- Home

- »

- Next Generation Technologies

- »

-

Charging As A Service Market Size, Industry Report, 2033GVR Report cover

![Charging As A Service Market Size, Share & Trends Report]()

Charging As A Service Market (2026 - 2033) Size, Share & Trends Analysis Report By Service (Subscription, Hosted), By Charging Station (AC, DC), By Application (Commercial, Residential), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-995-9

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Charging As A Service Market Summary

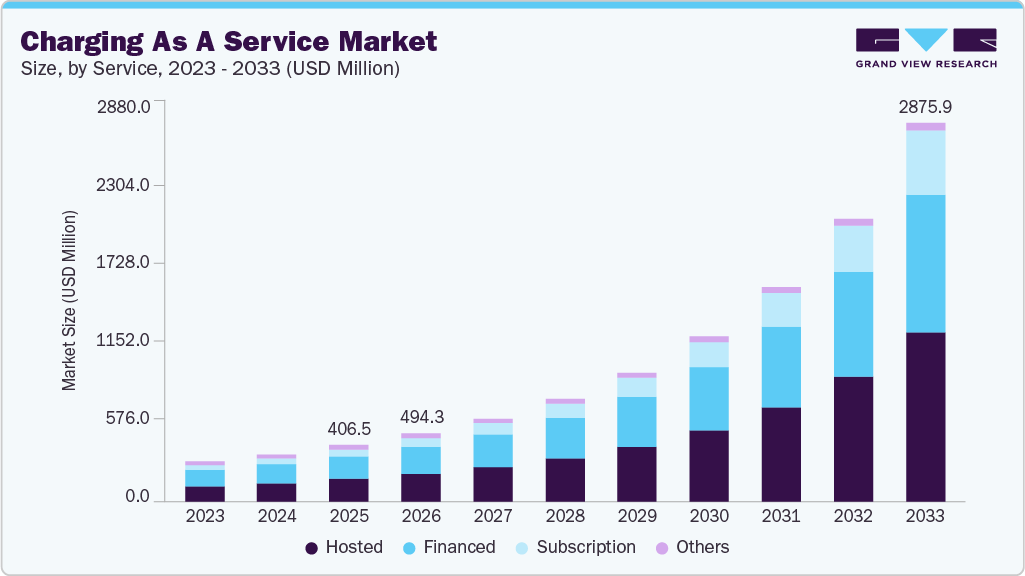

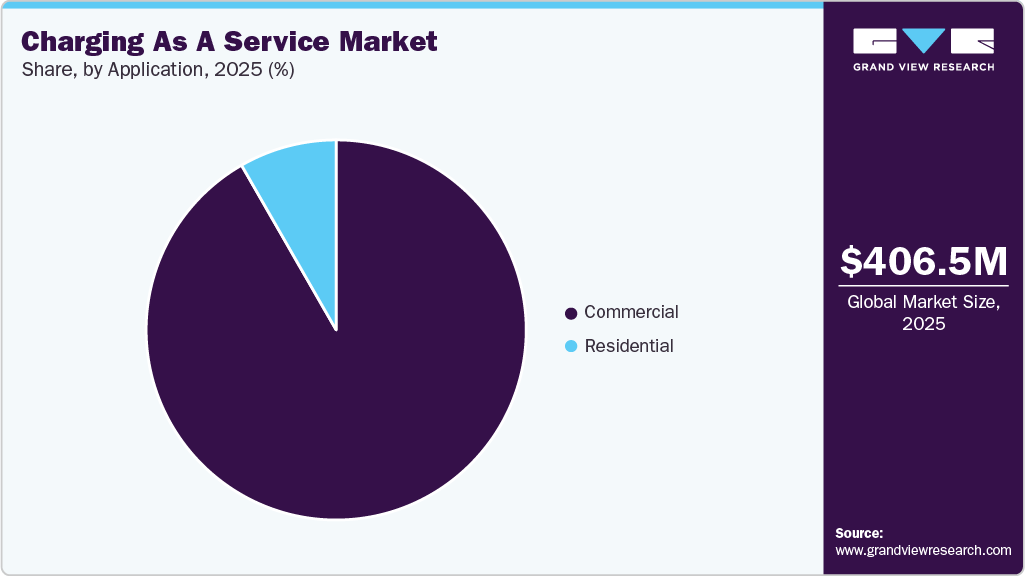

The global charging as a service market size was estimated at USD 406.5 million in 2025, and is projected to reach USD 2,875.9 million by 2033, growing at a CAGR of 28.6% from 2026 to 2033. Electric vehicle (EV) charging-as-a-service provides an efficient infrastructure for a quick, accessible, and easy charging experience for electric vehicles.

