- Home

- »

- Consumer F&B

- »

-

Chickpea Protein Market Size, Share, Growth Report, 2030GVR Report cover

![Chickpea Protein Market Size, Share & Trends Report]()

Chickpea Protein Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Chickpea Protein Isolate, Chickpea Protein Concentrates), By Application (Food & Beverage, Animal Feed), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-487-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Chickpea Protein Market Size & Trends

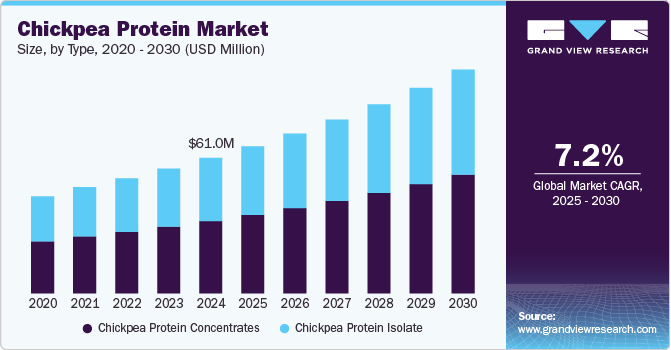

The global chickpea protein market size was estimated at USD 61.02 million in 2024 and is expected to grow at a CAGR of 7.2% from 2025 to 2030. One of the primary drivers is the increasing demand for plant-based proteins, as more consumers shift towards vegetarian and vegan diets. This trend is particularly pronounced in regions like North America and Europe, where health consciousness is rising, leading to greater consumption of chickpeas as a nutritious alternative to meat products.

In addition to dietary shifts, the chickpea market benefits from its established role in traditional cuisines, especially in South Asia. India, the largest producer and consumer of chickpeas, contributes substantially to global supply and demand. The country's production has steadily increased, reflecting a growing area under cultivation and enhanced agricultural practices. The Asia-Pacific region is expected to dominate market growth due to urbanization, rising household incomes, and changing consumer preferences toward healthier food options.

The advantages of chickpeas over other protein sources are significantly driving the growth of the chickpea market globally. As consumers increasingly seek healthier dietary options, chickpeas stand out due to their impressive nutritional profile. They provide about 8.9 grams of protein per 100 grams cooked, along with a high fiber content of approximately 7.6 grams, making them an excellent choice for those looking to increase their protein intake without the saturated fats found in animal proteins like beef, which contains around 25.4 grams of protein and 7.3 grams of saturated fat per 100 grams.

This shift in consumer preference towards plant-based proteins is reflected in the rising demand for chickpeas, particularly in regions with growing health awareness and dietary changes, such as North America and Europe. Moreover, the sustainability aspect of chickpeas enhances their market appeal. Chickpeas require significantly less water compared to animal farming, making them a more environmentally friendly protein source. This aligns with the increasing consumer focus on sustainable eating practices, further propelling market growth.

In addition, the versatility of chickpeas in various culinary applications-from traditional dishes in South Asia to innovative snacks and ready-to-eat meals-contributes to their rising popularity. The introduction of chickpea-based products like snacks and gluten-free alternatives is appealing to health-conscious consumers and those following vegan or vegetarian diets. For instance, the launch of products like chickpea pasta and snacks has tapped into the growing trend of functional foods that offer health benefits beyond basic nutrition.

Health benefits associated with chickpeas also play a crucial role in their market expansion. Chickpeas are rich in protein and fiber while low in fat, making them an attractive option for health-conscious consumers. They are linked to various health benefits, including improved digestion, blood sugar stabilization, and reduced risk of chronic diseases like diabetes and cardiovascular issues. The rising awareness of these health benefits is driving demand for whole chickpeas and chickpea-based products such as snacks and flour used in gluten-free diets.

