- Home

- »

- Next Generation Technologies

- »

-

Centralized Refrigeration Systems Market Size Report, 2030GVR Report cover

![Centralized Refrigeration Systems Market Size, Share & Trends Report]()

Centralized Refrigeration Systems Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Compressor, Condenser, Evaporator, Others), By Type (Ammonia, CO2, Others), By End Use (Commercial, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-474-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Centralized Refrigeration Systems Market Summary

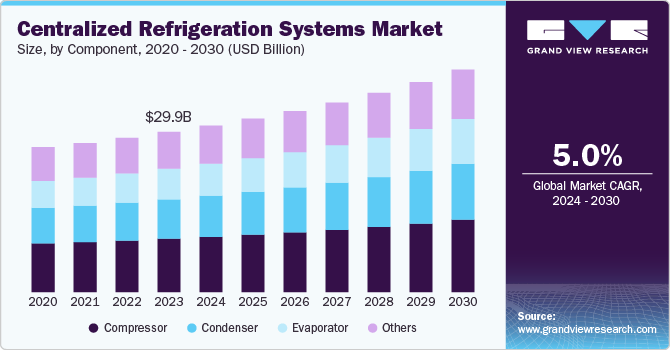

The global centralized refrigeration systems market size was estimated at USD 29.87 billion in 2023 and is projected to reach USD 41.52 billion by 2030, growing at a CAGR of 5.0% from 2024 to 2030. The increasing demand for energy-efficient, environmentally friendly, and reliable refrigeration systems has driven the growth of the centralized refrigeration systems market.

Key Market Trends & Insights

- North America centralized refrigeration systems market dominated the global market and accounted for a revenue share of over 34.0% in 2023.

- The centralized refrigeration systems market in the U.S. is expected to grow at a CAGR of 4.0% from 2024 to 2030.

- Based on component, the compressor segment dominated the market and accounted for more than 33.0% share of global revenue in 2023.

- Based on type, the ammonia segment dominated the market and accounted for more than 38.0% share of global revenue in 2023.

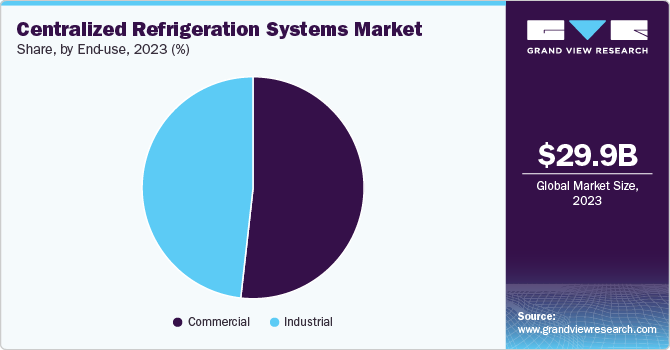

- Based on end-use, the commercial segment dominated the market and accounted for more than 51.0% share of global revenue in 2023.

Market Size & Forecast

- 2023 Market Size: USD 29.87 billion

- 2030 Projected Market Size: USD 41.52 billion

- CAGR (2024-2030): 5.0%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The food industry has witnessed an increased demand for processed, frozen, and ready-to-eat foods. This shift in consumer preferences is driven by changing lifestyles and rising urbanization, particularly in emerging economies such as China and India. These products require stringent temperature control throughout the supply chain, from production to consumption, driving the demand for centralized refrigeration systems.

The expansion of supermarket chains and hypermarkets, especially in developing regions, is creating substantial demand for centralized refrigeration systems. These systems provide energy-efficient and reliable cooling solutions for large-scale food preservation needs. Moreover, the rise in demand for perishable goods, particularly in emerging economies, is a significant factor. As global trade in fresh food, pharmaceuticals, and vaccines increases, the demand for cold chain logistics infrastructure grows. Centralized refrigeration systems are the backbone of this infrastructure, ensuring that products are stored and transported at the right temperatures to maintain quality.

Government and regulatory bodies across the globe are implementing stricter environmental regulations to reduce greenhouse gas emissions and energy consumption. These regulations have pushed manufacturers and industries to adopt eco-friendly refrigerants and energy-efficient refrigeration systems. For instance, the European Union’s F-gas regulation, which aims to reduce the use of hydrofluorocarbons has significantly influenced the market. Furthermore, the U.S. Environmental Protection Agency (EPA) has introduced several measures under the Clean Air Act to phase out harmful refrigerants. These regulations are encouraging companies to invest in centralized refrigeration systems that comply with environmental standards.

