- Home

- »

- Medical Devices

- »

-

Charcot Foot Reconstruction Market Size, Share Report 2030GVR Report cover

![Charcot Foot Reconstruction Market Size, Share & Trends Report]()

Charcot Foot Reconstruction Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Implants, Foot Plating Systems), By fixation Type (Internal, External), By Application, By End-user, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-269-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Charcot Foot Reconstruction Market Trends

The global charcot foot reconstruction market size was estimated at USD 205.4 million in 2023 and is projected to grow at a CAGR of 4.5% from 2024 to 2030. The escalating prevalence of diabetes worldwide is one of the major factors driving this growth. According to a study published in the Lancet titled "Global, regional, and national burden of diabetes from 1990 to 2021, with projections of prevalence to 2050: a systematic analysis for the Global Burden of Disease Study 2021," over 500 million people worldwide are living with diabetes. This chronic health condition affects individuals of all ages, genders, and nationalities, and this number is expected to more than double to 1.3 billion within the next 30 years.

Diabetes, when not managed properly, can result in a variety of complications, including peripheral neuropathy. This condition is characterized by nerve damage, particularly in the extremities such as the feet. For instance, according to a report published on ScienceDirect, Charcot foot is estimated to affect between 0.1% and 7.5% of the general diabetic population. As the global prevalence of diabetes continues to increase, the risk of Charcot foot among diabetic patients also increases.

The increasing geriatric population presents a significant growth opportunity for the Charcot foot reconstruction market. As the global life expectancy continues to rise and the birth rates decline, the demographic landscape is changing, resulting in a larger proportion of elderly individuals. According to the WHO report, the proportion of people aged 60 years or older in the world will increase to 1 in 6 by 2030. This means that the number of people aged 60 years and over will rise from 1 billion in 2020 to 1.4 billion in 2030. Furthermore, by 2050, the worldwide population of people aged 60 years and older will double to 2.1 billion. The report also predicts that the number of individuals aged 80 years or older will triple from 2020 to 2050, reaching 426 million. Elderly people are more likely to develop chronic conditions such as diabetes and peripheral neuropathy, which increases their risk factors for Charcot foot.

Continuous innovation in medical technology, such as advanced imaging modalities, minimally invasive surgical techniques, and cutting-edge implant materials, has significantly improved the effectiveness and safety of Charcot foot reconstruction procedures. Additionally, as healthcare professionals and patients become more aware of the consequences of Charcot foot disease, the demand for Charcot foot surgery increases, thereby fostering market growth.

Additionally, growing initiatives undertaken by government and non-government organizations to create an awareness for the Charcot foot is driving market growth. In March 2019, Vejthani Hospital, one of the leading hospitals that specializes in bone and joint treatments in Thailand, raised awareness on Charcot foot. The hospital urged patients who are suffering from complications caused by diseases like diabetes to take care of their health regularly. The hospital advised them to practice self-monitoring, which includes taking care of their wounds and checking their nervous system to prevent the occurrence of Charcot foot. They further emphasized that the success rate of treating foot deformities caused by Charcot foot is high if detected early. Such initiatives will supplement market growth.

Market Concentration & Characteristics

The market for Charcot foot reconstruction has recently seen significant advancements in surgical techniques, materials, and technology. This includes the refinement of minimally invasive surgical approaches, the integration of advanced imaging modalities, and the use of intraoperative navigation systems. In addition, novel biomaterials and patient-specific implants utilizing 3D printing technology have been developed. These advancements are leading to more effective, precise, and personalized solutions for patients with Charcot foot.

The Charcot foot reconstruction market is characterized by a high level of merger and acquisition (M&A) activity by the leading players. These M&A facilitate access to complementary technologies, expertise, and distribution channels, enabling companies to accelerate product development, improve operational efficiency, and capture a larger share of the market.

Regulations are crucial in shaping the Charcot foot reconstruction industry, as they ensure patient safety and maintain the efficacy of medical devices. Regulatory bodies, such as the FDA in the U.S. play a crucial role in ensuring the safety, efficacy, and quality of medical devices and procedures used in Charcot foot reconstruction. Stringent regulatory requirements govern the approval and marketing of new technologies and implants.

