- Home

- »

- Advanced Interior Materials

- »

-

Chemical Anchors Market Size, Share, Industry Report, 2030GVR Report cover

![Chemical Anchors Market Size, Share & Trends Report]()

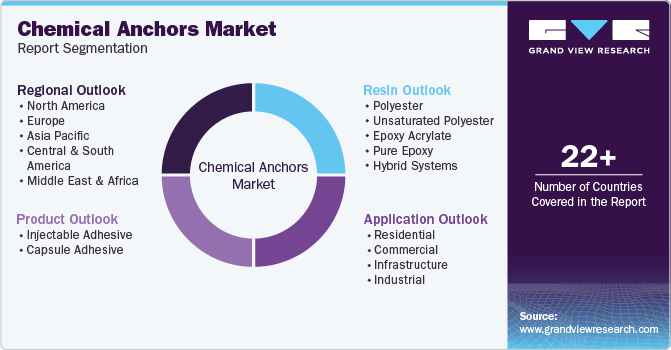

Chemical Anchors Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Injectable Adhesive, Capsule Adhesive), By Resin (Epoxy Acrylate, Hybrid Systems), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-310-2

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Chemical Anchors Market Summary

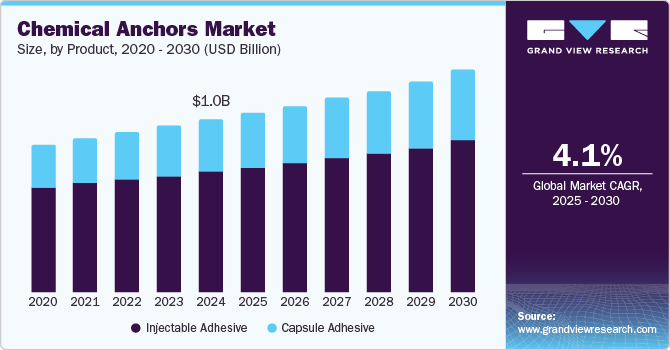

The global chemical anchors market size was estimated at USD 1.03 billion in 2024 and is projected to reach USD 1.32 billion by 2030, growing at a CAGR of 4.1% from 2025 to 2030. The increasing demand for chemical anchors is driven by the rapid expansion of infrastructure and construction projects worldwide.

Key Market Trends & Insights

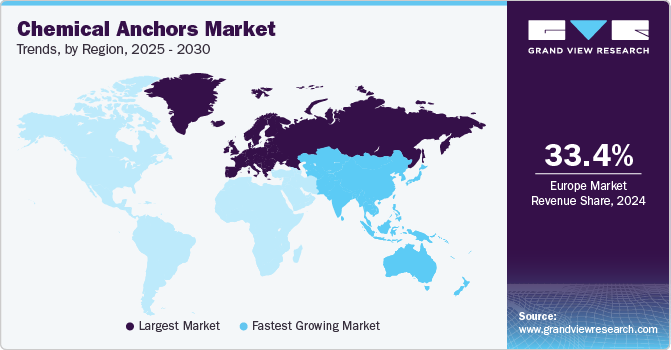

- In terms of region, Europe was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- Based on product, the injectable adhesive anchors held the largest share, over 70.1% of the global revenue in 2024.

- Based on resin, the epoxy acrylate held the largest share of over 35.4% in 2024.

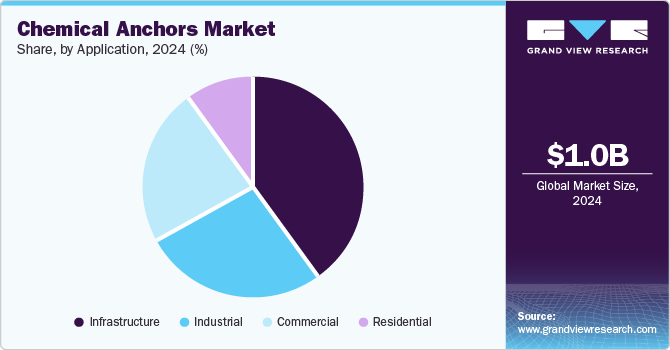

- Based on apllication, the infrastructure segment accounted for the largest share, over 39.8%, in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.03 Billion

- 2030 Projected Market Size: USD 1.32 Billion

- CAGR (2025-2030): 4.1%

- Europe: Largest market in 2024

Chemical anchors offer superior load-bearing capacity and enhanced performance compared to mechanical anchors, making them essential for modern construction applications. In addition, advancements in anchor formulations, such as fast-curing and environmentally friendly options, are further boosting market adoption.

