- Home

- »

- Medical Devices

- »

-

Chemotherapy-induced Alopecia Treatment Device Market Report, 2030GVR Report cover

![Chemotherapy-induced Alopecia Treatment Device Market Size, Share & Trends Report]()

Chemotherapy-induced Alopecia Treatment Device Market Size, Share & Trends Analysis Report By Product (Manual Cooling Systems, Automated Cooling Systems), By Sales Modality, By Indication, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-433-6

- Number of Report Pages: 145

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

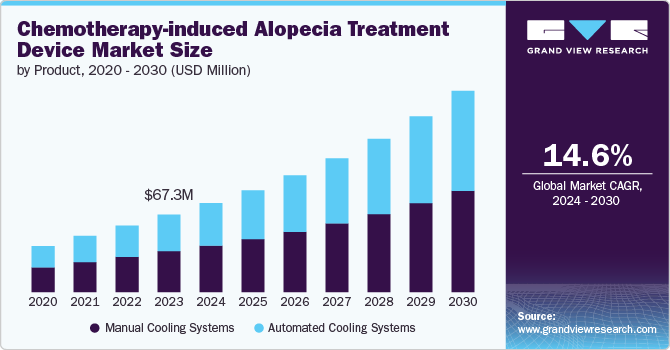

The global chemotherapy-induced alopecia treatment device market size was estimated at USD 67.3 million in 2023 and is projected to grow at a CAGR of 14.6% from 2024 to 2030. Chemotherapy-induced alopecia (CIA) treatment devices are used to prevent or minimize hair loss in patients undergoing chemotherapy. These devices, like scalp cooling systems, reduce the amount of chemotherapy drugs reaching the hair follicles by cooling the scalp, helping to preserve hair during treatment.

The market is driven by a combination of factors, including an aging and growing population and increased exposure to various risk factors, many of which are linked to socioeconomic development. Key contributors to the rising incidence of cancer include tobacco use, alcohol consumption, and obesity, while environmental factors like air pollution continue to play a significant role. The global cancer burden is expected to grow rapidly. According to the WHO article published in February 2024, over 35 million new cases are projected by 2050, marking a 77% increase from the estimated 20 million cases in 2022.

The increasing prevalence of chemotherapy-induced alopecia (CIA) in pediatric patients fuels market opportunity. According to the Springer Nature Limited article published in February 2024, in a retrospective cohort study, patients who visited the Pediatric Dermatology Department between January 2011 - 2022, due to CIA were identified; studies revealed that over 90% of children with cancer experience hair loss, with 12% to 24% of these cases becoming permanent. The demand for effective CIA treatments is driven by the psychological and social impact of hair loss, which is particularly significant in children. With ongoing research and advancements in treatment options, the market for CIA treatment devices and therapies is poised for growth, addressing the critical need for effective solutions in this vulnerable population.

Technological advancements in the market are focused on enhancing the efficacy and patient comfort of available interventions. According to the NCBI article published in December 2023, one such advancement is Low-Level Light Therapy (LLLT), which has shown promise in mitigating hair loss during chemotherapy. LLLT works by extending the anagen phase of hair growth and preventing hair follicles from prematurely entering the catagen phase, which is critical in reducing hair loss. The technology leverages cytochrome C oxidases in mitochondria, which absorb red and near-infrared light, increasing enzyme activity, electron transport, and adenosine triphosphate (ATP) production. This process promotes vascularization and stimulates hair follicle stem cell growth, offering a non-invasive and user-friendly treatment option.

Clinical studies have further refined LLLT devices, demonstrating their potential in CIA treatment. For instance, a randomized controlled trial involving 106 breast cancer patients utilized a more advanced LLLT device with 69 laser diodes (LDs), showing improved outcomes compared to previous models. The trial reported statistically significant increases in hair count and width over a 4-week period, as measured by a phototrichogram, with 12 sessions of LLLT intervention. These advancements enhance the effectiveness of CIA treatment and improve patients' quality of life, offering a more reliable alternative to traditional scalp cooling methods.