Product substitutes are alternative methods or technologies that healthcare facilities can use instead of performing Charcot foot reconstruction surgery. One notable substitute in the market is minimally invasive procedures, along with regenerative medicine. These substitutes provide patients and physicians with options that may moderate certain risks associated with traditional implants, offer tailored solutions for complex cases, and potentially speed up the healing process.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. Rising product launches create more opportunities for market players to enter new regions.

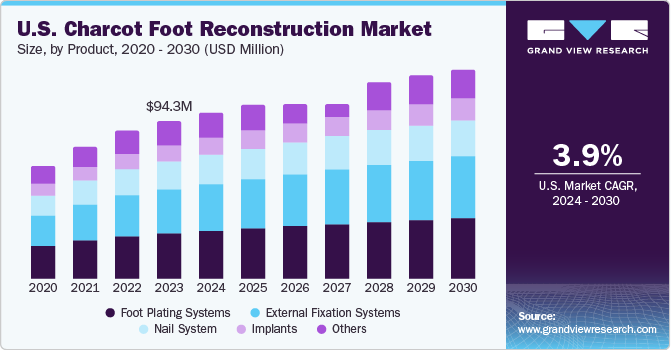

Product Insights

The foot plating systems segment dominated the market in 2023 and accounted for the largest revenue share of 28.2%. Foot plating systems offer customizable implants and instrumentation specifically tailored to the unique requirements of Charcot foot surgeries. Furthermore, advancements in foot plating technology continue to drive market growth. Manufacturers are continually innovating to develop implants and instruments that provide improved biomechanical stability and durability, thereby fostering market growth. Moreover, increasing cases of diabetic patients is anticipated to boost market growth. For instance, according to foot and ankle surgeon, Dr. Rajesh Simon, in 2022, the state of Kerala had one of the highest numbers of diabetic patients in India. Nearly 8% of these patients were at risk of Charcot foot.

The external fixation systems segment is anticipated to witness the fastest CAGR over the forecast period. The ability of external fixation systems to provide immediate stabilization and relief to the affected foot is anticipated to boost market growth. Charcot foot deformities often result in severe instability and structural changes, necessitating rapid intervention to prevent further damage and facilitate healing. External fixation systems offer adjustable frames and multiplanar fixation options, allowing surgeons to customize the stabilization to the specific needs of each patient, thereby supplementing segmental growth.

Fixation Type Insights

The internal fixation devices segment held the largest revenue share of 71.4% in 2023. Internal fixation devices provide significant benefits such as direct compression between bones, which facilitates faster healing and decreases the possibility of nonunion or malunion. Additionally, internal fixation devices can accommodate various fixation devices, including screws, plates, and intramedullary nails, allowing surgeons to customize the treatment plan. Such associated benefits are fostering the demand for internal fixation devices. For instance, as per the study title “Charcot foot reconstruction outcomes: A systematic review” published by NIH in 2020, 65% of the feet underwent internal fixation, 31% underwent external fixation, and 44% underwent simultaneous internal and external fixation.

The external fixation systems segment is anticipated to witness the fastest CAGR over the forecast period. External fixation systems provide a less invasive treatment option compared to internal fixation methods. This is due to the use of smaller incisions and minimal soft tissue disruption, leading to faster recovery times and better outcomes for patients. Recently, in December 2023, an article published by Orthofix also highlights the importance and use of external fixator devices in foot and ankle Charcot reconstruction, it further adds that ‘the preferred treatment for infections, particularly in severe cases like infected joints (septic joints), involves an initial external fixation only. If the affected area, such as the foot, remains unstable it can be later replaced by internal fixation once the frame is taken out, usually after approximately 3 months. Furthermore, the growing incidence of Charcot foot deformities is expected to drive market growth.