Key Market Trends & Insights

- The Asia Pacific charging-as-a-service industry accounted for a 31.4% share of the overall market in 2025.

- The charging-as-a-service industry in China held a dominant position in 2025.

- By service, the hosted segment accounted for the largest share of 43.6% in 2025.

- By charging station, the AC charging segment held the largest market share in 2025.

- By application, the commercial segment dominated the market in 2025.

Market Size & Forecast

- 2025 Market Size: USD 406.5 Million

- 2033 Projected Market Size: USD 2,875.9 Million

- CAGR (2026-2033): 28.6%

- Asia Pacific: Largest market in 2025

- Europe: Fastest growing market

Charging-as-a-service (CaaS) offers many advantages to EV charging service providers where they do not have to stress over the cost of installation, ownership, and maintenance. The market growth can be attributed to the growing sales of electric vehicles, increasing demand for public charging infrastructure, lower upfront costs, and the overall cost efficiency of CaaS. As sales of electric vehicles are increasing globally, the demand for charging infrastructure is expanding. According to the International Energy Agency, global EV sales reached 14 million in 2023, marking a 35% increase compared to 2022.However, this unprecedented growth in the sales of electric vehicles needs to be backed by a robust charging infrastructure that is enough for the total EV-using population. Moreover, a looming lack of public charging infrastructure and a dearth of enough space and capital to install EV charging infrastructure in personal spaces is driving the demand for charging as a service business model, thereby propelling the market growth.

Charging-as-a-service provides a low-risk and economical approach to electric vehicle charging, which expands EV charging infrastructure to many more places. It provides EV drivers with a reliable network of charging wherever they go, reducing their vehicle range anxiety. Due to these advantages, the demand for charging-as-a-service is increasing, driving the market’s growth.

Businesses are expanding their CaaS networks to cater to this increased demand. For instance, in February 2022, EV Connect announced the expansion of its low-risk, flexible charging option with small monthly payments, EV charging as a service (EVCaaS) program. Favorable government initiatives across the globe to promote electric vehicle usage and charging infrastructure are expected to drive the growth of the EV charging as a service industry.

For instance, the Infrastructure Investment and Jobs Act of the U.S. aims to invest about USD 550 billion over the next ten years to improve the nation’s infrastructure. This act has about USD 7.5 billion allocated nationwide for a national network of electric vehicle chargers. Such initiatives aim to provide seamless and accessible EV charging infrastructure, which is expected to drive the adoption and growth of the market for charging-as-a-service.

An academic study in the U.S. found that only 72.5% of 657 public fast chargers worked in the San Francisco Bay area. Another study published by The Eco Experts, in the UK, states that over 5.2% of the 26,000 public EV chargers at the surveyed places in the UK were broken. Electric vehicle chargers require high maintenance, which is taken care of in the charging-as-a-service business model.

The insufficient charging infrastructure for electric vehicles poses a growth opportunity for the market. The reason behind many broken EV chargers can be that they lack appropriate maintenance since all of the electric vehicles require a different charging infrastructure, which is difficult to maintain. This creates a growth opportunity for the market, where CaaS providers can provide charging service with the help of a third-party looking into the maintenance of the infrastructure.

Service Insights

The hosted segment accounted for a significant market share of 43.6% in 2025. The hosted charging-as-a-service can be deployed at various locations, including tourist destinations, public lands, businesses, hotels, commercial complexes, transportation facilities, and restaurants, among others. The growth of the segment can be attributed to a variety of benefits provided to the hosts, including attracting and retaining EV-driving visitors or customers as well as employees and earning revenue from user fees or land rents for EV charging.

The subscription segment is anticipated to register the fastest growth over the forecast period. Subscription-based charging-as-a-service provides customers the efficiency and ease of charging on a monthly/yearly subscription basis. It reduces the upfront cost of buying a charging station, as customers need not purchase or install the charging stations at their premises, and they can opt for a subscription model. The accessibility provided by subscription-based charging-as-a-service is driving the segment’s growth. In February 2022, Liberty Global Ventures launched Egg to offer a range of clean technology solutions, including electric vehicle charging on a subscription basis. The service will offer UK customers ongoing support and maintenance, all included in a monthly payment of GBP 30 (USD 40.25). Such initiatives are fostering the segment’s growth.

