- Home

- »

- Beauty & Personal Care

- »

-

Centella Cosmetics Market Size And Share Report, 2030GVR Report cover

![Centella Cosmetics Market Size, Share & Trends Report]()

Centella Cosmetics Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Skin Care, Hair Care, Makeup, Fragrance, Others), By End-use (Women, Men), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-397-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Centella Cosmetics Market Summary

The global centella cosmetics market size was estimated at USD 790.3 million in 2024 and is projected to reach USD 1,166.5 million by 2030, growing at a CAGR of 6.9% from 2025 to 2030. The cosmetics industry has been undergoing a significant transformation over the past few years, with a marked shift towards natural and plant-based ingredients.

Key Market Trends & Insights

- The centella cosmetics market in North America held 24% of the global revenue share in 2023.

- The centella cosmetics market in the U.S. is projected to grow at a CAGR of 7.6% from 2024 to 2030.

- By product, the centella skin care product segment accounted for a revenue share of around 27% in 2023.

- By end-use, the demand for centella cosmetics among women accounted for a revenue share of around 61% in 2023.

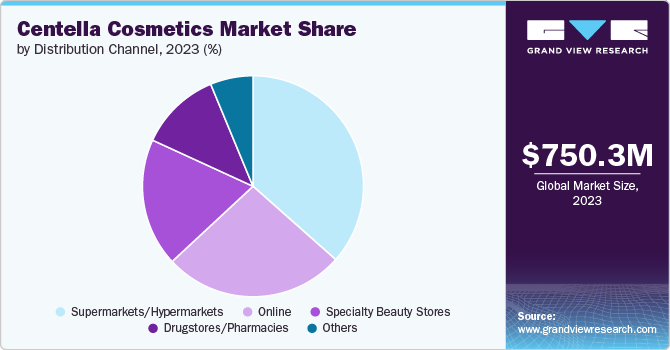

- By distribution channel, the centella cosmetics sales through hypermarkets and supermarkets segment accounted for a share of around 36% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 790.3 Million

- 2030 Projected Market Size: USD 1,166.5 Million

- CAGR (2025-2030): 6.9%

- Asia Pacific: Largest market in 2023

One of the most prominent ingredients gaining widespread popularity is Centella Asiatica, also known as Gotu Kola or Cica. Known for its healing, soothing, and anti-aging properties, Centella Asiatica has become a star ingredient in skincare products, driving considerable interest and innovation within the cosmetics market.

Centella Asiatica’s rise to fame can be attributed to its extensive use in traditional Asian medicine, particularly in Korea, where it is known as “Tiger Grass” because tigers would roll in the plant to heal their wounds. This historical context has contributed to its reputation as a potent healing agent, which modern skincare brands have leveraged to create products that promise to repair and rejuvenate the skin. The ingredient's popularity has surged, propelled by a growing consumer preference for products that offer both efficacy and safety.

Several trends have emerged in the market for Centella Asiatica cosmetics, such as the rise of K-beauty (Korean beauty), which is crucial in popularizing centella-based products globally. K-beauty is renowned for its innovative formulations and emphasis on natural ingredients, with Centella Asiatica becoming a staple in many of its skincare lines. Major brands such as Dr. Jart+, Innisfree, and Cosrx have launched products featuring Centella Asiatica, ranging from creams and serums to masks and toners. These products are marketed for their ability to calm inflammation, promote collagen production, and improve skin hydration.

Another significant trend is the increasing demand for clean and sustainable beauty products. Consumers are now more informed about the ingredients in their skincare products and are actively seeking options that are free from harmful chemicals and environmentally friendly. Centella Asiatica fits perfectly into this category, as it is a natural and biodegradable ingredient. Brands have responded by creating clean beauty lines that prominently feature Centella Asiatica, such as the "Clean It Zero" line by Banila Co and "Cica Care" by Etude House, both of which emphasize minimalistic and non-toxic formulations.

In addition to these trends, there have been notable initiatives aimed at enhancing the accessibility and benefits of Centella Asiatica-based products. For example, some brands have invested in sustainable sourcing and cultivation practices to ensure a steady supply of high-quality Centella Asiatica. L'Oréal, through its Garnier brand, has launched a "Green Beauty" initiative that includes the sustainable harvesting of Centella Asiatica. This initiative not only ensures the purity and potency of the ingredients but also supports local farming communities.

