- Home

- »

- Medical Devices

- »

-

Chemistry, Manufacturing And Control Services Outsourcing Market Report, 2030GVR Report cover

![Chemistry, Manufacturing And Control Services Outsourcing Market Size, Share & Trends Report]()

Chemistry, Manufacturing And Control Services Outsourcing Market Size, Share & Trends Analysis Report By Type (API, Finished Drug Formulation, Medical Devices), By Service, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-320-2

- Number of Report Pages: 210

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

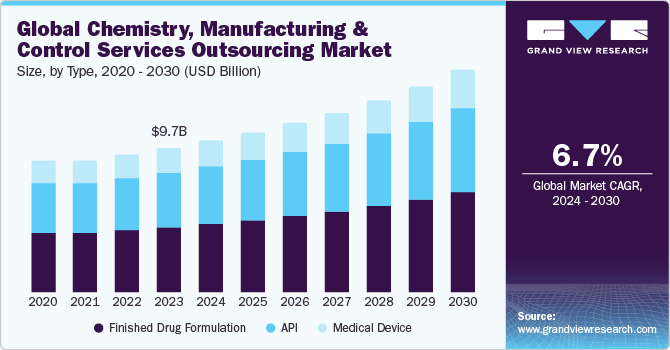

The global chemistry, manufacturing and control services outsourcing market size was estimated at USD 9.74 billion in 2023 and is projected to grow at a CAGR of 6.72% from 2024 to 2030. Market growth can be attributed toincreasing complexity of drug development, rising R&D costs, and need for specialized expertise in advanced therapies. Growing preference by several companies towards contract development and manufacturing organizations (CDMOs) to access innovative technologies, streamline operations, and reduce time to market.

Evolving regulatory landscape and the globalization of clinical trials are likely to enhance CMC outsourcing services to enhance compliance and management of international manufacturing standards effectively. Further, adoption of advanced technologies such as continuous manufacturing and single-use systems by CDMOs is expected to accelerate overall market growth.

Ongoing technological advancements in novel drug development and manufacturing will propel market growth potential. Innovations such as continuous manufacturing, single-use systems, and advanced analytical techniques to improve efficiency and scalability thereby positively impacting industry revenue growth. For instance, as per the International Society for Pharmaceutical Engineering (ISPE), continuous manufacturing enables uninterrupted production, reducing time up to 90% and costs by up to 30% as compared to traditional batch methods. Further, single-use systems utilized disposable bioprocessing equipment to minimize contamination risks and cleaning expenses, enhancing operational flexibility. Whereas advancements in analytical techniques such as real-time monitoring and predictive analytics to enhance accuracy and reliability of quality control processes will propel market growth opportunities. These technological innovations assist CDMOs to provide more sophisticated, efficient, and compliant solutions, thereby increasing demand for CMC outsourcing.

Increase in R&D investment and new product development and manufacturing activities in pharmaceuticals and biotechnology will accelerate the adoption of CMC compliant services. Stringent quality standards and evolving regulatory requirements for development and manufacturing will further positively influencing market dynamics. Increasing chemistry, manufacturing and control (CMC) services outsourcing by several biopharmaceutical companies to specialized CROs to navigate and compliance with complex regulatory standards among numerous countries. Moreover, several organizations outsource CMC services to streamline manufacturing processes and accelerate product development timelines, which bolster the market growth.

Globalization of pharmaceutical manufacturing led to increased outsourcing of CMC services to CROs, CDMOs and CMOs located in regions with cost-effective manufacturing capabilities, such as Asia-Pacific and Europe. This enables companies to access global footprints and manufacturing expertise while optimizing supply chain efficiency. Moreover, pharmaceutical and biotechnology companies are focusing on their core competencies such as drug discovery and clinical development, while outsourcing non-core activities including CMC services to specialized service providers to reduce procedural cost and capital investment, and infrastructure.

Market Concentration & Characteristics

The market growth stage is medium and pace is accelerating. Key drivers include technological advancements, evolving regulatory landscapes, and the globalization of healthcare manufacturing and increasing outsourcing trends. These factors offer distinct advantages, allowing organizations to access specialized capabilities and optimize operational efficiency.

The market exhibits a moderate degree of innovation owing to technological advancements, high R&D investment, and the demand for novel therapies. The adoption of advanced manufacturing technologies such as continuous manufacturing and the development of personalized medicines are key factors impacting market growth.

