Cerebral Infarction Treatment Market Size, Share & Trends Analysis Report By Drug Class (Anticoagulants, Antiplatelets), By Type (Ischemic Stroke), By Distribution Channel, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-450-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Cerebral Infarction Treatment Market Trends

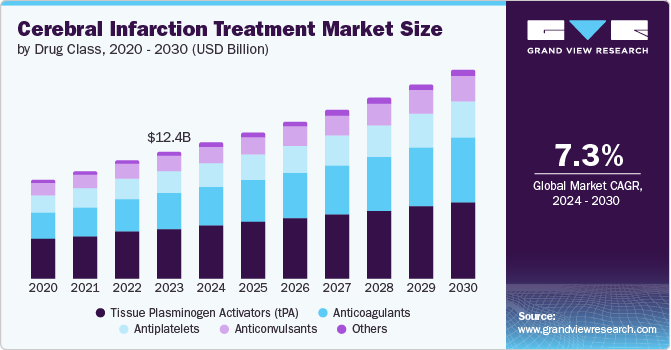

The global cerebral infarction treatment market size was estimated at USD 13.40 billion in 2024 and is anticipated to grow at a CAGR of 7.4% from 2025 to 2030. The increasing incidence of cerebral infarction is largely attributed to the growing prevalence of cerebrovascular diseases, particularly ischemic strokes. Key factors contributing to this rise include an aging population, unhealthy lifestyles such as poor diet, smoking, and lack of physical activity, as well as higher rates of conditions such as hypertension and diabetes. These risk factors significantly elevate the likelihood of experiencing cerebral infarction. As these health issues become more common, the number of stroke cases continues to rise, leading to an increased demand for effective treatments. This trend highlights the critical role of the cerebral infarction treatment industry in addressing these pressing health challenges.

The increasing advancements in medical technology have significantly enhanced the detection and treatment of cerebral infarction. New imaging techniques, such as MRI and CT scans, enable early diagnosis, crucial for timely treatment and improving patient outcomes. In addition, minimally invasive surgical methods such as thrombectomy have made it easier to treat strokes effectively. These technological improvements have contributed to better patient care and boosted the market demand for cerebral infarction treatments. Overall, these innovations play a vital role in shaping the future of the cerebral infarction treatment industry.

In addition, the increasing development of targeted therapies, such as thrombolytic agents and neuroprotective drugs, is expanding the treatment options for cerebral infarction. These new medications aim to reduce the risk of secondary strokes and enhance recovery for patients. Moreover, growing awareness of stroke symptoms and the importance of early intervention has encouraged both patients and healthcare professionals to seek medical care more rapidly. Early diagnosis and treatment are crucial for achieving better recovery results, leading to an increased demand for effective treatment options. This trend reflects the ongoing evolution within the cerebral infarction treatment industry.

Drug Class Insights

The Tissue Plasminogen Activators (tPA) segment dominated the market with a revenue share of 39.2% in 2024, which can be attributed to the high efficacy of tPA in treating acute ischemic strokes. Timely administration of tPA significantly improves patient outcomes, making it a critical component of stroke management. The rising incidence of cerebrovascular disorders, especially among aging populations, has led to a greater demand for effective thrombolytic therapies such as tPA. Furthermore, advancements in drug delivery technologies and raised awareness about the importance of early intervention have supported the adoption of tPA in clinical settings. As these factors continue to influence treatment practices, the tPA segment is expected to maintain its significant role in the cerebral infarction treatment industry.

The anticoagulants segment is projected to grow at the highest CAGR of 9.0% over the forecast period, fueled by the rising prevalence of conditions such as atrial fibrillation and venous thromboembolism necessitating anticoagulation therapy. This growth is supported by a growing understanding of stroke prevention strategies and the effectiveness of anticoagulants in reducing stroke risk. In addition, developing novel anticoagulant agents with improved safety profiles and ease of use will likely enhance their market presence. As healthcare professionals and patients become more aware of these treatment options, the demand for anticoagulants continues to rise. Therefore, these factors shape a dynamic cerebral infarction treatment industry environment.

Type Insights

The ischemic stroke segment dominated the market with the largest revenue share in 2024, driven by the global incidence rate of ischemic strokes. This growth was supported by increasing awareness regarding stroke symptoms and the critical importance of rapid treatment to minimize neurological damage. Enhanced integration of advanced diagnostic tools, such as MRI and CT scans, along with improved treatment protocols in hospitals, contributed to better management of ischemic strokes. As a result, patient outcomes have improved significantly, leading to a greater focus on effective therapies.