The digital and social media landscape has also significantly influenced the popularity of Centella Asiatica. Influencers and skincare experts on platforms such as Instagram, YouTube, and TikTok have played a pivotal role in educating consumers about its benefits. These influencers often share their personal experiences and reviews of Centella-based products, helping to build trust and credibility. Hashtags such as #CicaCream, #CentellaAsiatica, and #TigerGrass have garnered millions of views, further amplifying the ingredient’s visibility.

Several brands have introduced innovative Centella Asiatica-based products to the market. For instance, Kiehl’s introduced the "Centella Sensitive Cica-Cream," designed specifically for sensitive skin. This product harnesses the soothing properties of Centella Asiatica to reduce redness and irritation. Similarly, La Roche-Posay launched the "Cicaplast Baume B5," a multi-repairing balm that combines Centella Asiatica with other healing ingredients to address various skin concerns such as dryness and post-procedure recovery.

The popularity of Centella Asiatica has also led to its incorporation into multi-functional products that offer comprehensive skincare benefits. For example, the "Cica Pair" line by Dr. Jart+ includes a color-correcting treatment that not only calms and hydrates the skin but also provides SPF protection and conceals redness. This multi-functional approach aligns with the consumer demand for products that simplify skincare routines while delivering multiple benefits.

Furthermore, research and development in the field of biotechnology have enabled brands to enhance the efficacy of Centella Asiatica extracts. Advanced extraction methods, such as the use of ultrasonic-assisted extraction and enzyme-assisted extraction, have been employed to obtain high-purity and high-concentration extracts. These technological advancements ensure that the active compounds in Centella Asiatica are preserved and delivered effectively to the skin, enhancing the overall performance of the products.

The success of Centella Asiatica-based cosmetics can also be attributed to extensive clinical research supporting its benefits. Studies have shown that Centella Asiatica possesses anti-inflammatory, antioxidant, and wound-healing properties, making it an ideal ingredient for treating acne, eczema, and other skin conditions. Brands often highlight these scientific findings in their marketing campaigns, reinforcing the credibility and effectiveness of their products.

Product Insights

The Centella skin care product segment accounted for a revenue share of around 27% in 2023. The demand for Centella skin care products is driven by their anti-inflammatory, antioxidant, and wound-healing properties, making them ideal for products aimed at sensitive and acne-prone skin. Brands like Cosrx and Kiehl’s have capitalized on these benefits by introducing Centella-infused serums and creams. The trend towards minimalistic and natural skincare routines has also fueled demand, with consumers seeking out products that offer both efficacy and safety.

The Centella fragrance segment is projected to grow at a CAGR of 8.7% from 2024 to 2030. Centella fragrances category, though niche, is gaining traction due to the ingredient’s calming and therapeutic properties. Brands are formulating perfumes and body mists that incorporate Centella Asiatica for its refreshing and soothing scent. This trend aligns with the increasing consumer interest in holistic wellness, where fragrances are expected to offer more than just a pleasant smell but also contribute to overall well-being.

End-use Insights

The demand for Centella cosmetics among women accounted for a revenue share of around 61% in 2023. This is primarily attributed to the demand for anti-aging and skin-soothing products. The versatility of Centella Asiatica in addressing various skin concerns such as wrinkles, fine lines, and redness makes it a preferred ingredient in women's skincare.

The demand for Centella cosmetics among men is expected to grow at a CAGR of 7.4% from 2024 to 2030. This demand is growing as more men adopt comprehensive skincare routines. Brands such as L'Oréal Men Expert have launched Centella-infused products to cater to men's specific skincare needs, promoting healthier skin post-shave.

Distribution Channel Insights

The Centella cosmetics sales through hypermarkets and supermarkets accounted for a share of around 36% in 2023. Supermarkets/hypermarkets play a crucial role in the distribution of Centella cosmetics, providing wide visibility and accessibility. These retail formats offer a diverse range of Centella-based products from various brands, attracting consumers with in-store promotions and the convenience of one-stop shopping.

Online sales are expected to grow at a CAGR of 7.7% from 2024 to 2030. Online cosmetic sales are benefiting from the digital-savvy consumer base. E-commerce platforms such as Amazon, Sephora, and YesStyle offer extensive product ranges, detailed reviews, and competitive pricing, making it easier for consumers to explore and purchase Centella-infused cosmetics. The convenience of home delivery and the availability of exclusive online discounts further boost online sales.

