- Home

- »

- Medical Devices

- »

-

China Blood Pressure Monitoring Devices Market, Report 2030GVR Report cover

![China Blood Pressure Monitoring Devices Market Size, Share & Trends Report]()

China Blood Pressure Monitoring Devices Market Size, Share & Trends Analysis Report By Product (Aneroid BP Monitor, Digital Blood Pressure Monitor), By End-use (Hospitals, Ambulatory Surgery Centers, Homecare), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-448-6

- Number of Report Pages: 85

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

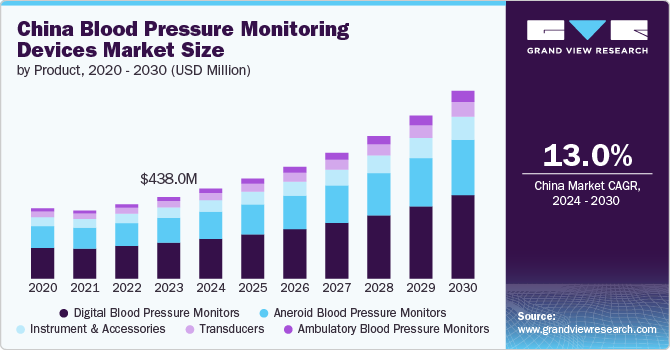

The China blood pressure monitoring devices market size was estimated at USD 438.0 million in 2023 and is projected to grow at a CAGR of 13.0%, from 2024 to 2030. Blood pressure monitoring refers to the process of measuring and tracking the force of blood against the walls of the arteries. The growing incidence of hypertension is one of the primary factors driving the market's growth. According to a Chinese Medical Association article published in December 2023, China is facing a significant health challenge, with an estimated 245 million individuals living with hypertension, driving the growth of the China blood pressure monitoring devices market.

The increasing integration of digital tools into hypertension care significantly drives the market's growth. A March 2020 article by NCBI highlights efforts by the Chinese Hypertension League to address the country's low awareness and control rates among hypertensive patients through the adoption of innovative digital solutions. One such initiative involves the development of a nationwide, web-based system linked with the popular messaging platform WeChat, allowing patients to measure their blood pressure at home and automatically transmit data to healthcare providers. Furthermore, public locations across the country are being equipped with stations for regular BP monitoring. Hospitals are also establishing intelligent excellence centers specifically for hypertension management, where patients can undergo automated blood pressure measurements, receive comprehensive cardiovascular risk assessments, and undergo specialized diagnostic tests, such as screenings for aldosteronism. These combined efforts aim to boost the awareness and control rates of hypertension to 70%, with therapeutic targets being adjusted to more stringent levels, such as 130/80 mm Hg, in line with global best practices.

Government initiatives and strong policy support are key drivers of the Chinese blood pressure monitoring devices market. According to a July 2021 article published by Springer Nature Limited, the 'Healthy China 2030' initiative was set to substantially improve public health, with a particular focus on enhancing the control rate of hypertension. This program emphasizes raising awareness, promoting prevention, and improving the treatment of hypertension through nationwide public health campaigns and far-reaching healthcare reforms. A key aspect of the initiative is integrating hypertension management into primary healthcare services, ensuring that blood pressure screening and ongoing management are embedded within routine care. To support this, new policies are expanding the availability of blood pressure monitoring devices in community health centers, ensuring greater patient access to monitoring tools. Additionally, healthcare professionals are receiving targeted training to manage hypertension better, further fueling growth in the China blood pressure monitoring devices market and improving patient outcomes.

China Hypertension Awareness, Treatment, and Control Rates from 2019 to 2023 (%)

Year

Awareness Rate (%)

Treatment Rate (%)

Control Rate (%)

2019

51.5%

48.4%

29.1%

2020

45.3%

39.7%

24.2%

2023

16.0%

14.3%

7.1%

2020 - 2023: These rates significantly declined, likely due to the impact of COVID-19.

Strategic initiatives by key players are significantly driving growth in the Chinese blood pressure monitoring devices market. In April 2024, Hanvon launched an innovative blood pressure monitor designed to offer enhanced accuracy by utilizing the Korotkoff-Sound method, a technique traditionally employed in clinical settings. This advanced monitor brings hospital-level precision to home-use devices, leveraging artificial intelligence (AI) trained on blood pressure data from over 300,000 individuals to replicate the Korotkoff-Sound technique. Hanvon's AI model, already applied across various industries, including healthcare, is aimed at improving the early detection and management of hypertension-related complications. By integrating cutting-edge AI technology with blood pressure monitoring, Hanvon's initiative advances home-based hypertension care and supports broader efforts to combat hypertension in China, which is further propelling growth in the blood pressure monitoring devices market.

