- Home

- »

- Consumer F&B

- »

-

Chickpea Snacks Market Size, Share, Industry Report, 2030GVR Report cover

![Chickpea Snacks Market Size, Share & Trends Report]()

Chickpea Snacks Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Roasted Chickpea, Seasoned Chickpea, Chickpea Chips, Chickpea Puffs), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-493-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Chickpea Snacks Market Size & Trends

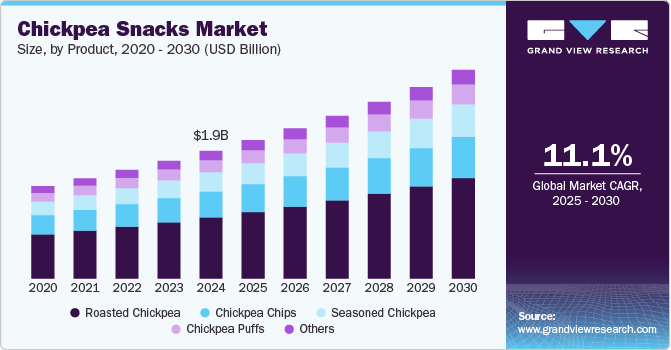

The global chickpea snacks market size was estimated at USD 1,875.32 million in 2024 and is projected to grow at a CAGR of 8.5% from 2025 to 2030. One of the primary drivers is the increasing health consciousness among consumers. As people become more aware of the nutritional benefits of their food choices, there is a shift towards convenient snacks that are rich in nutrients. Chickpeas are recognized for their high protein and fiber content, making them an attractive alternative to snacks often high in unhealthy fats and sugars. This demand for healthier options aligns with the rising popularity of plant-based diets, as chickpea snacks cater to vegetarians, vegans, and those looking to reduce their meat consumption.

Another significant factor contributing to market growth is innovation in product development. The chickpea snacks segment has seen a surge in creative flavors and product formats, including roasted chickpeas, chips, and puffs. These innovations enhance the appeal of chickpea snacks and cater to diverse consumer tastes. For instance, seasoned chickpeas are gaining traction due to their variety of flavors, such as barbecue and chili lime, which attract consumers looking for flavorful yet healthy snack options. This trend toward flavor innovation is crucial for maintaining consumer interest and expanding market reach.

Sustainability is also a key driver in the market growth. As environmental concerns become increasingly prominent among consumers, the demand for sustainably sourced ingredients has risen. Chickpeas are known for their lower environmental impact compared to animal-based protein sources; they require less water and contribute positively to soil health through nitrogen fixation. Companies are responding by emphasizing eco-friendly sourcing practices and exploring sustainable packaging options. This alignment with consumer values around sustainability enhances brand loyalty and attracts a broader customer base interested in environmentally responsible products.

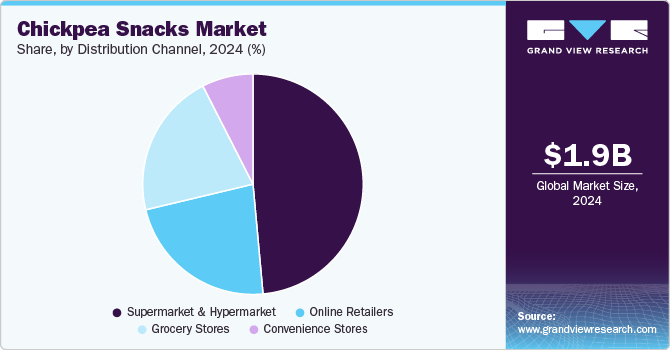

The expanding availability of chickpea snacks through various distribution channels further supports market growth. The rise of organized retail, including supermarkets and online platforms, has made it easier for consumers to access chickpea snacks. This increased availability is particularly beneficial in developing regions with rising disposable incomes, allowing more consumers to indulge in healthier snack options. The convenience of shopping online has also enhanced market penetration, making it easier for consumers to discover and purchase new products.