Charging Station Insights

The AC charging segment dominated the market in 2025. Most electric vehicle charging infrastructures use AC charging with a usual power output of 22 kW, depending upon the type of vehicle and available charging infrastructure. The AC chargers require more time for charging; hence they are used as an efficient option at residential or commercial places such as office buildings or hotels.

Electric vehicles store power as DC; therefore, the power from the electric charging infrastructure needs to be converted from AC to DC, which takes more time. However, AC charging is readily available and a safer option, driving the growth of the AC charging station segment in the charging-as-a-service industry.

The DC charging station segment is anticipated to register the fastest growth over the forecast period. Unlike AC charging stations, DC chargers have a converter inside the charger itself. DC charging is making its way into the charging-as-a-service space due to its fast charging and bidirectional charging capabilities. CaaS providers are expected to prefer DC chargers in the coming years, as they will save a lot of time in charging for EV users at commercial places, increasing the efficiency of the infrastructure so that CaaS providers can cater to more customers during the specified time. This is expected to drive the segment’s growth during the projection period.

Application Insights

The commercial segment dominated the market in 2025. Charging-as-a-service removes the burden of ownership and maintenance from charging by providing a more accessible charging solution. The commercial segment includes hospitality industry points, parking garages, office buildings, multi-facility units, and others. These public places can have charging-as-a-service on either a subscription basis, hosted on the premise, or financed through a third party.

Charging-as-a-service at such public places can provide immense accessibility to EV users, reducing their anxiety, and it can even promote EV usage for better environmental and societal health. Commercial places can benefit from CaaS by increasing customer retention and providing the most satisfactory and comfortable experience to their customers/residents, which is expected to drive the segment’s growth even further during the forecast period

The residential segment is anticipated to register significant growth over the forecast period. With the increasing sales and demand for electric vehicles, customers are constantly evolving regarding their expectations. Even though electric vehicle sales have flourished over the past few years, the charging infrastructure lacks the same growth.

Charging-as-a-service can provide electric vehicle users with easy and hassle-free charging solutions at their residences. Consumers can charge their vehicles without the stress of installing or maintaining them, which considerably reduces the upfront cost of buying an EV. The cost efficiency and accessibility of CaaS are expected to drive the segment’s growth during the assessment period.

Regional Insights

Asia Pacific charging-as-a-service industry dominated the global market in 2025 and accounted for a revenue share of 31.4% in 2025. The growth can be attributed to the presence of many prominent players. The growing adoption of electric vehicles in countries with large populations, such as China, India, and South Korea, is creating a significant demand for charging infrastructure and charging-as-a-service. Moreover, favorable government initiatives, such as the IEA Net Zero by 2050 roadmap promoting the use of electric vehicles and a better network of EV charging infrastructure, are expected to contribute to the region's growth.

China charging-as-a-service industry is driven by the rapid expansion of the electric vehicle market, coupled with a growing emphasis on sustainable transportation, that has propelled the adoption of charging-as-a-service models across the country. China's ambitious urban development projects and increasing urbanization have further accelerated the need for convenient and accessible charging infrastructure. Moreover, technological advancements and innovation in the electric vehicle sector are pivotal to this growth, with industry leaders continuously developing advanced software, high-capacity charging stations, and interactive technologies. As a result, the charging-as-a-service landscape in China is evolving dynamically, catering to the diverse charging needs of an expanding electric vehicle user base.

Europe Charging As A Service Market Trends

Europe charging-as-a-service industry is expected to emerge as the fastest-growing regional market during the forecast period. The European governments are looking at charging-as-a-service as the key to accelerating the use of electric vehicles. To accelerate the adoption, governments across Europe are offering various incentives. For instance, in the Netherlands, up to 36% of cost deductions on purchasing and installing charging stations are available to public entities and companies. Such initiatives are expected to drive the market’s growth in the coming years.

The charging-as-a-service industry expansion in the UK can be linked to the increasing adoption of EVs and the nation's commitment to sustainable transportation solutions. For instance, the number of EV registrations in the UK witnessed an increase of 40% from 2021 to 2022. Moreover, in 2023, 17% of the vehicle registrations were electric in the UK. The UK government's ambitious targets for reducing carbon emissions and promoting eco-friendly mobility have propelled the demand for electric vehicles, driving the need for a comprehensive and convenient charging infrastructure.