The major manufacturers of chemical anchors in the market have long-term contracts with players from the construction industry especially from the residential, commercial, and infrastructure sectors. The manufacturers offer specialty chemical anchors based on the specifications given by the end users. The product pricing given by chemical anchors manufacturers is a result of the purchase volume and duration of the contract with these end users. As a result, the product pricing and profit margins of these industry players are found to be varied across the industry players.

Product pricing largely depends upon the aggregate volume of raw materials produced and minimum lot sizes. Further, resource availability, governmental policy for procuring chemicals, and volatile transportation costs due to crude oil price fluctuations influence raw material prices. Chemical anchors are used in most steel constructions, column bases, and scaffold anchoring due to their superior characteristics. However, low awareness levels among contractors, particularly in emerging economies, regarding the use of the appropriate construction chemicals for structures are restricting market growth.

Market Concentration & Characteristics

The market growth stage is moderate, with an accelerating pace. The market exhibits a moderate degree of innovation, primarily driven by the technological improvements that have increased the functioning and the fair shelf life and a high level of corrosion resistance that is similar to two-component epoxy polyamide coatings. Epoxy is an important component in the chemical anchoring formulation and hence boosts its end use functionality.

The global chemical anchor industry is highly competitive owing to the presence of both multinational and local manufacturers. Mergers and acquisitions primarily aim to help companies enhance their market penetration and meet the changing technological demand of various applications, such as residential, commercial, infrastructure, and industrial.

Conventional mechanical anchors are projected as one of the major substitutes for the product market. Chemical anchors require longer curing time than mechanical anchors, approximately four times as long. Furthermore, the cost of chemical anchors is high compared to mechanical anchors. Therefore, the threat of substitutes is anticipated to be high over the forecast period.

End users of chemical anchors are the construction sector, namely the residential, commercial, and industrial sectors. Various large-scale construction and infrastructure projects globally create opportunities for the chemical anchors industry. For instance, China's Belt and Road Initiative (BRI) development strategy intends to increase connectivity and cooperation across six important economic corridors, which include Russia, China, Mongolia, Eurasian countries, Asia, and others.

Product Insights

Injectable adhesive anchors held the largest share, over 70.1% of the global revenue in 2024. They are the most often used chemical anchors. Injection chemicals are widely used in masonry, natural stone, and rebar applications. They are commonly used to fix steel dowels, staircases, handrails, building facades, sound barriers, pipes, brackets, and post-installation rebar connections.

Furthermore, injectable adhesive anchors require four times longer curing time than mechanical anchors. However, manufacturers are working on new resin formulations that will reduce curing time, making it a favorable option across applications and external conditions.

Capsule adhesive anchors are used on a concrete surface and find application in industrial and commercial construction. These are primarily used in anchoring steel structures, cranes, elevators, and industrial machinery. Post-pandemic growth in industrial and commercial output is encouraging companies to expand their manufacturing capacity, thereby providing ample growth opportunities for capsule adhesive anchors.

Resin Insights

Epoxy acrylate held the largest share of over 35.4% in 2024. Key characteristics of the resin, including high strength, fast curing, ideal for high load applications, and resistance to corrosive or moist conditions, promote its use across the construction sector.

Hybrid systems are expected to register the fastest CAGR of 4.8% over the forecast period owing to their ability to fill in any defects and make the hole airtight with 100% adhesion, resulting in increased load strength. It also strengthens the structure of the concrete walls as well as the area around the borehole, making it crack-resistant. Moreover, chemical anchoring enables the installer to make minor modifications to the stud alignment while the chemical combination cures.

Pure-epoxy chemical anchors are a two-part pure epoxy bonded anchoring system with a 1:1 ratio under normal and seismic conditions for use in cracked and uncracked concrete. These anchors are used across structural applications and rebar connections where high load-bearing capacity needs to be met.

Furthermore, it is ideal for strong load applications since the resulting bond is stronger than the base material itself. The system is centered on the adhesion principle, which results in no additional load stress being imparted to the base material. Thus, it is also ideal for reduced center, close-to-edge fixing, group anchoring, and low-compressive strength concrete.

Application Insights

The infrastructure segment accounted for the largest share, over 39.8%, in 2024 and is expected to witness the fastest CAGR over the forecast period. Chemical anchors are primarily used in this segment due to the need for robust and superior-performing products. Furthermore, the cost factor over mechanical anchors impact this sector the least owing to the scale of application.

