China Botulinum Toxin Type A Market Size, Share & Trends Analysis Report By Application (Upper Face, Mid Face, Lower Face, Body), By Gender (Female, Male), By Age (Below 30 Years, 31 to 59 Years, Over 60 Years), By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-366-6

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

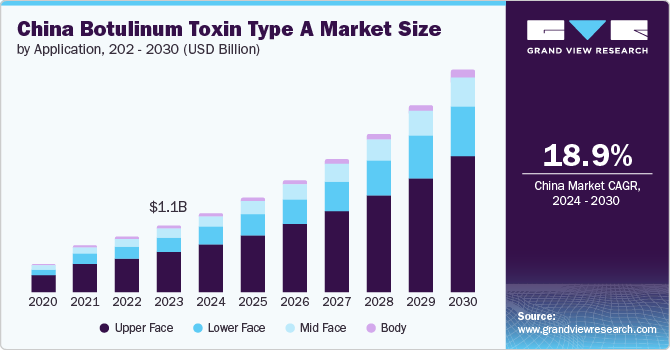

The China botulinum toxin type A market size was estimated at USD 1.06 billion in 2023 and is projected to grow at a CAGR of 18.9% from 2024 to 2030. Some of the key factors driving the country’s market are increasing disposable income fueling spending on medical aesthetics, diverse demand channels across genders and age groups, and the development of consumer-centric treatment modalities.

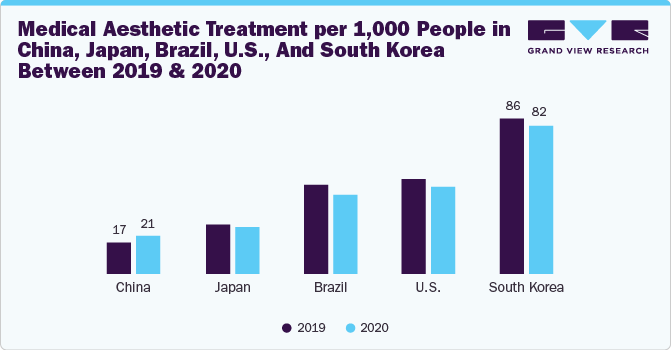

The market is expected to experience multiple opportunities due to the increasing penetration of medical aesthetic procedures. According to the Allergan Aesthetics Survey published in 2023, medical aesthetic treatment per 1,000 people in China increased from 17 in 2019 to 21 in 2020. Critically, other advanced countries in the sphere of medical aesthetics have shown a slowdown in 2020 compared to 2019, showing the country’s greater resilience towards aesthetic interventions even in the background of a pandemic. Moreover, China’s medical aesthetic industry is expected to reduce the patient volume gap further during the forecast period.

Another key drift is taking place within the paradigm of the Korean aesthetic industry. Korean players such as Medytox, Hugel, Daewoong, and Huons BioPharma are some of the key South Korean manufacturers entering the two largest botulinum toxin markets, i.e., the U.S. & China.

Key product approvals and launches within the market in the last 3 to 4 years that are expected to change the botulinum toxin type A (BoNT-A) future in China are represented in the table below-

|

Brand |

Manufacturer |

Product Status |

|

Letybo |

Hugel, Inc. |

Approved in 2020 |

|

Dysport |

Ipsen Pharma |

Approved in 2020 |

|

RT002 |

Shanghai Fosun Pharmaceutical Industrial Development Co., Ltd. |

Approved in April 2023 |

|

Xeomin |

Merz Pharma |

Approved in March 2024 |

|

Hutox |

Huons |

Expected approval by 2024 end |

|

Jetema |

Huadong Medicine |

Expected approval by 2024 end |

|

ReNTox Red Poison |

Pharma Research |

In Clinical Research |

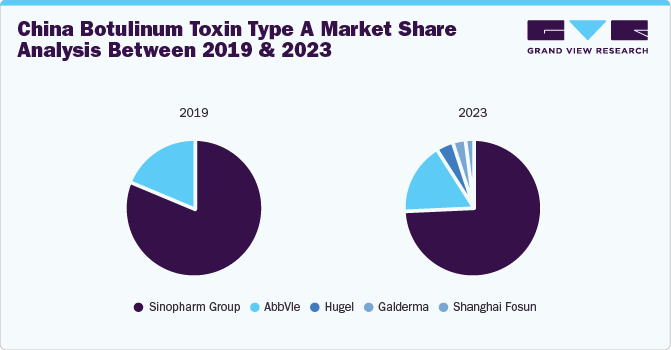

The introduction of newer players within the market paradigm shifted the market share structure, as seen in the table above; before 2020, only two products had received approval from China’s National Medical Product Administration (NMPA). However, post-2020, several established market players gained product approvals, while several others are in the pipeline. Such developments are expected to create lucrative opportunities in China’s botulinum toxin market.