Growing awareness of the CIA treatment drives the market growth. According to the NCBI article published in March 2023, there has been a significant increase in understanding the psychological effects of chemotherapy-induced alopecia (CIA) on cancer patients. Advocacy groups and healthcare professionals are actively informing patients about available CIA treatment options, which has led to greater adoption of these therapies. This heightened awareness encourages patients to address hair loss prevention with their oncologists, contributing to a more favorable treatment experience. In addition, oncology teams increasingly incorporate CIA management into a comprehensive cancer care strategy. Enhanced collaboration between oncologists and dermatologists is fostering a more integrated approach to patient care. This model improves patients' overall quality of life and boosts treatment adherence, as patients receive more comprehensive support throughout their cancer treatment journey.

Market Concentration & Characteristics

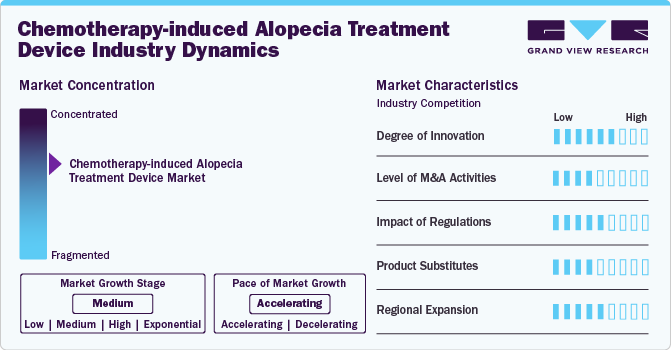

The market is witnessing high innovation, with companies introducing portable devices and technology. For manual cooling systems, recent advancements focus on refining design and functionality to enhance patient comfort and treatment efficacy. In contrast, automated cooling systems are experiencing more significant innovation, with developments in advanced cooling technologies and automation features aimed at improving precision, ease of use, and overall effectiveness in mitigating hair loss caused by chemotherapy.

Several market players, such as Dignitana, Paxman, Penguin Cold Caps, and Chemotherapy Cold Caps, Inc., are involved in mergers and acquisitions. Through M&A activity, these companies employ vital strategies such as product innovation, strategic collaborations, and geographical expansion to enhance their presence and address the growing demand for cancer interventions.

Regulations significantly impact the market by ensuring safety, efficacy, and quality standards. Strict regulatory standards can lead to delays in product approvals, impacting both market entry and innovation. Moreover, these regulations boost patient trust and ensure device reliability, supporting market growth by ensuring that only safe and effective devices are approved for clinical use.

There are currently no direct substitutes. Potential substitutes include hair transplant surgery, which can address permanent hair loss. Wigs and hairpieces are also common non-medical substitutes for managing visible hair loss.

Market players in the (CIA) treatment device sector are expanding their presence by entering new geographical markets, forming strategic partnerships with local distributors, and tailoring their product offerings to align with specific regional healthcare requirements. For instance, in May 2023, Dignitana signed a distribution agreement with a leading Japanese distributor, Konica Minolta. Through this arrangement, the latter company will aid the former in growing its revenue footprint in Asia.

Product Insights

The manual cooling systems segment led the market with the largest revenue share of 52.7% in 2023, due to ongoing product advancements, growing initiatives by key companies, and increasing cancer prevalence. Manual cooling systems for chemotherapy-induced alopecia (CIA) are expanding due to the growing adoption of these devices by patients and their proven effectiveness. According to the Springer Nature article published in March 2024, research indicates that a significant proportion of patients, approximately 92.1%, who use manual cold capping systems, such as Penguin Caps, achieve favorable outcomes by retaining at least 50% of their hair. This high level of effectiveness is further supported by a high completion rate, with 95% of patients who initiated the cold capping process following through to the end of their treatment. The substantial evidence of effectiveness and the ability of these systems to be used conveniently at home contribute to their increasing popularity among patients. As awareness of these benefits spreads, more individuals are likely to opt for manual cooling systems, leading to growth in the market and broader adoption of these non-invasive solutions for managing chemotherapy-induced hair loss.

The automated cooling systems segment is expected to grow at a lucrative CAGR during the forecast period. Rising chemotherapy incidence and technological advancements drive the segment growth. According to the International Information and Engineering Technology Association article published in September 2023, recent advancements in automated cooling systems include the introduction of sensor-equipped cooling caps featuring electronic Peltier elements, which replace traditional mechanical cooling methods. Some of the key players, such as Dignitana and Paxman, have pioneered automated cooling systems. For instance, Dignitana produces the DigniCap Scalp Cooling System. It uses a computerized cooling unit connected to a cap worn by the patient. The cooling process reduces the metabolic rate of the hair cells and temporarily reduces blood flow, thereby minimizing the exposure of the hair follicles to chemotherapy agents.

