- Home

- »

- Processed & Frozen Foods

- »

-

Celtic Salt Market Size, Share & Trends Analysis Report 2030GVR Report cover

![Celtic Salt Market Size, Share & Trends Report]()

Celtic Salt Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Coarse Celtic Salt, Fine Celtic Salt, Flavored Celtic Salt), By Application (Food & Beverage, Personal Care And Cosmetics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-400-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Celtic Salt Market Size & Trends

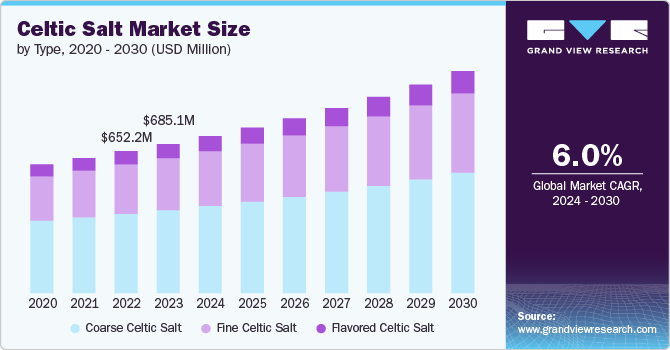

The global celtic salt market size was estimated at USD 685.1 million in 2023 and is expected to grow at a CAGR of 6.0% from 2024 to 2030. Increasing consumer focus on health and wellness is a key factor driving the celtic salt market growth. Celtic salt, often referred to as sea salt, is harvested from the coastal regions of Brittany, France, and is prized for its mineral-rich composition. Unlike refined table salt, celtic salt undergoes minimal processing, retaining trace minerals such as magnesium, potassium, and calcium, which are essential for various bodily functions.

Consumers are becoming more aware of the potential health risks associated with excessive consumption of refined salt, such as hypertension and cardiovascular diseases. In contrast, the mineral content in celtic salt offers various health benefits, including improved hydration, balanced electrolytes, and enhanced nutrient absorption. In addition, celtic salt is not only valued for its health benefits but also for its unique flavor profile, which enhances culinary experiences. The salt has a moist texture and a briny, complex taste that can elevate the flavors of both simple and gourmet dishes. This makes it a preferred choice among chefs and home cooks.

Manufacturers in the celtic salt market are continually innovating to meet diverse consumer preferences and expand their product lines. This includes the introduction of flavored and infused salts, such as herb-infused celtic salt or those blended with spices. These products cater to consumers looking for convenience and enhanced flavors in their cooking. Moreover, the packaging of celtic salt has evolved to attract a broader audience. From traditional glass jars to eco-friendly packaging and stylish, reusable containers, manufacturers are targeting both sustainability-conscious consumers and those looking for aesthetically pleasing products. This diversification helps in tapping into different market segments and increasing overall market penetration.

The global shift towards organic and natural products significantly benefits the celtic salt market. With increasing concerns about the environmental impact of industrial food production, consumers are inclining towards products that are perceived as more natural and less processed. Celtic salt is harvested using traditional methods that have minimal environmental impact, which fits into this trend resulting in its increasing adoption. This factor is particularly strong in developed regions such as North America and Europe, where organic and natural product markets are well-established. In addition, the demand for clean label products, which are free from artificial additives and preservatives, further drives the adoption of celtic salt.

Type Insights

Coarse celtic salt accounted for a revenue share of 55.8% in 2023. Coarse celtic salt is versatile and has traditional usage in culinary applications. Its large, moist crystals provide a unique texture and flavor that is highly valued by chefs and home cooks alike. This type of salt is often used as a finishing salt, enhancing the taste and presentation of dishes with its distinctive crunch and mineral-rich profile. In addition, the traditional methods of harvesting coarse celtic salt, which involve manual labor and natural drying processes, preserve its natural minerals and trace elements, making it an attractive option for health-conscious consumers.

Flavored celtic salt is expected to grow at a CAGR of 6.8% from 2024 to 2030 due to the increasing consumer demand for unique and convenient culinary products. These salts are infused with herbs, spices, and other natural flavors, providing a quick and easy way to enhance the taste of dishes without the need for additional seasonings. The trend towards gourmet cooking at home, driven by the popularity of cooking shows and food blogs, has fueled the demand for such innovative products.

