- Home

- »

- Advanced Interior Materials

- »

-

Ceramic Armor Market Size, Share & Growth Report, 2030GVR Report cover

![Ceramic Armor Market Size, Share & Trends Report]()

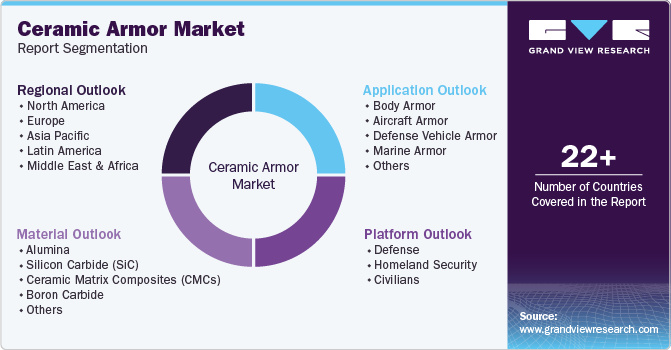

Ceramic Armor Market (2024 - 2030) Size, Share & Trends Analysis Report By Material, By Application (Body, Aircraft, Defense Vehicle, Marine), By Platform (Defense, Homeland Security), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-165-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ceramic Armor Market Summary

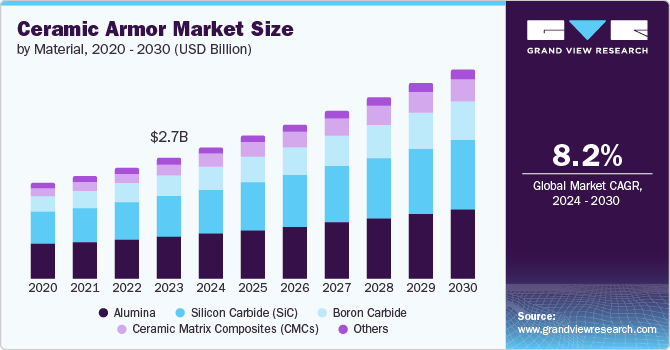

The global ceramic armor market size was valued at USD 2.69 billion in 2023 and is projected to reach USD 4.70 billion by 2030, growing at a CAGR of 8.2% from 2024 to 2030. Rising threat levels need for lightweight armor, new forms of technological developments, higher military spending, and wider utilization across industries are the factors that boost the market.

Key Market Trends & Insights

- North America ceramic armor market dominated the global ceramic armor market with a revenue share of 32.2% in 2023.

- The ceramic armor market in Asia Pacific is expected to register the fastest CAGR of 9.0% over the forecast period.

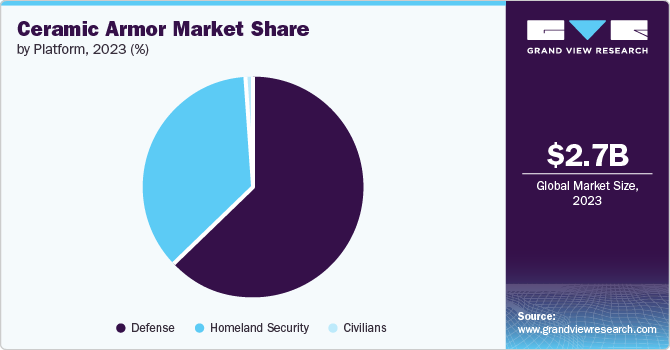

- Based on platform, defense held the largest revenue share of 62.6% in 2023.

- In terms of application, the defense vehicle armor segment led the market with a revenue share of 41.0% in 2023.

- Based on material, the alumina material segment dominated the global ceramic armor market with a revenue share of 34.2% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2.69 Billion

- 2030 Projected Market Size: USD 4.70 Billion

- CAGR (2024-2030): 8.2%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The variety of uses of ceramic armor does not stop at the military and can also be applied in aerospace, marine, and personal protection. The ceramic armor market is fueled by a combination of factors, with increasing military expenditure being a primary driver. Governments worldwide are investing heavily in advanced protective equipment to enhance the safety and effectiveness of their armed forces, resulting in a significant surge in demand for ceramic armor solutions.

Moreover, the need for lightweight and durable armor solutions is rising, particularly for body armor and vehicle applications. Ceramic materials, such as silicon carbide and alumina, provide high strength and hardness while being lighter than traditional metal armor, making them a preferred choice for military and law enforcement use.

Another key driver of the ceramic armor market is the growing emphasis on soldier safety. Military organizations are placing a greater focus on soldier survivability and safety, prompting them to upgrade their armor systems to provide effective protection against modern weaponry. Furthermore, the increasing global security threats and conflicts are driving demand for advanced ceramic armor systems that can protect against various types of threats. The development of new composites and improved ballistic protection technologies is also contributing to the market’s growth.

