- Home

- »

- Consumer F&B

- »

-

Chickpea Flour Market Size, Share, Industry Report, 2030GVR Report cover

![Chickpea Flour Market Size, Share & Trends Report]()

Chickpea Flour Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Food & Beverage, Animal Feed, Personal Care & Cosmetics), By Distribution (Retail, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-491-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Chickpea Flour Market Summary

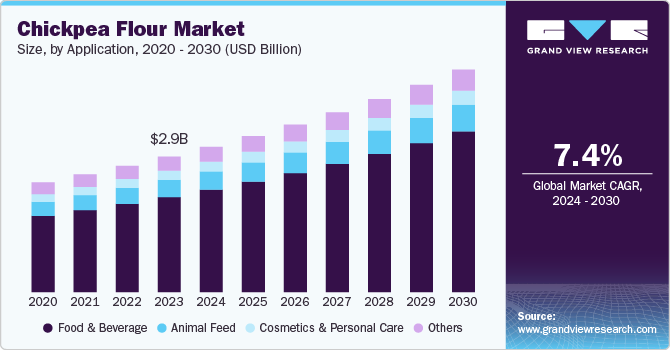

The global chickpea flour market size was estimated at USD 2,875 million in 2023 and is projected to reach USD 4.72 billion by 2030, growing at a CAGR of 7.4% from 2024 to 2030. The chickpea flour industry is experiencing significant growth, driven by various factors that reflect changing consumer preferences and broader market trends.

Key Market Trends & Insights

- Asia Pacific was the largest and was estimated at USD 1.38 billion in 2023.

- The U.S. is expected to exceed USD 700 million by 2030 primarily driven by increased demand for plant-based products.

- By application, the food & beverage was the largest segment of chickpea flour and had a market of USD 2.02 billion in 2023.

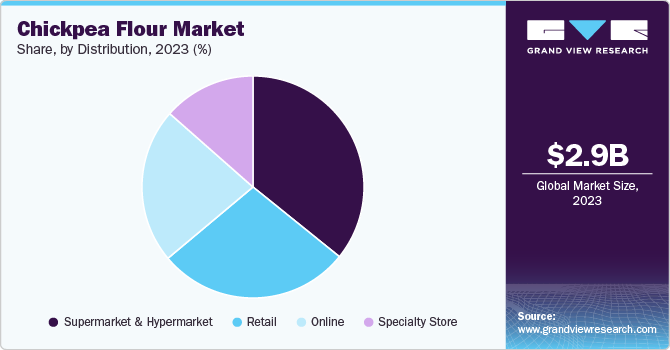

- By distribution, the supermarkets and hypermarkets were the largest segment for chickpea flours, accounting for over 35% of market revenue in 2024.

Market Size & Forecast

- 2023 Market Size: USD 2,875 Million

- 2030 Projected Market Size: USD 4.72 Billion

- CAGR (2024-2030): 7.4%

- Asia Pacific: Largest market in 2023

One of the primary drivers is the increased health consciousness among consumers. As more individuals prioritize health and wellness, they seek nutritious food options. Chickpea flour is recognized for its numerous health benefits, including its high fiber content, which aids in reducing cholesterol levels, regulating blood pressure, and stabilizing blood sugar levels. This growing awareness has led to a surge in demand for chickpea flour as a healthier alternative to traditional flours, particularly among those with dietary restrictions such as gluten intolerance or those following vegan diets.

Another significant factor contributing to the chickpea flour industry's growth is the expansion of the food and beverage industry. Chickpea flour is increasingly used in various food applications, including bakery products, snacks, and savory dishes. Its versatility allows it to be incorporated into a wide range of recipes, from traditional cuisines to modern culinary innovations. The rising popularity of gluten-free and plant-based products has further fueled this trend, as consumers are actively seeking alternatives that align with their dietary preferences. In addition, the affordability of chickpea flour compared to other specialty flours makes it an attractive option for both manufacturers and consumers alike.

The growing influence of social media and health trends also plays a crucial role in driving the chickpea flour industry. Influencers and celebrity chefs increasingly endorse chickpea flour for its nutritional value and culinary versatility. This exposure helps educate consumers about its benefits and encourages them to incorporate it into their diets. Moreover, online shopping has made chickpea flour more accessible to consumers worldwide, further boosting its popularity. The convenience of purchasing health-oriented products online aligns with the fast-paced lifestyle of many consumers today.

