- Home

- »

- Plastics, Polymers & Resins

- »

-

Cenospheres Market Size, Share And Growth Report, 2030GVR Report cover

![Cenospheres Market Size, Share & Trends Report]()

Cenospheres Market Size, Share & Trends Analysis Report By Product (Gray Cenospheres, White Cenospheres), By End-use (Oil & Gas, Construction, Automotive, Aerospace), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-410-2

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Cenospheres Market Size & Trends

“2030 Cenospheres Market value to reach USD 1,269.35 million”

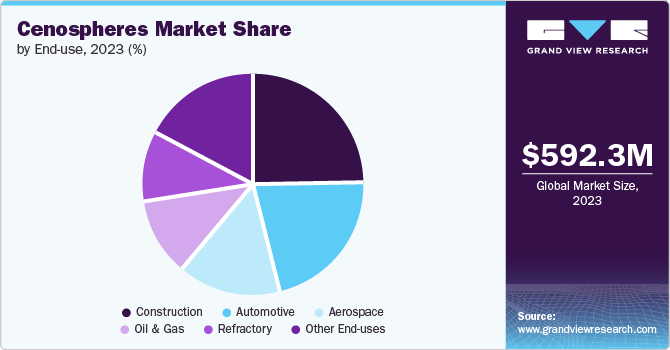

The global cenospheres market size was estimated at USD 592.32 million in 2023 and is projected to grow at a CAGR of 12.1% from 2024 to 2030. The market growth is expected to grow due to the diverse applications of cenospheres. The product market is added to drilling fluids in the oil and gas industry to enhance their performance. These lightweight, inert particles aid in controlling and reducing friction & fluid density and prevent blowouts during drilling operations.

The product market is expected to grow due to its application in gas and oil exploration activities, driving demand for drilling fluids and related additives. Cenospheres prevent well blowouts by enhancing drilling efficiency and pressure balance, displaying the product market's crucial role in the industry.

Drivers, Opportunities & Restraints

The construction industry is increasingly looking for lightweight fillers to improve the performance of building materials. Cenospheres, known for their high strength and low density, are mortar, excellent concrete, and insulation additives. By incorporating cenospheres into these materials, builders can achieve reduced weight, workability, and improved thermal insulation. This leads to more efficient construction processes, reduced building structural loads, and lower transportation costs. Moreover, the product supports sustainable construction practices by using recycled materials from combustion coal, aligning with the industry's focus on environmental responsibility and resource efficiency that drives market growth.

The regulations for disposing and handling fly ash, which is the primary source of cenospheres, vary worldwide and can require strict management. Adhering to these regulations makes product production more complex and expensive. Additionally, companies may need to invest more in waste treatment and mitigation as environmental standards change. The uncertainties around regulations can discourage investors and slow down the growth of the product market. This, in turn, limits the expansion of product production and hinders the development of new uses in industries that rely on lightweight fillers. As a result, regulatory obstacles in waste management significantly restrict the growth of the product market.

Innovations in production techniques drive the market by improving quality, cost-effectiveness, and efficiency. These advancements enable manufacturers to produce products with enhanced properties such as size purity, strength, and uniformity. Moreover, innovative techniques may facilitate the extraction of product markets more efficiently, expanding the available supply. As a result, industries relying on products can access high-quality materials at competitive prices, stimulating market growth.

Product Insights & Trends

“Gray Cenospheres emerged as the fastest growing product with a CAGR of 12.2%”