High impact of regulations on the market is owing to stringent regulatory requirements particularly in North America and Europe are driving the need for compliance in drug development and manufacturing. Outsourcing CMC services helps healthcare companies to navigate complex regulatory landscapes and enhance adherence to quality standards.

The level of M&A (mergers and acquisitions) activities in the market is high attributed to large CROs/CMOs are undertaking acquisition strategies for smaller competitors to expand service portfolios or enter new geographic markets. However, small market participants also engage in M&A strategies to enhance their capabilities or geographic reach. For instance, in Jan 2023, Gland Pharma acquired Cenexi Group, a prominent French CDMO specialized in lyophilized fill-finished drugs and sterile liquids. This acquisition broadened company’s operational capabilities in Europe.

Service expansion in the market is moderate. Continuous advancements in manufacturing technologies and analytical testing to broaden development and manufacturing capabilities and regulatory compliance are driving service expansions in the industry. Moreover, numerous service providers integrating comprehensive solutions from early-stage formulation development to commercial manufacturing thereby, accelerating market growth opportunities.

The market is experiencing significant regional expansion owing to several companies expanding their presence in regions with favourable regulatory environments, cost-effective manufacturing capabilities, and growing demand for pharmaceuticals. For instance, In September 2023, Enzene Biosciences established R&D facility in Pune, India. The facility offers advanced services from cell line development to fill & finish for multiple therapeutics. Such developments offered competitive edge to firm in the region.

Type Insights

Based on type, the market is segregated into API, finished drug formulation and medical devices. The finished drug formulation segment led the market with the largest revenue share of 43.77% in 2023. Finished drug formulation segment is further sub segmented into solid dosage form, liquid dosage form, semi-solid dosage form, and others. Finished drug formulations often require complex manufacturing processes, particularly for advanced therapies such as biologics, biosimilar, and personalized medicines. The complexity of formulations drives the need for specialized expertise and technologies, thereby propelling segment growth. Further, increasing investment in pharmaceutical R&D is accelerating demand for advanced formulation services. For instance, according to the Evaluate Pharma, the global pharmaceutical R&D spending will reach over USD 285 billion by 2028 at a growth rate of 2.6%. Ongoing innovations in drug delivery systems, such as sustained-release formulations, nanoparticles, and liposomes to enhance bioavailability, drug stability and patient outcome are propelling the finished drug formulation market growth. Moreover, the growing demand for generic drugs and the expiration of patents for blockbuster drugs are driving the need for efficient formulation services to support the production of cost-effective generics, which leads to overall segmental demand.

The API segment is anticipated to grow at a fastest CAGR over the forecast period. The high segmental market growth is attributed to complexities of the supply chain, stringent regulatory compliance, and technological advancements. Outsourcing of API production helps pharmaceutical companies to manage supply chain risks, meet regulatory requirements, and leverage specialized expertise. Advances in manufacturing technologies, such as continuous manufacturing and green chemistry, enhance efficiency and sustainability, giving providers a competitive edge. Furthermore, rising shift towards development of biologics and biosimilar require specialized API production capabilities which is expected to drive segment growth potential.

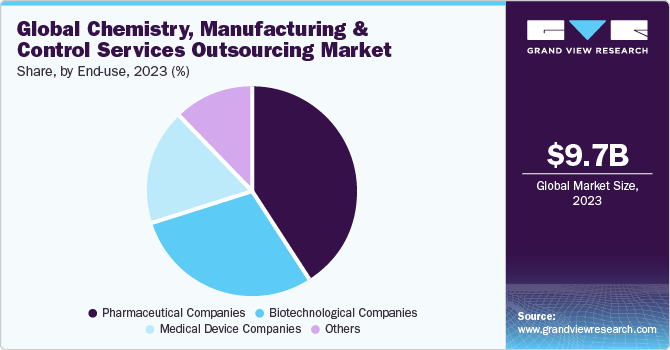

End-use Insights

Based on end use, the market is segregated intopharmaceutical companies, biotechnological companies, medical device companies and others. The pharmaceutical segment led the market with the largest revenue share of 40.56% in 2023. The segment growth is owing to high adoption of CMC services outsourcing to specialized service providers for new drug development to reduce operational cost and focus on core competencies. Moreover, rising consumption of pharmaceuticals along with growing need for regulatory compliant manufacturing capacities will bolster market demand in pharmaceutical companies.