The residential and commercial sectors collectively accounted for a significant revenue share in 2024. The rise in construction spending in emerging economies is expected to be the major driver for the market. The governments across these countries have made large investments in public infrastructures, such as offices, hospitals, and housing societies.

The emergence of various countries as upcoming manufacturing hubs can be attributed to the establishment of numerous industries and a large population migrating close to these facilities, resulting in the development of new cities and the expansion of existing cities. These factors have a major impact on the growth of the construction industry, including residential and commercial, resulting in an increasing demand for chemical anchors.

Regional Insights

North America chemical anchors industry has gained prominence over the past few years, especially in commercial and infrastructural activities. Increasing awareness of chemical anchors and the growing infrastructure investment in the area are anticipated to boost the market growth during the forecast period.

U.S. Chemical Anchors Market Trends

The U.S. chemical anchors industry is expected to grow steadily, with a projected CAGR of 3.6% over the forecast period. The country's economic strategy includes investments in competitive sectors that have high export value. Increasing manufacturing potential lowers average production costs and further contributes to its economic growth rate positively.

Canada chemical anchors market is driven by growing investments in infrastructure development, particularly in the transportation and energy sectors. The need for strong anchoring solutions in extreme weather conditions, including freeze-thaw cycles, has led to increased adoption of chemical anchors in structural applications. However, the market faces challenges due to the country’s strict environmental regulations and the high cost of imported raw materials.

Europe Chemical Anchors Market Trends

Europe chemical anchors industry dominated globally with a 33.4% revenue share in 2024. Supportive government efforts, significant pay increases, and continual job creation are factors driving the region's economic development. Furthermore, governmental expenditures, particularly in digital and transportation infrastructure, are likely to boost economic growth in the region.

The chemical anchors industry in the UK is expected to grow at a CAGR of 2.8% over the forecast period, driven by a strong focus on infrastructure renewal, particularly in aging bridges, tunnels, and commercial buildings. Stringent building regulations and a push for sustainable construction practices are increasing the adoption of chemical anchoring solutions that offer high strength and long-term durability.

The France chemical anchors industry is supported by government-led infrastructure projects and the modernization of historical buildings. The country’s strict seismic regulations also contribute to demand, as chemical anchors provide enhanced stability in earthquake-prone regions.

Asia Pacific Chemical Anchors Market Trends

The Asia Pacific chemical anchors industry was valued globally at USD 0.26 billion in 2024. Economic growth in India, China, and Southeast Asian countries has increased the need for improved public infrastructure, such as roads, harbors, airports, and rail transportation networks. A substantial increase in mergers and acquisitions, integration activities, and site relocations has propelled the region's industrial development activity.

The chemical anchors industry in China accounted for a revenue share of 38.8% in the Asia Pacific region in 2024, owing to increased investments, a good economic recovery, and rising disposable income, which positively impacted the market's growth. The market is likely to accelerate in the country due to the rise in infrastructure projects in rail, bridges, and steel constructions, where chemical anchor usage is on the rise.

The India chemical anchors industry is driven by the growth of the commercial and industrial construction sectors that support product demand. The government intends to invest in energy, highways, railroads, and urban and rural infrastructure, which is likely to push the demand for chemical anchors in India.

Central & South America Chemical Anchors Market Trends

The Central and South American chemical anchors industry is growing at a CAGR of 4.0% from 2025 to 2030. Factors such as the influx of remittances, increasing food costs, and effective governmental assistance in economic aid have helped the economies improve their GDP growth. However, natural catastrophes pose an additional threat to regional development, such as the destruction caused by hurricanes Eta and Iota. Increasing migration in the country's largest cities, including Sao Paulo and Rio de Janeiro, as well as in other cities, is projected to drive the demand for new dwellings.

Brazil's chemical anchors industry is anticipated to growover the forecast periodsinceits oil production is expected to increase with the opening of its oil market to new players. This is also likely to increase onshore and offshore construction, complementing the growth in Brazil's chemical anchors industry.

Middle East & Africa Chemical Anchors Market Trends

The chemical anchors industry in the Middle East & Africa is driven by the increasing construction activities coupled with new oil & gas projects. Infrastructure, mining, and oil & gas are some of the key sectors promoting the growth of the African region.

The chemical anchors industry in Saudi Arabia is driven by the large-scale investments in its main oilfields, such as Ghawar and Shaybah, which are projected to play a significant role in the growth of the oil & gas sector, which, in turn, is anticipated to boost the demand for chemical anchors in Saudi Arabia.

