- Home

- »

- Food Safety & Processing

- »

-

Central & South America Food Safety Testing Market Report, 2030GVR Report cover

![Central & South America Food Safety Testing Market Size, Share & Trends Report]()

Central & South America Food Safety Testing Market Size, Share & Trends Analysis Report By Test (Allergen Testing, Chemical & Nutritional Testing), By Application (Dairy & Dairy Products, Processed Food, Beverages), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-761-2

- Number of Report Pages: 98

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Market Size & Trends

The Central & South America food safety testing market size was valued at USD 1,326.1 million in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 6.9% from 2023 to 2030. The market is anticipated to be driven by growing instances of outbreaks of foodborne diseases, leading to consumer awareness regarding safety, which will consequently drive market growth. The rising demand for packaged eatables in the region driven by technological improvement, changing lifestyles, modern retail trades, and increased popularity of quick-service restaurants positively impacts market growth. In addition, innovative processing techniques for extending the shelf life of eatables is expected to drive the demand for processed food.

A wide range of chemical additives and preservatives used in the processing of eatables to extend the shelf life are projected to drive the demand for the chemical examination of processed food products. In addition, packaged eatables exhibit contamination due to the migration of chemicals from packaging materials which is further expected to increase the need for food testing. The government agencies are stepping up to monitor the food supply chain to minimize the contamination. The private sector is also contributing to the efforts by testing the raw ingredients and final products. In addition, increasing international trade with other countries, where regulations are stringent is expected to boost food safety testing.

The regional market is anticipated to be driven by growing instances of outbreaks of foodborne diseases, leading to consumer awareness regarding food safety, which will consequently drive the market growth. Food safety concerns are anticipated to rise as consumers' preferences for new and exotic items, such as tropical fruits, fine coffee, and imported goods, increase. The consumption of packaged and ready-to-eat foods is also predicted to increase as a result of changing lifestyles and a rise in two-earner families. Thus, the demand for these products is driven by technological improvement, changing lifestyles, modern retail trades, and the increased popularity of quick-service restaurants.

The demand for chemical testing of processed food products is anticipated to be driven by various chemical additives and preservatives used in the processing of these products to extend the shelf - life. In addition, the products are tested for residues and contaminants. In many cases, packaged food exhibits contamination due to the migration of chemicals from packaging materials. Hence, increased consumption of packaged food is further expected to increase the need for migration testing of these products. To reduce contamination, government agencies are strengthening their monitoring of the food supply chain. The private sector is also contributing to the efforts by testing the raw ingredients and final products. Additionally, increasing trade with countries where stringent laws are anticipated to increase food safety testing.

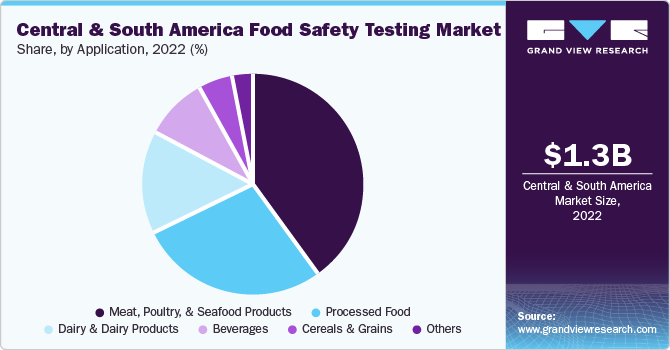

Application Insights

The meat, poultry, & seafood products segment held the largest revenue share of 40.3% in 2022 owing to high meat production in the region. These products are analyzed for the presence of chemical constituents such as fat & moisture content, protein, and protein on a fat-free basis (PFF) has a positive impact on driving the market growth.

Improper use of antibiotics and unapproved drugs in aquaculture is a major concern for seafood product manufacturers owing to their hazardous effects on consumers. This spiked the demand for drug residue testing in seafood products and processed crab meat. An increase in exports of seafood from the region is expected to aid the market growth further.