Sales Modality Insights

Based on sales modality, the rental sales segment led the market with the largest revenue share of 80.9% in 2023. Growing patient awareness of scalp cooling systems has increased demand for rental options. As more individuals seek to mitigate chemotherapy-induced hair loss, healthcare providers are expanding their services to include rental programs, enhancing accessibility. Advanced and affordable scalp cooling technology drives the market growth. For instance, in April 2024, an initiative by a CI MED and Grainger College team is developing CAPSLocks, a more accessible scalp-cooling system to prevent chemotherapy-induced hair loss. Offering their device at less than half the rental price of existing systems and benefiting from Medicare coverage is poised to increase adoption rates and improve affordability for a broader patient base.

The direct sales segment is expected to grow at a lucrative CAGR during the forecast period. Manufacturers are expanding their direct sales efforts to reach patients and healthcare providers more effectively. This approach allows for personalized customer support and streamlines access to treatment devices, enhancing patient adoption and driving market growth. Increasing direct sales and strategic partnerships drive market growth. For instance, Dignitana achieved a 19% revenue increase in 2023 due to its strategic direct sales initiatives and collaborations with healthcare providers. The company's focus on direct sales has improved customer support and facilitated valuable feedback, which has enhanced patient adoption of the DigniCap system.

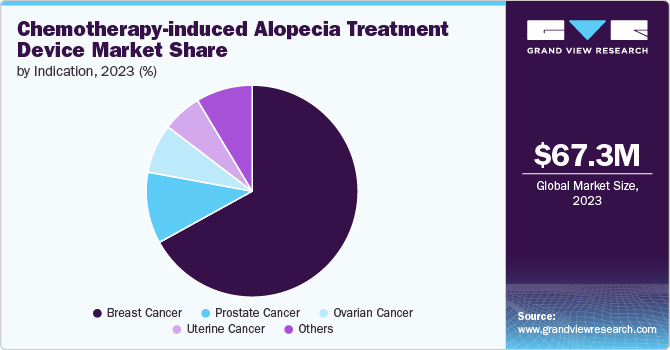

Indication Insights

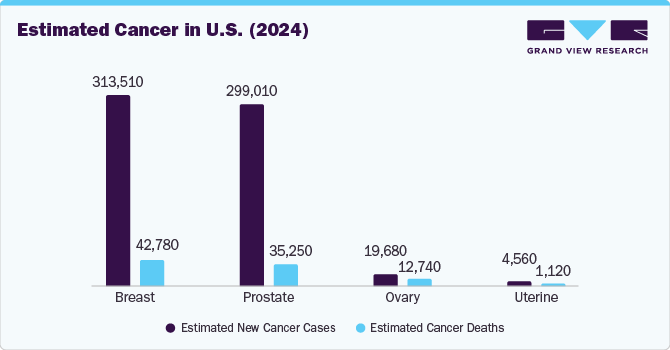

Based on indication, the breast cancer segment led the market with the largest revenue share of 66.93% in 2023. Rising incidence of breast cancer, technological advancement, and growing awareness drive the market growth. According to the World Cancer Research Fund International article published in June 2024, breast cancer remains the leading cancer among women, with 2,296,840 new cases reported in 2022. This high incidence rate underscores the significant demand for effective solutions to manage chemotherapy-induced alopecia (CIA). The large number of breast cancer diagnoses presents a substantial market opportunity for CIA treatment devices, as addressing hair loss is a critical concern for many women undergoing chemotherapy.

The ovarian cancer segment is anticipated to grow at the fastest CAGR over the forecast period. Rising ovarian cancer cases, technological advancements, and growing awareness drive the market growth. According to the World Cancer Research Fund International article published in June 2024, ovarian cancer ranks as the 8th most common cancer among women and the 18th globally. In 2022, over 324,603 new cases were reported. This significant prevalence highlights a growing need for chemotherapy-induced alopecia (CIA) treatment devices. As the number of ovarian cancer diagnoses rises, so does the demand for effective solutions to manage the hair loss associated with chemotherapy, creating a robust market opportunity for CIA treatment innovations.