The hemorrhagic stroke segment is predicted to grow at the highest CAGR over the forecast period due to increasing research into effective treatment options and management strategies. In addition, advancements in surgical techniques, such as minimally invasive procedures, are likely to improve recovery rates for patients suffering from hemorrhagic strokes. The growing emphasis on post-stroke care and rehabilitation further supports this segment's growth.

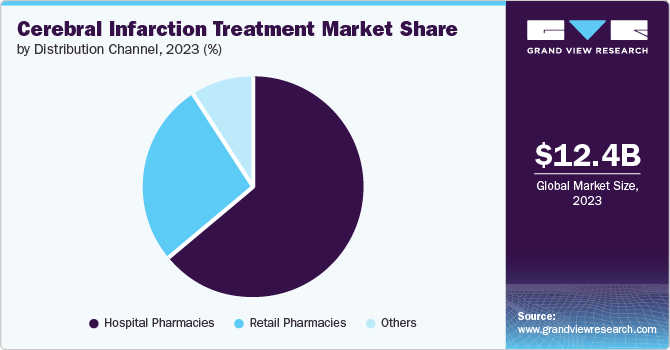

Distribution Channel Insights

The hospital pharmacies segment dominated the market with the largest revenue share in 2024, fueled by the high volume of patients requiring acute stroke care. Hospitals serve as primary treatment centers where patients receive immediate and comprehensive care, including advanced therapeutic options such as tPA. Investments in emergency care facilities have further enhanced their capacity to deliver timely medications and interventions. Hence, hospital pharmacies are crucial in ensuring effective treatment during critical moments for stroking patients.

The retail pharmacies segment is projected to grow at the highest CAGR over the forecast period, which can be attributed to increasing consumer access to medications and health information as more patients seek outpatient care and preventive treatments. Retail pharmacies are becoming essential providers for managing chronic diseases, including anticoagulants. In addition, the rise of online pharmacy services facilitates easier access to medications, further supporting this segment's expansion. The combination of these factors highlights retail pharmacies vital role in modern healthcare delivery.

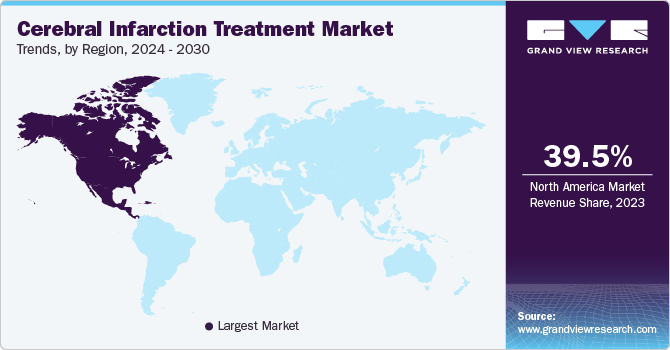

Regional Insights

North America cerebral infarction treatment market held the highest revenue share of 39.5% in 2024, driven by a strong healthcare infrastructure and high stroke incidence rates in the region. Focusing on advanced medical technologies and establishing comprehensive stroke centers has significantly improved patient outcomes. Furthermore, substantial investments in healthcare research and development have raised innovation in treatment options for cerebral infarction. As a result, North America continues to provide effective treatment solutions for stroke patients.

U.S. Cerebral Infarction Treatment Market Trends

The U.S. cerebral infarction treatment market dominated North America with the highest revenue share in 2024, which can be attributed to the high prevalence of risk factors such as hypertension and diabetes among the population. The presence of major pharmaceutical companies and active clinical research initiatives also play a crucial role in expanding the market. Moreover, public health campaigns intended to increase awareness about stroke prevention have positively influenced treatment uptake. Therefore, the demand for advanced treatment options continues to rise, reflecting a proactive approach to managing cerebral infarctions in the U.S.

Europe Cerebral Infarction Treatment Market Trends

Europe cerebral infarction treatment market held a substantial market share in 2024, driven by an aging population coupled with rising stroke incidences across various countries. The emphasis on improving healthcare access and quality through investments in medical technology has enhanced treatment options for stroke patients. In addition, collaborative efforts among healthcare providers to develop comprehensive stroke care protocols are expected to boost market growth.

Asia Pacific Cerebral Infarction Treatment Market Trends

The Asia Pacific cerebral infarction treatment market is expected to register the highest CAGR of 8.0% over the forecast period. This can be attributed to rapid urbanization, leading to lifestyle changes that increase stroke risk factors. Improving healthcare infrastructure and raising awareness about stroke symptoms are also contributing factors. As countries in this region invest more in healthcare services, access to effective treatments is expected to improve significantly.