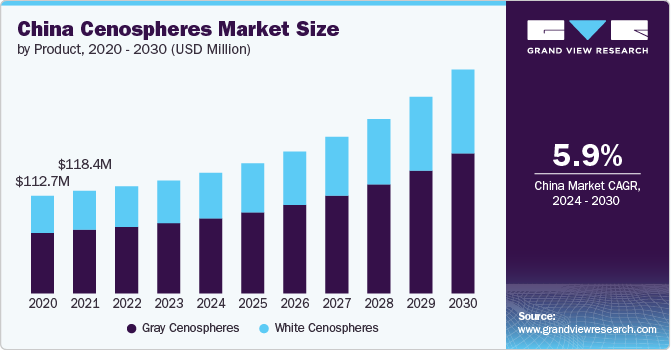

The gray cenospheres segment dominated the market and accounted for a revenue share of 62.3% in 2023. The segment's growth is fueled by high demand from Europe and North America. The increasing oil & gas and construction industries in countries like India, China, and Japan are expected to further bolster the segment's growth. Gray cenospheres are a byproduct of coal combustion in thermal power plants. These are lightweight, inert, hollow spheres composed primarily of silica and alumina and filled with air or inert gas. Typically, their color ranges from gray to light gray. These spheres are used in various applications due to their low density, thermal insulation, and fire resistance properties, making them valuable in the construction, oil and gas, and automotive industries, among others.

White cenospheres are lightweight, inert, hollow spheres composed primarily of silica and alumina and filled with air or inert gas. They are typically a byproduct of coal combustion in thermal power plants. Owing to their low density and high strength, white cenospheres are often used as fillers in cement, ceramics, paints, and plastics, improving the material properties without significantly increasing the weight. Their thermal insulation properties also make them valuable in various applications, from insulating materials to flame retardants.

End-use Insights & Trends

“Automotive emerged as the fastest growing end use with a CAGR of 12.8%”

The construction segment dominated the market with a market and accounted for a revenue share of 24.8% in 2023. Cenospheres, particularly the gray variety produced from coal combustion, are increasingly incorporated into the construction industry due to their unique properties. Their low density makes them an ideal additive for lightweight concrete, reducing the overall weight of structures while maintaining strength. The intrinsic thermal insulation and fire resistance of cenospheres enhance buildings' energy efficiency and safety. Moreover, their use in cement and concrete improves workability and durability and contributes to more environmentally friendly construction practices by recycling a byproduct of industrial processes.

Cenospheres are being increasingly utilized in the automotive industry, primarily due to their ability to enhance the properties of materials while reducing weight. Their inclusion in automotive components results in lighter vehicles, improving fuel efficiency and reducing carbon emissions. Moreover, the cenospheres' thermal resistance and durability contribute to the longevity and performance of automotive parts. Manufacturers can balance strength, weight reduction, and environmental sustainability in vehicle production by incorporating cenospheres.

Regional Insights & Trends

“U.S. emerged as the fastest growing region in North America with a CAGR of 10.9% in 2030”

North America dominated the market and accounted for a 34.19% share in 2023. This growth is attributed to the increasing usage of the product market for construction purposes. North American construction activities are also increasing due to the growing number of construction activities in Canada, Mexico, and the U.S.

U.S. Cenospheres Market Trends

U.S. dominated the market and accounted for a market share of 64.37% in 2023. This growth is attributed to increasing demand for the construction industry in the country. The U.S. is one of the cities with the highest construction activities, leading to a rise in demand for the products market in the region.

Aisa Pacific Cenospheres Market Trends

The Asia Pacific market is expected to grow due to the growing automotive manufacturing plants in the region. This growth will lead to a rise in demand for the product which is used in the automotive sector leading to a rise in demand for the product market.

Europe Cenospheres Market Trends

Europe plays a significant role in the cenospheres market, with countries such as Germany, the UK, France, Italy, Spain, Russia, Netherlands, and Belgium being key contributors to the market. The region's market dynamics are influenced by factors such as the rise in demand for electronics in the region leading to increased demand for the product market.

Key Cenospheres Company Insights

Some of the key players operating in the global cenospheres market include

-

CAMEX GmbH is a company specializing in the distribution and production of specialty chemicals and raw materials. With a focus on industries such as textiles, pharmaceuticals, and food, the company provides tailored solutions to meet the specific needs of its clients. CAMEX GmbH operates within international markets, leveraging its extensive industry expertise and supply chain capabilities. The company emphasizes quality control and regulatory compliance, ensuring that its products meet industry standards. Its operational strategy includes close collaboration with clients to deliver customized, efficient, and sustainable solutions.

-

Wolken is a company that offers cloud-based enterprise software solutions, focusing on service management and customer support. The company's platform is designed to help organizations streamline their processes, enhance customer interactions, and improve overall efficiency. Wolken's solutions are utilized across various industries, providing customizable and scalable tools that cater to different business needs. The company emphasizes data security, reliability, and compliance, ensuring that its software meets industry standards and regulations. Wolken operates globally, serving a diverse client base with its innovative technology offerings.

