- Home

- »

- Clinical Diagnostics

- »

-

China Alzheimer’s Disease Diagnostics Market, Report, 2030GVR Report cover

![China Alzheimer’s Disease Diagnostics Market Size, Share & Trends Report]()

China Alzheimer’s Disease Diagnostics Market Size, Share & Trends Analysis Report By Diagnostics Technique (Biomarkers, Imaging Techniques), By Type (Triage, Diagnosis), By End Use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-460-7

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

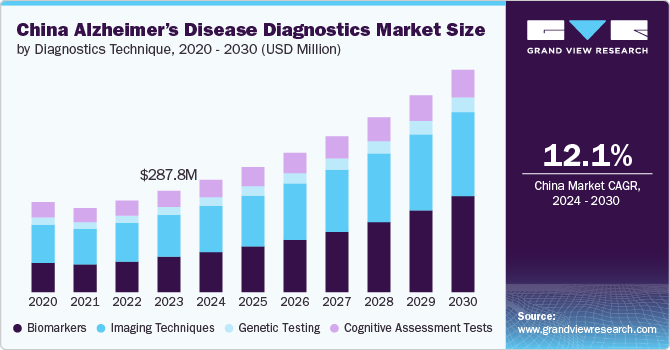

The China Alzheimer’s disease diagnostics market size was estimated at USD 287.76 million in 2023 and is expected to grow at a CAGR of 12.1% from 2024 to 2030. The increasing prevalence of Alzheimer’s disease (AD), growing use of biomarkers in disease diagnostics, growing adoption of personalized products, and increasing technological advancements in medical imaging are expected to drive the demand for Alzheimer’s diagnostics. Increasing government investments and R&D studies is further propelling growth.

In June 2024, the launch of LEQEMBI in China by Eisai Co., Ltd. and Biogen Inc. marked a significant driving factor in the market. Following its approval in January 2024 for treating mild cognitive impairment (MCI) and mild Alzheimer's dementia, China became the third country to introduce LEQEMBI, after the United States and Japan. With an estimated 17 million individuals in China affected by early-stage Alzheimer's in 2024, the number is expected to grow with the aging population. Eisai is actively building an early AD diagnosis and treatment pathway. This approach combines online and offline services, including collaboration with commercial health insurance companies, private health checkups, and nursing homes.

In addition, Eisai fosters early detection through disease awareness campaigns, pre-screening opportunities, and referrals to specialized hospitals or "Yin Fa Tong," an online platform developed with JD Health. Eisai’s efforts, including using blood biomarkers for definitive diagnosis, are poised to significantly impact the market growth and development, supporting early detection and treatment within a comprehensive dementia care ecosystem.

China's aging population has expanded rapidly since the 2010 census, leading to a significant rise in the incidence, morbidity, and mortality of age-related diseases, particularly Alzheimer's disease (AD). The increasing prevalence of AD poses substantial medical and social challenges, severely impacting both urban and rural communities. Recent data reveals that 15.07 million people aged 60 and over in China suffer from dementia, with 9.83 million affected by AD, 3.92 million by vascular dementia, and 1.32 million by other forms of dementia.

Furthermore, 15.5% of those over 60 have mild cognitive impairment (MCI), affecting approximately 38.77 million individuals. The economic burden is immense, with AD treatment costs soaring from $167.74 billion in 2015 to a projected $1.8 trillion by 2050. Despite this, China's diagnosis and treatment rates for AD remain alarmingly low, compounded by a shortage of medical specialists and limited public awareness. Addressing these issues through government-led initiatives to enhance AD prevention and treatment is urgently needed to mitigate the growing crisis.

Initiatives like the 'Guangci Home Ruijian Cognitive Science Popularization Volunteer Service Team' at Ruijin Hospital, affiliated with Shanghai Jiao Tong University School of Medicine, represent key driving factors in the market. This team conducts disease screening and educational outreach in communities and homes, emphasizing 'Early prevention, detection, diagnosis, and treatment.' Supported by the Shanghai Voluntary Service Public Welfare Foundation, such efforts highlight the growing focus on early intervention.

Similarly, the Beijing Senior Care Centre’s decade-long program uses art therapy to meet the deeper needs of seniors with dementia, enhancing their well-being. In addition, the Shanghai Jian’ai Charity Development Center’s ‘Anti-dementia Manual Assemblage’ activities foster social interaction among older adults through creative exercises. The Shanghai Brain Health Alliance, established by 141 institutions under the guidance of the Shanghai Medical Society General Medical Section and in line with WHO's Global Action Plan on Dementia, aims to enhance the diagnosis and treatment of cognitive impairment. By integrating prevention, screening, diagnosis, treatment, and long-term management into a cohesive system, these initiatives are set to significantly boost the detection and treatment rates of Alzheimer's disease, thereby driving advancements in the market in China.

