- Home

- »

- Medical Devices

- »

-

China Artificial Hip & Knee Joints Market Size, Report, 2030GVR Report cover

![China Artificial Hip & Knee Joints Market Size, Share & Trends Report]()

China Artificial Hip & Knee Joints Market Size, Share & Trends Analysis Report By Site (Hip Joints, Knee Joints), By End Use (Hospitals & Surgery Centers, Orthopedic Clinics), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-471-2

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

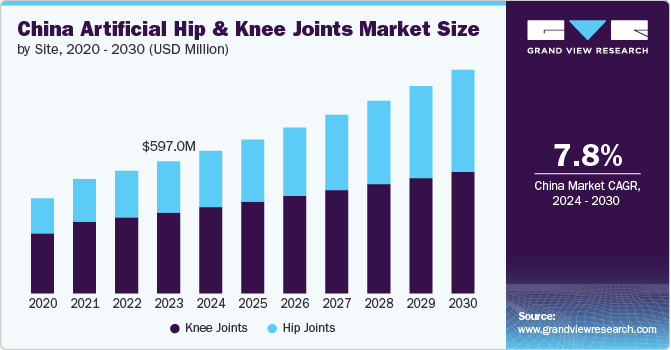

The China artificial hip & knee joints market size was valued at USD 597.0 million in 2023 and is projected to grow at a CAGR of 7.8% from 2024 to 2030. Factors such as the rising incidence of hip and knee injuries, obesity, and osteoarthritis and the growing adoption of minimally invasive surgeries are anticipated to increase the adoption of artificial joint devices, propelling the market's growth during the forecast period. For instance, according to an article published by John Wiley & Sons, Inc. in September 2023, tenderness and joint pain are the most common clinical symptoms and signs of knee osteoarthritis, with an incidence ranging from 36.8% to 60.7% in China.

Factors such as a growing geriatric population and the rising prevalence of hip fractures are expected to drive market growth over the forecast period. For instance, according to the recent government statistics published in January 2024, China's population aged 60 and older was about 297 million in 2023, making the country a "super-aged society" by World Bank standards. That demographic is anticipated to rise to over half a billion by 2050. This population is susceptible to various bone-related conditions fueling market growth.

Furthermore, there is a rise in hip and knee injury cases, and collaboration between government and private organizations to prevent and treat these injuries drives the market growth. For example, the Division of Injury Prevention and Mental Health of the Chinese Centre for Disease Control and Prevention [China CDC) collaborated with WHO for injury prevention in China. This collaboration focuses on preventing road traffic and falling injuries.

In addition, favorable government initiatives and reimbursement policies boost market growth. China operates several healthcare insurance schemes, including the Urban Resident Basic Medical Insurance (URBMI), the New Rural Cooperative Medical Scheme (NRCMS), and the Urban Employee Basic Medical Insurance (UEBMI). These schemes cover different population segments, including urban employees, urban residents, and rural residents. Reimbursement policies for orthopedic implants may vary among these schemes.

Launching new products by key market players and approvals fuels market growth. For instance, in November 2021, a femoral head made of zirconium -niobium alloy. This innovative medical device, developed by MicroPort Orthopedics, was allowed to participate in the 'Green Path,' a special approval procedure designated for medical technologies.

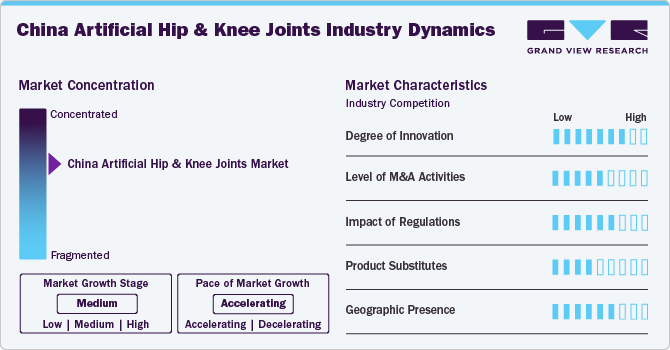

Market Concentration & Characteristics

The China artificial hip & knee joints market has been characterized by a high degree of innovation owing to advancements in surgical techniques, biomechanics, and materials science. Furthermore, innovations such as custom-made implants and minimally invasive surgical approaches have contributed to better outcomes and faster patient recovery times.

