- Home

- »

- Automotive & Transportation

- »

-

Chartered Air Transport Market Size & Share Report, 2030GVR Report cover

![Chartered Air Transport Market Size, Share & Trends Report]()

Chartered Air Transport Market (2024 - 2030) Size, Share & Trends Analysis Report By Services (Private, Business), By Application (Passenger, Cargo), By End Use (Corporates, Individuals, Government & Defense), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-465-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Chartered Air Transport Market Summary

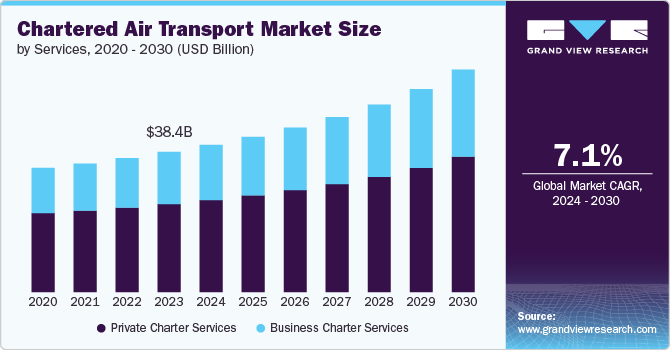

The global chartered air transport market was estimated at USD 38.41 billion in 2023 and is projected to reach USD 60.97 billion by 2030, growing at a CAGR of 7.1% from 2024 to 2030. The demand for chartered air transport, both for passengers and cargo, is experiencing a significant increase globally.

Key Market Trends & Insights

- North America chartered air transport market accounted for the largest revenue share of 45.4% in 2023.

- By application, the passenger cargo segment dominated the market with a revenue share of 71.4% in 2023.

- By services, the private charter services segment held the largest market share of 62.7% in 2023.

- By end use, the government & defense segment registered the highest CAGR of 8.2% over the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 38.41 Billion

- 2030 Projected Market Size: USD 60.97 Billion

- CAGR (2024-2030): 7.1%

- North America: Largest market in 2023

Several factors contribute to this rising trend. For businesses and high-net-worth individuals, chartered flights offer greater flexibility, privacy, and time-saving advantages compared to commercial airlines. These benefits have become more attractive in recent years due to heightened concerns over travel disruptions and security risks.

In the cargo sector, the growing reliance on e-commerce and the demand for rapid, reliable deliveries are key drivers. Chartered air freight services are increasingly used for urgent shipments, especially for high-value goods, pharmaceuticals, and perishable items. Companies are turning to chartered air transport to meet stringent deadlines and ensure timely delivery in global markets.

Technological advancements are playing a pivotal role in enhancing the efficiency and appeal of chartered air transport, affecting both passenger and cargo services. One significant improvement is in aircraft performance. Modern aircraft designs utilize lightweight materials, more fuel-efficient engines, and advanced aerodynamics. These upgrades allow for longer, non-stop routes and reduced fuel consumption, lowering operational costs. As a result, charter services can offer faster, more direct travel options, enhancing convenience and minimizing travel time.

Digital transformation is another area of growth. The development of user-friendly online platforms and real-time booking systems has streamlined the process of securing chartered flights. Clients can now view aircraft availability, check prices, and book flights with ease. This simplification of the booking process is contributing to a more efficient operation, benefiting both service providers and customers by minimizing time spent on logistics and increasing overall satisfaction.

However, the chartered air transport market faces several significant restraints that could slow down its widespread. One of the primary restraints is the high operational costs associated with chartered flights. The expenses of maintaining, operating, and ensuring private aircraft are significantly higher than those of commercial airlines. Fuel prices, crew salaries, and the cost of aircraft maintenance contribute to these costs, making charter services less accessible to the broader market. As a result, chartered air transport remains largely a premium service, limiting its expansion into cost-sensitive customer segments.

Services Insights

Based on the services, the market is segmented into private charter services and business charter services. The private charter services segment held the largest market share of 62.7% in 2023. The global increase in the number of high-net-worth individuals and ultra-high-net-worth individuals has significantly contributed to the demand for private charters. Rising disposable income and wealth concentration in key markets like North America, Europe, and parts of Asia-Pacific have expanded the customer base for luxury private air travel. This growth in wealth has enabled more individuals to afford private charters for leisure and personal travel, further bolstering the market share of the segment.

The business charter services segment registered the highest CAGR of 7.9% over the forecast period. As businesses continue to expand internationally, the need for rapid and reliable travel has grown. Many corporate executives need to attend meetings, negotiate deals, or oversee operations in different regions on short notice. Business charters provide the ability to fly directly to a wider range of destinations, including secondary airports that may not be served by commercial flights, which is crucial for companies operating in global or emerging markets. This ability to bypass commercial flight restrictions supports the rise in demand for business charter services.