The medical device segment is anticipated to grow at a fastest CAGR over the forecast period. The high segment growth is attributed to the necessity for stringent regulatory compliance, technological advancements, cost-effectiveness, and the prioritization of core business activities. Increasing demand for specialized CMC services is propelled by the complexity of regulatory frameworks such as those from the FDA and MDR, rapid advancements in digital health technologies, and the integration of advanced materials. Furthermore, a shift towards digitalization and automation, emergence of customized and patient-centered devices, efforts towards regulatory standardization, and the development of hybrid products that combine biologics with devices. This market segment demonstrates a moderate to high level of concentration, with a few major players leading along with numerous growth opportunities for specialized providers. Aforementioned factors will positively impacting segmental revenue share growth in the forthcoming years.

Service Insights

Based on service, the market is segregated intomanufacturing services, regulatory services, analytical testing, and others. The manufacturing segment led the market with the largest revenue share of 36.83% in 2023. Manufacturing services segment further segregated into clinical manufacturing, drug product development and manufacturing, fill finish manufacturing, and others. Growing investment in pharmaceutical and biotechnology R&D drives demand for comprehensive manufacturing services across all stages of drug development. Further, several market participant’s offers continuous manufacturing, single-use technologies, and bioprocessing advancements are expected to enhance efficiency and flexibility in manufacturing operations. Clinical manufacturing involves the production of small batches of drug products for use in clinical trials. Increasing number of clinical trials, especially for complex biologics and personalized medicines, drives the demand for clinical manufacturing services. The trend towards adaptive clinical trials and accelerated approval pathways also boosts segment revenue growth.

The analytical testing segment is anticipated to grow at the fastest CAGR over the forecast period. The analytical testing segment is further subdivided into stability testing, method development and validation, quality control testing, bioanalytical testing, and others. The segment growth is primarily attributable to growing integration of advanced analytical technologies such as AI, ML, and automation among service providers to enhance the efficiency and accuracy of analytical services will propel customer preference. Moreover, advances in predictive stability testing using computational models and real-time stability testing techniques are expected to drive segmental growth. Further, rising focus on advanced therapeutics and personalized medicine will drive demand for specialized bioanalytical testing and customized analytical solutions, thereby propelling segment demand.

Regional Insights

North America dominated the chemistry, manufacturing, and control (CMC) services outsourcing market with the largest revenue share of 47.30% in 2023. The stringent regulatory framework in North America, especially with the US FDA's guidelines enhanced standards for the development and manufacturing of drugs. Growing preference for outsourcing of CMC services by numerous companies to meet severe regulations offers numerous market growth opportunities in the region. Moreover, strong presence of major CMO/CDMOs offering one stop shop model including CMC services in the region will drive regional revenue growth. Further, rising focus on personalized medicine and orphan drugs development is another factor driving demand for specialized CMC services in North America.

U.S. Chemistry, Manufacturing And Control Services Outsourcing Market Trends

The chemistry, manufacturing, and control (CMC) services outsourcing market in the U.S. held the largest revenue share in North America in 2023. These include need for rapid scalability and flexibility in manufacturing to meet fluctuating demand, high number of pharmaceutical and biotechnology startups that rely on external expertise for early-stage development, and the availability of a skilled workforce specializing in CMC services driving market demand in the U.S. Further, increase in the collaboration between CMC service providers and academic institutions for innovative solutions will bolster industry progression. Upsurge in integrated service offerings that combine CMC with clinical trial support, and the rising importance of cybersecurity in protecting sensitive data throughout the drug development process are anticipated to propel overall market growth opportunities in the country.

Europe Chemistry, Manufacturing And Control Services Outsourcing Market Trends

The chemistry, manufacturing, and control (CMC) services outsourcing market in Europe is expected to grow at a significant CAGR during the forecast period, due to substantial government support for pharmaceutical R&D, strong presence of pharmaceutical and biotechnology companies, and a focus on innovation in drug development. For instance, the European Commission launched Horizon Europe research and innovation framework program to boost R&D activities in Europe. Furthermore, increasing adoption of advanced analytics and AI to optimize CMC processes, a growing focus on biosimilar and biopharmaceuticals, and enhanced regulatory harmonization across the European Union are driving regional market revenue growth.