Emerging markets in developing regions are also contributing significantly to market growth. As disposable incomes rise in countries such as India and Bangladesh, there is an increasing demand for healthy food options. The cultural significance of chickpeas in these regions enhances their acceptance and incorporation into local cuisines. Furthermore, with urbanization and changing lifestyles, consumers are more inclined to explore new food products that offer health benefits and culinary diversity. This trend is expected to continue as more people become aware of the advantages associated with chickpea flour.

In terms of applications, chickpea flour is making substantial inroads into various sectors. In the bakery industry, it serves as a gluten-free alternative that can enhance the nutritional profile of baked goods while providing a unique flavor. In snack production, chickpea flour creates healthier snack options that appeal to health-conscious consumers. Moreover, its use in confectionery products is rising as manufacturers seek to develop innovative treats that cater to dietary restrictions without compromising taste. The versatility of chickpea flour positions it well within these markets, promising continued growth as consumer preferences evolve toward healthier eating habits.

The chickpea flour industry faces several challenges that could impede its growth despite the increasing demand for healthier food options. One of the primary issues is consumer awareness. While chickpea flour is recognized for its nutritional benefits, many potential consumers remain unaware of its advantages compared to traditional flours. This lack of knowledge is particularly pronounced in developing countries, where consumers may not be familiar with chickpea flour or its applications in cooking and baking. Educating consumers about the benefits and uses of chickpea flour is crucial for expanding its market presence and increasing overall consumption.

Digestive issues associated with chickpea consumption pose another challenge for the market. Some individuals experience gastrointestinal discomfort after consuming chickpeas or products made from chickpea flour, such as bloating or constipation. These side effects can discourage consumers from incorporating chickpea flour into their diets, limiting its appeal as a staple ingredient. Addressing these concerns through product innovation or consumer education about proper preparation methods may be necessary to mitigate this issue.

Application Insights

Food & beverage was the largest application of chickpea flour and had a market of USD 2.02 billion in 2023. The increasing consumer health consciousness significantly drives market growth within the food and beverage industry. As more individuals become aware of the health benefits associated with chickpea flour, its popularity is surging. Chickpea flour is rich in protein, fiber, vitamins, and minerals, making it an attractive option for health-conscious consumers. Its low glycemic index also makes it suitable for those managing blood sugar levels, further enhancing its appeal among diabetic and health-focused populations. This shift towards healthier eating habits has increased demand for chickpea flour as a nutritious alternative to traditional wheat flour, particularly in baked goods and snacks.

Another important factor contributing to market growth is its versatility in culinary applications. Chickpea flour is not only used as a gluten-free substitute in baking but is also gaining traction in various cuisines around the world. It is a staple ingredient in many traditional dishes, especially in South Asian cooking, where it is used to make popular items like fritters and samosas. Innovative chefs and food manufacturers are experimenting with chickpea flour in modern recipes, incorporating it into pancakes, pasta, and even desserts. This versatility allows chickpea flour to cater to a wide range of dietary preferences, including vegan and gluten-free diets, thereby expanding its market reach.

The expansion of distribution channels has also played a crucial role in market growth. Previously limited to specialty stores or ethnic markets, chickpea flour is now widely available in mainstream supermarkets and online platforms. This increased accessibility allows consumers from diverse backgrounds to easily incorporate chickpea flour into their diets. Improved packaging options have further enhanced its appeal by ensuring product freshness and providing consumers with essential information on usage and recipes. As more brands enter the market with innovative products and marketing strategies, the presence of chickpea flour in the food and beverage industry continues to grow, solidifying its position as a key ingredient for health-conscious consumers.

Animal feed was another crucial application of chickpea flour and is expected to grow at a CAGR of 6.6% from 2024 to 2030. A significant driver is the rising demand for sustainable and plant-based feed alternatives. With growing concerns over the environmental impact of animal agriculture, there is a shift towards using plant-based ingredients in animal feed formulations. Chickpea flour fits well within this trend as it is derived from legumes, known for their lower carbon footprint than animal-based protein sources. Furthermore, chickpea flour can improve soil health through crop rotation practices, further enhancing its appeal among environmentally conscious farmers and feed manufacturers.

Expanding the animal husbandry industry in developing regions also contributes to market growth in animal feed. As populations rise and urbanization increases, there is a greater demand for meat and dairy products. This surge in demand necessitates efficient feeding strategies that can support large-scale livestock production. Chickpea flour provides an affordable protein source that can be easily integrated into existing feed formulations. Furthermore, its digestibility and ability to enhance feed efficiency make it an attractive choice for farmers looking to maximize production while minimizing costs. Overall, these factors collectively position chickpea flour as a key ingredient in the evolving landscape of animal nutrition.