Application Insights

On the basis of application, the market is bifurcated into passenger transport and cargo transport. The passenger cargo segment dominated the market with a revenue share of 71.4% in 2023. The rising demand for luxury travel has also fueled the growth of the passenger charter segment. Affluent travelers seeking unique and exclusive travel experiences choose chartered flights to access remote or exotic destinations where commercial airlines may not provide direct services. For these travelers, chartered flights offer not just transportation but an integral part of the overall luxury experience, with premium amenities, tailored services, and personalized attention.

The cargo transport segment is anticipated to register the highest CAGR of 8.0% over the forecast period in the target market. Air cargo is particularly critical for the transport of time-sensitive and high-value goods, such as pharmaceuticals, electronics, perishable goods, and luxury items. With industries such as healthcare, biotechnology, and high-tech manufacturing relying on the fast and secure delivery of their products, the demand for chartered air cargo services has surged. For instance, the transportation of vaccines, medical equipment, and other critical healthcare supplies during the COVID-19 pandemic underscored the importance of air cargo. Chartered air transport is often preferred for such goods due to the need for controlled environments, fast delivery times, and direct routes that avoid delays associated with commercial shipping channels.

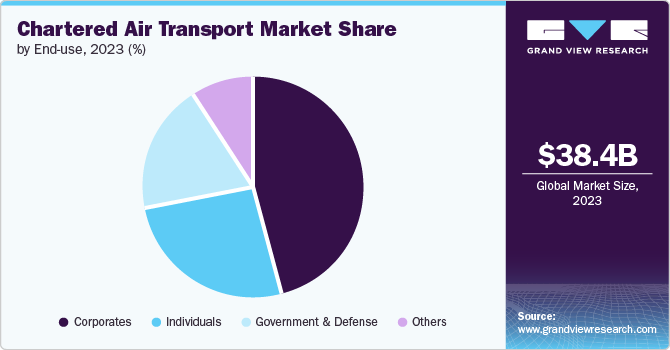

End Use Insights

Based on the end use, the market is segmented into corporates, individuals, government & defense, and others. The corpora segment held the largest market share of 46.3% in 2023. The corporate segment’s significant market share in chartered air transport reflects the high value that businesses place on the benefits of flexibility, efficiency, security, and personalized service. As companies continue to operate in an increasingly globalized and fast-paced environment, the demand for chartered air transport services that cater to their specific needs and preferences remains strong. The ability to facilitate productive and confidential travel, access remote locations, and offer a better travel experience makes chartered flights a preferred choice for corporate clients.

The government & defense segment registered the highest CAGR of 8.2% over the forecast period. Governments & defense organizations worldwide are increasing their budgets for various operations, including defense, disaster relief, and diplomatic missions. Chartered air transport plays a crucial role in these activities, offering quick and flexible transportation solutions for personnel, equipment, and supplies. The rising defense budgets and the need for rapid deployment in various regions contribute to the growing demand for chartered air services in this segment. Additionally, the government & defense sector often require specialized transport solutions, including secure and confidential transportation for high-profile individuals or sensitive materials. Chartered air services can provide the necessary security and customization to meet these requirements.

Regional Insights

North America accounted for the largest revenue share of 45.4% in 2023 and is expected to continue its dominance over the forecast period. North America has one of the most advanced and widespread aviation infrastructures in the world. The region has a large number of airports, including major international hubs and smaller regional airports that are well-equipped to handle chartered flights. This extensive airport network makes charter services more accessible, enabling charter companies to provide flexible, customized routes that meet the specific needs of their clients. Additionally, the regulatory environment for aviation in North America is supportive of the growth of charter services.

U.S. Chartered Air Transport Market Trends

The U.S. has a significant population of high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs). These individuals prefer private charters for leisure travel due to the privacy, luxury, and personalized service they offer. The country's affluence drives demand for chartered flights for both business and personal purposes, allowing the market to flourish. Additionally, the U.S. government & defense sector contribute to the growing demand for chartered air transport. Government agencies frequently use these services for emergency response, disaster relief, and diplomatic missions.

Asia Pacific Chartered Air Transport Market Trends

The Asia Pacific region has experienced a significant rise in the number of high-net-worth individuals (HNWIs), particularly in countries like China, Japan, Singapore, and India. These individuals, who value privacy, convenience, and time efficiency, are increasingly opting for chartered air travel for both business and leisure purposes. Additionally, chartered air transport in the Asia Pacific region is increasingly used for high-value cargo such as medical supplies, pharmaceuticals, and advanced technology components that require safe and direct delivery.

Europe Chartered Air Transport Market Trends

European countries continue to invest in expanding their aviation infrastructure, which has made it easier for chartered air transport services to operate. Airports in major cities and secondary airports alike are improving their capacity to handle private and chartered flights. Additionally, many high-net-worth individuals and tourists are choosing chartered flights to reach remote and exclusive destinations like the French Riviera, the Greek islands, or the Swiss Alps. These destinations often require customized travel routes that are not easily accessible by commercial airlines, making chartered flights the preferred option.