The integration of advanced technologies such as Internet of Things (IoT), machine learning, and artificial intelligence (AI) is driving the adoption of smart refrigeration systems. These technologies allow for real-time monitoring, predictive maintenance, and energy optimization, which can significantly enhance the performance and reliability of centralized refrigeration systems. The demand for automation and smart control is increasing, as it reduces operational risks and improves overall system efficiency. Moreover, advancements in materials and component design, such as more efficient heat exchangers and compressors, are also contributing to market growth.

Flexibility is becoming a crucial aspect of centralized refrigeration systems. Manufacturers are introducing modular refrigeration systems that allow scalability based on operational requirements. These systems are designed to support gradual expansions in storage capacity, energy requirements, or geographic distribution, making them highly adaptable for businesses that anticipate growth or operational changes. Moreover, growing energy costs and the need to reduce greenhouse gas emissions are driving industries to adopt more energy efficient refrigeration systems. Centralized systems provide an optimal solution as they allow for centralized control and management, thus reducing energy wastage and optimizing operations.

Component Insights

The compressor segment dominated the market and accounted for more than 33.0% share of global revenue in 2023. A key trend within the segment is the growing adoption of variable-speed compressors, which adjust the compressor’s operation to meet cooling demand. This results in significant energy savings, especially in commercial applications where load variability is common. Digitalization is also driving the segment’s growth, with IoT-enabled devices and smart sensors being integrated into compressors for predictive maintenance. These advances allow for real-time monitoring, reducing downtime, and extending the lifespan of the compressor.

The evaporator segment is projected to witness the highest CAGR of 5.8% from 2024 to 2030. In recent years, there has been a growing emphasis on improving the efficiency and design of evaporators to enhance overall system performance. One significant trend is the development of high-efficiency evaporators designed for low-temperature applications, particularly in large cold storage facilities and industrial processing plants. The expansion of cold chain logistics, driven by rising demand for frozen and perishable foods, is a major growth factor for evaporators. Pharmaceutical storage, which requires precise temperature control, has also significantly contributed to this trend.

Type Insights

The ammonia segment dominated the market and accounted for more than 38.0% share of global revenue in 2023. Ammonia-based systems are particularly common in large-scale refrigeration facilities, such as food processing plants, warehouses, and breweries. The latest trends in ammonia refrigeration involve the use of low-charge ammonia systems, which reduce the amount of refrigerant needed without compromising efficiency. This approach not only improves safety but also enhances energy efficiency, making it a preferred choice for industries looking to minimize both operational costs and environmental impact.

The CO2 segment is projected to witness the highest growth rate from 2024 to 2030. CO2 transcritical refrigeration systems are gaining popularity, especially in supermarkets and industrial applications, due to their low GWP and high efficiency in cold climates. These systems utilize CO2 as the primary refrigerant and are designed to operate above the critical point of CO2, making them suitable for environments with varying temperature requirements. Transcritical systems are considered highly energy-efficient, especially when coupled with heat recovery systems. They also reduce the environmental impact of refrigeration by using a natural refrigerant that does not deplete the ozone layer. European countries have been early adopters of CO2 transcritical systems, with the technology now gaining momentum in North America and other regions.

End Use Insights

The commercial segment dominated the market and accounted for more than 51.0% share of global revenue in 2023. The growing number of retail and food service establishments is driving demand for centralized refrigeration systems. As more supermarkets and restaurants open, there is a corresponding need for efficient refrigeration solutions to keep perishable goods fresh. Moreover, there is an increasing consumer preference for fresh and locally sourced products. This trend compels retailers to invest in advanced refrigeration systems that can maintain the quality and shelf life of perishable items.

The industrial segment is projected to register a significant growth rate from 2024 to 2030. The growth can be attributed to rising demand for process optimization at industrial segments to improve productivity and reduce costs, and the need for efficient refrigeration systems. The expansion of the cold chain logistics industry, driven by the growth of e-commerce and increased demand for perishable goods, is significantly influencing the industrial refrigeration market. Enhanced refrigeration capabilities are essential to maintain product quality during transportation and storage.

Regional Insights

North America centralized refrigeration systems market dominated the global market and accounted for a revenue share of over 34.0% in 2023. Stringent energy regulations from the U.S. Department of Energy (DOE) are driving manufacturers to innovate and adopt more energy-efficient systems. The implementation of energy efficiency standards is fostering the use of advanced technologies, thus driving the demand for advanced centralized refrigeration systems in the region.

U.S.Centralized Refrigeration Systems Market Trends

The centralized refrigeration systems market in the U.S. is expected to grow at a CAGR of 4.0% from 2024 to 2030. The U.S. environmental regulations, such as the American Innovation and Manufacturing (AIM) Act, which seeks to reduce HFC emissions, are driving the transition towards centralized refrigeration systems with eco-friendly refrigerants.

