- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Ceramic Coating Market Size Report, 2030GVR Report cover

![Ceramic Coating Market Size, Share & Trends Report]()

Ceramic Coating Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Oxide, Carbide, Nitride), By Technology (Thermal Spray, Physical Vapor Deposition), By Application (Energy, Healthcare), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-589-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ceramic Coating Market Summary

The global ceramic coating market size was valued at USD 11.16 billion in 2023 and is projected to reach USD 19.20 billion by 2030, growing at a CAGR of 8.1% from 2024 to 2030. The ceramic coating promotes increased heat resistance coupled with fewer emissions to the atmosphere.

Key Market Trends & Insights

- The North America ceramic coating market had a market share of 28.7% in 2023.

- Europe ceramic coating market is expected to grow at a CAGR of 6.0% over the forecast years.

- By product, the oxide segment dominated the market and accounted for the largest revenue share of 57.5% in 2023.

- By application, the industrial goods segment dominated the market and accounted for the largest revenue share of 31.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 11.16 Billion

- 2030 Projected Market Size: USD 19.20 Billion

- CAGR (2024-2030): 8.1%

- North America: Largest market in 2023

Moreover, these products are gradually finding applications on metal parts in vehicles owing to their suitable properties of abrasion and corrosion resistance along with it being an excellent thermal barrier. Furthermore, the aerospace & defence industry is exhibiting a trend of increasing consumption of oxide and carbide coatings. These coats are used exclusively in rocket exhaust cones, insulating tiles, space shuttles, and engine components, and are embedded into the windshield glass of many airplanes.The increasing awareness about several advantages of ceramic coating such as safeguarding against UV rays, scratches, and other chemicals is also attributed to the growth of ceramic coating market.The COVID-19 pandemic impacted various industries. There were substantial disruptions in their respective supply-chain operations and manufacturing due to precautionary lockdowns and other constraints imposed by governing authorities around the world. The global ceramic coatings market witnessed a slowdown in its year-on-year growth rate due to the reduced demand from key industries such as automotive, aerospace, and others and unexpected shutdowns of manufacturing plants, and temporary halts in production units.

However, in line with the current trend, there is an increased consumption of these coats in energy, healthcare, pharmaceutical, and different niche applications. These niche applications also include surgical instruments, prosthetic limbs & hips, and personal hygiene products.

At present, most of the product demand is derived from heavy industries, such as steel, cement, and power manufacturing plants, but is also observing increased demand from the automotive industry. These coats are also gradually replacing wax in automotive polishes. In April 2021, with the all-new Safari, Tata Motors unveiled one of the industry's first ceramic coating services. This is a cutting-edge hydrophilic formulation technology for renewing the appearance of Tata vehicles.

Rising demand for these coats in the defence, aerospace, energy, healthcare, and other industries is expected to push participants in the value chain to offer turnkey services along with providing engineering solutions. The cost depends on the type of product, i.e. oxide, carbide, or nitride, and the surface of application. The process is very much energy-intensive and, thus, the overheads form a major part of the overall cost.

The market witnesses a dispersed regional supply-demand trend. The North American region is the hub of superior grade coats and is likely to continue being the major supplier of coating services & products. The Asia Pacific region during the forecasted period is expected to account for the highest demand share as few manufacturers are situated in this geographic.

Asia-Pacific’s share of ceramic coating production is exported mainly to eastern Europe. Countries like China and India manufacture ceramic epoxy coatings that align with the material norms in that region. The coating solutions for the Asian countries are usually imported from North America as the products manufactured in that region are suitable for complying with the humidity effect in the Asia Pacific.

The development of enhanced ceramic coating formulations gives hydrophobic protective properties, which increases its durability. This protects against environmental pollutants, UV rays, and oxidation. The increasing adoption of ceramic coatings in chemical processing, power generation, oil, and gas is fueling the market growth. Additionally, the consumption in healthcare, and different niche applications including prosthetic limbs & hips, personal hygiene products, and surgical instruments is driving the demand for ceramic coating.