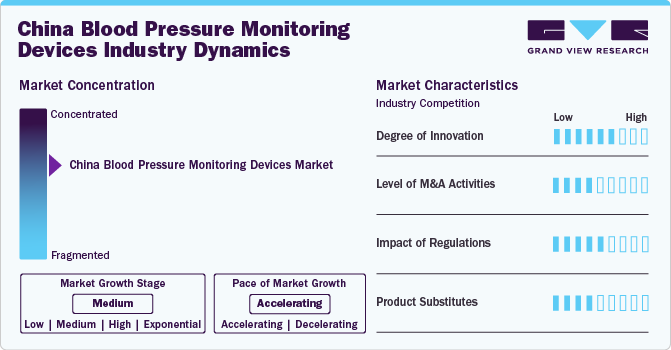

Market Concentration & Characteristics

The market is witnessing high innovation, with companies launching advanced systems incorporating new materials, improved technologies, and enhanced treatment capabilities.

Several market players, such as Omron Healthcare, A&D Medical, Beurer GmbH, and Xiaomi, are involved in merger and acquisition activities. Through M&A activity, these companies employ vital strategies such as strategic collaborations and geographical expansion to enhance their presence.

Regulations play a crucial role in the China blood pressure monitoring devices market by enforcing safety, efficacy, and quality standards. While strict regulatory processes may delay approval for specific age groups and impact market entry, they bolster patient trust and ensure that only reliable, high-quality devices are available, thus fostering long-term market growth.

There are currently no direct substitutes for blood pressure monitoring devices within the authentic medical field. However, wearable devices such as smartwatches and fitness trackers have integrated sensors that monitor blood pressure indirectly, alongside heart rate, oxygen levels, and physical activity.

Market players in China's blood pressure monitoring devices are expanding their presence by entering new geographical markets, forming strategic partnerships with local distributors, and tailoring their age group offerings to align with specific regional healthcare requirements.

Product Insights

The automated/digital blood pressure monitor segment has the largest share, over 44% in 2023. The increasing incidence of hypertension cases, technologically advanced products launched, and strategic initiatives by critical players fuel the market growth. For instance, in March 2024, the HINGMED V03D was introduced as an automatic blood pressure monitor to transform healthcare. Utilizing oscillometric technology, the device ensured precise readings with each use. Its tabletop design enhanced usability, offering convenience and efficiency for healthcare professionals and patients.

The ambulatory blood pressure monitors segment is expected to register the fastest CAGR of 16.9% over the forecast period. Rising clinical preference for ambulatory blood pressure monitoring to detect white-coat hypertension and nocturnal blood pressure variations drives market demand. Its critical role in refining hypertension treatment decisions and improving long-term patient outcomes, along with advancements in data analytics and Bluetooth connectivity, boosts the market's growth in China. For instance, in March 2024, Seca launched a 24-hour ambulatory blood pressure monitoring device.

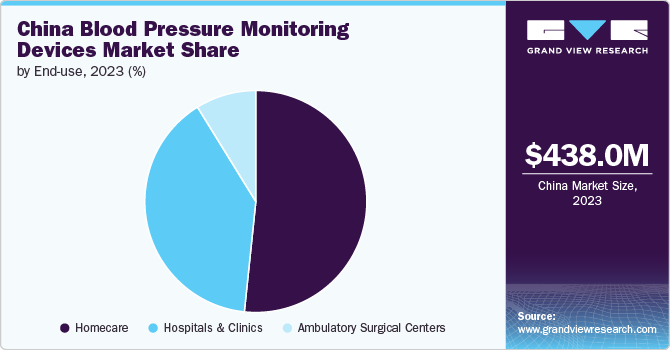

End Use Insights

The homecare segment dominated the market in 2023. Increasing demand for home care blood pressure monitoring devices fuels the growth of the market. According to the MDPI article published in August 2023, in China, about 20.12% of people aged 45 and older currently use home and community-based medical services. The government's emphasis on integrating medical and elderly care services, as outlined in the "Healthy China 2030" plan, is driving a growing need for convenient healthcare solutions. With increasing awareness and demand for accessible health management, there is a rising interest in home blood pressure monitoring devices.

