- Home

- »

- Plastics, Polymers & Resins

- »

-

Ceramic Packaging Market Size, Share, Growth Report, 2030GVR Report cover

![Ceramic Packaging Market Size, Share & Trends Report]()

Ceramic Packaging Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Alumina Ceramic, Silicon Nitride, Zirconia, Others), By End-use (Electronics, Medical Devices, Aerospace & Defense), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-455-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ceramic Packaging Market Size & Trends

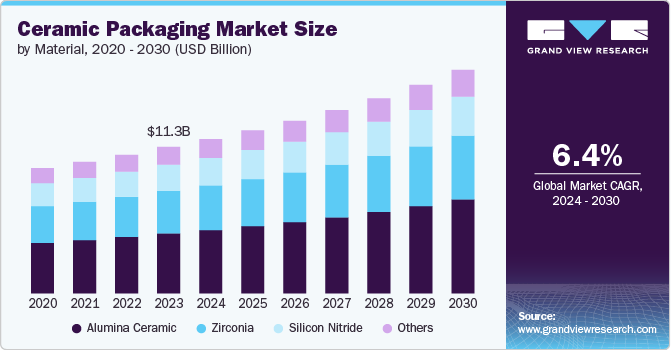

The global ceramic packaging market size was valued at USD 11.32 billion in 2023 and is expected to expand at a CAGR of 6.4% from 2024 to 2030. An increasing adoption of ceramic packaging in the healthcare industry, particularly for medical implants and devices, is driving the market growth. Ceramics are biocompatible and can withstand sterilization processes, making them suitable for use in packaging medical components such as pacemakers, drug delivery systems, and other implantable devices. For example, ceramic-based bio-packaging is gaining traction due to its ability to interact with biological tissues without causing adverse reactions, thereby ensuring patient safety and improving the effectiveness of medical devices.

Additionally, the growth of the market is driven by its superior properties, such as high durability, thermal stability, and resistance to harsh environments. These characteristics make ceramic materials an ideal choice for packaging applications in industries such as electronics, healthcare, and aerospace. For example, in the electronics sector, ceramic packaging is used to protect microelectronic devices, semiconductors, and sensors from high temperatures, moisture, and mechanical stress. With the rising demand for miniaturized electronic components, ceramic packaging is increasingly becoming critical to ensure reliability and long-term performance.

The aerospace and defense sectors also contribute significantly to the market growth. Ceramic materials are highly resistant to extreme temperatures and radiation, making them ideal for packaging sensitive components used in satellites, missiles, and avionics. As these sectors prioritize reliability and performance in challenging environments, ceramic packaging is becoming increasingly important for protecting electronic systems critical to the functioning of aerospace and defense technologies.

Furthermore, sustainability is emerging as a key factor in the market. Ceramics are eco-friendly and can be recycled or safely disposed of without harmful environmental impacts. As industries across the board prioritize sustainable packaging solutions, ceramics offer an attractive alternative to conventional plastic or metal packaging, aligning with global trends toward reducing environmental footprints.

Material Insights

Based on material, the global market for ceramic packaging has been segmented into alumina ceramic, silicon nitride, zirconia, and other materials. Alumina ceramic dominated the overall market with a revenue market share of over 40.8% in 2023 and is expected to witness robust growth with a CAGR of 6.8% over the forecast period. It is a widely used material in the ceramic packaging due to its exceptional thermal and electrical insulation properties. It is highly resistant to corrosion and wear, making it suitable for applications in harsh environments, such as electronic packaging and automotive components. Besides, it offers high mechanical strength and stability, ensuring longevity in performance.

Furthermore, silicon nitride is a high-performance ceramic material known for its exceptional mechanical strength, thermal shock resistance, and low thermal expansion. It is commonly used in demanding environments such as aerospace, automotive, and semiconductor packaging, where both strength and thermal management are critical.

Moreover, zirconia ceramic is valued for its high strength, fracture toughness, and biocompatibility. These properties make it ideal for medical device packaging, dental applications, and precision components in industries such as electronics and telecommunications. Besides, it is also known for its aesthetic appearance in specialized packaging.