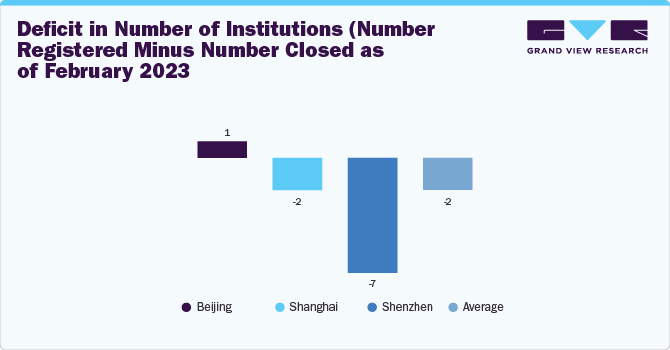

China’s botulinum toxin type A market faces significant challenges, such as the insufficient supply of aesthetic medical practitioners, a lack of sufficient formal consumer education for aesthetic interventions, and changing regulatory trends resulting in the closure of institutions. For instance, nearly 8,068 medical aesthetic institutions had their business license revoked between 2017 & 2022.

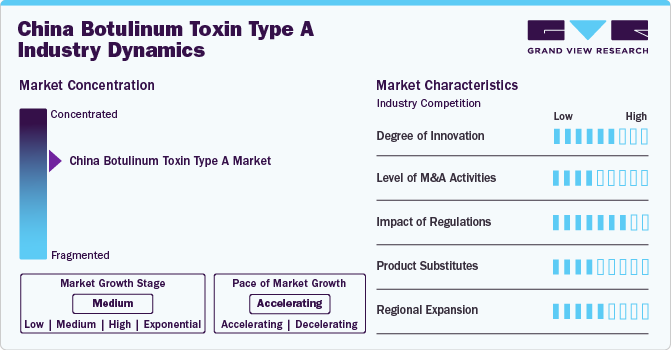

Market Concentration & Characteristics

The market is moderately consolidated, with leading players holding significant market shares, while newer players are eager to introduce novel products. The market growth stage is high, and the pace of market growth is accelerating. For instance, in July 2023, Shanghai Fosun Pharmaceutical Co., Ltd. received approval from the NMPA for its product, RT002, to treat moderate to severe glabellar lines in adults

The market is characterized by a moderate level of M&A activities. Mergers and distribution agreements with local players enable the international players to reap the benefits of robust distribution channels, higher gross margins, and easier regulatory approvals. In addition, such partnerships enable the company to target a higher market share in a consolidated industry. For instance, Sihuan Pharmaceutical Holdings Group Ltd. entered a distribution agreement with Hugel to distribute its botulinum toxin type A product, Letybo, in Mainland China. Moreover, Sihuan aims to capture more than 30% market share for Letybo in China within the projected period

Regulations in the market have a significant impact, setting high standards for product approval and compliance. For example, to ensure the safe and effective use of BoNT-A in aesthetic treatments, NMPA paves a rigorous approval process for all medical devices and drugs, including BoNT-A. In addition, NMPA often requires BoNT-A manufacturers to conduct additional clinical trials in China to demonstrate safety and efficacy specific to the Chinese population

Potential product substitutes in the industry include dermal fillers, chemical peels, and laser treatments. For instance, hyaluronic acid-based dermal fillers, like Juvederm, offer an alternative for wrinkle reduction and facial volume enhancement, catering to patients seeking non-toxic cosmetic solutions

Key companies in the botulinum toxin type A market also focus on expansion. For instance, in May 2023, Daewoong Pharmaceutical, a key player, announced investing USD 74.6 million to build a third plant to produce BoNT-A, Nabota, in response to a growing global market

Application Insights

The upper face segment held the largest share of over 59.75% in 2023 due to increasing demand for aesthetic treatments to reduce wrinkles in areas such as the forehead, glabella, and crow's feet. Botulinum toxin targets these facial areas, highlighting the significance placed on reducing frown lines and forehead creases, which are key signs of aging and stress among individuals. Moreover, technological advancements and product innovations have improved the precision and longevity of treatments, enhanced patient satisfaction, and led to repeat procedures.