Europe Centralized Refrigeration Systems Market Trends

Europe centralized refrigeration systems market is expected to register a considerable growth rate from 2024 to 2030. The shift towards green technologies and sustainable practices within the industry is compelling businesses to invest in advanced refrigeration solutions. Initiatives such as the Green Deal further encourage investments in energy-efficient systems.

Asia Pacific Centralized Refrigeration Systems Market Trends

The centralized refrigeration systems market in Asia Pacific is expected to grow at the highest CAGR of 6.0% from 2024 to 2030. The burgeoning e-commerce sector, particularly in food delivery and online grocery shopping, is significantly influencing the demand for centralized refrigeration to maintain product quality during transportation. Furthermore, governments across the region are investing in cold chain development and energy-efficient technologies to meet the growing demand for food preservation and pharmaceutical storage is driving the demand for centralized refrigeration systems in Asia Pacific.

Key Centralized Refrigeration Systems Company Insights

Some key companies operating in the market include Carrier, Daikin Industries Ltd., Emerson Electric Co., Gea Group, Green Cooling, and Hussmann Corporation.

-

Gea Group, a Germany-based company engaged in manufacturing industrial machinery. GEA Group provides a wide range of centralized refrigeration solutions tailored to various industries, including food and beverage and pharmaceuticals. The company has an established global footprint, allowing it to serve a diverse clientele across different regions.

Enex srl, Mirai Intex, and CoolSys are some emerging companies in the target market.

-

CoolSys is engaged in providing commercial and industrial refrigeration and HVAC systems. The company offers advanced centralized refrigeration systems that use environmentally friendly refrigerants, such as CO2-based systems. The company also offers various services, including design, installation, maintenance, and retrofitting for centralized refrigeration systems. It offers products and services to various end-users from commercial, industrial, healthcare, and institutional services.

Key Centralized Refrigeration Systems Companies:

The following are the leading companies in the centralized refrigeration systems market. These companies collectively hold the largest market share and dictate industry trends.

- Carrier

- Daikin Industries Ltd.

- Emerson Electric Co.

- Gea Group

- Green Cooling

- Hussmann Corporation

- Johnson Controls Inc.

- LU-VE Group

- Mitsubishi Electric Corporation

- Scantec Refrigeration Technologies

- SCM Frigo S.p.A

Recent Developments

-

In September 2024, YOKOREI Co., Ltd., a refrigerated warehouse operator announced the construction of Nagaoka Logistics Center in Japan. The center will have a capacity of 27,272 metric tons and installed with CO2(R744) and ammonia (R717) manufactured by Mayekawa Mfg. Co., Ltd. for refrigeration and freezing.

-

In February 2024 , Scantec Refrigeration Technologies, a provider of industrial and commercial refrigeration and freezing systems provided a centralized low-charge ammonia-based refrigeration system for a poultry warehouse in Australia. The system allowed the warehouse to save energy by around 30% compared to the liquid overfeed system.

Centralized Refrigeration Systems Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 31.06 billion

Revenue forecast in 2030

USD 41.52 billion

Growth rate

CAGR of 5.0% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; India; China; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Carrier; Daikin Industries Ltd.; Emerson Electric Co.; Gea Group; Green Cooling; Hussmann Corporation; Johnson Controls Inc.; LU-VE Group; Mitsubishi Electric Corporation; Scantec Refrigeration Technologies; SCM Frigo S.p.A

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Centralized Refrigeration Systems Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global centralized refrigeration systems market report based on component, type, end use, and region.

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Compressor

-

Condenser

-

Evaporator

-

Others

-

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Ammonia

-

CO2

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2017 - 2030)

-

Commercial

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global centralized refrigeration systems market size was estimated at USD 29.87 billion in 2023 and is expected to reach USD 31.05 billion in 2024.

b. The global centralized refrigeration systems market is expected to grow at a compound annual growth rate of 5.0% from 2024 to 2030 to reach USD 41.52 billion by 2030.

b. The compressor segment dominated the market in 2023 and accounted for more than 33.0% share of global revenue. A key trend within the segment is the growing adoption of variable-speed compressors, which adjust the compressor’s operation to meet cooling demand. This results in significant energy savings, especially in commercial applications where load variability is common.

b. Some of the key companies operating in the centralized refrigeration systems market include Carrier, Daikin Industries Ltd., Emerson Electric Co., Gea Group, Green Cooling, and Hussmann Corporation.

b. The increasing demand for energy-efficient, environmentally friendly, and reliable refrigeration systems has driven the growth of the centralized refrigeration systems market. The food industry has witnessed an increased demand for processed, frozen, and ready-to-eat foods. This shift in consumer preferences is driven by changing lifestyles and rising urbanization, particularly in emerging economies such as China and India.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.