The China market for artificial hip & knee joints is characterized by a medium level of merger and acquisition (M&A) activity by the market players. These mergers and acquisitions facilitate access to complementary distribution channels, expertise, and technologies, allowing companies to enhance operational efficiency, accelerate product development, and capture a larger market share.

Regulations play a crucial role in shaping the China artificial hip & knee joints market, ensuring the efficacy, safety and quality of implants and joints available to patients.

Aspect

Details

Regulatory Body

National Medical Products Administration (NMPA)

Applicable Regulations

MDR, Regulations on the Supervision and Administration of Medical Devices, and additional regulations related to medical devices in China

Legislation

MDR (2018 version), Regulations on the Supervision and Administration of Medical Devices (2017 version), and additional regulations specifying requirements for medical devices

Product Marking

CFDA Marking (China Food and Drug Administration), New marking system under NMPA

Standardization Body

Standardization Administration of China (SAC)

The threat of substitutes in the China hip and knee implant market is significantly low. While alternative treatments such as physical therapy and pain medication may provide temporary relief for patients with joint issues, they do not offer a permanent solution such as joint replacement surgery. Similarly, the Chinese government's cost-cutting measures on implant prices further increase their accessibility. For instance, in April 2022, a procurement agreement in the country led to significant price reductions for artificial hip and knee joints. Over two years, over 1.1 million sets were procured at these negotiated prices, representing more than 90% of total usage. Following this agreement, the National Health Security Administration launched a new VBP bid in Tianjin for 580,000 sets of joints needed by over 6,000 hospitals nationwide.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. Rising product launches create more opportunities for market players to enter new regions. In February 2021, Ortho Development Corporation (ODEV) partnered with Changzhou Waston Medical Appliance Co., Ltd. to create a joint venture in China, focusing on manufacturing orthopedic devices. The venture aims to market ODEV's Balanced Knee® System and aims to leverage local manufacturing capabilities to meet the growing demand for joint replacements.

Site Insights

By site, the knee joints segment dominated the China artificial hip & knee joints market in 2023 and accounted for the largest revenue share of 61.2%. This can be attributed to the rising prevalence of knee disorders, especially osteoarthritis, leading to increased total knee arthroplasties (TKAs). According to the China artificial joint annual data report published by the National Institutes of Health (NIH) in November 2020, the number of total knee arthroplasty has grown significantly from 53,880 in 2011 to over 374,000 in 2019. Moreover, economic growth allows more patients to afford these procedures, while advancements in technology enhance implant designs and surgical outcomes.

The hip joint segment in China artificial hip & knee joints market is anticipated to witness the fastest CAGR over the forecast period. The aging population is increasingly susceptible to hip disorders, particularly osteoarthritis, driving demand for total hip arthroplasties (THAs). Economic growth has improved healthcare access and affordability, encouraging more patients to get surgical solutions. Moreover, technological advancements in implant design and surgical techniques enhance patient outcomes and satisfaction, making THAs more convenient.

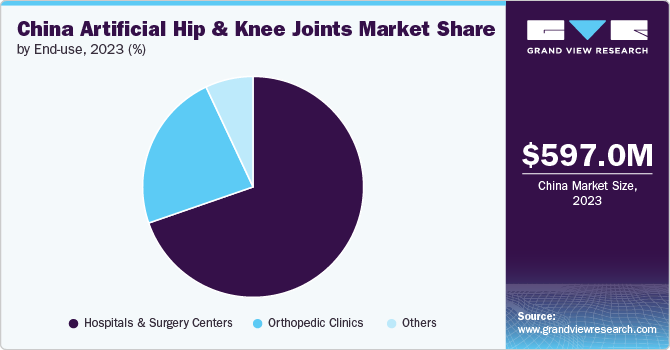

End Use Insights

Hospitals & surgery centers segment dominated the artificial hip & knee joints market in 2023 with a revenue share of 69.7%. These facilities are equipped with advanced surgical technologies and skilled surgical teams that specialize in joint replacement procedures, ensuring high-quality care and improved patient outcomes. Additionally, supportive reimbursement policies for patients in hospitals, along with the widespread availability of hospitals and surgery centers in China, play a significant role in driving the demand for hospital services. For instance, according to the CEIC Data, the number of hospitals in China have increased from 36,976.000 Unit for 2022 to 38,400.000 Unit in 2023, which significantly increases the accessibility of these facilities to the patients.