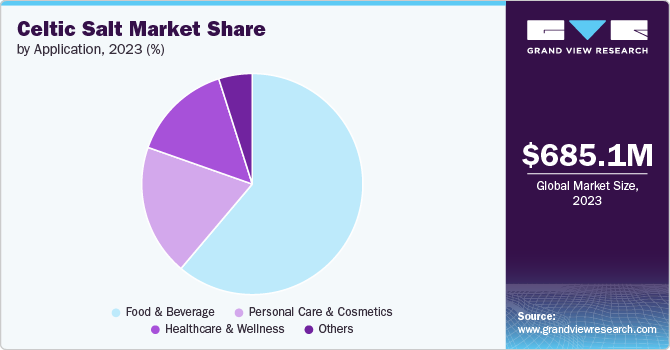

Application Insights

Food & beverage application accounted for a revenue share of 61.1% in 2023 due to the extensive use of Celtic salt in culinary practices. Its unique mineral composition and flavor profile make it a preferred choice for enhancing the taste of various dishes. From gourmet restaurants to household kitchens, celtic salt is widely used for seasoning, baking, and preserving foods. Its versatility and premium quality appeal to chefs and food enthusiasts, driving significant demand in this segment. In addition, the rising trend of gourmet cooking and the growing popularity of health-conscious eating habits have further boosted the demand for Celtic salt in the food and beverages sector.

Personal care and cosmetics application is expected to grow at a CAGR of 6.5% from 2024 to 2030 driven by the rising consumer interest in natural and organic beauty products. Celtic salt's mineral-rich composition makes it a popular ingredient in skincare and personal care formulations, such as exfoliants, bath salts, and detoxifying scrubs. Its ability to cleanse, exfoliate, and nourish the skin aligns with the growing trend of using natural ingredients in beauty routines. Furthermore, the increasing awareness of the benefits of mineral salts for skin health and wellness is propelling the demand for celtic salt in the personal care industry.

Nature Insights

Conventional celtic salt accounted for a revenue share of 93.8% in 2023 due to its widespread availability and lower cost compared to organic alternatives. Most consumers and businesses opt for conventional products for their regular needs, especially in the food and beverage sector where bulk purchasing is common. The production and distribution processes for conventional celtic salt are well-established, ensuring a steady supply chain that meets the demands of various industries. The lower price point of conventional celtic salt makes it accessible to a broader audience, including households and foodservice establishments.

Organic celtic salt is expected to grow at a CAGR of 10.2% from 2024 to 2030 driven by the increasing consumer preference for organic and clean-label products. As awareness of environmental sustainability and health benefits associated with organic products grows, more consumers are willing to pay a premium price for organic celtic salt. The increasing emphasize on products free from synthetic additives, pesticides, and GMOs is further driving the market growth. In addition, the rise of organic certifications and stringent quality standards also bolster consumer confidence in organic celtic salt.

Distribution Channel Insights

Sales through B2B channel accounted for a revenue share of 61.4% in 2023 owing to its efficiency in catering to bulk purchasing needs and established business relationships. Businesses, particularly in the foodservice and manufacturing sectors, require large quantities of salt for their operations. The B2B channel allows suppliers to deliver bulk orders, ensuring a consistent and reliable supply chain for commercial clients. Moreover, the long-term contracts and partnerships typical of B2B transactions provide stability and predictability for both suppliers and buyers. Businesses in the food industry, such as restaurants, hotels, and food processors, rely on a steady supply of high-quality ingredients, making the B2B channel crucial for meeting their demands.

Sales through B2C is expected to grow at a CAGR of 6.3% from 2024 to 2030 owing to increasing consumer demand for health and wellness products and the rise of e-commerce. Consumers are becoming more health-conscious and are actively seeking out natural and minimally processed foods including celtic salt. The convenience of online shopping has made it easier for consumers to access a wide variety of celtic salt products, boosting the growth of the B2C channel. E-commerce platforms and specialty food stores are expanding their offerings of gourmet and health-oriented products, making celtic salt more accessible to individual consumers driving the growth.

Regional Insights

Europe Celtic salt market accounted for a revenue share of 39.9% in 2023 owing to its strong culinary heritage, health-conscious population, and established retail infrastructure. European cuisine values high-quality, natural ingredients, and celtic salt is prized for its unique flavor and mineral content. Countries such as France, Italy, and Spain have rich culinary traditions that emphasize the use of artisanal products, contributing to the high demand for celtic salt. The region's health-conscious consumers prefer natural and organic food products, aligning with the growing trend towards healthier eating habits further driving the demand for celtic salt.