The growing popularity of snacking as a lifestyle choice must be noticed. With busy schedules leading many individuals to seek quick and nutritious snack options, chickpea snacks fit perfectly into this trend. Their versatility allows them to be consumed on the go or as part of a meal, appealing to a wide demographic that includes children, athletes, and health-conscious adults. As more people turn to snacks rather than traditional meals, the demand for nutritious alternatives like chickpea snacks is expected to continue rising, further propelling the market growth.

One of the primary challenges is environmental limitations affecting chickpea production. Chickpeas require specific climatic conditions and soil quality to thrive, making them vulnerable to fluctuations in weather patterns. Unpredictable climatic events, such as droughts or excessive rainfall, can lead to reduced crop yields and compromised quality, ultimately affecting the supply chain for chickpea snacks. This environmental sensitivity poses a significant risk for manufacturers who rely on consistent raw material availability. Digestive issues associated with chickpeas also pose a challenge for market acceptance. Some consumers experience discomfort, such as bloating and acidity, after consuming chickpeas or chickpea-based products. These side effects can limit consumer adoption of chickpea snacks, especially among those not accustomed to high-fiber diets.

Product Insights

The roasted chickpea segment led the market with the largest revenue share of 47.84% in 2024. Roasted chickpeas are rich in protein, fiber, and essential vitamins and minerals, making them an appealing choice for health-conscious consumers. They provide a satisfying crunch and can be flavored in numerous ways, catering to a wide range of taste preferences. This adaptability allows roasted chickpeas to be enjoyed as a standalone snack or incorporated into various dishes, enhancing their appeal compared to other chickpea snacks that may not offer the same level of versatility. Combining health benefits and culinary flexibility positions roasted chickpeas as a top choice among consumers seeking nutritious snack options.

The increased awareness of dietary choices plays a significant role in the rising popularity of roasted chickpeas. As more individuals adopt plant-based diets or seek to reduce their intake of processed snacks, roasted chickpeas emerge as a convenient and healthy alternative. Their low caloric density and high satiety factor help consumers manage their weight while enjoying flavorful snacks. Furthermore, the growing trend towards clean eating and avoiding artificial ingredients makes roasted chickpeas particularly attractive, as they can be easily prepared at home with minimal ingredients. This alignment with current dietary trends contributes to the sustained growth of roasted chickpeas over other types of chickpea snacks.

The seasoned chickpea segment is expected to grow at the fastest CAGR of 9% during the forecast period. The fast growth of seasoned chickpeas over other chickpea snacks can be attributed to their enhanced flavor profiles and the increasing consumer preference for bold, diverse tastes in snacking. Seasoned chickpeas offer a variety of flavors-from spicy to savory-which appeal to a wide range of palates. This flavor innovation attracts health-conscious consumers seeking nutritious options and engages those looking for exciting snack alternatives. Customizing seasoning blends allows manufacturers to cater to regional tastes and dietary preferences, making seasoned chickpeas a versatile choice in the snack market. As consumers become more adventurous in their food choices, the demand for flavorful snacks rises, positioning seasoned chickpeas favorably against less innovative options.

Chickpea chips were an important product category, as the rise in health consciousness among consumers has significantly boosted the demand for nutritious and convenient snack alternatives. Chickpea chips, made from chickpea flour, are marketed as a healthier substitute for traditional potato chips, appealing to those seeking gluten-free and high-protein snacks. This trend aligns with the growing interest in plant-based diets, where chickpeas are versatile and nutritious. As more consumers prioritize their dietary choices, the appeal of chickpea chips continues to grow, contributing to the overall expansion of the chickpea snacks industry.

Distribution Channel Insights

Based on distribution channel, the supermarkets and hypermarkets segment led the market with the largest revenue share of 48.56% in 2024. The growth of supermarkets and hypermarkets as preferred distribution channels for chickpea snacks is primarily driven by their convenience and variety. These large retail outlets offer a one-stop shopping experience, allowing consumers to easily access a wide range of chickpea snack products alongside other grocery items. This convenience particularly appeals to busy consumers who prefer to complete their shopping in a single trip. Moreover, supermarkets and hypermarkets typically feature extensive product assortments, including various brands and flavors of chickpea snacks, which cater to diverse consumer preferences. This broad selection enhances the visibility of chickpea snacks and encourages impulse purchases, contributing to increased sales.