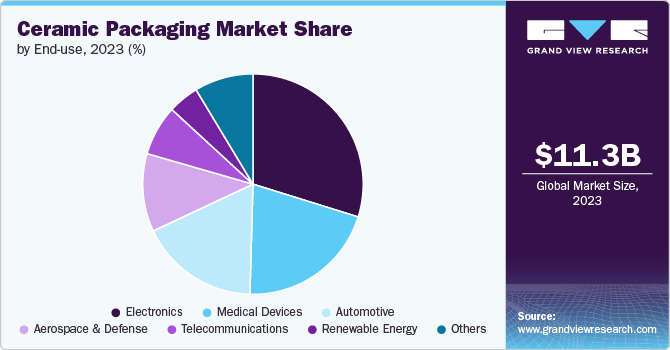

End-use Insights

Based on the end-use, the market is segmented into electronics, medical devices, automotive, aerospace & defense, telecommunications, renewable energy, and others. The electronics dominated the end use segment and accounted for largest revenue share of over 29.8% in 2023. The increasing demand for miniaturization and high-performance electronics, especially in consumer electronics, computing, and industrial electronics, is driving the growth of ceramic packaging in this segment. The rise in demand for high-speed processors and advanced semiconductors also boosts ceramic packaging adoption due to its superior heat dissipation properties.

In medical devices, ceramic packaging is used for implantable devices, diagnostic tools, and surgical equipment, where biocompatibility, durability, and resistance to body fluids are critical. Ceramic materials are also preferred for applications requiring sterilization and long-term reliability, such as pacemakers and defibrillators.

Additionally, ceramic packaging in the automotive sector is crucial for applications requiring high durability and resistance to extreme temperatures, such as sensors, engine control units (ECUs), and power electronics for electric vehicles (EVs). Therefore, the rapid growth of electric vehicles (EVs) and advanced driver assistance systems (ADAS) is a primary driver for ceramic packaging in the automotive industry.

Moreover, the aerospace and defense industry rely on ceramic packaging for high-reliability applications such as radar systems, satellite communication, avionics, and military-grade electronics. Ceramic materials provide excellent resistance to high temperatures, radiation, and harsh environmental conditions encountered in aerospace and defense operations.

Regional Insights

In North America, increasing use of ceramic packaging in military and aerospace applications strengthen region’s leadership in the ceramic packaging market. The region has a well-established defense sector, with companies such as Lockheed Martin and Raytheon regularly developing sophisticated communication and guidance systems, which rely heavily on ceramic packaging for its reliability under extreme conditions. Government funding and initiatives aimed at maintaining technological superiority in defense systems further drive the demand for ceramic packaging in North America.

U.S. Ceramic Packaging Market Trends

Ceramic packaging market in the U.S. is growing due to its leadership in advanced electronics, defense, and aerospace industries, which heavily rely on ceramic materials for their unique properties such as heat resistance, durability, and insulation. The U.S. has a strong semiconductor manufacturing sector, which demands innovative packaging solutions such as ceramic packaging to ensure the reliability and longevity of chips in harsh environments. As the U.S. continues to lead in technological innovation, particularly in areas such as 5G, AI, and IoT, the demand for high-performance ceramic packaging solutions is growing.

Asia Pacific Ceramic Packaging Market Trends

Asia Pacific dominated the market and accounted for the largest revenue share of over 33.8% in 2023. The Asia Pacific region is driving the ceramic packaging market due to a combination of factors, including robust industrial growth, technological advancements, and increasing demand from key end-use sectors such as electronics, telecommunications, and automotive industries. Countries such as China, Japan, South Korea, and Taiwan are major contributors, given their dominance in electronics manufacturing. These countries are home to some of the world’s largest producers of semiconductors, integrated circuits, and other electronic components, which rely heavily on ceramic packaging for enhanced thermal management, electrical insulation, and structural integrity.

China ceramic packaging market is primarily driven by rapid industrialization and its leadership in the global electronics and automotive industries. The country is a prominent manufacturer of consumer electronics, including smartphones, laptops, and home appliances, all of which require advanced packaging materials for chips and circuits. Additionally, China's growing investments in 5G infrastructure and electric vehicle production have further boosted the demand for ceramic packaging due to the need for heat-resistant and reliable materials in high-performance applications.

