primary research |

Secondary research |

|

Supply-side |

|

|

|

Demand-side |

|

|

Industry Analysis Matrix

|

Qualitative analysis |

Quantitative analysis |

|

|

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."