The growing trend towards health-conscious eating has positioned supermarkets and hypermarkets as key players in the distribution channel of chickpea snacks. As consumers become more aware of the health benefits associated with chickpeas-such as their high protein and fiber content-supermarkets are responding by expanding their offerings of healthier snack options. Many of these retail outlets also focus on promoting more nutritious food choices through strategic product placements and marketing campaigns highlighting chickpea snacks' nutritional advantages. This alignment with consumer health trends not only boosts the appeal of supermarkets and hypermarkets as distribution channels but also supports the overall growth of the chickpea snack industry.

The online segment is expected to grow at the fastest CAGR of 9% from 2024 to 2030. With the rise of e-commerce, consumers increasingly prefer to shop from home, avoiding the time and effort associated with visiting physical stores. Online platforms provide a broader selection of chickpea snacks, including niche and premium brands that may not be available in local supermarkets. This accessibility allows consumers to explore various flavors and product types, enhancing their shopping experience. In addition, reading reviews and comparing prices online empowers consumers to make informed purchasing decisions, further driving the popularity of online shopping for chickpea snacks.

Regional Insights

North America chickpea snacks market dominated the industry with the largest revenue share of 37.34% in 2024. The growth of chickpea snacks in North America is significantly influenced by the increasing health consciousness among consumers, particularly in the United States. As more people become aware of the nutritional benefits associated with chickpeas-such as high protein and fiber content-there is a marked shift towards healthier snacking options. This trend has been further amplified by the rising popularity of plant-based diets, where chickpeas serve as a versatile and nutritious ingredient. The success of hummus, a chickpea-based dip that gained mainstream acceptance in the 2000s, has paved the way for other chickpea products, making them more familiar and appealing to American consumers. The growing demand for snacks that are convenient and align with health and wellness goals has positioned chickpea snacks favorably in the competitive snack food market.

U.S. Chickpea Snacks Market Trends

The chickpea snacks market in the U.S. is expected to grow at the fastest CAGR during the forecast period. In the U.S., the cultural shift towards sustainable eating is another critical factor driving the growth of chickpea snacks. As concerns about climate change and environmental sustainability become more pronounced, consumers increasingly seek food options with a lower environmental impact. Chickpeas are recognized for their sustainable agricultural practices, requiring less water than animal protein sources and enriching soil health through nitrogen fixation. This eco-friendly aspect resonates with a significant population segment that prioritizes sustainability in their food choices. Moreover, introducing innovative flavors and product formats has expanded the appeal of chickpea snacks, attracting health-conscious individuals and those looking for tasty and satisfying alternatives to traditional snacks.

Asia Pacific Chickpea Snacks Market Trends

The chickpea snacks market in the Asia Pacific accounted for the market share of 22.29% in 2024 and is expected to grow at a significant CAGR of 9.1% during the forecast period. The growth of the chickpea snacks industry in the Asia Pacific region is driven by the increasing demand for healthy and nutritious snack options, particularly among the large vegetarian population in countries like India. Chickpeas are a staple in many traditional diets across this region, and their recognition as a rich source of protein, fiber, and essential nutrients aligns well with the rising health consciousness among consumers. The growing awareness of the health benefits associated with chickpeas, such as improved digestion and blood sugar regulation, has led to a surge in their consumption as snacks. In addition, the popularity of plant-based diets and gluten-free products further amplifies the appeal of chickpea snacks, making them a preferred choice for health-focused consumers.

Key Chickpea Snacks Company Insights

The chickpea snacks industry is characterized by a diverse landscape of key players and emerging brands, reflecting the growing demand for healthy and innovative snack options. Major companies such as PepsiCo, Nestlé, Mondelez International, and General Mills dominate the market, leveraging their established brand recognition and extensive distribution networks to capture significant market share. These companies offer a variety of chickpea-based products, including chips and puffs, which cater to health-conscious consumers seeking nutritious alternatives to traditional snacks. In addition, regional players like Hippeas and Biena have gained traction by focusing on sustainability and unique flavor offerings, appealing to niche markets within the broader snack industry.