Regional Insights

The Centella cosmetics market in North America held 24% of the global revenue share in 2023. The North American market is driven by the growing trend towards natural and organic skincare. The region has seen a significant uptake in Centella-based products, particularly within the wellness and beauty-conscious segments. Major brand players have successfully penetrated the market with their Centella lines, focusing on anti-aging and sensitive skin solutions. The rise of e-commerce and influencer marketing has further propelled the popularity of Centella Asiatica in this region.

U.S. Centella Cosmetics Market Trends

The Centella cosmetics market in the U.S. is projected to grow at a CAGR of 7.6% from 2024 to 2030. In the U.S., the demand for Centella cosmetics is propelled by consumers' increasing awareness of the benefits of natural ingredients and a shift towards clean beauty. The market is characterized by high consumer engagement on social media platforms, where Centella products frequently feature in skincare routines shared by influencers and dermatologists.

Asia Pacific Centella Cosmetics Market Trends

The Asia Pacific centella cosmetics market is expected to grow at a CAGR of 6.3% from 2024 to 2030. Asia Pacific remains a dominant region in the Centella cosmetics market, largely due to its origins in traditional Asian medicine and strong presence in K-beauty products. The Centella cosmetics market in Asia Pacific is growing due to increasing consumer awareness of the skincare benefits of Centella Asiatica, including its soothing and anti-inflammatory properties. In addition, the rising demand for natural and herbal ingredients in cosmetics, along with the expanding middle-class population in the region, contributes to the market's growth.

Europe Centella Cosmetics Market Trends

The Centella cosmetics market in Europe is projected to grow at a CAGR of 6.1% from 2024 to 2030. The market in Europe is growing rapidly as consumers increasingly prioritize natural and sustainable beauty products. The region has seen a rise in demand for Centella-based skincare, driven by the popularity of anti-aging and soothing formulations.

Key Centella Cosmetics Company Insights

The market features both established global firms and emerging players. Key industry leaders prioritize product innovation, differentiation, and distinctive designs in line with evolving consumer preferences. Leveraging extensive global distribution networks, these major players effectively reach diverse customer bases and tap into emerging markets.

Key Centella Cosmetics Companies:

The following are the leading companies in the centella cosmetics market. These companies collectively hold the largest market share and dictate industry trends.

- Estee Lauder

- L’Oréal Paris

- Procter & Gamble

- Shiseido

- SKIN1004

- Amorepacific Corporation

- Unilever

- SkinRx Lab

- Purito

- Benton

Recent Developments

-

In March 2024, multi-brand beauty and personal care retailer Tira introduced the Korean skincare brand Skin1004 exclusively on its platform and in-store locations in India. The brand debuts with a collection of clean beauty products featuring its signature ingredient, Centella Asiatica.

-

In May, 2023, Sublime Cosmetics launched CONTRASOL, a new product line developed with Carmel Cosmetics Labs. CONTRASOL includes a range of sunscreens and after-sun lotions for superior skin protection. The Postsun Cica Lotion, featuring Centella Asiatica extract and vitamin B5, is designed to regenerate skin after sun exposure.

Centella Cosmetics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 835.4 million

Revenue forecast in 2030

USD 1,166.5 million

Growth rate

CAGR of 6.9% from 2025 to 2030

Actuals

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; South Africa

Key companies profiled

Estee Lauder; L’Oréal Paris; Procter & Gamble; Shiseido; SKIN1004; Amorepacific Corporation; Unilever; SkinRx Lab; Purito; Benton

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Centella Cosmetics Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global centella cosmetics market based on product, end-use, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Skin Care

-

Hair Care

-

Makeup

-

Fragrance

-

Others

-

-

End-use Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Women

-

Men

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets/Hypermarkets

-

Specialty Beauty Stores

-

Drugstores/Pharmacies

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global centella cosmetics market was estimated at USD 750.3 billion in 2023 and is expected to reach USD 790.3 billion in 2024.

b. The global centella cosmetics market is expected to grow at a compound annual growth rate of 6.5% from 2024 to 2030 to reach USD 1,166.5 billion by 2030.

b. Asia Pacific dominated the centella cosmetics market with a share of around 39% in 2023. The extensive use of Centella Asiatica in local skincare routines and its widespread availability in both physical stores and online platforms drive the market growth in this region.

b. Some of the key players operating in the centella cosmetics market include Estee Lauder; L’Oréal Paris; Procter & Gamble; Shiseido; SKIN1004; Amorepacific Corporation; Unilever; SkinRx Lab; Purito; Benton

b. Key factors that are driving the centella cosmetics market growth include the trend towards minimalistic and natural skincare routines, and versatility of Centella Asiatica in addressing various skin concerns.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.