Distribution Insights

Supermarkets and hypermarkets were the largest distribution channels for chickpea flours, accounting for over 35% of market revenue in 2024. As awareness of the nutritional benefits of chickpea flour rises, more consumers are seeking alternatives to traditional wheat flour, particularly due to its high protein, fiber content, and low glycemic index. Supermarkets and hypermarkets play a crucial role in this trend by providing easy access to chickpea flour alongside other health-focused items. The convenience of shopping in these larger retail formats allows consumers to explore various options, including gluten-free and plant-based products, which align with their dietary preferences and health goals.

Another significant factor driving sales is the strategic marketing and product placement within these retail environments. Supermarkets and hypermarkets often highlight chickpea flour as part of their health food sections or during promotional events centered around gluten-free or organic products. This visibility educates consumers about chickpea flour's benefits and uses and encourages trial and adoption. In addition, collaborations with brands that offer innovative recipes or cooking demonstrations can further stimulate interest and sales. As a result, the combination of heightened consumer awareness and effective marketing strategies in supermarkets and hypermarkets is propelling the growth of chickpea flour in the retail space.

The online distribution channel for chickpea flour is expected to grow at a CAGR of 8.9% from 2024 to 2030. The growth of chickpea flour sales through online channels is significantly driven by the increased accessibility and convenience that e-commerce platforms offer to consumers. With the rise of digitalization and the proliferation of smartphones, consumers can easily browse and purchase chickpea flour from the comfort of their homes. This shift has particularly benefited health-conscious individuals seeking gluten-free and plant-based alternatives, as online retailers often provide a wider variety of products than traditional brick-and-mortar stores. Furthermore, comparing prices, reading reviews, and accessing detailed product information enhances the shopping experience, making it more appealing for consumers to choose chickpea flour over other options.

Another key factor contributing to the growth of chickpea flour sales online is the strategic marketing efforts and promotional activities employed by manufacturers and retailers. Many companies are leveraging social media, influencer partnerships, and targeted online advertising to raise awareness about chickpea flour's health benefits and culinary versatility. Promotions such as discounts, free shipping, and bundled offers further incentivize consumers to purchase online. Furthermore, the ongoing trend towards healthier eating habits has increased interest in chickpea flour as a nutritious ingredient in various recipes, effectively showcased through engaging online content. As a result, the combination of convenience, accessibility, and effective marketing strategies is driving significant growth in chickpea flour sales through online channels.

Regional Insights

The North America chickpea flour market is expected to grow at a CAGR of 7.4% from 2024 to 2030. The expansion of distribution channels has facilitated the availability of chickpea flour across North America. Supermarkets and hypermarkets are increasingly stocking chickpea flour alongside other health food products, making it more accessible to a broader audience. Moreover, the rise of e-commerce has further enhanced consumer access to chickpea flour, allowing for easy online purchasing and delivery options. This increased availability, combined with effective marketing strategies highlighting chickpea flour's health benefits and culinary versatility, has significantly contributed to its growing market presence in North America. As a result, consumers are more inclined to incorporate chickpea flour into their diets, driving sales and fostering market growth.

U.S. Chickpea Flour Market Trends

The chickpea flour market in the U.S. is expected to exceed USD 700 million by 2030 primarily driven by increased demand for plant-based products. As more individuals adopt vegetarian and vegan diets or simply seek to reduce their meat consumption, the demand for nutritious plant-based ingredients has surged. With its high protein and fiber content, chickpea flour is an excellent alternative to traditional flour, making it a favored choice for health-conscious consumers. The increasing awareness of the health benefits associated with chickpeas-such as improved heart health, weight management, and better blood sugar control-has further propelled its adoption in various food products, including baked goods, snacks, and ready-to-eat meals. This trend aligns with the broader movement towards healthier eating habits, where consumers actively seek ingredients that contribute positively to their overall well-being.

Asia Pacific Chickpea Flour Market Trends

The chickpea flour market in Asia Pacific was the largest and was estimated at USD 1.38 billion in 2023. India is a major market in the region and is expected to be the fastest-growing region. Chickpeas are rich in protein and provide essential nutrients and dietary fiber, making them an attractive option for those seeking healthier food choices. This trend is further supported by the cultural significance of chickpeas in Indian cuisine, which is commonly used in various traditional dishes such as curries, snacks, and salads. The integration of chickpeas into everyday diets aligns with the broader movement towards health-conscious eating, thereby driving demand.