Moreover, the growing trend of functional foods-products that offer health benefits beyond basic nutrition-has led to innovations in chickpea-based food items. Companies are increasingly developing snacks and ready-to-eat meals that incorporate chickpeas, tapping into the convenience factor sought by modern consumers. Diversifying product offerings enhances market accessibility and caters to varying consumer preferences.

Lastly, sustainability concerns are influencing market dynamics as consumers prefer environmentally friendly ingredients. Chickpeas require less water than other crops and contribute positively to soil health through nitrogen fixation, aligning with the global push towards sustainable agricultural practices. This alignment with environmental sustainability is expected to further bolster the demand for chickpeas in the coming years.

A primary restraint for the market is the competition from other protein types. Chickpea protein competes with established alternatives like soy, pea, and rice proteins, which have a strong market presence due to their versatility and established consumer bases. For instance, soy protein is often preferred for its complete amino acid profile and functionality in various food applications. As the plant-based protein market expands, chickpea protein producers must differentiate their products to capture market share.

Chickpeas' unique flavor and texture may appeal to only some consumers or fit seamlessly into every dish. While chickpeas are an excellent meat substitute, their distinct taste can limit their application in specific culinary contexts. This challenge necessitates the development of innovative processing techniques to enhance flavor and texture, which can complicate production and increase costs. Some consumers experience digestive discomfort when consuming chickpeas or chickpea protein, including bloating and acidity. These side effects can deter potential customers from adopting chickpea-based products, limiting market growth.

Type Insights

Chickpea protein concentrates accounted for a revenue share of over 53% in 2024. Chickpea protein concentrates are derived from whole chickpeas, retaining a significant portion of the fiber and other nutrients. They generally contain about 60-70% protein by weight, making them a valuable source of plant-based protein. One of the primary advantages of chickpea protein concentrates is their high fiber content, which aids digestion and promotes satiety, making them beneficial for weight management. This characteristic is particularly appealing in products aimed at health-conscious consumers.

Chickpea protein concentrates are also known for their emulsifying properties, which can enhance texture and stability in food formulations. For example, they are commonly used in baked goods, sauces, and meat alternatives to improve mouthfeel and moisture retention. Additionally, their allergen-friendly nature makes them an excellent alternative for individuals with sensitivities to soy or dairy, thus expanding their market reach into products like snack bars and plant-based spreads.

The chickpea protein isolate market is expected to grow at a CAGR of 7.3% over the forecast period. Chickpea protein isolates offer a higher protein content, typically around 80-90% by weight, with significantly lower levels of carbohydrates and fats. This makes them an ideal choice for athletes and fitness enthusiasts seeking a concentrated source of protein for muscle recovery and growth. The isolation process enhances digestibility by removing specific components that inhibit protein absorption, making these isolates more bioavailable than whole chickpeas.

Chickpea protein isolates are highly versatile and can be incorporated into various applications, including smoothies, protein shakes, baked goods, and nutritional bars. Their neutral flavor profile allows them to blend seamlessly into various recipes without altering taste. It is advantageous for product developers looking to create clean-label products that appeal to health-conscious consumers. Furthermore, the isolates' functional properties-such as solubility across different pH levels-make them suitable for use in beverages and soups where texture and stability are critical.