The versatility of ceramic armor in various applications, including body armor, aircraft armor, marine armor, and vehicle armor, is another factor driving market growth. The use of ceramic armor is not limited to military applications alone; it is also used in homeland security to protect patrol vehicles, borders, and buildings. The integration of ceramic armor with sensors and communication equipment provides real-time threat identification and quick response during high-stress incidents, improving tactical awareness and decision-making processes. As a result, the ceramic armor market is poised for continued growth as governments and security organizations seek to invest in advanced protective solutions to mitigate emerging threats.

Material Insights

The alumina material segment dominated the global ceramic armor market with a revenue share of 34.2% in 2023. Alumina ceramics are a sought-after choice for ceramic armor due to their exceptional hardness, strength, and ballistic properties, providing superior protection against various threats. Market trends indicate that alumina will continue to grow, driven by its favorable cost-performance ratio, high fire resistance, and high modulus of elasticity, making it an attractive option for armor manufacturers seeking reliable and cost-effective solutions.

The Ceramic Matrix Composites (CMCs) material segment is expected to register the fastest CAGR of 10.9% in the forecast period. CMCs exhibit superior toughness, enabling effective crack arrest in the event of impact, thereby enhancing overall strength, ballistic performance, and survivability. Their lightweight nature offers a significant advantage in armor applications, improving mobility and reducing personnel fatigue. In addition, CMCs demonstrate good thermal stability, ensuring reliable performance in high-temperature environments, such as those encountered in fire or explosive scenarios.

Application Insights

The defense vehicle armor segment led the market with a revenue share of 41.0% in 2023, owing to the need for enhanced protection, mobility, and survivability. Ceramic armor’s ability to resist various threats in contemporary warfare scenarios has led to increased demand for its incorporation in defense vehicles, enhancing occupant safety and overall vehicle resilience.

The body armor application segment is expected to register the fastest growth of 8.9% over the forecast period,driven by increasing demand from homeland security units worldwide for lightweight, corrosion-resistant, and thermally protective gear. As a critical component of personnel protective equipment, body armor enables soldiers, police officers, and EMS personnel to withstand ballistic impacts, making it an essential requirement in modern warfare and law enforcement. This growing need for advanced protection fuels the market for ceramic armor in body armor.

Platform Insights

Defense held the largest revenue share of 62.6% in 2023, fueled by military modernization efforts worldwide. Governments are investing in advanced protective gear, including ceramic armor, to enhance soldier lethality and secure infrastructure. As global conflicts and cross-border violence escalate, the need for robust security measures increases, making ceramic armor a critical component for defense platforms to counter various threats.

The civilian platform segment is expected to register the fastest CAGR of 9.8% over the forecast period. The adoption of ceramic armor in civilian applications is driven by regulations and increasing threats to personal safety, as well as demand from the military, law enforcement, private security firms, and individuals seeking personal protection. As threats to safety emerge in various aspects of civilian life, there is a growing need for enhanced protection.

Regional Insights

North America ceramic armor market dominated the global ceramic armor market with a revenue share of 32.2% in 2023. The dominance can be attributed to the aerospace and defense sector which has constantly placed high demand on the production of these products. The constant funding of expenses towards the military by countries in the North American region to provide ample protection to the armed forces has always fueled the need for ceramic armor.

U.S. Ceramic Armor Market Trends

The ceramic armor market in the U.S. dominated the North America ceramic armor market with a revenue share of 88.9% in 2023. The U.S. has diverse needs for top-end armor protection starting from bulletproof vests, moving to bulletproof vehicles, and bulletproof aircraft. The corporate demand from the military and police departments influences the consumption of ceramic armor in the country.

Europe Ceramic Armor Market Trends

Europe ceramic armor market has a significant market share in the global ceramic armor market. The growth can be attributed to the strict legal framework and an advanced defense sector in the region. Some of the requirements that considerably affect the growth of the market are conflicts, military upgrades, and counter-terrorism measures on the territory of the region. Moreover, the mechanical, electrical, civil engineering, and construction industries support the market through the designing of advanced ceramic armor solutions for airplane and automobile applications.

The ceramic armor market in Germany is expected to grow rapidly in the coming years. Germany has a highly developed technological sector, which is known for innovations concerning various materials and processes. Thus, German companies’ experience enables them to design and create new complex ceramic armor components corresponding to high performance. Furthermore, it has a stable and diversified industrial structure, especially in manufacturing which the country specializes in high-precision engineering.