The processed food segment is expected to grow at the second fastest CAGR of 7.0% over the forecast period. The convenience and ready-to-eat eatables undergo a number of tests including sensory analysis, health claims, allergen testing, shelf life testing, and packaging migration analysis. Increasing consumer preference for processed and exotic fruits in the region is driving segment growth.

The growing customer requirements for premium quality beverages with longer shelf-life including soft drinks, energy drinks, fruit juices, and alcoholic beverages are leading to the increased use of concentrates, flavorants, and preservatives in the products. This has resulted in increased instances of beverage testing thereby driving the segment growth over the projected period.

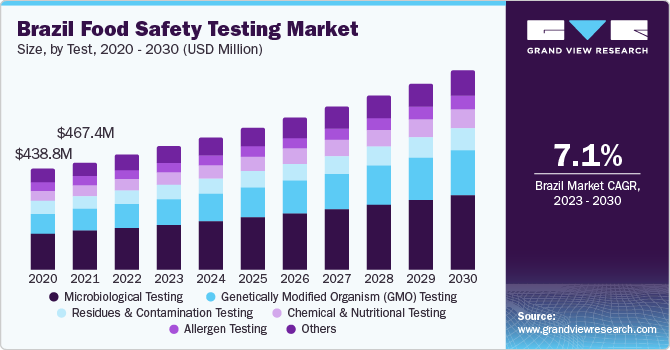

Test Insights

The microbiological testing segment accounted for the largest revenue share of 36.5% in 2022. The risk of being negatively affected by microorganisms such as E. Coli, Salmonella, Campylobacter, listeria; and bacteria causing significant contamination and damage to human health have a major impact on market growth.

The genetically modified organism (GMO) testing segment is expected to grow at the fastest CAGR of 8.0% during the forecast owing to stringent regulations regarding the cultivation of GMO seeds. Harmful effects due to the presence of GMOs in the food have caused governments to issue regulatory measures governing genetically modified products, which has resulted in an increase in GMO testing within the food sector.

An increase in the use of unapproved pesticides for crops and preservatives in eatables is estimated to lead to the growth in residue & contamination testing over the forecast period. The contamination of vegetables and fruits with pesticides can lead to many health hazards including cancer, malformation, and damage to the endocrine, nervous, and immune systems thereby driving the segment growth.

Chemical & nutritional testing of products is essential to know the nutritional composition of eatables and to ensure compliance with labeling regulations. Mass spectroscopy is the most commonly used testing technique which allows the detection of low-concentration analytes and ensures that the product meets all the regulatory requirements regarding nutritional declarations.

Regional Insights

The Central & South America food safety testing market is expected to exhibit substantial growth of 6.9% over the forecast period, owing to the numerous frauds in the region leading to increased market demand. The region is expected to witness increased demand for authenticity testing, owing to the meat scandal in Brazil and the milk scandal in Peru.

The government of Peru has implemented stringent laws regarding the safety testing of food products as a result of the rising number of foodborne disease outbreaks in the region. The consumption of packaged and processed foods is on the rise in the region, which is expected to further fuel market expansion. In addition, the rising number of frauds along with an increase in allergy-prone populations in the country is expected to drive market growth over the projected period.

Key Companies & Market Share Insights

The market exhibits a large number of players providing food safety testing services to the food manufacturers, leading to high competitive rivalry in the market. However, the market is highly concentrated with a handful of players controlling the larger market share and trying to build goodwill by providing better service to its customers.

The market is very capital intensive, thereby making it difficult for the new entrants to establish their business. Major food manufacturers prefer long-term contracts with the laboratories, further providing barriers to the entry of new players. Furthermore, the industry has witnessed a trend of increasing consolidation, which is expected to continue over the forecast period.

Key Central & South America Food Safety Testing Companies:

- Bureau Veritas

- Intertek Group plc

- SGS Société Générale de Surveillance SA

- ALS

- Eurofins Scientific

- LGC Limited

- Mérieux NutriSciences Corporation

- Microbac Laboratories, Inc.

