- Home

- »

- Medical Devices

- »

-

Cervical Disc Prosthesis Market Size And Share Report 2030GVR Report cover

![Cervical Disc Prosthesis Market Size, Share, And Trend Report]()

Cervical Disc Prosthesis Market (2025 - 2030) Size, Share, And Trend Analysis Report, By Disc Type (M-o-P, M-o-M), By End-use (Orthopedic & Trauma Centers, Hospitals), By Indication (Neck Pain, Myelopathy), By Material, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-952-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cervical Disc Prosthesis Market Trends

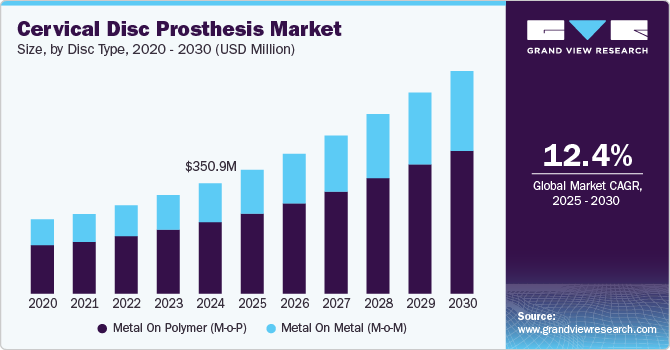

The global cervical disc prosthesis market size was estimated at USD 350.88 million in 2024 and is projected to grow at a CAGR of 12.4% from 2025 to 2030. The increasing geriatric population, growing demand for minimal surgical procedures, technological advancements in the cervical disc prosthesis, strategies implemented by key companies and an increase in healthcare expenditure are some of the key drivers of this market. For instance, in September 2023, ZimVie Inc., a prominent global leader in life sciences focused on dental and spine sectors, revealed that the U.S. Food and Drug Administration granted approval for its Mobi-C Cervical Disc Hybrid Investigational Device Exemption (IDE) application. The ruling permits ZimVie to start recruiting U.S. patients for the study.

Increasing economic affluence in major developing regions would boost the demand for such products, resulting in market expansion. Some of the key drivers impacting the market include the growing prevalence of degenerative disc disorders, an increase in the number of sports-related injuries & trauma cases, technological advancements, and increased product development activities. According to a report from Columbia University, around 30% of individuals will exhibit signs of disc degeneration at one or more levels by the age of 35. By the time a person reaches 60, over 90% will display some evidence of disc degeneration.

Furthermore, lower back discomfort is one of the most common symptoms pointing to an underlying spine-related illness, expanding the market’s potential. Furthermore, to address the drawbacks of spinal fusion surgeries, non-fusion techniques, such as cervical disc prostheses are gaining traction among end-users, resulting in an increased demand for cervical discs around the world.

One of the main drivers of the cervical disc prosthesis market is the growing geriatric population around the world. Improvements in health facilities and disposable income were key factors in improving quality of life and overall life expectancy. The elderly constitute a large part of the subpopulation susceptible to many diseases and disorders such as degenerative diseases of the spine. For instance, based on the WHO report, by 2030, one in every six individuals globally will be 60 years old or older. At that time, the proportion of the population aged 60 and above will rise from 1 billion in 2020 to 1.4 billion. By 2050, the global population of those aged 60 and older is expected to double, reaching 2.1 billion. In addition, according to an article published in Springer Nature in 2021, the total prevalence of diagnosed spinal degenerative diseases was found to be 27.3%, and it rose with advancing age. Thus, increasing geriatric population will foster market growth.

Increasing sports related injuries are supplementing market growth. According to information from Johns Hopkins University, around 30 million kids and teenagers in the U.S. engage in various organized sports, and annually, over 3.5 million injuries occur. Increasing participation in sports will drive market growth. For instance, according to a report from the American Association of Neurological Surgeons published in 2024, around 10.1% of all spinal cord injuries (SCIs) are associated with sports. The sports most linked to cervical injuries include football, diving, and cycling.