End-use Insights

Based on end use, the hospital segment led the market with the largest revenue share at 44.85% in 2023. Hospitals are integrating these CIA devices into their oncology departments to offer patients a proven method for mitigating chemotherapy-related hair loss. This expansion is driven by the growing recognition of the psychological and emotional benefits of preventing hair loss during cancer treatment, alongside the increasing availability of advanced, cost-effective cooling systems. Hospitals invest in these technologies to enhance patient care and improve treatment experiences, further fueling market growth. For instance, in May 2024, it was estimated that nearly 10,000 people in Kentucky died from cancer annually, but UofL Health aims to cut that number in half with the help of state funding. A major advancement is established a USD 25 million facility dedicated to rural cancer education and research at the UofL Health South Hospital in Bullitt County. This expansion will improve access to cancer care in rural areas, likely increasing demand for Chemotherapy-Induced Alopecia (CIA) treatment devices as more patients receive chemotherapy.

The cancer centers segment is anticipated to experience at a significant CAGR during the forecast period. The global rise in cancer incidence is driving an increased demand for chemotherapy treatments, thereby escalating the need for Chemotherapy-Induced Alopecia (CIA) treatment devices in these centers. Advances in scalp cooling technologies and other CIA treatments have notably enhanced their effectiveness and patient comfort, leading to wider adoption. Moreover, the cancer care landscape is poised for a major shift in December 2023, with the opening, expansion, and affiliation of 123 cancer centers in the U.S. This rapid growth is expected to have a profound impact on the market, as new facilities come online and existing centers expand their capabilities, increasing the capacity to treat a larger number of cancer patients. This expansion underscores the growing demand for comprehensive cancer care and highlights the critical need for supportive care solutions, such as CIA treatment devices, to enhance patient outcomes and quality of life.

Regional Insights

North America dominated the chemotherapy-induced alopecia (CIA) treatment device market with the revenue share of 52.80% in 2023. Rising cancer cases, product launches, regulatory approvals, and advanced healthcare infrastructure drive North America's demand for (CIA) treatment devices. According to an American Cancer Society article published in 2024, the U.S. is expected to record nearly 300,000 new cases of prostate cancer in 2024. The significant incidence and mortality rates of prostate cancer highlight the critical need for effective treatments, including those addressing chemotherapy-induced alopecia (CIA). This growing demand for supportive therapies, such as CIA treatment devices, is driving market expansion in North America as patients seek solutions to manage and mitigate the side effects of chemotherapy.

U.S. Chemotherapy-induced Alopecia Treatment Device Market Trends

The chemotherapy induced alopecia (CIA) treatment device market in U.S. accounted for the largest share of North America in 2023. Rising incidence of cancer, growing awareness, and technological advancement drive the market growth. According to an American Cancer Society article published in 2023, the U.S. is expected to see 1,958,310 new cancer cases and 609,820 cancer-related deaths. Moreover, breast cancer held a dominant share among all cancer types, with an estimated incidence of 0.37 million cases. In addition, it was estimated that in 2024, nearly 43,170 patients will succumb to this disease.

Europe Chemotherapy-induced Alopecia Treatment Device Market Trends

The chemotherapy induced alopecia (CIA) treatment device market in Europe held the second-largest revenue market share in 2023. Rising cancer cases and technological advancements drive the demand for the market. For instance, projections suggest that Europe's aging population could lead to an additional 775,000 cancer cases by 2040 if advancements in cancer prevention and treatment are not achieved. This highlights the growing need for effective cancer care solutions, including chemotherapy-induced alopecia (CIA) devices, to manage side effects and improve patient quality of life as cancer incidence rises.

The Germany chemotherapy induced alopecia (CIA) treatment device market accounted for the largest revenue share in 2023. Rising cancer incidence and government initiatives drive market growth. In Germany, over 498,000 cancer cases were recorded, with breast, prostate, colorectal, lung, and skin cancers being the most common. Approximately 37% of these cases were considered preventable. This emphasizes the importance of comprehensive cancer care and supportive treatments, such as Chemotherapy-Induced Alopecia (CIA) devices, to address the side effects of chemotherapy and enhance patient well-being.

The chemotherapy-induced alopecia (CIA) treatment device market in UK held the second-largest market share in 2023. Rising cancer cases, longer chemotherapy waiting times, technological advancements, and growing awareness drives market growth. According to Euronews, in February 2024, the study found that UK cancer patients face longer wait times for chemotherapy than those in Norway and Australia. This underscores the need for better chemotherapy delivery in the UK, which could influence policy changes and enhance treatment practices. Improving these delays is essential for better cancer outcomes, highlighting the importance of supportive treatments such as chemotherapy-induced alopecia (CIA) devices to improve patient care during chemotherapy.