Application Insights

The mid foot segment dominated the market in 2023 with a revenue share of 34.3%. This is attributed to the rising prevalence of diabetes leading to chronic and destructive diseases of the bone structure, such as Charcot neuroarthropathy (CN). In February 2023, Annal of Joints publication highlighted in a study that the prevalence of CN in patients with long-term or unrecognized diabetes is estimated to be around 7.5%. Charcot involvement of midfoot is more widespread than similar disease processes such as ankle and hindfoot CN. For instance, in March 2022, according to a study on Charcot neuroarthropathy and recent surgical management, the most commonly affected area in Charcot neuroarthropathy is midfoot, which stands as the most common site and affected area accounting for 60% followed by hindfoot (30% - 35%). Several factors contribute to the increased risk of midfoot injuries in these populations, including peripheral neuropathy, loss of protective sensation, and biomechanical abnormalities. Thus, the mid-foot segment is anticipated to hold a substantial market share over the forecast period.

The forefoot application segment is anticipated to witness the fastest CAGR over the forecast period. The forefoot plays a vital role in weight distribution, shock absorption, and overall foot stability. In Charcot foot reconstruction, surgeons focus on addressing the specific issues in the forefoot while maintaining the integrity of the midfoot and hindfoot. In February 2023, The International Working Group on the Diabetic Foot (IWGDF) released practical guidelines for the prevention and management of diabetes-related foot disease, highlighting regular foot examinations, Neuropathy screening, vascular assessment, employing offloading techniques like total contact casting, removable braces, or specialized footwear to reduce pressure on the ulcer and promote forefoot healing.

Several key players are involved in foot fixation systems and product launches to gain a substantial market share. For instance, in July 2023, Paragon 28, Inc. announced the launch of its Metatarsal Shortening System, which consists of an intramedullary device for the fixation of shortening osteotomies of the lower metatarsals. This device aims to address floating toe and metatarsalgia, two prevalent foot and ankle pathologies. The system incorporates a patent-pending cut guide, enabling increased precision during the corrective procedure.

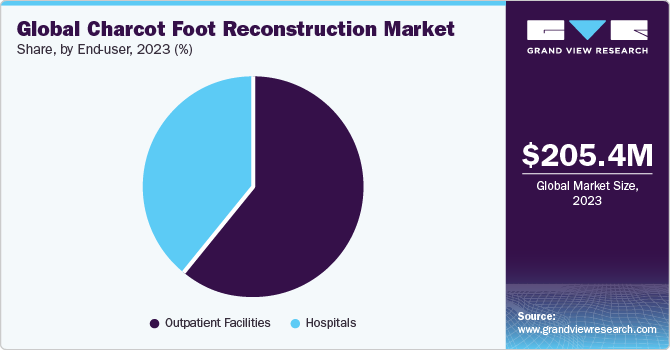

End-user Insights

The outpatient facilities segment dominated the in 2023 with a revenue share of 61.5%. Outpatient facilities often incorporate multidisciplinary clinics, where specialists from various medical fields collaborate to manage complex conditions like Charcot foot. This collaborative approach ensures comprehensive care and optimal outcomes for patients. Outpatient facilities may be more preferable and saw increase in patient visits as it offer lower costs compared to inpatient settings. Outpatient settings, including ambulatory surgery centers (ASCs), are witnessing a surge in the volume of foot fixation procedures, thereby escalating segmental growth. Open reduction and internal fixation (ORIF) is a widespread preferred treatment strategy for ankle fracture that can be performed in an outpatient setting. In January 2024, a research study from the ‘Journal of Foot and Ankle Surgery’ stated that the operatively treated ankle fractures and other conditions outpatient costs were noted to be 31.6% less than inpatient settings.

The hospitals segment is anticipated to register a significant CAGR from 2024 to 2030. Hospitals play a crucial role in providing medical procedures, diagnostics, and treatments and inpatient care for complex care. Some patients with Charcot foot may require inpatient care due to the complexity of their condition, comorbidities, or the need for post-operative monitoring. Hospitals are equipped to handle such cases, providing round-the-clock medical supervision, advanced imaging, and surgical processes such as tendon lengthening and tenotomies. To ensure high standards of patient care and infection prevention, hospitals need reliable Charcot foot reconstruction solutions. Additionally, the rising prevalence of chronic Charcot neuroarthropathy coupled with the rising patient preference for hospitals are driving market growth in this area.