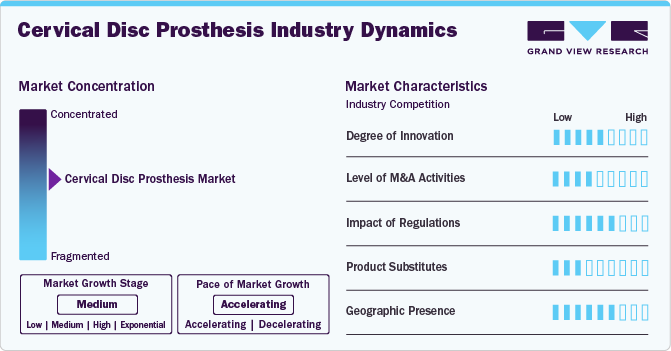

Market Concentration & Characteristics

The degree of innovation in the cervical disc prosthesis market is marked by significant advancements in materials, design, and surgical techniques aimed at enhancing patient outcomes. Recent innovations include the development of biomechanically optimized disc prostheses that mimic the natural motion of the spine, reducing the risk of adjacent segment degeneration. Improvements in materials, such as biocompatible polymers and advanced alloys, have led to devices that offer greater durability and improved integration with surrounding tissues.

The cervical disc prosthesis market is characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to expand the business to cater to the growing demand for cervical disc prosthesis.

Regulatory bodies, such as the FDA in the U.S. and the EMA in Europe, enforce stringent guidelines to ensure that cervical disc prostheses meet rigorous safety and efficacy standards before they can be marketed. These regulations require extensive clinical testing and comprehensive documentation, which can lengthen the approval process and increase costs for manufacturers.

Traditional spinal fusion remains a prominent alternative, offering a well-established method for treating cervical disc disorders by fusing adjacent vertebrae. Other substitutes include cervical cages and artificial discs, which aim to restore disc height and maintain some level of motion. Emerging technologies, such as stem cell therapy and regenerative medicine approaches, also present potential substitutes by promoting natural healing and tissue regeneration.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. Rising product approvals and funding create more opportunities for market players to enter new regions.

Disc Type Insights

In 2024, the metal on polymer (M-o-P) segment dominated the cervical disc prosthesis market and accounted for the largest revenue share. As a bearing surface for many joints, metal-on-polymer articulations have substantial clinical experience and literature backing. The majority of FDA-approved cervical TDR implants in the U.S. use repetitions of metal alloy-based superior & inferior prosthetic endplates that articulate through a central polymer core. Furthermore, the market is projected to develop due to an increase in the number of trauma-related and sports-related injuries, as well as orthopedic operations. According to an article published on ResearchGate in 2022, various authors of different studies demonstrated through their findings that the occurrence of football injuries varies from 0.5 to 45 injuries for every 1000 hours of practice and games.

The metal on metal (M-o-M) segment in the cervical disc prosthesis market is anticipated to witness the fastest growth with a CAGR of 12.7% over the forecast period. This growth can be attributed to their durability and biomechanical properties. MoM discs are engineered to endure considerable wear and stress, offering a durable solution that effectively mimics natural spinal movement. Furthermore, recent advancements in metallurgy and manufacturing techniques have resulted in smoother articulating surfaces, minimizing friction and enhancing overall performance.

Material Insights

In 2024, the cobalt segment dominated the cervical disc prosthesis market and accounted for the largest revenue share of 35.3%. Cobalt alloys, especially those high in chromium and molybdenum, offer exceptional mechanical properties, making them well-suited for load-bearing applications in spinal implants. Their capacity to retain structural integrity under stress enhances the durability of cervical disc prostheses. For instance, Cobalt Chromium-chrome (CoCr) is a Cobalt Chromium-chromium metal alloy with high specific strength and stiffness. CoCr alloys have a low risk of irritation, allergic reaction, or immunological response due to their corrosion resistance and great biocompatibility.

The titanium segment in the cervical disc prosthesis market is anticipated to witness significant growth over the forecast period. Titanium is a high-strength, low-density transition metal with excellent corrosion resistance. Titanium can be alloyed with a variety of other metals, including iron, aluminum, vanadium, and molybdenum, to generate strong, lightweight alloys that can be used in a wide range of applications. Titanium naturally osseointegrates because its lower modulus of elasticity, or Young's modulus, closely matches that of bone, allowing for better mechanical compatibility.

Indication Insights

In 2024, the myelopathy segment dominated the cervical disc prosthesis market and accounted for the largest revenue share of 44.3%. Growth in the segment can be attributed to the increasing prevalence of cervical myelopathy, particularly among aging populations and individuals with degenerative spinal conditions. For instance, according to a 2023 article in Springer Nature, the average prevalence of degenerative cervical myelopathy (DCM) across all age demographics was 0.19%, with the highest prevalence reaching 0.42% for individuals aged 50-54 years. Cervical disc prostheses offer a viable solution by alleviating pressure on the spinal cord and restoring mobility. In addition, advancements in surgical techniques and improved prosthetic designs have enhanced the safety and efficacy of these procedures, thereby escalating market growth.