Key Chartered Air Transport Company Insights

Some of the key companies operating in the market include NetJets IP, LLC, among others.

-

NetJets IP, LLC is a U.S. based one of the leading private jet operators globally. The company serves a global clientele of high-net-worth individuals, corporations, and government bodies. The company’s business model includes fractional ownership, private jet leasing, and jet card services, which allow for more flexible access to private aviation services. Fractional ownership allows clients to purchase a share of a private jet, giving them a set number of flight hours each year without the full costs of owning an aircraft. Jet cards offer pre-paid flight time, enabling users to fly on demand without the commitment of ownership. Additionally, NetJets offers short- and long-term leasing options, providing businesses and individuals with temporary access to private jets based on their travel needs.

VistaJet and GlobalAir AG are some of the emerging market companies in the target market.

-

GlobeAir AG is a European private jet operator specializing in on-demand charter services with a focus on short-haul flights. The company offers on-demand private jet charter services with a fleet of Citation Mustang jets optimized for short-haul, point-to-point travel across Europe. The company focuses on delivering flexible air travel solutions with minimal lead time, accommodating both business and leisure clients. Additionally, GlobeAir AG offers empty-leg flights at reduced rates, which helps clients obtain private aviation services at a lower cost.

Key Chartered Air Transport Companies:

The following are the leading companies in the chartered air transport market. These companies collectively hold the largest market share and dictate industry trends.

- NetJets IP, LLC

- VistaJet

- FLEXJET, LLC

- Wheels Up Partners Holdings LLC

- Gama Aviation Plc

- FedEx

- Deutsche Post AG

- Qatar Airways IT

- Air Charter Service

- GlobeAir AG

Recent Developments

-

In July 2024, NetJets IP, LLC announced the expansion of its real estate presence with the introduction of exclusive-use facilities at Teterboro Airport and additional locations. These new facilities are designed to enhance the travel experience for clients, providing tailored solutions to meet their unique travel needs. The expansion reflects the company’s commitment to offering premium services and convenience in private aviation.

-

In June 2024, Wheels Up Partners Holdings LLC announced a streamlined product portfolio aimed at enhancing global access through more flexible membership and charter options. The updated offerings are designed to simplify the booking process and provide more tailored solutions for private aviation. By refining its range of services, the company seeks to improve customer experience and accommodate a broader spectrum of travel needs, making private jet access more straightforward and efficient for its clients.

Chartered Air Transport Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 40.35 billion

Revenue forecast in 2030

USD 60.97 billion

Growth Rate

CAGR of 7.1% from 2024 to 2030

Actual Data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Services, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

NetJets IP, LLC; VistaJet; FLEXJET, LLC; Wheels Up Partners Holdings LLC; Gama Aviation Plc; FedEx; Deutsche Post AG; Qatar Airways IT; Air Charter Service; GlobeAir AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Chartered Air Transport Market Report Segmentation

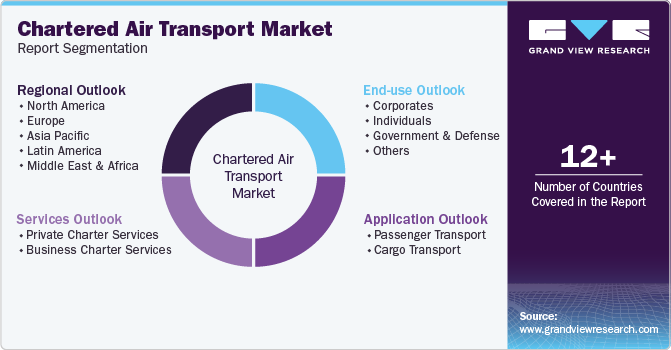

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global chartered air transport market report based on services, application, end use, and region.

-

Services Outlook (Revenue, USD Billion, 2017 - 2030)

-

Private Charter Services

-

Business Charter Services

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Passenger Transport

-

Cargo Transport

-

-

End Use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Corporates

-

Individuals

-

Government & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global chartered air transport market size was estimated at USD 38.41 billion in 2023 and is expected to reach USD 40.35 million in 2024.

b. The global chartered air transport market is expected to grow at a compound annual growth rate of 7.1% from 2024 to 2030 to reach USD 60.97 billion by 2030.

b. The passenger segment claimed the largest market share of 62.7% in 2023 in the chartered air transport market, driven by increased corporate travel demand, rising high-net-worth individuals (HNWIs), and technological advancements.

b. Some of the prominent players in the chartered air transport market are NetJets IP, LLC, VistaJet, FLEXJET, LLC, Wheels Up Partners Holdings LLC, Gama Aviation Plc, FedEx, Deutsche Post AG, Qatar Airways IT, Air Charter Service, GlobeAir AG.

b. The chartered air transport market is driven by factors such as rising demand for business and luxury travel, the need for access to remote destinations, time-sensitive cargo transportation, and the flexibility offered by charter services.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.