Currently, there are no standardized cutoff values for Alzheimer's disease (AD) biomarkers in the Chinese population, which presents a challenge for consistent diagnosis. However, as part of the Alzheimer’s Association Quality Control (QC) program for cerebrospinal fluid (CSF) biomarkers, researchers have made significant progress by establishing diagnostic cutoff values for core CSF biomarkers in a Chinese cohort. Using methods recommended by the QC program, they developed an optimal diagnostic model that combines these biomarkers. This study represents a critical step toward defining uniform cutoff values tailored to the Chinese population, facilitating the integration of CSF biomarkers into clinical practice. This advancement is poised to enhance the accuracy and reliability of AD diagnostics in China, thereby driving growth in the country's Alzheimer’s Disease Diagnostics Market.

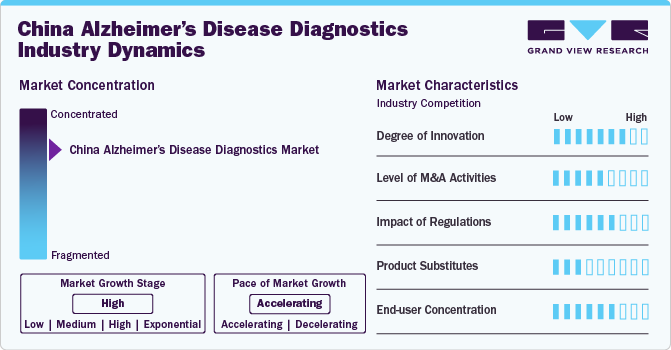

Market Concentration & Characteristics

The market is characterized by a high degree of innovation driven by advancements in diagnostic technologies such as biomarkers and neuroimaging techniques. These innovations enable more accurate and early diagnosis of Alzheimer’s, allowing for prompt intervention and individualized treatment. In May 2024, China’s National Medical Products Administration (NMPA) approved AriBio’s IND application for a Phase III trial of AR1001 for early Alzheimer’s disease (AD). The Polaris-AD trial will enroll patients at up to 20 sites in China, maintaining the same eligibility criteria as other participating countries. This double-blind, placebo-controlled study will evaluate AR1001, an oral PDE5 inhibitor, assessing its efficacy and safety through measures including the Geriatric Depression Scale (GDS), Mini-Mental State Examination (MMSE), and various biomarkers.

The market is characterized by the leading players with moderate levels of technology launches and merger and acquisition (M&A) activity. Market players like Quest and others are involved in new product launches and M&A activities.

Regulation significantly impacts the market. The market is evolving with a growing focus on biomarker regulation. However, the lack of standardized biomarker cutoff values poses a challenge for consistent diagnosis across the population. Efforts are underway to establish regulatory guidelines, particularly for cerebrospinal fluid (CSF) biomarkers. As part of the Alzheimer’s Association Quality Control (QC) program, researchers are working on defining uniform diagnostic criteria tailored to the Chinese population. These efforts aim to improve the accuracy of early Alzheimer’s detection and foster the adoption of biomarker-based diagnostics in clinical practice, which will be crucial for the market's growth.

There is no direct substitute for existing disease diagnostic products and treatments, as various diagnostic tests and tools are complementary in assessing risk, aiding diagnosis, and monitoring disease progression. However, some alternatives, such as cognitive assessments, neurological exams, genetic testing, spinal fluid analysis, and neuropsychological tests, can provide valuable information. These alternatives are often used in conjunction with biomarker tests to provide a comprehensive understanding of an individual's cognitive health.

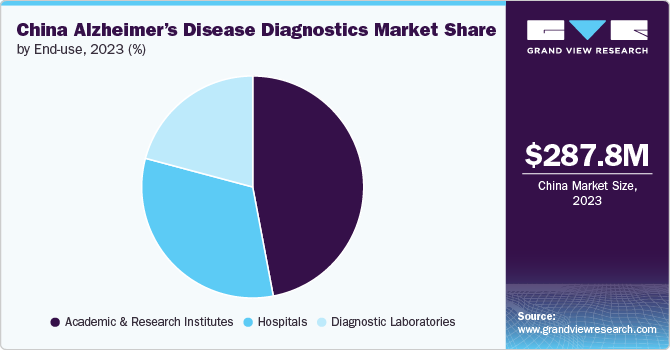

The market mostly comprises end users such as hospitals and clinicians, who allow hospitals and clinics to purchase the necessary equipment and drugs to treat patients with Alzheimer’s. This concentration of end users in institutional settings drives the demand for reliable and accurate diagnostic tests, fueling the market's growth.