The charging-as-a-service industry in Germany is driven by it being a powerhouse in the automotive industry. There is a growing emphasis on transitioning toward cleaner and greener transportation solutions. Government initiatives and strong environmental policies are propelling the expansion of the charging-as-a-service industry, with subsidies, grants, and supportive regulations encouraging the development of an extensive charging infrastructure. The strategic placement of charging stations in urban areas, along highways, and in public spaces aligns with the increasing demand for convenient and accessible charging options, addressing the concerns about range limitations.

North America Charging As A Service Market Trends

North America charging-as-a-service industry is anticipated to register significant growth during the forecast period. North America is home to some of the prominent market players. Moreover, organizations in North American countries are investing aggressively in electric vehicles and related companies, propelling the region’s growth. Charging-as-a-service will be instrumental in achieving the U.S. and Canada’s zero carbon emission goals. The U.S. federal government has set a target that half of the new passenger cars and light trucks sold in 2030 should be ZEV (including both battery-electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs)). Such regional initiatives are expected to create further growth opportunities for the market in North America.

The charging-as-a-service industry in the U.S. is undergoing substantial expansion, driven by a growing need for convenient and accessible EV charging solutions. The automotive sector in the U.S. is witnessing a surge in the adoption of charging-as-a-service models, with a focus on optimizing user experience and addressing range anxiety. Corporate and public spaces, including parking facilities and commercial establishments, are incorporating this service to cater to the increasing number of EV users. Furthermore, the market is propelled by strategic partnerships with utility providers and collaborations between charging service providers and automotive manufacturers, along with product launches. For instance, in September 2023, Daimler Truck AG, an automotive financial service company, and Electrada, an electric vehicle charging station provider, launched charging-as-a-service in North America, available both for trucks and for buses. The launch was aimed at assisting customers in transitioning to sustainable transportation. The initial implementation of this comprehensive solution is scheduled for select projects with customers in the U.S. during the first half of 2024.

Key Charging As A Service Company Insights

Some of the key companies in the charging-as-a-service industry include ChargePoint Holdings, Inc., Shell Recharge Solutions, EV Connect, EV Safe Charge Inc, Blink Charging Co. and others. The vendors operating in the charging-as-a-service industry are mainly adopting expansion and partnerships as a strategy to cater to the increased demand. The demand is attributed to the ability of CaaS business model to provide efficient, hassle-free charging. The players in the market are investing heavily to expand their charging networks to offer their customers multiple charging spots.

-

ChargePoint Holdings, Inc. is a provider of charging technology solutions for electric vehicles with a keen focus on developing a comprehensive charging network that promotes the use of electricity in the transportation sector. The company offers networked charging solutions for commercial use (workplace, retail, parking, hospitality, education, recreation, municipal, and highway fast charge), fleets (take home, delivery, motor pool, logistics, transit, and shared mobility), and residential use (multi-family and single-family homes, apartments, and condominiums) in North America and Europe.

-

Blink Charging Co. offers a range of residential and commercial charging equipment and networked services for EV owners. The company's subsidiaries handle the manufacture, ownership, operation, and provision of these services, catering to the growing demand for EV charging in the U.S. and international markets. The company’s offerings enable electric vehicle drivers to conveniently recharge their vehicles at different locations. In June 2022, Blink Charging Co. acquired SemaConnect, Inc., a manufacturer and supplier of electric vehicle charging solutions.

Key Charging As A Service Companies:

The following are the leading companies in the charging-as-a-service market. These companies collectively hold the largest Market share and dictate industry trends.

- ChargePoint Holdings, Inc.

- Shell Recharge Solutions

- EV Connect

- EV Safe Charge Inc

- Blink Charging Co.

- Lightning eMotors

- Electrify America

- CATEC

- WattLogic, LLC

- Bp pulse

- Enel X Way USA, LLC

- Spark Charge

Recent Developments

- In May 2023, Shoals Technologies Group and Brookfield Renewable formed a strategic collaboration to launch an innovative Charging-as-a-Service (CaaS) offering for EV charging infrastructure. This solution targets public sector entities, EV solution providers, automakers, fleet operators, and other stakeholders, delivering comprehensive EV charging solutions with nominal cost and operational disruption for customers.