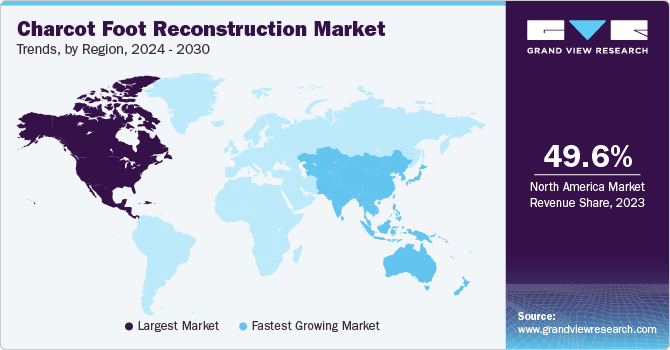

Regional Insights

North America dominated the Charcot foot reconstruction market in 2023 and accounted for the largest revenue share of 49.6%, owing to a rising prevalence of diabetic foot diseases, well-established healthcare infrastructure, and high healthcare expenditure. For instance, in November 2023 American Diabetes Association highlighted the national healthcare costs attributable to diabetes increased by USD 80 billion in the last 10 years, amounting to USD 412.9 billion in 2022 from 227 billion in 2012. The diverse range of products and procedures aimed at restoring stability and functionality to affected feet and rising awareness about diabetic foot complications in the region have further fueled market expansion.

U.S. Charcot Foot Reconstruction Market Trends

The Charcot foot reconstruction market in the U.S. held the largest share of the North American market in 2023. This is attributable to key presence of global manufacturers such as Stryker Corporation, Zimmer Biomet, Orthofix and others in the country, which are involved in the introduction of innovative foot fixation systems designs and materials aimed at improving patient outcomes and reducing the risk of complications. Furthermore, rising prevalence of diabetes leads to diabetic foot or Charcot foot conditions.

For instance, approximately 11.6% of the U.S population is diabetic. Serious complications to the foot and ankle, including nerve damage and poor circulation, can weaken the bones, resulting in conditions such as Charcot arthropathy (Charcot foot and Charcot ankle). The incidence rate of Charcot foot or Charcot ankle is recorded to be 0.08-0.13% of the 29 million people suffering from diabetes. Such prevalence needs to be diagnosed timely bringing forth the need of advanced Charcot foot reconstruction devices, thus bolstering the market growth over the forecast period.

Charcot foot reconstruction market in Canada is anticipated to register the fastest CAGR during the forecast period. Government initiatives in the country aimed at improving diabetes management and foot care, coupled with public healthcare coverage, facilitate access to Charcot foot reconstruction procedures in Canada, driving market growth. In addition, the growing emphasis on evidence-based practice and clinical research to evaluate the effectiveness of different reconstruction techniques and implants in the Canadian population is fostering market growth.

Europe Charcot Foot Reconstruction Market Trends

Charcot foot reconstruction market in Europe is anticipated to register a significant market growth during the forecast period. Growing geriatric population, prevalence of diabetes, and the manufacturers focused on technological advancements are the factors accelerating the market growth. In June 2022, stats published by WHO Europe, reports nearly 52 million people are affected by diabetes, 19.3 million people aged 60-79 years, 11.3 million aged 40-59 years, and 1.7 million aged 20-39 years suffered from diabetes. The number of adults with diabetes is accounted to reach 67 million by 2030 and 69 million by 2045.

In addition, manufacturers in the region are attending the national level programs and conferences for diabetic foot treatment, For instance, in May 2023, Mölnlycke Health Care AB attended the International Symposium on the Diabetic Foot (ISDF) in Hague, Netherlands, which highlighted lower extremity and diabetic foot wound care. The 2023’s ISDF brought forward 1500 healthcare professionals, indicating the rising awareness and developmental activities in the diabetic foot reconstruction technique space.

Germany Charcot foot reconstruction market is anticipated to register a considerable CAGR during the forecast period. This is driven by the rising number of organizations and the government showing support for procedures and increasing technological advancement in the field of Charcot foot diagnosis. Furthermore, the best hospital organizations in the surgical stabilization and reconstruction of bones are involved in providing patient centered care, For instance, Vitos Orthopedic Clinic, Kassel, the St. Vinzenz Hospital for Orthopedics, Duesseldorf, the University Hospital Ulm provides extensive care units and surgical reconstruction facilities across Germany. Such factors are anticipated to fuel the market growth.