The neck pain segment in the cervical disc prosthesis market is anticipated to witness significant growth over the forecast period. The increasing prevalence of cervical disc degeneration and related disorders are major factors contributing to market growth. Factors such as sedentary lifestyles, poor posture, and an aging population are worsening these conditions, resulting in a higher demand for effective treatment options. Cervical disc prostheses offer a promising alternative to traditional spinal fusion, as they preserve motion and provide pain relief, making them appealing to both patients and healthcare providers.

End-use Insights

In 2024, the hospitals segment dominated the cervical disc prosthesis market and accounted for the largest revenue share of 44.6%. The growth of this segment can be attributed to the availability of advanced facilities and cutting-edge implants in hospitals for the treatment and diagnosis of cervical spine disorders. In addition, the increasing demand for prostheses for patients suffering from myelopathy, radiculopathy, and severe neck pain is another factor driving segment growth during the forecast period. Furthermore, the increasing number of hospitals worldwide, and rise in government funding for the hospitals are supplementing segmental growth. As of January 2023, there are nearly 7,335 functioning hospitals in the U.S., based on data from the Definitive Healthcare HospitalView product.

The orthopedic & trauma centers segment in the cervical disc prosthesis market is anticipated to witness significant growth over the forecast period. Orthopedics and trauma centers provide end-to-end care and management for all types of bone and joint disorders. Many patients experience less pain in their daily activities as a result of the professional and individualized surgical approach to bone and joint disorders offered at these centers. Furthermore, surgeons in these centers are highly specialized and experienced with cutting-edge research to provide the best possible care.

Regional Insights

North America Cervical Disc Prosthesis Market Trends

North America cervical disc prosthesis market dominated the market in 2024 and accounted for the largest revenue share of 48.9%. The high share of this regional market can be attributed to the presence of several key service providers along with their adoption of various strategic initiatives to increase market penetration. In addition, a well-established regulatory framework ensures rigorous evaluation of new products, fostering confidence among healthcare providers and patients.

U.S. Cervical Disc Prosthesis Market Trends

U.S. cervical disc prosthesis market in the held the largest share of North America market in 2024. Owing to the advanced healthcare technology and a well-established framework for medical innovation. The country is a leader in the development and adoption of spinal implants, supported by significant investment in research and development from both private and public sectors.

Canada cervical disc prosthesis market is anticipated to register the fastest growth during the forecast period. The rising awareness of cervical disc disorders and their impact on quality of life are fostering market growth. Furthermore, the increasing preference for minimally invasive procedures among patients and healthcare providers enhances the demand for cervical disc prostheses.

Europe Cervical Disc Prosthesis Market Trends

Europe cervical disc prosthesis market is anticipated to grow lucratively during the forecast period owing to rising healthcare expenditure and a shift towards patient-focused treatment options. European countries are increasingly adopting innovative spinal technologies, supported by favorable reimbursement policies and healthcare systems.

Germany cervical disc prosthesis market is anticipated to register a considerable growth rate during the forecast period owing to the highly developed healthcare system. Moreover, combination of an aging population, rising incidences of cervical disc degeneration, and an expanding network of specialized clinics further supports market growth.

UK cervical disc prosthesis market is anticipated to register a considerable growth rate during the forecast period owing to an increasing recognition of the benefits of advanced spinal surgery techniques. Furthermore, the integration of new technologies and surgical approaches within the National Health Service (NHS) is also fostering an environment conducive to the growth of the cervical disc prosthesis market.

Asia Pacific Cervical Disc Prosthesis Market Trends

Asia Pacificcervical disc prosthesis market is anticipated to register the fastest growth rate during the forecast period owing to rapidly improving healthcare infrastructure and increasing access to advanced medical technologies. Moreover, the growing prevalence of lifestyle-related health issues, such as obesity and sedentary behavior, contributes to a higher incidence of neck pain and degenerative disc conditions, thereby escalating market growth.

Chinacervical disc prosthesis market held the largest share of Asia Pacific market in 2024. The growing geriatric population in the country is fostering market growth. Recent government data indicates that in 2023, approximately 297 million people in China were aged 60 and older, accounting for 21.1% of the total population, which designates the nation as a "super-aged society" according to World Bank criteria. This demographic is projected to exceed half a billion by the year 2050.

Japancervical disc prosthesis market is anticipated to register a considerable growth during the forecast period. Rising geriatric population and increasing incidence of degenerative spinal conditions are expected to drive market growth. Additionally, the combination of high healthcare standards and a focus on minimally invasive surgical techniques are accelerating market growth.