The Germany chemistry, manufacturing and control services outsourcing market held the largest revenue share in Europe in 2023, owing to rising demand for sustainable manufacturing practices and a focus on expanding CMC services to support advanced therapies and precision medicine.

The chemistry, manufacturing and control services outsourcing market in the UK is anticipated to grow at the fastest CAGR over the forecast period. The presence of leading research institutions and a skilled workforce along with strong focus on developing cutting-edge therapies, such as cell and gene therapies, will increase demand for specialized CMC services, contributing to the market growth.

Asia Pacific Chemistry, Manufacturing And Control Services Outsourcing Market Trends

The chemistry, manufacturing and control services outsourcing market in Asia Pacific is expected to grow at the fastest CAGR of 7.41% over the forecast period. The Asia Pacific market is driven by rapid economic growth and expanding pharmaceutical and biotechnology industries in countries like China and India. The region offers cost-effective manufacturing capabilities and a large, skilled workforce, thereby attracting customer demand. Further, growing investment in R&D and healthcare infrastructure to enhance manufacturing capabilities, and high availability of raw materials will accelerate regional growth opportunities. In addition, the surge in the number of CROs, CDMOs and CMOs that offering end-to-end CMC solutions in the region is expected to boost the market growth.

The China chemistry, manufacturing and control services outsourcing market held the largest revenue share in Asia Pacific in 2023, due to large pool of skilled professionals, cost-effective manufacturing capabilities, and improving regulatory environment. In addition, growing demand for biologics and specialty drugs is expected to drive expansion in CMC services outsourcing, particularly in areas such as bioprocessing and formulation development.

The chemistry, manufacturing and control services outsourcing market in Japan is expected to grow at the rapid CAGR over the forecast period, due to high-quality manufacturing and stringent quality control standards. Further, growing geriatric population and rising healthcare expenditures are expected to drive growth in the pharmaceutical sector, leading to increased demand for CMC outsourcing services to support drug development and manufacturing.

The India chemistry, manufacturing and control services outsourcing market is anticipated to grow at the fastest CAGR over the forecast period, owing to increasing adoption of advanced manufacturing technologies and digital solutions to enhance efficiency and compliance. Moreover, the rise of biosimilar and specialty generics is expected to drive market growth, as companies seek expertise in formulation development and manufacturing.

Latin America Chemistry, Manufacturing And Control Services Outsourcing Market Trends

The chemistry, manufacturing and control services outsourcing market in Latin America is anticipated to grow at the fastest CAGR over the forecast period. Growing demand for generic drugs and specialty pharmaceuticals is expected to drive increased outsourcing of CMC services, particularly in areas such as formulation development and analytical testing.

The Brazil chemistry, manufacturing and control services outsourcing market is anticipated to grow at a significant CAGR over the forecast period, due to growing pharmaceutical sector, diverse range of healthcare needs, rising demand for affordable healthcare solutions, and increasing government investments in healthcare infrastructure.

Middle East & Africa Chemistry, Manufacturing And Control (CMC) Services Outsourcing Market

The chemistry, manufacturing, and control (CMC) services outsourcing market in Middle East & Africa is expected to grow at a substantial CAGR over the forecast period, due to increasing healthcare expenditure, expanding pharmaceutical markets, and government initiatives to bolster the healthcare infrastructure.

The South Africa chemistry, manufacturing and control services outsourcing market is anticipated to grow at the fastest CAGR over the forecast period, owing torise in CMOs and CROs in the region is expected to boost market growth, as companies seeking local expertise and resources for drug development and manufacturing.

Key Chemistry, Manufacturing And Control Services Outsourcing Company Insights

The major players operating across the market focus on implementing several strategic initiatives such as partnerships, collaborations, mergers, acquisitions, etc. The prominent strategies companies adopt are service launches, mergers, partnership & agreements, mergers & acquisitions/joint ventures, expansions, and others to increase market presence & revenue and gain a competitive edge. Hence, increasing adoption of in-organic strategic initiatives is highly anticipated to boost the market share.

Key Chemistry, Manufacturing And Control Services Outsourcing Companies:

The following are the leading companies in the chemistry, manufacturing and control services outsourcing market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific

- ICON plc

- Catalent, Inc.