The UK ceramic armor market held a substantial market share in 2023. The UK’s military modernization programs have seen a demand for advanced armor such as ceramic armor. Moreover, the adaptability of new technologies that have been incorporated into the manufacture of ceramic armor products is another factor that has impacted growth in the market.

Asia Pacific Ceramic Armor Market Trends

The ceramic armor market in Asia Pacific is expected to register the fastest CAGR of 9.0% over the forecast period. The region’s defense expenditure growth is driven by countries’ increased investment in military modernization. China, India, South Korea, and Japan are leaders in this trend, adopting cutting-edge technologies such as ceramic armor to enhance their military capabilities. This strategic shift is expected to drive market demand for advanced defense solutions.

China ceramic armor market is expected to grow rapidly in the coming years. Chinese companies are dedicating resources to improving ceramic armor quality and performance through research and development in technological advancements. China has been able to provide creative solutions for the changing needs of the defense and military sectors by concentrating on technological advancements.

The ceramic armor market in India held a substantial market share in 2023. India’s defense budget allocation has increased to modernize its military, prioritizing enhanced protective gear and equipment, including ceramic armor, to safeguard personnel. Regional conflicts and disputes have intensified the need for high-quality protection, driving demand for advanced defense solutions. This strategic investment is expected to propel market growth in the region.

Key Ceramic Armor Company Insights

Some key companies in the ceramic armor market include ArmorWorks Enterprises, LLC; Ceradyne, Inc. (3M); CeramTec GmbH; CoorsTek Inc.; and Integris; among others. Prominent organizations compete on product performance, innovation, quality, and price. Strategic partnerships, mergers, and acquisitions are key strategies to gain a competitive edge, while new entrants in emerging economies intensify market competition.

-

ArmorWorks Enterprises, LLC is a provider of advanced defense and security solutions, offering a range of protective products, including commercial aviation doors, blast-resistant doors, platform armor, and secure trailers. The company prioritizes engineering excellence and delivers tailored solutions for global clients, including military and government sectors.

-

Ceradyne, Inc., a 3M subsidiary, is a provider of advanced ceramic materials for defense applications, particularly ballistic protection. The company produces lightweight, high-strength armor solutions for military personnel and vehicles, meeting stringent standards and driving innovation in next-generation armor systems.

Key Ceramic Armor Companies:

The following are the leading companies in the ceramic armor market. These companies collectively hold the largest market share and dictate industry trends.

- ArmorWorks Enterprises, LLC

- Ceradyne, Inc. (3M)

- CeramTec GmbH

- CoorsTek Inc.

- Integris

- Armor Express

- Safariland, LLC.

- Compagnie de Saint-Gobain

- DSM

- Alpine Armoring Inc.

- General Dynamics Corporation

Recent Developments

-

In June 2024, General Dynamics Land Systems secured a USD 712.3m contract to supply 300 Stryker DVHA1 vehicles to the US Army, enhancing survivability and capability in Stryker brigades.

-

In March 2024, ArmorWorks announced the acquisition of Fox Valley Metal-Tech, Incorporated. Fox Valley is known for its specialization in generating difficult and particular metal fabrications which can be applied in numerous defense packages along with naval ships, submarines, fight vessels, and other essential protection structures.

-

In September 2023, TenCate Advanced Armour was renamed Integris Composites, marking a shift in its mission and identity. The company, a trusted provider of protective armor solutions for 25 years, now focuses on broadening its market reach beyond defense and law enforcement.

Ceramic Armor Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.93 billion

Revenue forecast in 2030

USD 4.70 billion

Growth rate

CAGR of 8.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Report updated

September 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, application, platform, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, Saudi Arabia, UAE, South Africa

Key companies profiled

ArmorWorks Enterprises, LLC; Ceradyne, Inc. (3M); CeramTec GmbH; CoorsTek Inc.; Integris; Armor Express; Safariland, LLC.; Compagnie de Saint-Gobain; DSM; Alpine Armoring Inc.; General Dynamics Corporation; Saab AB

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ceramic Armor Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global ceramic armor market report based on material, application, platform, and region.

-

Material Outlook (Revenue, USD Billion, 2017 - 2030)

-

Alumina

-

Silicon Carbide (SiC)

-

Ceramic Matrix Composites (CMCs)

-

Boron Carbide

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Body Armor

-

Aircraft Armor

-

Defense Vehicle Armor

-

Marine Armor

-

Others

-

-

Platform Outlook (Revenue, USD Billion, 2017 - 2030)

-

Defense

-

Homeland Security

-

Civilians

-

-

Region Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.