Latin America Cervical Disc Prosthesis Market Trends

Latin America cervical disc prosthesis market is anticipated to register significant growth during the forecast period due to increasing healthcare investments and a rising prevalence of spinal disorders. Furthermore, improvements in healthcare accessibility and the adoption of modern medical technologies are fostering market growth.

Brazil cervical disc prosthesis market is anticipated to register a considerable growth during the forecast period. The rising awareness of spinal health and an increasing demand for effective treatments for neck pain and related disorders are some of the key factors boosting the market growth in Brazil.

Middle East & Africa Cervical Disc Prosthesis Market Trends

MEA cervical disc prosthesis market is anticipated to register lucrative growth during the forecast period. Increasing investments in healthcare infrastructure and the growing elderly population are escalating market growth. Moreover, the rise of minimally invasive surgical techniques and patient-centric care models are supplementing market growth.

South Africa cervical disc prosthesis market is anticipated to register a considerable growth during the forecast period. The increased availability of specialized medical facilities and trained professionals contributes to the adoption of cervical disc prostheses. Moreover, increasing healthcare investments and a rising prevalence of cervical disorders among the population are fostering market growth.

Key Cervical Disc Prosthesis Company Insights

Key participants in the cervical disc prosthesis market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Cervical Disc Prosthesis Companies:

The following are the leading companies in the cervical disc prosthesis market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic, Plc

- Depuy Synthes (Johnson & Johnson Inc.)

- Stryker Corporation

- Zimmer Biomet

- Globus Medical, Inc.

- NuVasive, Inc.

- Orthofix Medical Inc.

- Olympus Corporation

- Centinel Spine, Inc.

- Axiomed LLC

Recent Developments

-

In February 2024, NGMedical GmbH, a manufacturer of medical devices, announced the launch of sales and the first surgical procedure using the MOVE-C artificial cervical disc in the United Arab Emirates. This launch in the UAE represents a significant step forward in NGMedical's global commercialization, following the approval of the MOVE-C cervical artificial disc replacement in Mexico at the end of November 2023.

-

In September 2022, NuVasive, Inc. revealed the introduction of Reline Cervical, an innovative fixation system designed for posterior cervical fusion (PCF), in specific areas.

-

In April 2021, NuVasive Inc. received FDA approval for the Simplify Cervical Artificial Disc for two-level cervical total disc replacement.

Cervical Disc Prosthesis Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 394.23 million

Revenue forecast in 2030

USD 708.51 million

Growth rate

CAGR of 12.4% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Disc type, indication, material, end-use, region

Regional scope

North America, Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic, Plc; Depuy Synthes (Johnson & Johnson Inc.); Stryker Corporation; Zimmer Biomet; Globus Medical, Inc.; NuVasive, Inc.; Orthofix Medical Inc.; Olympus Corporation; Centinel Spine, Inc.; Axiomed LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Cervical Disc Prosthesis Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country level and provides an analysis on industry trends in each of the sub segments from 2018 to 2030. For the purpose of this study, Grand View Research, Inc. has segmented the cervical disc prosthesis market report on the basis of disc type, indication, material, end-use and region:

-

Disc Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Metal on Polymer (M-o-P)

-

Metal on Metal (M-o-M)

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Myelopathy

-

Radiculopathy

-

Neck Pain

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Stainless Steel

-

Cobalt

-

Titanium

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Orthopedic and Trauma Centers

-

Others

-

-

Regional Outlook Revenue USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cervical disc prosthesis market size was estimated at USD 350.88 million in 2024 and is expected to reach USD 394.23 million in 2025.

b. The global cervical disc prosthesis market is expected to grow at a compound annual growth rate of 12.4% from 2025 to 2030 to reach USD 708.51 million by 2030.

b. North America dominated the cervical disc prosthesis market with a share of 48.9% in 2024. This is attributable to the growing geriatric population and the presence of various market players.

b. Some key players operating in the cervical disc prosthesis market include Medtronic, Plc, Depuy Synthes (Johnson & Johnson Inc.), Stryker Corporation, Zimmer Biomet, Globus Medical, Inc., NuVasive, Inc., Orthofix Medical Inc., Olympus Corporation, Centinel Spine, Inc., Axiomed LLC

b. Key factors that are driving the cervical disc prosthesis market growth include the increasing geriatric population, growing demand for minimal surgical procedures and technological advancements in the cervical disc prosthesis, strategies implemented by key companies, and an increase in healthcare expenditure.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.