Emerging brands are increasingly entering the global market, driven by the rising popularity of plant-based diets and the demand for gluten-free options. Companies like The Good Bean and Saffron Road emphasize innovative product development and clean ingredient sourcing, which resonate with health-focused consumers.

Key Chickpea Snacks Companies:

The following are the leading companies in the chickpea snacks market. These companies collectively hold the largest market share and dictate industry trends.

- PepsiCo, Inc.

- Nestlé S.A.

- Mondelez International, Inc.

- General Mills, Inc.

- Calbee, Inc.

- Campbell Soup Company

- Conagra Brands, Inc.

- Aryzta AG

- The Hain Celestial Group, Inc.

- Kraft Heinz Company

- ITC Limited

- Grupo Bimbo, S.A.B. de C.V.

- Kellogg Company

- The J.M. Smucker Company

- Biena Snacks

- Hippeas

- The Good Bean

- Saffron Road

Recent Developments

-

In November 2024, ChickP Protein Ltd won the top prize for its high-protein chickpea snack, ChickP Puffs, during a project meeting in Lleida, Spain. This snack contains 20% protein and was evaluated by 140 tasters as part of an EU initiative.

-

In March 2023, InnovoPro showcased new food products developed with chickpea protein at the Natural Products Expo West. This initiative emphasizes the versatility of chickpea protein in various applications, including snacks and dairy alternatives.

Chickpea Snacks Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2,033.41 million

Revenue forecast in 2030

USD 3,064.58 million

Growth rate

CAGR of 8.5% from 2024 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; Saudi Arabia

Key companies profiled

PepsiCo, Inc.; Nestlé S.A.; Mondelez International, Inc.; General Mills, Inc.; Calbee, Inc.; Campbell Soup Company; Conagra Brands, Inc.; Aryzta AG; The Hain Celestial Group, Inc.; Kraft Heinz Company; ITC Limited; Grupo Bimbo, S.A.B. de C.V.; Kellogg Company; Premier Foods Group; The J.M. Smucker Company; Biena Snacks; Hippeas; The Good Bean; Saffron Road

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Chickpea Snacks Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global chickpea snacks market report based on the product, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Roasted Chickpea

-

Chickpea Chips

-

Chickpea Puffs

-

Seasoned Chickpea

-

Others

-

-

Distribution Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Grocery Stores

-

Online Retailers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global chickpea snacks market was valued at USD 1,875.32 millionn in 2024 and is expected to reach USD 2,033.41 million in 2025.

b. The global chickpea snacks market is expected to grow at a CAGR of 8.5% from 2025 to 2030 to reach USD 3,064.58 million by 2030.

b. The roasted chickpea segment led the market with the largest revenue share of 47.84% in 2024. Roasted chickpeas are rich in protein, fiber, and essential vitamins and minerals, making them an appealing choice for health-conscious consumers. They provide a satisfying crunch and can be flavored in numerous ways, catering to a wide range of taste preferences.

b. Some key players operating in the roasted chickpea market include PepsiCo, Inc.; Nestlé S.A.; Mondelez International, Inc.; General Mills, Inc.; Calbee, Inc.; Campbell Soup Company; Conagra Brands, Inc.; Aryzta AG; The Hain Celestial Group, Inc.; Kraft Heinz Company; ITC Limited; Grupo Bimbo, S.A.B. de C.V.; Kellogg Company; Premier Foods Group; The J.M. Smucker Company; Biena Snacks; Hippeas; The Good Bean; Saffron Road

b. One of the primary drivers is the increasing health consciousness among consumers. As people become more aware of the nutritional benefits of their food choices, there is a shift towards convenient snacks that are rich in nutrients. Chickpeas are recognized for their high protein and fiber content, making them an attractive alternative to snacks often high in unhealthy fats and sugars. This demand for healthier options aligns with the rising popularity of plant-based diets, as chickpea snacks cater to vegetarians, vegans, and those looking to reduce their meat consumption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.