The Celtic salt market in Asia Pacific is expected to grow at a CAGR of 6.6% from 2024 to 2030. Rising health awareness, urbanization, and changing dietary habits are key factors deriving the demand for Celtic salt. Moreover, the rapid growth of e-commerce in the Asia Pacific region is also enhancing the accessibility of celtic salt. Online retail platforms offer a wide range of health-oriented and gourmet products, making it easier for consumers to purchase gourmet products including celtic salt. In addition, the influence of Western culinary trends and the popularity of international cuisine are further driving demand in this region.

North America Celtic Salt Market Trends

The Celtic salt market in North America is expected to grow at a CAGR of 6.2% from 2024 to 2030. Consumers in the U.S. and Canada are increasingly seeking healthier and minimally processed food options. The popularity of cooking shows, food networks, and celebrity chefs has heightened consumer interest in premium ingredients such as celtic salt. The established market for organic and natural products in North America further supports the growth of the celtic salt market. Retailers and health food stores stock a variety of gourmet salts, making them accessible to a wide audience.

U.S. Celtic Salt Market Trends

The U.S. Celtic salt market is expected to grow at a CAGR of 6.5% from 2024 to 2030. The growing awareness of the health risks associated with excessive consumption of refined salt is driving consumers towards natural options such as celtic salt. Moreover, U.S. is known for its culinary diversity and innovation. The popularity of cooking shows, food blogs, and social media platforms showcases the use of Celtic salt in various recipes, inspiring consumers to try it in their own cooking.

Key Celtic Salt Company Insights

Manufacturers operating in the celtic salt market are adopting various strategies to capitalize on the growing demand and ensure sustained market growth. These strategies include product innovation such as launching infused and flavored celtic salts, sustainable practices, mergers, acquisitions, expanding distribution channels, and others.

Key Celtic Salt Companies:

The following are the leading companies in the celtic salt market. These companies collectively hold the largest market share and dictate industry trends.

- Eden Foods

- Le Marinier

- Selina Naturally

- Le Guérandais

- SaltWorks

- Sampige Foods

- 82 Minerals

- Celt Salt

- Cupplement BV

- Mattisson

Recent Developments

- In May 2024, Aashirvaad brand by ITC introduced its new product: Himalayan Pink Salt, emphasizing “Purity You Can See & Taste. This salt is naturally deep pink in color reflecting its premium quality and purity, with no added colors. This Himalayan Pink Salt is sourced from Himalayan salt mines and is rich in essential minerals like calcium and magnesium. This launch enhances Aashirvaad’s reputation for providing products that blend quality, safety, and natural goodness.

Celtic Salt Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 721.0 million

Revenue forecast in 2030

USD 1,020.0 million

Growth rate

CAGR of 6.0% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type application, nature, distribution channel, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia; South Korea; Brazil; UAE

Key companies profiled

Eden Foods; Le Marinier; Selina Naturally; Le Guérandais; SaltWorks; Sampige Foods; 82 Minerals; Celt Salt; Cupplement BV; Mattisson

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Celtic Salt Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global Celtic salt market report based on type, application, nature, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Coarse Celtic Salt

-

Fine Celtic Salt

-

Flavored Celtic Salt

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Culinary Seasoning

-

Baking

-

Gourmet Cooking

-

Food Processing

-

Snacks and Confectionery

-

-

Personal Care and Cosmetics

-

Healthcare and Wellness

-

Others

-

-

Nature Outlook (Revenue, USD Million, 2018 - 2030)

-

Conventional

-

Organic

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

B2B

-

B2C

-

Hypermarkets & Supermarkets

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global celtic salt market size was estimated at USD 685.1 million in 2023 and is expected to reach USD 721.0 million in 2024.

b. The global celtic salt market is expected to grow at a compounded growth rate of 6.0% from 2024 to 2030 to reach USD 1,020.0 million by 2030.

b. Food & beverage application accounted for a revenue share of 61.1% in 2023 due to the extensive use of Celtic salt in culinary practices.

b. Some key players operating in the celtic salt market include Eden Foods; Le Marinier; Selina Naturally; Le Guérandais; SaltWorks; Sampige Foods; 82 Minerals; Celt Salt; Cupplement BV; and Mattisson

b. Increasing consumer focus on health and wellness is a key factor driving the growth of the Celtic salt market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.