- In March 2023, SparkCharge introduced SparkCharge Fleet, a mobile Charging as a Service (CaaS) service. The service is designed to provide businesses with immediate access to charging for their electric vehicle fleets, irrespective of the location or grid connection capabilities.

Charging As A Service Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 494.3 million

Revenue forecast in 2033

USD 2,875.9 million

Growth rate

CAGR of 28.6% from 2026 to 2033

Base year of estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Service, charging station, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Netherlands; UK; France; Norway; Germany; China; Japan; India; South Korea; Australia; Brazil; Kingdom of Saudi Arabia; UAE; South Africa

Key companies profiled

ChargePoint Holdings, Inc.; Shell Recharge Solutions; EV Connect; EV Safe Charge Inc; Blink Charging Co.; Lightning eMotors; Electrify America; CATEC; WattLogic, LLC; Bp pulse; Enel X Way USA, LLC

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

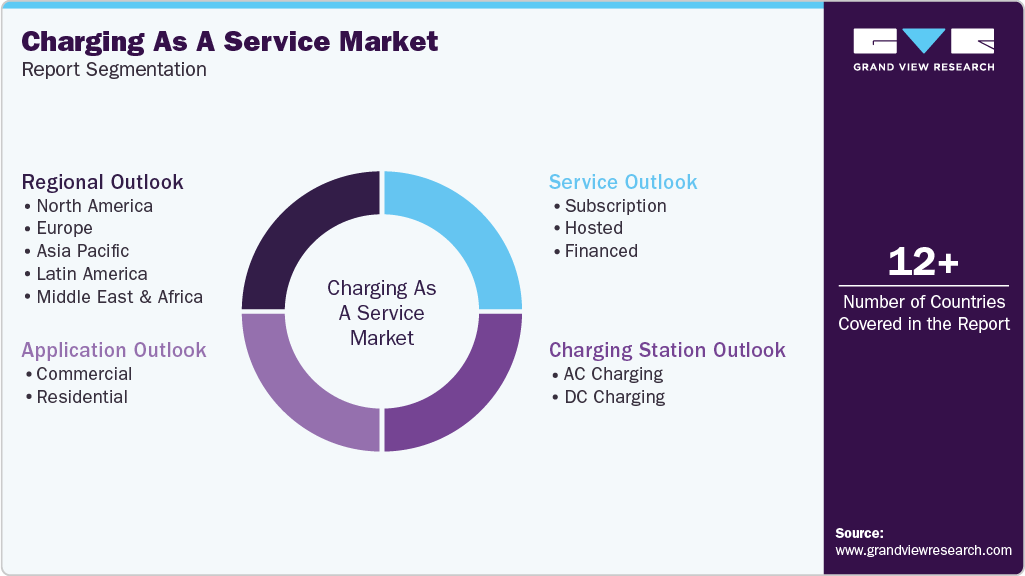

Global Charging As A Service Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the charging-as-a-service market report based on service, charging station, application, and region.

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Subscription

-

Hosted

-

Financed

-

-

Charging Station Outlook (Revenue, USD Million, 2021 - 2033)

-

AC Charging

-

DC Charging

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Commercial

-

Hospitality

-

Parking Garage

-

Office Buildings

-

Multi-family Units

-

Others

-

Residential

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Netherlands

-

UK

-

France

-

Norway

-

Germany

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global charging as a service market size was estimated at USD 406.5 million in 2025 and is expected to reach USD 494.3 million in 2026.

b. The global charging as a service market is expected to grow at a compound annual growth rate of 28.6% from 2026 to 2033 to reach USD 2,875.9 million by 2033.

b. Asia Pacific dominated the charging as a service market with a share of 31.4% in 2025. The region's growth can be attributed to the growing adoption of electric vehicles in countries with large populations, such as China, India, and South Korea, which is creating a significant demand for charging infrastructure and charging-as-a-service in the region

b. Some key players operating in the charging as a service market include ChargePoint Holdings, Inc.; Shell Recharge Solutions; EV Connect; EV Safe Charge Inc; Blink Charging Co.; Lightning eMotors; SemaConnect; CATEC; WattLogic, LLC; Bp pulse

b. Key factors that are driving the market growth include growing sales and demand of electric vehicles and growing demand for public charging infrastructure at lower costs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.