Diagnostics Technique Insights

The imaging techniques accounted for the largest revenue share of 41.40% in 2023. This high share is attributable to the urgent need for early and accurate disease detection. Advancements in imaging technologies such as Computed Tomography (CT), Positron Emission Tomography (PET), and functional MRI (fMRI) have emerged as crucial tools for diagnosing and monitoring disease. These techniques can identify alterations associated with Alzheimer’s disease, such as amyloid plaques and brain atrophy. Chinese clinicians have demonstrated the effectiveness of amyloid PET imaging in diagnosing and managing Alzheimer's disease through a "real-world study" published in February 2024 in Alzheimer’s and Dementia. Conducted at the memory clinic of Huashan Hospital in Shanghai, the study revealed that amyloid PET scans successfully detected brain pathology associated with Alzheimer’s disease and resulted in changes to treatment plans for 36.5% of patients. This evidence supports amyloid PET imaging as a valuable diagnostic technique, significantly driving the Alzheimer's disease diagnostics market in China. The growing adoption of advanced imaging techniques like PET, increasing awareness, and improved diagnostic accuracy are expected to propel market growth further.

Biomarkers are anticipated to witness the fastest growth, with a CAGR of 15.7% in the forecast period, owing to the increasing demand for biomarkers to diagnose and monitor the condition. The segment is further divided into CSF biomarkers and blood-based biomarkers. CSF Biomarkers, such as amyloid-beta (Aβ), tau, and neurofilament light chain (NfL), are used in clinical practice to help diagnose Alzheimer’s and other types of dementia. Blood-based biomarkers are being explored for their potential to predict Alzheimer’s from blood samples. Furthermore, blood biomarkers are anticipated to witness the fastest segment growth. Recent advances in blood-based biomarkers have shown great potential for the early detection, diagnosis, and monitoring of various neurological disorders, particularly Alzheimer’s.

Type Insights

Diagnosis dominated the market and accounted for the largest share of 53.49% in 2023. The global market is expanding as the aging population rises, with more individuals at risk of developing Alzheimer's. This has heightened the demand for early and accurate diagnostic tools, driving the market forward. In October 2023, Neuraceq (florbetaben F-18) received regulatory approval in China, marking the first approval of an Alzheimer’s disease imaging tracer. Life Molecular Imaging announced that its Chinese partner, Sinotau Pharmaceutical Group, will produce Neuraceq at facilities in Jiangsu, Guangdong, and Sichuan provinces to ensure broad distribution across China. The approval is timely, as new disease-modifying Alzheimer’s drugs are emerging in China, highlighting the need for accurate early diagnosis using PET radiotracers that target amyloid plaques. Neuraceq was previously approved in the U.S. and Europe in 2014.

Moreover, awareness campaigns and initiatives play a significant role in market growth. Organizations such as the Alzheimer's Association and the World Health Organization (WHO) are increasing public and professional awareness about the importance of early diagnosis and intervention. These efforts are supported by educational programs, public service announcements, and community outreach, encouraging individuals to seek diagnostic evaluations at the earliest signs of cognitive decline. In addition, in January 2022, Clario, a leading provider of endpoint technology solutions for clinical trials, and XingImaging, specializing in radiopharmaceutical production and positron emission tomography (PET) acquisition, have expanded their partnership to enhance PET imaging clinical trials for novel therapeutics in China. Since their initial collaboration in 2018, Clario and XingImaging have supported multi-center trials utilizing PET for eligibility and drug efficacy assessments, particularly in Alzheimer's disease (AD) and other neurodegenerative conditions. The expanded partnership combines the expertise of both organizations to accelerate clinical trial initiation and drug discovery in China, focusing on amyloid, tau, and other critical targets.

End Use Insights

The academic and research institutes segment is dominated the end use segments with the largest market share of 47.02% in 2023. This is attributable to increased research studies and clinical trials for neurological disorders over the last decade. Academic and research institutes are at the forefront of advanced research, clinical trials, and the development of innovative diagnostic techniques. Academic and research institutes often receive substantial funding and grants from government agencies, private foundations, and industry partners. For instance, The China ADNI project collects data to develop biomarkers for Alzheimer's disease, assess the impact of lifestyle risk factors, and establish predictive measures for the disease. The C-ADNI team has trained and validated cognitive testing protocols in both Chinese and English to ensure comprehensive and accurate assessments.