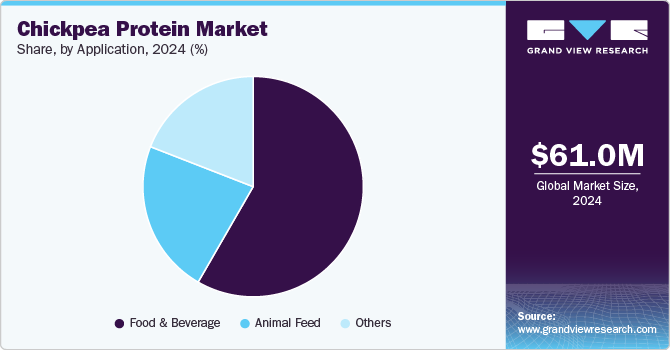

Application Insights

The food & beverage industry was the largest application for chickpea protein, accounted for a revenue of USD 35 million in 2023. Chickpea protein exhibits excellent functional properties such as emulsification, foaming, and gelling, which enhance its versatility in food applications. These properties allow chickpea protein to mimic the texture and functionality of animal proteins, making it suitable for use in plant-based meat alternatives, dairy replacements, and baked goods. For example, chickpea protein is commonly used in products like vegan sausages and non-dairy yogurts, contributing to texture and mouthfeel. Improving dough handling and increasing water absorption makes it valuable in bakery applications, contributing to a softer crumb structure in gluten-free products.

Chickpea protein is rich in essential amino acids, particularly lysine, and boasts a highly digestible indispensable amino acid score of 76 (DIAAS), making it an excellent substitute for animal proteins. Its high fiber content supports digestive health and contributes to satiety, appealing to health-conscious consumers. For instance, chickpea protein's role in blood sugar regulation is particularly beneficial for individuals with type 2 diabetes, as it helps prevent spikes in glucose levels post-meal. This nutritional profile positions chickpea protein as a preferred ingredient in products aimed at weight management and overall health.

The applications of chickpea protein are diverse and expanding. Due to its high protein content and neutral flavor profile, chickpea protein is utilized in plant-based milk alternatives and smoothies in the beverage sector. This allows manufacturers to enhance the nutritional content of their products without compromising taste. Chickpea protein is increasingly found in snack foods such as protein bars and chips, catering to the growing demand for on-the-go nutritious options. Its allergen-free nature makes it suitable for consumers with dietary restrictions, further broadening its market appeal.

Chickpea protein usage in animal feed is expected to grow at a CAGR of 7.0% from 2024 to 2030. The increasing focus on sustainable agriculture practices is another significant driver for chickpea protein in animal feed. Chickpeas require less water and have a lower environmental impact than conventional animal feed sources. As consumers and producers become more environmentally conscious, the demand for sustainable feed options rises. Chickpea protein aligns with these values, providing an eco-friendly alternative that supports ethical farming practices.

Chickpea protein can be incorporated into various animal diets, including poultry, swine, and ruminants. In poultry feeds, chickpeas contribute to balanced nutrition by enhancing protein intake and supporting muscle growth. Chickpeas can improve feed efficiency and weight gain for swine when included in their diets. Despite their primary forage-based diet, ruminants can also benefit from ground chickpeas as a supplemental protein source. This versatility allows chickpea protein to cater to diverse livestock needs while promoting overall animal health.

Regional Insights

The North America chickpea protein market exceeded USD 22 million in 2024. There is a significant shift towards plant-based diets among North American consumers, fueled by health consciousness and the desire to reduce meat consumption. This trend is reflected in the growing popularity of vegetarian and vegan diets, leading to an increased demand for alternative protein sources like chickpeas.

U.S. Chickpea Protein Market Trends

The chickpea protein market in the U.S. is expected to grow at a CAGR of 6.9% from 2025 to 2030. As environmental awareness grows, U.S. consumers are increasingly seeking sustainable food sources. Chickpeas require less water and have a lower carbon footprint than traditional animal farming methods, making them an eco-friendly choice for protein sourcing. This sustainability aspect resonates with consumers who prioritize environmentally responsible products, boosting the demand for chickpea protein.

The food industry is witnessing significant innovation involving chickpea protein, with manufacturers developing new products that utilize this ingredient effectively. For example, chickpea protein is being incorporated into plant-based meat alternatives such as burgers and sausages and dairy replacements like yogurt and cheese. This innovation not only enhances the nutritional profile of these products but also improves taste and texture, making them more appealing to consumers.

Asia Pacific Chickpea Protein Market Trends

The Asia Pacific chickpea protein market is expected to be the fastest growing market, growing at a CAGR of 8.0% from 2024 to 2030. Rapid economic development and urbanization in countries like China are contributing to changing dietary habits. As disposable incomes rise, consumers are more willing to invest in healthier food options, including plant-based proteins. The demand for chickpea protein is expected to grow significantly as urban populations seek convenient and nutritious food solutions that fit their busy lifestyles.

