- Home

- »

- Advanced Interior Materials

- »

-

Centrifugal Air Compressor Market Size, Share Report, 2030GVR Report cover

![Centrifugal Air Compressor Market Size, Share & Trends Report]()

Centrifugal Air Compressor Market (2023 - 2030) Size, Share & Trends Analysis Report By Lubrication (Oil-free, Oil Filled), By Application (Manufacturing, Food & Beverage), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-143-6

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Centrifugal Air Compressor Market Trends

The global centrifugal air compressor market size was estimated at USD 7.66 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 5.3% from 2023 to 2030. The oil and gas industry is a major consumer of centrifugal air compressors, using them in various applications such as gas processing, offshore drilling, and pipeline transportation. The expansion of oil and gas projects globally contributes to the market's growth. Ongoing advancements in compressor technology have led to improved performance, reliability, and efficiency of centrifugal air compressors, making them more attractive to various industries.

In recent years, there has been a growing trend in the adoption of centrifugal air compressor technology in the U.S., especially in industries such as healthcare, food and beverage, and electronics manufacturing. This increase in adoption is influenced by several factors, such as increased awareness of the potential hazards of oil contamination, as well as the need for higher levels of air purity and energy efficiency.

The demand for centrifugal air compressors in the U.S. is likely to grow in the forecast period, driven by a combination of environmental concerns, regulatory requirements, and the need for more efficient and reliable compressed air systems. Increasing investments and innovations in the air compressor industry have led to the adoption of new designs and materials that offer greater levels of performance, reliability, and sustainability.

Increasing environmental regulations and a focus on reducing greenhouse gas emissions have prompted industries to adopt more energy-efficient and eco-friendly equipment, such as centrifugal compressors. Moreover, industries are increasingly seeking value-added services such as maintenance, monitoring, and data analytics along with their compressor systems, which can further drive market growth.

The market players are constantly undertaking expansion initiatives such as mergers, acquisitions, partnerships, and product launches to expand their market footprint. For instance, In November 2022, Atlas Copco AB, a Swedish multinational industrial company, acquired Northeast Compressor, which sells air compressors, related services & equipment to a wide range of industrial customers in New York, the U.S. The acquisition is expected to aid Atlas Copco AB in getting closer to customers and increase its coverage in upstate New York.

Increasing investments in technological advancements by market players have made centrifugal air compressors more efficient, reliable, and cost-effective, which has increased their demand in the North American region. Modern centrifugal air compressors are outfitted with advanced features such as variable speed drives, integrated air dryers, and advanced filtration systems, which aid in optimizing performance, lowering energy consumption, and lowering maintenance costs.

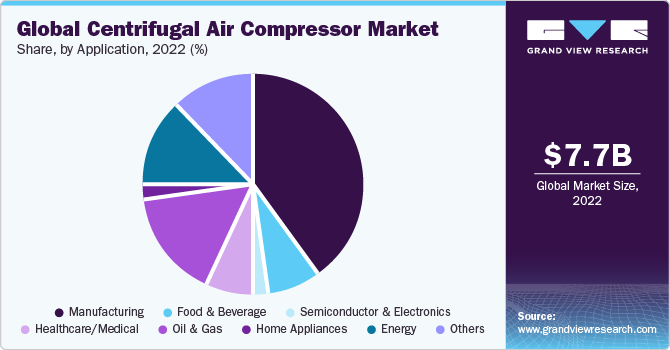

Application Insights

Based on application, the manufacturing segment dominated the market with a revenue share of 39.7% in 2022. Many manufacturing processes require compressed air for various applications, such as pneumatic tools, material handling, and machine operations. Centrifugal compressors provide a reliable source of compressed air for these needs. Moreover, low noise levels in manufacturing environments are crucial for worker comfort and safety. Centrifugal air compressors, with their quieter operation, are preferred in settings where noise reduction is essential.

The adoption of advanced automation technologies in the oil and gas industry, as well as the growing demand for reliable and consistent compressed air, are some of the factors driving the segment's growth. The ability of centrifugal air compressors to operate in harsh and remote environments without the risk of equipment failure and high operational costs is contributing to the increasing demand for such solutions in the oil & gas industry.

The food and beverage industry is subject to rigorous hygiene and safety regulations. Centrifugal air compressors, especially oil-free variants, are favored for their ability to provide clean and contaminant-free compressed air, ensuring compliance with food safety standards. In addition, cost-efficiency is a key consideration in the food and beverage sector. Energy-efficient centrifugal air compressors help reduce operational costs while ensuring a reliable source of compressed air for various processes.

Lubrication Insights

The oil-filled lubrication segment dominated the market with a revenue share of 61.7% in 2022. Oil-filled centrifugal air compressors are well-suited for a variety of industrial applications where oil contamination is not a concern. This includes industries such as manufacturing, construction, and general industrial processes. In addition, oil-filled compressors are often more cost-effective to manufacture and maintain compared to oil-free counterparts, making them a preferred choice for industries focused on cost efficiency.