The France chemotherapy induced alopecia (CIA) treatment device market is anticipated to grow at a significant CAGR during the forecast period. Increasing demand for chemotherapy, technological advancement, and growing awareness drive the market growth. For instance, in 2023, France saw an estimated 433,136 new cancer cases, with men accounting for 57% of these cases. The most prevalent cancers included breast cancer, with 61,214 new cases, and prostate cancer, with 59,885 new cases. This high incidence of cancer underscores the growing need for supportive treatments, such as chemotherapy-induced alopecia (CIA) treatment devices. As chemotherapy remains a common treatment for these cancers, the demand for effective CIA solutions is likely to rise, driven by the significant number of patients experiencing hair loss as a side effect of their treatment.

Asia Pacific Chemotherapy-induced Alopecia Treatment Device Market Trends

The chemotherapy induced alopecia (CIA) treatment device market in Asia Pacific is expected to grow at the fastest CAGR during the forecast period. The rising adoption of innovative therapies in Asia-Pacific oncology practices is driving demand for CIA treatment devices and driving market growth. According to the NCBI article published in March 2023, research reveals a growing trend in Asia-Pacific oncology practices towards adopting innovative therapies, including immunotherapies and combination treatments with chemotherapy. The study highlighted that healthcare practices increasingly incorporate these advanced cancer treatments into their protocols, marking a significant shift towards more effective cancer care. This trend underscores the increasing demand for (CIA) treatment devices in the region, as patients undergoing these cutting-edge therapies are likely to experience hair loss as a side effect. Consequently, the need for effective solutions to manage chemotherapy-related alopecia is expected to rise in tandem with the adoption of these novel cancer treatments.

The China chemotherapy-induced alopecia treatment device market accounted for a significant market share in the Asia Pacific region in 2023. China's growing cancer disease burden fuels the demand for the market. According to the Springer Nature article published in September 2023, China reported around 4,546,400 new cancer cases and 2,992,600 cancer-related deaths, representing 25.1% of global cancer cases and 30.2%. The most prevalent cancers included lung, colorectal, and breast cancers, with a significant proportion of new cases and deaths attributed to digestive system cancers. This high incidence of cancer highlights the growing need for chemotherapy-induced alopecia (CIA) treatment devices in China. As chemotherapy remains a primary treatment for these common cancers, the demand for effective solutions to manage chemotherapy-related hair loss is expected to increase significantly.

The chemotherapy-induced alopecia treatment device market in India is experiencing significant growth, driven by several key factors, such as increasing incidence of cancer disorders, expanding healthcare infrastructure, and technological advancements. For instance, India saw an estimated 1,461,427 new cancer cases, with an incidence rate of 100.4 per 100,000 individuals in 2022-2023. This suggests that roughly one in nine people in India may develop cancer during their lifetime. As the number of cancer cases continues to rise, the demand for supportive care solutions, such as Chemotherapy-Induced Alopecia (CIA) treatment devices, is expected to grow. With more patients undergoing chemotherapy, the need for effective solutions to manage hair loss is becoming increasingly important in India's cancer care landscape.

Latin America Chemotherapy-induced Alopecia Treatment Device Market Trends

The chemotherapy induced alopecia (CIA) treatment device market in Latin America is growing due to several factors. Increasing cancer incidence and strategic initiatives drive market growth. According to the NCBI article published in April 2024, the Choosing Wisely initiative in Latin America, supported by the Latin American and Caribbean Society of Medical Oncology (SLACOM), aims to reduce unnecessary oncology procedures and improve the overall quality of cancer care. Emphasizing evidence-based treatments and the appropriate use of chemotherapy, the initiative seeks to avoid harmful practices in oncology. This focus on optimizing cancer treatment is likely to increase demand for (CIA) treatment devices as more patients undergo carefully managed chemotherapy regimens across the region, with a growing emphasis on mitigating side effects like hair loss.

MEA Chemotherapy-induced Alopecia Treatment Device Market Trends

The chemotherapy induced alopecia (CIA) treatment device market in MEA is expected to grow at a lucrative CAGR during the forecast period, due to the rising prevalence of cancer and the increasing adoption of advanced medical technologies in the region.