The hospitals segment is also anticipated to grow at a faster pace. This is attributable to the growing recognition of the importance of early detection and diagnosis of Alzheimer’s disease, and hospitals are the primary settings where patients often seek treatment and care. Hospitals are equipped with state-of-the-art diagnostic equipment and technologies, such as neuroimaging techniques, MRI, PET, and biomarker tests. These advanced tools are crucial for accurate and early diagnosis of Alzheimer’s disease, enabling timely intervention and management. In addition, hospitals are working to integrate blood-based biomarkers into their diagnostic protocols to improve patient care.

Key China Alzheimer’s Disease Diagnostics Company Insights

Some key players operating in the market include Quest Diagnostics Incorporated, Abbott, F. Hoffmann-La Roche Ltd., Eli Lily, Bio-Rad Laboratories, Inc., Eisai Co Ltd, Clario, and others. The market is highly competitive, with many manufacturers accounting for most of the share. New source developments, mergers and acquisitions, and collaborations are major strategies these players adopt to counter stiff competition.

Key China Alzheimer’s Disease Diagnostics Companies:

- Quest Diagnostics

- Labcorb

- C2N diagnostics

- FujireBio

- Bristol Myers Squibb

- Hoffmann-La Roche

- Quanterix

- Sysmex

- Lantheus

- Siemens Healthineers

- Life Molecular Imaging

Recent Developments

-

In October 2023, Neuraceq (florbetaben F-18) received regulatory approval in China, marking the first approval of an Alzheimer’s disease imaging tracer in the country. Life Molecular Imaging announced that its Chinese partner, Sinotau Pharmaceutical Group, will produce Neuraceq at facilities in Jiangsu, Guangdong, and Sichuan provinces to ensure broad distribution across China. The approval is timely, as new disease-modifying Alzheimer’s drugs are emerging in China, highlighting the need for accurate early diagnosis using PET radiotracers that target amyloid plaques. Neuraceq was previously approved in the U.S. and Europe in 2014.

China Alzheimer’s Disease Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 319.18 million

Revenue forecast in 2030

USD 631.73 million

Growth rate

CAGR of 12.05% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Diagnostics technique, type, end use

Country scope

China

Key companies profiled

Quest Diagnostics; Labcorp; C2N Diagnostics; Fujirebio; Bristol Myers Squibb; Hoffmann-La Roche; Quanterix, Sysmex; Lantheus; Siemens Healthineers

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

China Alzheimer’s Disease Diagnostics Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 - 2030. For this study, Grand View Research has segmented the China Alzheimer’s disease diagnostics market report based on diagnostics technique, type, and end use:

-

Diagnostics Technique Outlook (Revenue, USD Million, 2018 - 2030)

-

Biomarkers

-

CSF Biomarkers

-

Blood-Based Biomarkers

-

-

Imaging Techniques

-

Genetic Testing

-

Cognitive Assessment Tests

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Triage

-

Diagnosis

-

Screening

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Laboratories

-

Academic and Research Institutes

-

Frequently Asked Questions About This Report

b. The China Alzheimer’s disease diagnostics market size was estimated at USD 287.76 million in 2023 and is expected to reach USD 319.18 million in 2024.

b. The China Alzheimer’s disease diagnostics market is expected to grow at a compound annual growth rate of 12.05% from 2024 to 2030 to reach USD 631.73 million by 2030.

b. The imaging techniques accounted for largest revenue share of 41.40% in 2023. This high share is attributable to the urgent need for early and accurate detection of the disease. Advancements in imaging technologies such as Computed Tomography (CT), Positron Emission Tomography (PET), functional MRI (fMRI) have emerged as crucial tools for diagnosing and monitoring the disease.

b. Some key players operating in the China Alzheimer’s disease diagnostics market include Quest Diagnostics, Labcorp, C2N Diagnostics, Fujirebio, Bristol Myers Squibb, Hoffmann-La Roche, Quanterix, Sysmex, Lantheus, Siemens Healthineers

b. The increasing prevalence of alzheimer’s disease (AD), growing use of biomarkers in disease diagnostics, growing adoption of personalized products, and increasing technological advancements in medical imaging are some of the factors which is expected to drive the demand for alzheimer’s diagnostics. Increasing government investments and R&D studies is further propelling growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."