The demand in the oil-free lubrication segment is anticipated to show lucrative growth over the forecast period. Continuous improvements in oil-free compressor technology have enhanced their efficiency and reliability, making them more attractive to a wider range of industries. Oil-free centrifugal compressors are known for their energy efficiency, and industries are increasingly adopting them to reduce energy consumption and operational costs.

Regional Insights

The Asia Pacific region led the market with a revenue share of 37.2% in 2022. The rapid industrialization in countries like China, India, and Southeast Asian nations has led to increased demand for compressed air in various industries, including manufacturing, construction, and petrochemicals. Moreover, ongoing infrastructure development projects, such as construction, transportation, and utilities, require compressed air for various applications, boosting the demand for centrifugal air compressors.

Stringent environmental regulations and emissions standards in North America encourage industries to adopt cleaner and more energy-efficient technologies, such as centrifugal compressors.As older compressor systems in various industries reach the end of their operational life, they are being replaced with newer, more efficient centrifugal compressors. In addition, government incentives and rebates for energy-efficient equipment encourage industries in North America to invest in energy-efficient compressed air systems.

Key Companies & Market Share Insights

The market is highly fragmented, with numerous small to large manufacturers and suppliers competing for market share. This fragmentation offers a wide selection of equipment, and customization choices to buyers while catering to specific industry needs. To meet the rising demand from a diverse range of industries, the market players are pursuing business growth through strategies such as mergers and acquisitions, the establishment of new manufacturing facilities, and geographic expansion initiatives.

For instance, in August 2023, FS-Elliott introduced the P400HPR Centrifugal Air Compressor, boasting advanced features and exceptional performance. This compressor is designed with additional aero stages, enabling it to handle elevated discharge pressures of up to 250 PSIG. With its three-stage compression capability, this compressor proves to be highly adaptable and well-suited for a wide range of industrial applications.

Key Centrifugal Air Compressor Companies:

- Atlas Copco AB

- Ingersoll-Rand PLC

- Baker Hughes a GE Co.

- Sundyne

- Gardner Denver Holdings Inc.

- Dresser-Rand Group Inc.

- Howden Group

- Mitsubishi Heavy Industries Compressor Corporation

- Sullair, LLC

- Zhejiang Kaishan Compressor CO. LTD.

Centrifugal Air Compressor Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 8.06 billion

Revenue forecast in 2030

USD 11.57 billion

Growth rate

CAGR of 5.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Lubrication, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Asia Pacific; India; China; Japan; South Korea; Brazil

Key companies profiled

Atlas Copco AB; Ingersoll-Rand PLC; Baker Hughes a GE Co.; Sundyne; Gardner Denver Holdings Inc.; Dresser-Rand Group Inc.; Howden Group; Mitsubishi Heavy Industries Compressor Corporation; Sullair LLC; Zhejiang Kaishan Compressor CO. LTD.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Centrifugal Air Compressor Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and analyzes the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global centrifugal air compressor market report based on lubrication, application, and region:

-

Lubrication Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil-free

-

Oil Filled

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Manufacturing

-

Food & Beverage

-

Semiconductor & Electronics

-

Healthcare/Medical

-

Oil & Gas

-

Home Appliances

-

Energy

-

Others

-

Manufacturer (IDMs)

-

Foundries

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Central & South America

-

Brazil

-

Argentina

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

Frequently Asked Questions About This Report

b. The global centrifugal air compressor market size was estimated at USD 7.66 billion in 2022 and is expected to reach USD 8.06 billion in 2023.

b. The global centrifugal air compressor market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.3% from 2023 to 2030 and reach USD 11.57 billion by 2030.

b. The Asia Pacific led the market and accounted for 37.2% share of the total revenue of the centrifugal air compressor market in 2022. The rapid industrialization in countries like China, India, and Southeast Asian nations has led to increased demand for compressed air in various industries, including manufacturing, construction, and petrochemicals. Moreover, ongoing infrastructure development projects, such as construction, transportation, and utilities, require compressed air for various applications, boosting the demand for centrifugal air compressors.

b. Some of the key players operating in the centrifugal air compressor market include Atlas Copco AB, Ingersoll-Rand PLC, Baker Hughes a GE Co., Sundyne, Gardner Denver Holdings Inc., Dresser-Rand Group Inc., Howden Group, Mitsubishi Heavy Industries Compressor Corporation, Sullair, LLC, Zhejiang Kaishan Compressor CO. LTD, among others.

b. The key factors that are driving the centrifugal air compressor market including the energy efficiency, reduced number of frictional components, and superior airflow capacity of these compressors. Moreover, their extensive utilization across various industries, including gas turbines, oil refineries, petrochemical manufacturing, food and beverage production, and manufacturing plants, is expected to significantly propel the growth of this segment throughout the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.