Charcot foot reconstruction market in the UK is expected to register a considerable CAGR during the forecast period. The growth is attributable to the increasing awareness among healthcare professionals and the public about the importance of early diagnosis and treatment of Charcot foot can drive the demand for reconstruction procedures. For instance, the Northern England Clinical Networks, keep releasing guidelines on management of Charcot foot, alongside helping with the Podiatrist or the Foot Protection Team (FPT).

Furthermore, the UK government and healthcare providers have been promoting initiatives to improve diabetic foot care, which include funding for specialized centers, insurance coverage for Charcot foot reconstruction procedures, and E-learning leaflets and guidelines. For instance, Diabetes UK released the ‘Improving Diabetes Footcare’ publication aimed at providing an online foot screening program, foot risk awareness and management education (FRAME) website, Diabetes foot screening video by NHS England, Cheshire and Merseyside strategic clinical network website. This can make these treatments more accessible, boosting the market growth in the UK.

Asia Pacific Foot Reconstruction Market Trends

Charcot foot reconstruction market in Asia Pacific is anticipated to witness the fastest CAGR from 2024 to 2030. The World Diabetes Foundation (WDF) supports collaborative projects in middle-and low-income countries in the region to improve diabetes care & prevention and strengthen healthcare systems, through partnerships with local organizations & international experts. According to the International Diabetes Federation in South East Asia, nearly 90 million people suffered from diabetes in 2021, and is expected to reach 113 million by 2030 and 152 million in 2045.

However, the increase in hospitalization in some countries in the region has grown significantly over the years, for instance, in May 2023,a study published in the Journal of Endocrinology, highlighted the rise in hospital admissions due to diabetes-related foot ulcers (DFU) observed in a Western Australian population with Type 2 Diabetes Mellitus (T2DM), notably affecting a younger patient demographic.

China Charcot foot reconstruction market is anticipated to hold a considerable market share rate during the forecast period, owing to a rise in diabetic population and patients’ preference for early diagnosis. With approximately 141 million individuals diagnosed with diabetes, China represents one-quarter of the global diabetes population. In 2022, the International Diabetes Federation (IDF) and the Chinese Diabetes Society (CDS) collaborated to collect video testimonials from Chinese diabetes patients, aiming to enhance awareness and offer a platform for their expression. Further the presence of global and local manufacturers such as Changzhou Meditech Technology Co., Ltd, who provide orthopedic implants and devices. Such manufacturers involved in the management of Charcot foot reconstruction devices and orthopedic devices, drive market growth in the region.

The Charcot foot reconstruction market in India accounted for a significant market share, owing to the evolving patterns and developments in the Indian healthcare industry concerning the management and treatment of Charcot foot conditions. The country is working on various aspects, such as technological advancements, surgical techniques, and healthcare policies that influence the healthcare scenario in India.

Latin America Charcot Foot Reconstruction Market Trends

Latin American market involves the healthcare sector's advancements in diagnosing, treating, and managing Charcot foot conditions in various countries in the region. Key factors driving growth include increased awareness, favorable healthcare policies, and collaborations among medical professionals and organizations. For instance, in July 2023, Diabetic Voice, released the global impact of preventive measures for the diabetic foot with the "Save the Diabetic Foot" initiative in Brazil showcasing the effectiveness of inexpensive and straightforward preventive strategies. This project led to a significant 78% reduction in lower limb amputations over nine years, highlighting the potential impact of such measures on diabetic foot care.

MEA Charcot Foot Reconstruction Market Trends

The MEA Charcot foot reconstruction market is expected to grow lucratively over the forecast period. However, even with the rapid developments, disparities still persist between high-income nations and their middle and low-income counterparts. The IDF Diabetes Atlas 2022 reveals that African and Middle Eastern countries bear the heaviest burden, with over 20% of people living with diabetes experiencing foot ulcers or amputations. This highlights the need for enhanced diabetes management and foot care in these regions.