The hospital segment is expected to grow at a significant rate over the forecast period. Growing demand for accurate blood pressure monitoring devices in Chinese hospitals fuels the market's growth. According to the Elsevier Ltd. article published in February 2024, China's high hospital admission rate for hypertension, at 490 admissions per 100,000 population, significantly exceeds the OECD average of 95 per 100,000. This elevated rate highlights a critical need for precise hospital blood pressure measurement. As the prevalence of hypertension continues to rise, hospitals are increasingly focused on adopting accurate and reliable BP monitoring technologies to improve diagnosis and treatment. This growing need for precise hospital blood pressure monitoring devices is driving market growth.

Key China Blood Pressure Monitoring Devices Company Insights

Some key players operating in the industry include Omron Healthcare, Yuyue Medical, Beurer GmbH, Panasonic, and Xiaomi. The company’s key strategies include understanding the strengths and weaknesses of major market participants, anticipating future market trends, opportunities, and challenges, and making proactive decisions based on insights into emerging technologies and changing consumer preferences. For instance, Jiangsu KTK Health Technology Co., Ltd. and Huaian Aiyou Medical Instrument Co., Ltd. are emerging players in China's blood pressure monitoring devices.

Key China Blood Pressure Monitoring Devices Companies:

- Omron Healthcare

- A&D Medical

- Beurer GmbH

- Xiaomi

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Shenzhen Hingmed Instrument Co., Ltd

- CONTEC Medical Systems Co., Ltd.

- Yuwell

- Zebex Industries

- Tianjin Huanan Medical Equipment Co., Ltd.

- Jiangsu KTK Health Technology Co., Ltd.

- Huaian Aiyou Medical Instrument Co., Ltd.

Recent Developments

-

In November 2023, Xiaomi’s ecological chain partner, Haylou, introduced a new smartwatch to the global market. The device, named the Haylou S8 smartwatch, featured an AMOLED display and other premium technologies.

-

In October 2023,Xiaomi introduced its inaugural blood pressure watch, a device designed to allow users to monitor their blood pressure conveniently from their wrist.

-

In October 2023, HINGMED introduced an innovative 24-hour ambulatory blood pressure monitor, the WBP-02A, which stands out for being a non-tube-based device.

China Blood Pressure Monitoring Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 483.5 million

Revenue forecast in 2030

USD 1.01 billion

Growth rate

CAGR of 13.0% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use

Key companies profiled

Omron Healthcare; Yuyue Medical; Beurer GmbH; Xiaomi; Shenzhen Mindray Bio-Medical Electronics Co., Ltd.; Shenzhen Hingmed Instrument Co., Ltd; CONTEC Medical Systems Co., Ltd.; Yuwell; Zebex Industries; Tianjin Huanan Medical Equipment Co., Ltd.; Jiangsu KTK Health Technology Co., Ltd.; Huaian Aiyou Medical Instrument Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

China Blood Pressure Monitoring Devices Market Report Segmentation

This report forecasts revenue growth at the country level and analyzes industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the China blood pressure monitoring devices market report based on product and end use.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Sphygmomanometer/Aneroid BP Monitor

-

Automated/Digital Blood Pressure Monitor

-

Arm

-

Wrist

-

Finger

-

-

Ambulatory Blood Pressure Monitor

-

Transducers

-

Disposable

-

Reusable

-

-

Instruments And Accessories

-

Blood Pressure Cuffs

-

Disposable

-

Reusable

-

-

Others

-

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Homecare

-

Frequently Asked Questions About This Report

b. The China blood pressure monitoring devices market size was estimated at USD 438 million in 2023 and is expected to reach USD 483.5 million in 2024.

b. The China blood pressure monitoring devices market is expected to grow at a compound annual growth rate of 13% from 2024 to 2030 to reach USD 1.01 billion by 2030.

b. The automated/digital blood pressure monitor segment held the largest share, over 44%, in 2023, due to heightened awareness among consumers regarding health monitoring and ease of using the devices, driving demand for automated blood pressure monitors.

b. Some of the key players of China blood pressure monitoring devices are Omron Healthcare; Yuyue Medical; Beurer GmbH; Xiaomi; Shenzhen Mindray Bio-Medical Electronics Co., Ltd.; Shenzhen Hingmed Instrument Co., Ltd; CONTEC Medical Systems Co., Ltd.; Yuwell; Zebex Industries; Tianjin Huanan Medical Equipment Co., Ltd.; Jiangsu KTK Health Technology Co., Ltd.; Huaian Aiyou Medical Instrument Co., Ltd.

b. The growing incidence of hypertension is one of the primary factors driving the market's growth. According to a Chinese Medical Association article published in December 2023, China is facing a significant health challenge, with an estimated 245 million individuals living with hypertension, driving the growth of the Chinese blood pressure monitoring devices market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."