Chickpeas have long been a part of traditional diets across Asia, particularly in South Asian countries where they are used in various dishes such as curries and snacks. This cultural acceptance facilitates the integration of chickpea protein into modern food products without significant resistance from consumers. As a result, chickpeas are increasingly being recognized for their traditional uses and potential as a versatile ingredient in contemporary cuisine.

Key Chickpea Protein Company Insights

The competitive landscape is marked by both established companies and new entrants focusing on innovation and sustainability. The fragmented market has numerous players vying for market share through product differentiation and strategic partnerships.

Key Chickpea Protein Companies:

The following are the leading companies in the chickpea protein market. These companies collectively hold the largest market share and dictate industry trends.

- Batory Foods

- Ingredion Inc.

- ADM

- PLT Health Solutions

- Chickplease

- Cambridge Commodities Ltd

- AGT Food and Ingredients

- Nutriati, Inc.

- ChickP Protein Ltd.

- InnovoPro Ltd.

- The Scoular Company

- Vestkorn Milling AS

- Socius Ingredients

- Parabel USA Inc.

- Puris Proteins, LLC

Recent Developments

-

In March 2023, InnovoPro announced plans to showcase new food products developed with chickpea protein at the Natural Products Expo West 2023. These products span various categories, including snacks, dressings, dairy alternatives, and meat substitutes, emphasizing the versatility and application of chickpea protein in modern food formulations.

-

In September 2022, Ingredion Inc. made headlines by acquiring an equity stake in InnovoPro, which specializes in chickpea ingredients. This strategic investment aims to enhance Ingredion's portfolio in the plant-based protein sector and reflects the increasing interest in sustainable protein sources.

Chickpea Protein Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 66.26 million

Revenue forecast in 2030

USD 100.82 million

Growth rate

CAGR of 7.2% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Batory Foods; Ingredion Inc.; Archer Daniels Midland CompanyPLT Health Solutions; Cambridge Commodities Ltd; AGT Food and Ingredients; Nutriati, Inc.; ChickP Protein Ltd.; InnovoPro Ltd.; The Scoular CompanyVestkorn Milling AS; Socius Ingredients; Parabel USA Inc.; Puris Proteins, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Chickpea Protein Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and analyzes the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global chickpea protein market report by type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Chickpea Protein Isolate

-

Chickpea Protein Concentrates

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Animal Feed

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global chickpea protein market size was valued at USD 61.02 million in 2024 and is expected to reach USD 66.26 million in 2025.

b. The global chickpea protein market is expected to expand at a compound annual growth rate (CAGR) of 8.7% from 2025 to 2030 to reach USD 100.82 million by 2030.

b. The food & beverage industry was the largest application for chickpea protein, accounting for a market revenue of USD 32 million in 2023. Chickpea protein exhibits excellent functional properties such as emulsification, foaming, and gelling, which enhance its versatility in food applications. These properties allow chickpea protein to mimic the texture and functionality of animal proteins, making it suitable for use in plant-based meat alternatives, dairy replacements, and baked goods.

b. Some key players operating in the chickpea protein market include Batory Foods; Ingredion Inc.; Archer Daniels Midland CompanyPLT Health Solutions; Cambridge Commodities Ltd; AGT Food and Ingredients; Nutriati, Inc.; ChickP Protein Ltd.; InnovoPro Ltd.; The Scoular CompanyVestkorn Milling AS; Socius Ingredients; Parabel USA Inc.; Puris Proteins, LLC

b. One of the primary drivers is the increasing demand for plant-based proteins, as more consumers shift towards vegetarian and vegan diets. This trend is particularly pronounced in regions like North America and Europe, where health consciousness is rising, leading to greater consumption of chickpeas as a nutritious alternative to meat products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.