Frilite SA and Cenosphere India Pvt. Ltd. are some of the emerging market participants in the global cenospheres market.

-

Frilite SA specializes in the production and distribution of lightweight aggregates and industrial minerals. The company's products are primarily used in the construction, automotive, and refractory industries, offering solutions that enhance material performance and energy efficiency. Frilite SA emphasizes innovation in its product development, ensuring that its offerings meet the evolving needs of its customers. The company operates with a strong commitment to quality and sustainability, adhering to industry standards and regulations across its global operations.

-

Cenosphere India Pvt. Ltd. is a company focused on the manufacturing and export of cenospheres, which are lightweight, hollow spheres primarily composed of silica and alumina. These cenospheres are utilized in a variety of industries, including construction, automotive, and oil and gas, due to their properties such as low density, thermal insulation, and high strength. The company emphasizes quality control and consistency in its production processes, ensuring that its products meet international standards. Cenosphere India Pvt. Ltd. serves both domestic and international markets, catering to the specific needs of its clients.

Key Cenospheres Companies:

The following are the leading companies in the cenospheres market. These companies collectively hold the largest market share and dictate industry trends.

- PRIMA CHEM INTERNATIONAL CO., LIMITED

- Gimpex

- CAMEX GmbH

- Wolkem

- Xingtai Kehui Trading Co., Ltd.

- China Beihai Fiberglass Co., Ltd.

- Frilite SA

- Ashtec India

- Cenosphere India Pvt. Ltd.

Recent Developments

-

In March 2022, Omya AG announced the acquisition of Prima Inter-Chem, a specialty chemical distributor in Malaysia. This acquisition is part of Omya's strategy to expand its presence in Southeast Asia, enhancing its regional distribution network and product offerings. Prima Inter-Chem's established market position and customer base will complement Omya's existing operations, allowing for a broader range of services and products to be offered to customers in various industries. The integration aims to strengthen Omya's footprint in the Southeast Asian market.

-

In May 2021, Omya International AG, a significant company in cenosphere manufacturing, introduced a new line of functionalized calcium carbonate products for PET applications. This cost-effective opacifier is primarily used to produce white opaque PET bottles. The innovation is designed to enhance product appeal and efficiency, which is expected to drive demand and create new opportunities for market growth.

Cenospheres Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 639.11 million

Revenue forecast in 2030

USD 1,269.35 million

Growth rate

CAGR of 12.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kiloton, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa.

Key companies profiled

PRIMA CHEM INTERNATIONAL CO., LIMITED; Gimpex; CAMEX GmbH; Wolkem; Xingtai Kehui Trading Co., Ltd.; China Beihai Fiberglass Co., Ltd.; Frilite SA; Ashtec India; and Cenosphere India Pvt. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cenospheres Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cenospheres market report based on product, end-use, and region.

-

Product Outlook (Volume, Kiloton; Revenue, USD Million, 2018 - 2030)

-

Gray Cenosphere

-

White Cenosphere

-

-

End-use Outlook (Volume, Kiloton; Revenue, USD Million, 2018 - 2030)

-

Oil & Gas

-

Construction

-

Automotive

-

Refractory

-

Aerospace

-

Other End-uses

-

-

Regional Outlook (Volume, Kiloton; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cenospheres market was valued at USD 592.32 million in 2023 and is expected to reach USD 639.11 million in 2024.

b. The global cenospheres market is anticipated to witness a high CAGR of 12.1% from 2024 to reach 1269.34 million by 2030

b. North America dominated the market and accounted for a 34.19% share in 2023. This growth is attributed to increasing usage of the product market for construction purposes. North America construction activities is also increasing due to growing number of construction activities in the Canada, Mexico and U.S.

b. Some of the key players operating in the global cenospheres market include CAMEX GmbH, Wolken, Frilite SA and Cenosphere India Pvt. Ltd., among others.

b. The cenospheres market is added to drilling fluids in the oil and gas industry to enhance their performance. These lightweight, inert particles aid in controlling and reducing friction & fluid density and prevent blowouts during drilling operations.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."