Product Insights

The oxide segment dominated the market and accounted for the largest revenue share of 57.5% in 2023. Oxides are cheaper in comparison to other coatings such as carbide and nitride. This type of coating is used in the steel industry, where it is applied to chimneys, refractory bricks, guide bars, bearings and pumps. Oxide & carbide coats are also heavily consumed in the oil & gas industries, where it is utilized in valve components, pump sleeves, mud rotors, and MWD equipment.

The carbide segment is expected to grow at a significant CAGR of 8.0% over the forecast years. Carbide coatings are expensive due to the high raw material and process costs. Carbide coatings are gradually venturing into the sports industry, where it is used on applications such as golf clubs, horse hooves, and bicycles.

Technology Insights

The thermal spray segment dominated the market and accounted for the largest revenue share of 75.0% in 2023. This mode of application is the most popular choice among ceramic coating producers as it can be used for almost every material composition and has high density. Thermal spray coating offers defense against oxidation, erosion, and corrosion. This could lower expenses for maintenance, downtime, and alternate parts. The use of thermal spray coatings on factory components lowers the expense by reducing the need for frequent repairs and replacement.

The physical vapor deposition segment is expected to grow at a significant CAGR of 7.8% over the forecast years. The primary factor associated with the increase in consumption is its cheaper cost. Furthermore, along with the cost, this method is also more energy-efficient than the rest. The several benefits from physical vapour deposition coatings such as anti-reflective ceramic coatings for optics, corrosion-resistant coatings on gas turbine blades, decorative coatings on plastics, coatings to prevent wear on machines are the factors propelling the segment growth.

Application Insights

The industrial goods segment dominated the market and accounted for the largest revenue share of 31.0% in 2023 owing to the enhanced performance and durability offered by ceramic coatings. The technological advancements in ceramic coating technology continue to broaden the scope of uses and improve overall effectiveness. The properties that are crucial for industrial components such as wear resistance, high-temperature resistance, abrasion resistance, and corrosion resistance is attributing to the segment growth.

The transportation & automotive segment is expected to grow at a significant CAGR of 8.5% over the forecast years. The rising awareness and importance of customers towards vehicle aesthetics is resulting in the high demand for ceramic coatings. It provides a remarkable gloss and dimension to the vehicle's outer surface, improving its aesthetics. Furthermore, the thriving automotive industry and increasing consumer affluence is driving the segment growth.

Regional Insights

The North America ceramic coating market had a market share of 28.7% in 2023. The demand for protective coatings is heightened by the importance placed on maintaining and enhancing the appearance of vehicles. Furthermore, stringent safety regulations in sectors such as automotive and aerospace contribute to the need for protective coatings. The ceramic coating market in the U.S. experienced significant growth in 2023. The continuous infrastructure development projects are generating various opportunities for ceramic coatings in a range of uses.

Asia Pacific Ceramic Coating Market Trends

Asia Pacific ceramic coating market dominated the global market with a market share of 41.5% in 2023. The local demand can be characterized by humongous consumption from developing countries, such as China, India, and Japan. The increasing number of middle-class individuals is fueling the need for high-end items such as ceramic coatings in the automotive and consumer goods industries. In April 2021, Oerlikon Balzers opened its first customer center in Vietnam, expanding its coating operations in Asia. The company has made strategic investments to increase its footprint in the booming Asian market.

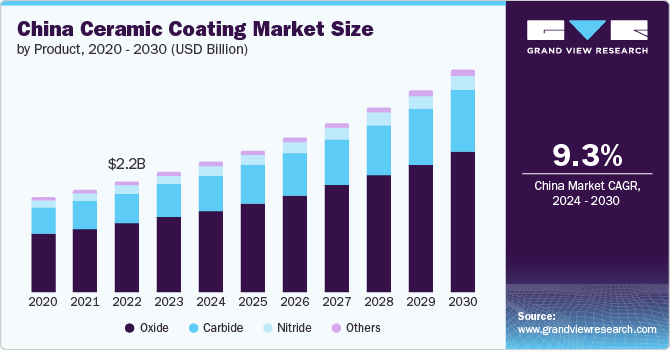

The ceramic coating market in China is expected to grow significantly during the forecast period. The increasing engineering component production in the region is expected to probably trigger market growth. The development in automotive industries is fueling the demand for ceramic coating as it gives protection against oxidation, weathering, and corrosion. The expansion in aviation sector necessitates coatings that can endure severe environmental conditions.