Government initiatives and agricultural advancements have also played a crucial role in boosting chickpea production in India. The Indian government has implemented supportive policies to increase chickpea cultivation and improve agricultural practices. This includes providing subsidies for farmers, promoting research on high-yield varieties, and enhancing irrigation facilities. As a result, India has become the largest producer of chickpeas globally, accounting for approximately 70% of total production. The increased availability of chickpeas not only meets domestic demand but also positions India as a key exporter in the global market.

Key Chickpea Flour Company Insights

The market is characterized by a competitive landscape that includes several key players and emerging companies focused on innovation and product development. Major companies such as Ingredion, ADM, The Scoular Company, and SunOpta dominate the industry, leveraging their extensive distribution networks and established brand recognition to capture a significant market share. These companies are actively involved in expanding their product lines, introducing new formulations, and enhancing the nutritional profile of chickpea flour to cater to the growing demand for health-oriented food products. For instance, recent developments include partnerships and acquisitions to improve supply chain efficiencies and expand into new markets, particularly in North America and Asia.

Key Chickpea Flour Companies:

The following are the leading companies in the chickpea flour market. These companies collectively hold the largest market share and dictate industry trends.

- Ingredion Incorporated

- ADM (Archer Daniels Midland Company)

- The Scoular Company

- SunOpta

- Anchor Ingredients

- EHL Limited

- Batory Foods

- Blue Ribbon

- Diefenbaker Spice & Pulse

- Great Western Grain

- Best Cooking Pulses

- Bean Growers Australia

- Parakh Agro Industries Ltd

- CanMar Grain Products

- Jain Group of Companies

Chickpea Flour Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.08 billion

Revenue forecast in 2030

USD 4.72 billion

Growth rate (revenue)

CAGR 7.4% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, distribution, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; Brazil; Saudi Arabia

Key companies profiled

Ingredion Incorporated; ADM (Archer Daniels Midland Company); The Scoular Company; SunOpta; Anchor Ingredients; EHL Limited; Batory Foods; Blue Ribbon; Diefenbaker Spice & Pulse; Great Western Grain; Best Cooking Pulses; Bean Growers Australia; Parakh Agro Industries Ltd; CanMar Grain Products; Jain Group of Companies

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Chickpea Flour Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and analyzes the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global chickpea flour market report based on application, distribution, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Animal Feed

-

Personal Care & Cosmetics

-

Others

-

-

Distribution Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Retail

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global fresh fish market was estimated at USD 2,875 million in 2023 and is expected to reach USD 3.08 billion in 2024.

b. The global fresh fish market is expected to grow at a compound annual growth rate of 7.4% from 2024 to 2030 to reach USD 4.72 billion by 2030.

b. Food & beverage was the largest application of chickpea flour and had a market of USD 2020 million in 2023. The growth of the chickpea flour market within the food and beverage industry is significantly driven by the increasing consumer health consciousness. As more individuals become aware of the health benefits associated with chickpea flour, its popularity is surging. Chickpea flour is rich in protein, fiber, vitamins, and minerals, making it an attractive option for health-conscious consumers. Its low glycemic index also makes it suitable for those managing blood sugar levels, further enhancing its appeal among diabetic and health-focused populations.

b. Some of the key market players in the chickpea flour market are Ingredion Incorporated; ADM (Archer Daniels Midland Company); The Scoular Company; SunOpta; Anchor Ingredients; EHL Limited; Batory Foods; Blue Ribbon; Diefenbaker Spice & Pulse; Great Western Grain; Best Cooking Pulses; Bean Growers Australia; Parakh Agro Industries Ltd; CanMar Grain Products; Jain Group of Companies

b. The chickpea flour market is experiencing significant growth, driven by various factors that reflect changing consumer preferences and broader market trends. One of the primary drivers is the increased health consciousness among consumers. As more individuals prioritize health and wellness, they are seeking out nutritious food options. Chickpea flour is recognized for its numerous health benefits, including its high fiber content, which aids in reducing cholesterol levels, regulating blood pressure, and stabilizing blood sugar levels. This growing awareness has led to a surge in demand for chickpea flour as a healthier alternative to traditional flours, particularly among those with dietary restrictions such as gluten intolerance or those following vegan diets.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.