Key Chemical Anchors Company Insights

Some of the key players operating in the market are Hilti Group, Fisher Group, Illinois Tool Works Inc., Sika AG, Simpson StrongTie Company Inc., and Henkel AG & Company, KGaA:

-

Hilti Group offers several products and services, including anchor systems, cordless systems, construction chemicals, diamond corning and cutting, cutting, sawing, & grinding, direct fastening, drilling and demolition, screw fastening, firestop, accessories, measuring systems, modular support systems, façade systems, and ON!Track equipment management for the construction industry.

-

Fischer Group has five business divisions: Fischer fixing system, Fischer automotive, Fischertechnik, Fischer consulting, and LNT Automation. It distributes its products to more than 120 countries worldwide and has production facilities in Europe, North America, Central and South America.

EJOT, Ripple India, Koelner Rawlplug IP, Chemfix Products Ltd, and Leviat B.V. are some of the emerging market participants in the chemical anchors industry.

-

Leviat B.V. sells its products through its brands, namely Meadow Burke, HALFEN, Plaka, and Ancon. Halfen brand offers a wide range of anchoring, framing, framing & façade technology, and reinforcing for industrial and construction applications.

-

Chemfix Products Ltd specializes in the development of chemical anchoring, anchoring products, and repair solutions for construction, industrial, and DIY sectors. The company has four product lines, namely, chemical anchoring, metolux repair fillers, metolux adhesives, and timbabuild wood repair.

Key Chemical Anchors Companies:

The following are the leading companies in the chemical anchors market. These companies collectively hold the largest market share and dictate industry trends.

- Hilti Group

- MKT Fastening

- Power Fasteners

- FIXDEX Fastening Technology

- Fischer Group

- Leviat B.V.

- Chemfix Products Ltd.

- Mungo Befestigungstechnik AG

- Koelner Rawlplug IP

- Ripple India

- EJOT

- Illinois Tool Works Inc.

- Sika AG

- Simpson Strong-Tie Company, Inc.

- Henkel AG & Company, KGaA

Recent Developments

-

In July 2023, Simpson Strong-Tie Company, Inc. announced the launch of AT-3G, an all-weather hybrid-acrylic anchoring adhesive for high-strength bonding and curing for uncracked and cracked concrete. The new product introduction aims to attract additional clients and expand their chemical anchor customer base.

Chemical Anchors Market Report Scope

Report Attribute

Details

Market size in 2025

USD 1.07 billion

Revenue Forecast in 2030

USD 1.32 billion

Growth rate

CAGR of 4.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, resin, application, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Saudi Arabia

Key companies profiled

Hilti Group, MKT Fastening, Power Fasteners, FIXDEX Fastening Technology, Fischer Group, Leviat B.V., Chemfix Products Ltd., Mungo Befestigungstechnik AG, Koelner Rawlplug IP, Ripple India, EJOT, Illinois Tool Works Inc., Sika AG, Simpson Strong-Tie Company, Inc., Henkel AG & Company, KGaA

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Chemical Anchors Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global chemical anchors market report based on product, resin, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Injectable Adhesive

-

Capsule Adhesive

-

-

Resin Outlook (Revenue, USD Million, 2018 - 2030)

-

Polyester

-

Unsaturated Polyester

-

Epoxy Acrylate

-

Pure Epoxy

-

Hybrid Systems

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Infrastructure

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global chemical anchors market size was estimated at USD 1.03 billion in 2024 and is expected to reach USD 1.07 billion in 2025..

b. The chemical anchors market is expected to grow at a compound annual growth rate of 4.1% from 2025 to 2030, reaching USD 1.32 billion by 2030.

b. The infrastructure segment accounted for the largest segment, with a revenue share of 39.8% in 2024. Chemical anchors are primarily used in this segment due to the need for robust and superior-performing products.

b. Some of the key players in the chemical anchors market are Hilti Group, Illinois Tool Works Inc., Sika AG, Simpson Strong-Tie Company, Inc., and Henkel AG & Company, KGaA, MKT Fastening, Power Fasteners, FIXDEX Fastening Technology, EJOT, Ripple India, Koelner Rawlplug IP, Mungo Befestigungstechnik AG, Chemfix Products Ltd, Leviat B.V., and Fischer Group.

b. The key factors that are driving the chemical anchors market include the rising demand for the product in the construction industry owing to its superior performance as compared to mechanical anchors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.