Europe Ceramic Coating Market Trends

Europe ceramic coating market is expected to grow at a CAGR of 6.0% over the forecast years owing to the increased awareness of the advantages of ceramic coatings, which include improved appearance, protection, and longevity. The continuous development in ceramic coating technology are resulting in better products and application methods, increasing consumer accessibility. The influence of social media culture is leading to change in customer preferences and consumer behaviour.

The ceramic coating market in the UK is expected to grow significantly due to the robust automotive industry, which drives demand for ceramic coating in the country. The high disposable income is allowing customers to spend more in premium automotive care products. A rising trend of customizing vehicles in the UK has led to a preference for ceramic coatings to improve the appearance of cars.

Key Ceramic Coating Company Insights

Some of the key participants in the global ceramic coating market are Praxair Technology, Inc. (Linde PLC), Aremco, Keronite , APS Materials, Inc., and others. Key players are aggressive in establishing manufacturing plants in the Asia Pacific region as it is expected to emerge to be the epicenter of the demand.

-

APS Materials products are designed and engineered for protecting and coating vital components. Its offerings include thermal spray, ceramic coatings, polymer coatings, metallic coatings and CerAnode coatings.

Key Ceramic Coating Companies:

The following are the leading companies in the ceramic coating market. These companies collectively hold the largest market share and dictate industry trends.

- Praxair Technology, Inc. (Linde PLC)

- Aremco

- APS Materials, Inc.

- Cetek Cermaic Technologies Ltd.

- Keronite

- Saint-Gobain S.A.

- Element 119

- NANOSHINE GROUP CORP

- Ultramet

Recent Developments

-

In May 2023, Canlak Coatings Inc. announced the acquisition of Ceramic Industrial Coatings. The acquisition aligns Canlak’s vision to create wood coating systems business and growth acceleration in North America OEM wood coatings market.

Ceramic Coating Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 12.03 billion

Revenue forecast in 2030

USD 19.20 billion

Growth rate

CAGR of 8.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons, Revenue in Million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., UK, Germany, France, China, India, Japan

Key companies profiled

Praxair Technology, Inc. (Linde PLC); Aremco ; APS Materials, Inc.; Cetek Cermaic Technologies Ltd.; Keronite; Saint-Gobain S.A.; Element 119; NANOSHINE GROUP CORP; Ultramet

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ceramic Coating Market Report Segmentation

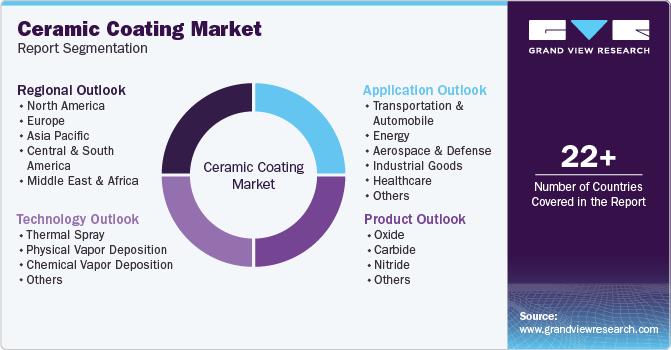

This report forecasts revenue growth at global, regional, and country levels and analyses the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ceramic coating Market report based on product, technology, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Oxide

-

Carbide

-

Nitride

-

Other

-

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Thermal Spray

-

Physical Vapor Deposition

-

Chemical Vapor Deposition

-

Other

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Transportation & Automotive

-

Energy

-

Aerospace & Defense

-

Industrial goods

-

Healthcare

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Middle East and Africa (MEA)

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.