The Charcot foot reconstruction market in UAE is expected to grow at a significant CAGR over the forecast period, owing to the establishment of advanced healthcare infrastructure and improving healthcare services coupled with the provision of cutting-edge solutions for patients suffering from various orthopedic conditions. For instance, in January 2023, the Paley Middle East Clinic, situated within the Burjeel Medical City, was established through a partnership between private healthcare company Burjeel Holdings and Dr. Dror Paley, a renowned specialist in deformity correction and limb lengthening surgery. This facility aspires to serve as a central point for intricate medical treatments, diabetic care related to Charcot foot or neuropathic foot in the region.

Key Charcot Foot Reconstruction Company Insights

Key participants in the Charcot foot reconstruction market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Charcot Foot Reconstruction Companies:

The following are the leading companies in the charcot foot reconstruction market. These companies collectively hold the largest market share and dictate industry trends.

- Stryker

- Zimmer Biomet

- DePuy Synthes

- Arthrex, Inc.

- Orthofix

- Acumed LLC

- Integra LifeSciences

- Ossur

- DJO, LLC

- Paragon 28, Inc.

Recent Developments

-

In January 2023, MiMedx Group, Inc. announced it has entered a partnership with the Gunze Medical for the sales of EPIFIX in Japan. Epifix is a placental tissue allograft serving as a supportive element in the healing process by offering a semi-permeable, safeguarding cover for hard-to-heal wounds injuries. Further it has a protective layer that facilitates the natural progression of wound recovery treatment option for patients dealing with chronic wounds and diabetic foot diseases. With this partnership the company will gain the first mover advantage in the market.

-

In October 2022, He althium Medtech announced launch of its diabetic foot ulcers wound healing and dressing portfolio range Theruptor Novo, which is also used for all types of leg ulcers and further aims at covering wound dressing for complications such as diabetic neuropathy and diabetic nephropathy.

-

In Jan 2022, Alkem Laboratories announced the launch of its patented 4D bio printing technology for treatment of diabetic foot ulcers, which is associated to neuropathy or diseases affecting lower limb in patients with diabetes. Further the company collaborated with Rokit Healthcare Inc. to commercialize the technology in India.

Charcot Foot Reconstruction Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 217.7 million

Revenue forecast in 2030

USD 283.2 million

Growth rate

CAGR of 4.5% from 2024 to 2030

Historical data

2018 - 2023

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, fixation type, application, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Stryker; Zimmer Biomet; DePuy Synthes; Arthrex Inc.; Orthofix Acumed LLC; Integra LifeSciences; Ossur; DJO LLC;

Paragon 28, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Charcot Foot Reconstruction Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country level and provides an analysis on industry trends in each of the sub segments from 2018 to 2030. For fthis study, Grand View Research, Inc. has segmented the Charcot foot reconstruction market report based on product, application, fixation type, end-user, and region:

-

Fixation Type Outlook (Revenue, USD Million, 2018 - 2030)

-

External

-

Internal

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital

-

Outpatient Facilities

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Implants

-

Foot Plating Systems

-

Nail system

-

External Fixation Systems

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Forefoot

-

Mid foot

-

Hind foot

-

Ankle

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global charcot foot reconstruction market size was estimated at USD 205.4 million in 2023 and is expected to reach USD 217.7 million in 2024.

b. The global charcot foot reconstruction market is expected to grow at a compound annual growth rate of 4.5% from 2024 to 2030 to reach USD 283.2 million by 2030.

b. North America dominated the charcot foot reconstruction market in 2023 and accounted for the largest revenue share of 49.6%, owing to a rising prevalence of diabetic foot diseases, well-established healthcare infrastructure and high healthcare expenditure.

b. Some key players operating in the market include Stryker, Zimmer Biomet, DePuy Synthes, Arthrex, Inc., Orthofix Acumed LLC, Integra LifeSciences, Ossur, DJO, LLC Paragon 28, Inc.

b. The escalating incidence of diabetes worldwide is one of the major factors driving the market growth. This chronic health condition affects individuals of all ages, genders, and nationalities, and this number is expected to more than double to 1.3 billion within the next 30 years.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.