The lower face segment is expected to show lucrative growth during the forecast period. There is an increasing demand for treatments targeting areas like the jawline, chin, and neck, where botulinum toxin type A can effectively reduce wrinkles and provide facial contouring. According to the NCBI article published in June 2023, social media influence and heightened aesthetic awareness drive the rising demand for lower face and neck treatments. However, a lack of published guidance on evaluating and treating these areas highlights the need for expert advice.

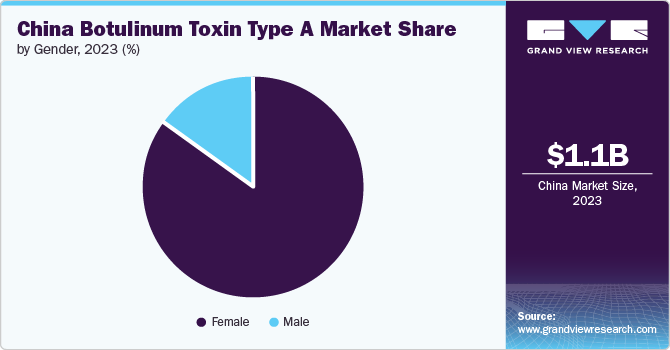

Gender Insights

The female segment held the largest share of 85.01% in 2023 as the women in the country experience early signs of aging and skin dullness, influenced by hormonal fluctuations, such as declining estrogen levels. This accelerates aging processes, making women more proactive in seeking treatments like botulinum toxin type A to tackle wrinkles and maintain youthful skin. Moreover, women in China often prioritize personal appearance and invest in treatments like botulinum toxin type A to maintain youthful looks and address signs of aging, such as wrinkles and fine lines.

The male segment is expected to grow at the fastest CAGR of 23.2% during the forecast period. This is due to increasing awareness and acceptance of cosmetic procedures among men. Traditionally, societal patterns around male grooming and appearance have shifted, leading to a greater willingness among men to invest in treatments like botulinum toxin for facial rejuvenation and wrinkle reduction. Additionally, social media platforms showcasing male celebrities and influencers who have undergone BoNT-A procedures are normalizing these treatments for men.

Age Insights

The 31 to 59 years age group segment held the largest share of over 64.1% in 2023. This age group is concerned with signs of aging, such as wrinkles and fine lines, making botulinum toxin type A injections a popular choice for rejuvenating facial appearance. Moreover, this age group has significant disposable income, which propels expenditure on medical aesthetic interventions, such as botulinum toxin type A injectables. In addition, advancements in product formulations and techniques have improved the effectiveness and safety of treatments, catering specifically to the needs and expectations of this demographic.

The below 30 years age group segment is expected to grow at the fastest CAGR of 21.1% during the forecast period. Younger individuals are increasingly proactive about skincare and aesthetics, starting preventive measures earlier to maintain youthful appearances. This demographic is more open to exploring non-invasive cosmetic treatments like botulinum toxin to address early signs of aging, such as fine lines, and prevent future wrinkles. According to the MilfordMD Cosmetic Dermatology Surgery & Laser Center article published in March 2020, the American Academy of Facial Plastic and Reconstructive Surgery (AAFPRS) reported that 41% of patients cite a fear of looking unnatural as their top concern when considering cosmetic enhancements. There's also been a significant rise in patients under 30 seeking cosmetic treatments. Like the U.S., China has used 'Skin Botox' for ten years due to the increasing demand for natural-looking results, particularly among millennials.

End-use Insights

The MedSpas segment held the largest share of over 43.4% in 2023. The upscale ambiance and relaxing environment fuel the demand for medspas. These facilities offer a spa-like atmosphere and medical expertise, appealing to clients seeking a luxurious experience and effective treatment. Moreover, increased accessibility and convenience boost the growth of the segment. For instance, these establishments are often conveniently located in urban centers or retail areas, making them easily accessible to busy professionals and residents alike.