Europe Ceramic Packaging Market Trends

Europe’s focus on innovation and technology development also contributes to its leadership in the ceramic packaging market. Countries such as Germany, France, and the Netherlands have a strong R&D ecosystem, promoting advancements in ceramic materials for electronics, medical devices, and aerospace applications. For instance, the European Space Agency (ESA) and various aerospace companies leverage ceramic packaging for its ability to withstand extreme temperatures and radiation, which is crucial for space exploration technologies. This focus on high-tech industries positions Europe at the forefront of ceramic packaging innovation, driving demand for advanced solutions.

UK Ceramic Packaging Market Trends

The UK’s well-established medical technology sector, combined with increasing investments in innovative healthcare solutions, has boosted demand for ceramic packaging. Ceramic materials offer excellent biocompatibility and are widely used in the encapsulation of medical sensors, pacemakers, and other critical devices, ensuring they operate reliably in the human body.

Key Ceramic Packaging Company Insights

The ceramic packaging market is characterized by a moderately concentrated competitive environment. The market share is fragmented, with key players holding significant portions due to their innovations in ceramic materials and miniaturization techniques. However, smaller players are increasingly entering the market, focusing on niche applications and offering cost-effective solutions. Competitive strategies such as mergers, acquisitions, and product innovation play a crucial role in maintaining and expanding market share.

-

In March 2023, StratEdge launched its innovative molded ceramic semiconductor packages at the IMAPS Device Packaging, APEC, and GOMACTech conferences, which held in Arizona, U.S. These packages are designed for high-frequency applications and are particularly suited for demanding gallium arsenide (GaAs) and gallium nitride (GaN) devices. The showcased products emphasize thermal efficiency and reliability, catering to various markets including telecommunications, military, and clean energy.

-

In July 2021, MATERION CORPORATION, an advanced materials producer based in Ohio, announced the plan to invest at least USD 80.0 million in expanding its manufacturing operations in Berks County, Pennsylvania. The project received support from the Pennsylvania Department of Community and Economic Development, including a USD 320,000 grant and job creation tax credits.

Key Ceramic Packaging Companies:

The following are the leading companies in the ceramic packaging market. These companies collectively hold the largest market share and dictate industry trends.

- KYOCERA Corporation

- AGC Inc.

- Innova Maquinaria Industrial

- KOA Corporation

- MATERION CORPORATION

- E Pack Polymers Private Limited

- AdTech Ceramics

- Remtec, Inc.

- Croxsons

- StratEdge

Ceramic Packaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.92 billion

Revenue forecast in 2030

USD 17.28 billion

Growth rate

CAGR of 6.4% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Material, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

KYOCERA Corporation; AGC Inc.; Innova Maquinaria Industrial; KOA Corporation; MATERION CORPORATION; E Pack Polymers Private Limited; AdTech Ceramics; Remtec, Inc.; Croxsons; StratEdge

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ceramic Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the ceramic packaging market report on the basis of material, end-use, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Alumina Ceramic

-

Silicon Nitride

-

Zirconia

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Electronics

-

Medical Devices

-

Automotive

-

Aerospace & Defense

-

Telecommunications

-

Renewable Energy

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global ceramic packaging market was estimated at USD 11.32 billion in 2023 and is expected to reach USD 11.92 billion in 2024.

b. The global ceramic packaging market is expected to grow at a compound annual growth rate of 6.4% from 2024 to 2030, reaching around USD 17.28 billion by 2030.

b. Alumina ceramic dominated the overall market with a revenue market share of over 40.8% in 2023. Due to its exceptional thermal and electrical insulation properties, it is a widely used material in ceramic packaging.

b. Some of the key players in the market include KYOCERA Corporation; AGC Inc.; Innova Maquinaria Industrial; KOA Corporation; MATERION CORPORATION; E Pack Polymers Private Limited; AdTech Ceramics; Remtec, Inc.; Croxsons; StratEdge

b. The increasing adoption of ceramic packaging in the healthcare industry, particularly for medical implants and devices, is driving the growth of the ceramic packaging market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.