The orthopedic clinics segment in the China artificial hip & knee market is anticipated to register a significant growth rate over the forecast period due to their specialized focus on musculoskeletal care. These clinics provide accessible and convenient services with shorter wait times, streamlined processes, and personalized attention from healthcare providers. Many orthopedic clinics offer advanced surgical techniques, such as minimally invasive procedures, which reduce recovery times and complications, attracting patients who prioritize a quick return to daily activities. As orthopedic clinics continue to expand their surgical capacity, and provide comprehensive care, they are expected to witness significant growth over the forecast period

Key China Artificial Hip & Knee Joints Company Insights

Key participants in the China artificial hip & knee joints market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key China Artificial Hip & Knee Joints Companies:

- Zimmer Biomet

- Stryker

- Smith+Nephew

- AK Medical

- Waston Medical Corporation

- Extremity Medical LLC

- CONMED Corporation.

- Enovis Corporation

- Johnson & Johnson (DePuy Synthes)

- Aesculap, Inc. (B. Braun)

Recent Developments

- In March 2024, Stryker acquired SERF SAS, a joint replacement company. This strategic move aims to enhance Stryker's global orthopedic portfolio. SERF SAS is known for innovations in hip implants, including the original Dual Mobility Cup. The acquisition will allow Stryker to expand its product offerings and improve patient access to advanced joint replacement solutions.

- In July 2021, Zimmer Biomet partnered with OSSIS to become the exclusive distributor of patient-specific 3D-printed titanium hip replacement joints in the Asia Pacific region. This collaboration aims to enhance the offerings for orthopedic surgeons, particularly in complex cases such as revision surgeries and those involving bone tumors.

- In June 2021, MicroPort Orthopedics partnered with PatientIQ to launch an initiative to enhance patient education and engagement in orthopedic care. By providing tools and resources, the company aims to empower patients with knowledge about their conditions and treatments, ultimately improving outcomes and satisfaction in their healthcare journey.

China Artificial Hip & Knee Joints Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 644.2 million

Revenue forecast in 2030

USD 1,009.9 million

Growth rate

CAGR of 7.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Site, end use

Country scope

China

Key companies profiled

Zimmer Biomet; Stryker; Smith+Nephew; AK Medical; Waston Medical Corporation; Extremity Medical LLC; CONMED Corporation.; Enovis Corporation; Johnson & Johnson (DePuy Synthes); Aesculap, Inc. (B. Braun)

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

China Artificial Hip & Knee Joints Market Report Segmentation

This report forecasts revenue and volume growth at country level and provides an analysis on industry trends in each of the sub segments from 2018 to 2030. For the purpose of this study, Grand View Research, Inc. has segmented the China artificial hip & knee joints market report based on site and end use:

-

Site Outlook (Revenue, USD Million, 2018 - 2030)

-

Hip Joints

-

By Hip Product

-

Total Hip

-

Partial Femoral Head

-

Hip Resurfacing

-

Revision Hip

-

Knee Joints

-

By Knee Product

-

Fixed-bearing Implants

-

Mobile-bearing Implants

-

By Knee Procedure

-

Total Knee Replacement

-

Partial Knee Replacement

-

Revision Knee Replacement

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Surgery Centers

-

Orthopedic Clinics

-

Others

Frequently Asked Questions About This Report

b. The China artificial hip & knee joints market size was estimated at USD 597 million in 2023 and is expected to reach USD 644.2 million in 2024.

b. The China artificial hip & knee joints market is expected to grow at a compound annual growth rate of 7.8% from 2024 to 2030 to reach USD 1,009.9 million by 2030.

b. By site, the knee joints segment dominated the China artificial hip & knee joints market in 2023 and accounted for the largest revenue share of 61.2%. This can be attributed to the rising prevalence of knee disorders, especially osteoarthritis, leading to increased total knee arthroplasties (TKAs).

b. Some key players operating in the China artificial hip & knee joints market include Stryker Corporation, Zimmer Biomet, DePuy Synthes, MicroPort Scientific Corporation, Shanghai United Imaging Healthcare, and Orthofix Medical Inc.

b. Factors such as the rising incidence of hip and knee injuries, obesity, and osteoarthritis and the growing adoption of minimally invasive surgeries are anticipated to increase the adoption of artificial joint devices, propelling the market's growth during the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."