China cerebral infarction treatment market dominated the Asia Pacific with a significant revenue share in 2024 due to the country's large population facing high cerebrovascular diseases. The increasing prevalence of risk factors such as obesity and hypertension has necessitated enhanced treatment strategies for strokes. Moreover, government initiatives to improve healthcare access and promote early intervention will likely support continued growth in this market segment.

Key Cerebral Infarction Treatment Company Insights

Some key companies operating in the market are Amgen Inc., Pfizer Inc., Novartis AG, Amneal Pharmaceuticals LLC, and Sanofi. Companies are undertaking strategic initiatives, such as mergers, acquisitions, and product launches, to expand their market presence and address the evolving healthcare demands in the cerebral infarction treatment market.

-

Amgen Inc. offers several key products and solutions for the cerebral infarction treatment market. Its leading product is Repatha (evolocumab), a PCSK9 inhibitor that effectively lowers LDL cholesterol levels. Clinical studies have shown that Repatha can reduce the risk of stroke by 21% when used alongside statin therapy, thereby helping to prevent heart attacks and strokes in patients with existing cardiovascular disease. In addition, the company offers the Repatha Ready program, which allows patients and healthcare providers to manage treatment effectively.

-

Pfizer Inc. offers several products and solutions for the cerebral infarction treatment market, primarily focusing on stroke prevention and management. Eliquis (apixaban) is a notable oral direct factor Xa inhibitor that effectively prevents stroke and systemic embolism in patients with nonvalvular atrial fibrillation, significantly reducing the risk of ischemic strokes. Moreover, Pfizer previously developed bococizumab, a PCSK9 inhibitor aimed at lowering LDL cholesterol, although its development was discontinued due to safety concerns.

Key Cerebral Infarction Treatment Companies:

The following are the leading companies in the cerebral infarction treatment market. These companies collectively hold the largest market share and dictate industry trends.

- Amgen Inc.

- Pfizer Inc.

- Novartis AG

- Amneal Pharmaceuticals LLC

- Sanofi

- Abbott

- Johnson & Johnson Services, Inc.

- Bristol-Myers Squibb Company

- DAIICHI SANKYO COMPANY

- Otsuka Holdings Co., Ltd.

Recent Developments

-

In September 2022, Abbott launched the Amplatzer Talisman PFO Occlusion System in Europe. This system is intended to treat individuals with Patent Foramen Ovale (PFO) who have suffered a stroke and are at risk of recurrence. This innovative system features pre-attached occluders to the delivery cable, significantly reducing healthcare professionals' preparation time and enhancing usability.

-

In August 2022,Pfizer Inc. acquired Global Blood Therapeutics (GBT) for approximately $5.4 billion, which enhanced its position in the rare hematology market. The acquisition integrated GBT's expertise and innovative treatments, particularly for Sickle Cell Disease (SCD), including the first-in-class oral therapy Oxbryta (voxelotor).

Cerebral Infarction Treatment Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 14.39 billion |

|

Revenue forecast in 2030 |

USD 20.51 billion |

|

Growth rate |

CAGR of 7.4% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Drug class,type, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, South Korea, Australia, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait. |

|

Key companies profiled |

Amgen Inc.; Pfizer Inc.; Novartis AG; Amneal Pharmaceuticals LLC; Sanofi; Abbott; Johnson & Johnson Services, Inc.; Bristol-Myers Squibb Company; DAIICHI SANKYO COMPANY; Otsuka Holdings Co., Ltd. |

|

Customization scope |

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Cerebral Infarction Treatment Market Report Segmentation

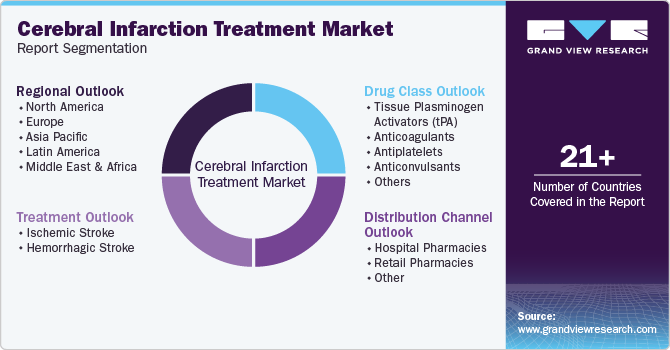

This report forecasts global, regional, and country revenue growth and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global cerebral infarction treatment market report based on drug class, type, distribution channel, and region:

-

Drug Class Outlook (Revenue, USD Billion, 2018 - 2030)

-

Tissue Plasminogen Activators (tPA)

-

Anticoagulants

-

Antiplatelets

-

Anticonvulsants

-

Others

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Ischemic Stroke

-

Hemorrhagic Stroke

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Other

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."