- Thermo Fisher Scientific Inc.

- Recipharm AB

- WuXi AppT0ec

- Jubilant Life Sciences

- Samsung Biologics

- Boehringer Ingelheim BioXcellence

- Evonik Industries AG

- Allucent.

- Ardena Holding NV.

- Argonaut Manufacturing Services Inc.

- Bachem

- Siegfried Holding AG

- AbbVie Inc.

- Ajinomoto Bio-Pharma

- CordenPharma

Recent Developments

-

In May 2023, Aurigene Pharmaceutical Services, a part of Dr. Reddy’s Laboratories invested over USD 40 million to develop biologics pilot scaled CDMO facility for antibodies, therapeutic proteins and viral vectors in Hyderabad, India. The facility is expected to be fully operational by the first half of 2024. Such developments offers competitive edge to the company

-

In April 2023, CordenPharma established the Finished Drug Formulation Innovation Centre of Excellence (DPICoE) in Germany. The center provide additional capabilities for developing new innovative APIs such as API formulation into Solid Dosage Forms (OSD) drug products for small molecules and peptides with low stability, permeability, solubility, and high potency. This establishment broadened company’s service offerings

-

In April 2023, In April 2023, Serum Institute of India and Biocon Biologics restructured an investment agreement related to vaccines and various biological products. Through this agreement, Serum Institute increased its total investment up to USD 300 million in Biocon Biologics and secured 4.9% equity stake in Biocon Biologics

Chemistry, Manufacturing And Control Services Outsourcing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.26 billion

Revenue forecast in 2030

USD 15.16 billion

Growth rate

CAGR of 6.72% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, service, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

ICON plc; Catalent, Inc.; Thermo Fisher Scientific Inc.; Recipharm AB; WuXi AppTec; Jubilant Life Sciences; Samsung Biologics; Boehringer Ingelheim BioXcellence; Evonik Industries AG; Allucent; Ardena Holding NV.; Argonaut Manufacturing Services Inc.; Bachem; Siegfried Holding AG; AbbVie Inc.; Ajinomoto Bio-Pharma; CordenPharma

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Chemistry, Manufacturing And Control Services Outsourcing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the chemistry, manufacturing and control services outsourcing market report based on type, service, end-use and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

API

-

Small Molecule

-

Large Molecule

-

-

Finished Drug Formulation

-

Solid Dosage Forms

-

Semi-solid Dosage Forms

-

Liquid Dosage Forms

-

Others

-

-

Medical Device

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Manufacturing Services

-

Clinical Manufacturing

-

Drug Product Development and Manufacturing

-

Fill Finish Manufacturing

-

Others

-

-

Regulatory Services

-

Regulatory Consulting

-

Regulatory Submissions

-

Compliance Audits

-

Others

-

-

Analytical Testing

-

Stability Testing

-

Method Development and Validation

-

Quality Control (QC) Testing

-

Bioanalytical Testing

-

Others

-

-

Others

-

-

End use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical Companies

-

Biotechnological Companies

-

Medical Device Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The chemistry, manufacturing and control services outsourcing market size was estimated at USD 9.74 billion in 2023 and is expected to reach USD 10.26 billion in 2024.

b. The global chemistry, manufacturing and control services outsourcing market is expected to grow at a compound annual growth rate of 6.72% from 2024 to 2030 to reach USD 15.16 billion by 2030.

b. On the basis of the region, the North America region dominated the CMC services outsourcing market with a share of 47.30% in 2023. This is attributable to the high presence of market players and biopharmaceutical companies, significant R&D investment, advanced healthcare infrastructure, and stringent regulatory guidelines.

b. Some key players operating in the CMC services outsourcing market include ICON plc, Catalent, Inc., Thermo Fisher Scientific Inc., Recipharm AB, WuXi AppTec, Jubilant Life Sciences, Samsung Biologics, Boehringer Ingelheim BioXcellence, Evonik Industries AG, Allucent, Ardena Holding NV., Argonaut Manufacturing Services Inc., Bachem, Siegfried Holding AG, AbbVie Inc., Ajinomoto Bio-Pharma, CordenPharma.

b. Key factors driving market growth include growing demand for biologics and advanced therapies, increasing outsourcing trends among pharmaceutical companies, evolving regulatory scenarios, and a surge in clinical trials, among others.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."