The Saudi Arabia chemotherapy-induced alopecia treatment device market is expected to grow at the fastest CAGR over the forecast period. Increasing cancer cases, rising healthcare expenditure, and strategic initiatives by the key players contribute to the market expansion. The upward trend highlights a growing need for supportive care solutions, including chemotherapy-induced alopecia (CIA) treatment devices. As more patients undergo chemotherapy, managing side effects like hair loss becomes increasingly important. The expanding cancer patient population underscores the need for effective CIA treatment solutions to enhance patient comfort and quality of life during cancer treatment in Saudi Arabia.

Key Chemotherapy-induced Alopecia Treatment Device Company Insights

Some of the key players operating in the industry include Dignitana, Paxman, Penguin Cold Caps and Chemotherapy Cold Caps, Inc. The company’s key strategies include understanding the strengths and weaknesses of major market participants, anticipating future market trends, opportunities, and challenges, and making proactive decisions based on insights into emerging technologies and changing consumer preferences. For instance, Arctic Cold Caps, LLC, Stemtech Medical Devices, and Polar Cold Caps LLC are some of the emerging players in (CIA) treatment devices.

Key Chemotherapy Induced Alopecia Treatment Device Companies:

The following are the leading companies in the chemotherapy-induced alopecia treatment device market. These companies collectively hold the largest market share and dictate industry trends.

- Dignitana

- Paxman

- Penguin Cold Caps

- Chemotherapy Cold Caps, Inc.

- Aspen Systems, LLC's

- Cooler Heads Care, Inc.

- Arctic Cold Caps, LLC

- Stemtech Medical Devices

- Polar Cold Caps LLC

Recent Developments

-

In May 2024, Paxman introduced its Scalp Cooling Technology in two cities of India, within a recognized hospital chain, Health Care Global (HCG). The device received approval from the Central Drugs Standard Control Organisation (CDSCO)

-

In March 2024, Dignitana announced that one of the key hospitals in Italy, Antonio Perrino initiated clinical studies to gauge the effectiveness of DigniCap Delta Scalp Cooling System

-

In October 2023,Dignitana established a strategic sales and marketing partnership with InfuSystem to enhance the availability of scalp cooling systems across the U.S. This collaboration aims to leverage InfuSystem's extensive distribution network and marketing expertise to broaden the reach of Dignitana’s scalp cooling technology

Chemotherapy-induced Alopecia Treatment Device Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 77.2 million

Revenue forecast in 2030

USD 174.7 million

Growth rate

CAGR of 14.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, sales modality, indication, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Mexico; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Dignitana; Paxman; Penguin Cold Caps; Chemotherapy Cold Caps, Inc.; Aspen Systems, LLC; Cooler Heads Care, Inc.; Arctic Cold Caps, LLC; Stemtech Medical Devices; Polar Cold Caps LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Chemotherapy-induced Alopecia Treatment Device Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global chemotherapy-induced alopecia treatment device market report based on product, sales modality,indication, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Manual Cooling Systems

-

Automated Cooling Systems

-

-

Sales Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

Rental Sales

-

Direct Sales

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Breast Cancer

-

Prostate Cancer

-

Ovarian Cancer

-

Uterine Cancer

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Cancer Centers

-

Outpatient Clinics

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global chemotherapy-induced alopecia treatment device market size was estimated at USD 67.3 million in 2023 and is expected to reach USD 77.2 million in 2024.

b. The global chemotherapy-induced alopecia treatment device market is expected to grow at a compound annual growth rate of 14.6% from 2024 to 2030 to reach USD 174.7 million by 2030.

b. North America dominated the CIA treatment device market with a share of 52.8% in 2023. Rising cancer cases, product launches, regulatory approvals, and advanced healthcare infrastructure drive North America's demand for (CIA) treatment devices

b. Some key players operating in the chemotherapy-induced alopecia treatment device market include Dignitana, Paxman, Penguin Cold Caps, Chemotherapy Cold Caps, Inc., Aspen Systems, LLC's, Cooler Heads Care, Inc., Arctic Cold Caps, LLC, Stemtech Medical Devices, Polar Cold Caps LLC

b. The primary factors driving the chemotherapy-induced alopecia treatment device market are increasing chemotherapy adoption, technological advancements, growing awareness & adoption, and government initiatives.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."