Recent Development

-

In April 2023, ALS acquired ASR Laboratórios (ASR), a renowned leader in conducting agrochemical and household product testing in Brazil. ASR, which was established in 2014 and operates from Charqueada, São Paulo, Brazil, specializes in a comprehensive array of analytical studies focused on quality assurance, product registration, efficacy, and R&D support for the household products, agrochemicals, and cosmetics industries. This strategic acquisition enhances ALS's presence in Brazil and across the globe.

-

In April 2023, Mérieux NutriSciences Corporation, a global company in food safety, quality, and sustainability, declared the completion of its acquisition of Blonk, a prominent international specialist in food system sustainability. Blonk assists organizations in comprehending their environmental impact within the agri-food value chain by providing expert advice based on Life Cycle Assessment (LCA) and creating customized software tools utilizing the most recent scientific advancements and data. This acquisition further strengthens Mérieux NutriSciences' position as a leader in the industry, enabling the company to offer enhanced solutions for sustainable practices in the food sector.

-

In April 2023, ALS acquired Hidro.Lab. doo, a provider of environmental testing services. Established in 2003 and operating from Kastav, Croatia, Hidro.Lab offers an extensive range of offerings, including physical-chemical laboratory testing and sampling, with a specific focus on solid waste, wastewater, and surface water analysis. This acquisition represents a regionally significant milestone for ALS, as it gains a well-established business with a strong market position in Croatia. The addition of Hidro.lab to ALS's portfolio enhances the company's offerings and further solidifies its presence in the Croatian market.

Central & South America Food Safety Testing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1,416.5 million

Revenue forecast in 2030

USD 2,254.2 million

Growth rate

CAGR of 6.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Test, application, region

Country scope

Brazil; Peru; Ecuador; Bolivia; Colombia; Paraguay; Costa Rica; Guatemala

Key companies profiled

Bureau Veritas; Intertek Group plc; SGS Société Générale de Surveillance SA; ALS; Eurofins Scientific; LGC Limited; Mérieux NutriSciences Corporation; Microbac Laboratories, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Central & South America Food Safety Testing Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Central & South America food safety testing market based on test, application, and region:

-

Test Outlook (Revenue, USD Million, 2018 - 2030)

-

Allergen Testing

-

Chemical & Nutritional Testing

-

Genetically Modified Organism (GMO) Testing

-

Microbiological Testing

-

Residues & Contamination Testing

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Meat, Poultry, & Seafood Products

-

Dairy & Dairy Products

-

Processed Food

-

Beverages

-

Cereals & Grains

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Central & South America

-

Brazil

-

Peru

-

Ecuador

-

Bolivia

-

Colombia

-

Paraguay

-

Costa Rica

-

Guatemala

-

Rest of CSA

-

-

Frequently Asked Questions About This Report

b. The global Central & South America food safety testing market size was estimated at USD 1,326.1 million in 2022 and is expected to reach USD 1,416.5 million in 2023.

b. The global Central & South America food safety testing market is expected to grow at a compound annual growth rate of 6.9% from 2023 to 2030 to reach USD 2,254.2 million by 2030.

b. Microbiological testing dominated the Central & South America food safety testing market with a share of 36.5% in 2022. This is attributable to a crucial requirement of the microbial testing across numerous applications in the food industry along with the high risk of microorganisms such as E. Coli, Salmonella, Campylobacter, listeria; and bacteria causing significant contamination, and damage to human health.

b. Some key players operating in the Central & South America food safety testing market include SGS S.A., Intertek Group plc, Bureau Veritas SA, Eurofins Scientific SE, Mérieux NutriSciences, Microbac Laboratories, Inc., and Nova Biologicals, Inc.

b. Key factors that are driving the market growth include growing instances of outbreaks of foodborne diseases leading to consumer awareness regarding food safety.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."