Medspas offer flexible scheduling, online booking options, and efficient treatment procedures, providing clients with quick and convenient cosmetic enhancements without lengthy downtime. The clinics and aesthetic centers segment is expected to show lucrative growth during the forecast period. These facilities provide a range of cosmetic procedures under one roof, serving diverse patient needs. In addition, these providers leverage larger purchasing power, which allows them to negotiate bulk discounts with BoNT-A manufacturers, further reducing their treatment costs and offering competitive pricing to attract customers.

Key China Botulinum Toxin Type A Company Insights

Some of the key players operating in the industry include AbbVie, Sinopharm, Hugel, and Galderma. Companies undertake various strategies including understanding the strengths and weaknesses of major market participants, anticipating future market trends, opportunities, and challenges, and making proactive decisions based on insights into emerging technologies and changing consumer preferences.

Key China Botulinum Toxin Type A Companies:

- Hugel

- Medytox

- Daewoong

- Galderma

- AbbVie

- Huons Global

- Sinopharm Group

- Huadong Medicine

- Shanghai Fosun Pharmaceutical Industrial Development Co., Ltd.

- Merz Pharma

Recent Developments

-

In February 2024, Merz Pharmaceutical GmbH received approval for its botulinum toxin product Xeomin in China. The time from acceptance to approval was nearly 1,141 days. The product is indicated to treat severe canthus wrinkles (crow’s feet) in adults

-

In October 2023, Sinclair, a subsidiary of Huadong Medicine Co., Ltd. & ATGC Co., Ltd., announced a strategic collaboration and licensing agreement through, which Sinclair shall develop and commercialize ATGC’s BoNT-A, ATGC-110 for an aesthetic and therapeutic indication

-

In May 2022, Huons, a South Korean manufacturer of botulinum toxin, announced that its product, Hutox (BoNT-A), is currently under Phase III clinical trial within China and expects marketing approval by mid-to-late 2024

China Botulinum Toxin Type A Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.3 billion |

|

Revenue forecast in 2030 |

USD 3.6 billion |

|

Growth rate |

CAGR of 18.9% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, gender, age, end use |

|

Country scope |

China |

|

Key companies profiled |

Hugel; Medytox; Daewoon; Galderma; Ipsen; Huons Global; Pharma Research BIO; AbbVie; Sinopharm Group; Huadong Medicine; Shanghai Fosun Pharmaceutical Industrial Development Co.; Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

China Botulinum Toxin Type A Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the China botulinum toxin type A market report based on application, gender, age, and end use:

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Upper Face

-

Glabellar Wrinkles

-

Forehead Wrinkles

-

Crow’s Feet

-

-

Mid Face

-

Lower Face

-

Body

-

-

Gender Outlook (Revenue, USD Billion, 2018 - 2030)

-

Female

-

Male

-

-

Age Outlook (Revenue, USD Billion, 2018 - 2030)

-

Below 30 Years

-

31 to 59 Years

-

Over 60 Years

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

Clinics & Aesthetic Centers

-

Medspas

-

Frequently Asked Questions About This Report

b. The China botulinum toxin type A market size was estimated at USD at USD 1.06 billion in 2023 and is expected to reach 1.3 billion in 2024.

b. The China botulinum toxin type A market is expected to grow at a compound annual growth rate of 18.9% from 2024 to 2030 to reach USD 3.6 billion by 2030.

b. The upper face segment held the largest share of over 59.75% in 2023 due to increasing demand for aesthetic treatments to reduce wrinkles in areas such as the forehead, glabella, and crow's feet. Moreover, lower face segment is expected to show lucrative growth during the forecast period.

b. The key players currently operating in this market are Hugel, Medytox, Daewoong, Galderma, Ipsen, Huons Global, Shanghai Fosun Pharmaceutical Industrial Development Co., Ltd., AbbVie, Sinopharm Group, and others.

b. Increasing demand for aesthetic procedures, advancements in technology and techniques, and growing applications for existing products are some of the key factors boosting botulinum toxin type A market growth in China.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."