Cellulose Acetate Market Size, Share & Trends Analysis Report By Product (Fiber, Plastic), By Application (Cigarette Filters, LCD & Photographic Films, Textiles & Apparels, Tapes & Labels), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-332-0

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

Cellulose Acetate Market Size & Trends

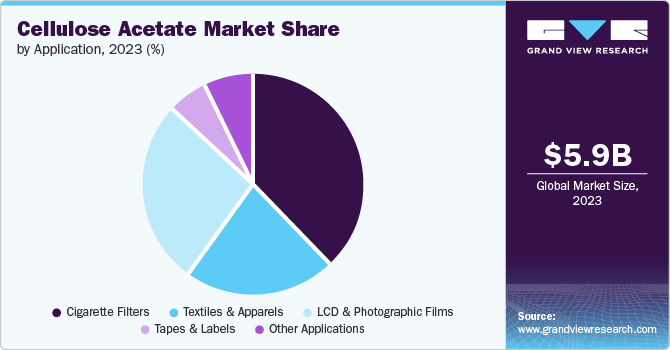

The global cellulose acetate market size was valued at USD 5.95 billion in 2023 and is projected to grow at a CAGR of 4.4% from 2024 to 2030. The market is driven by the rising demand for cellulose acetate in applications like textiles and apparel, additionally, the material's increasing popularity in the production of eyewear frames and photographic films is another key driver, with eyewear manufacturers preferring it due to its lightweight, durable, and flexible nature. The growing consumer demand for low-tar cigarettes globally and properties that extend the shelf life of food products are enhancing the market growth, with the rise in cigarette usage expected to propel the market ahead.

Cellulose acetate is a thermoplastic polymer derived from cellulose; a natural compound found in plants. It possesses several unique characteristics that make it a sought-after material in various industries. Cellulose acetate exhibits excellent transparency, UV resistance, and high impact strength, making it an ideal choice for the production of eyeglass frames, where its lightweight and durable nature is highly valued. Moreover, its ability to be easily molded and colored makes it suitable for the manufacturing of cigarette filters, where its porous structure effectively traps harmful particles while allowing the passage of air and smoke.

Drivers, Opportunities & Restraints

The global cellulose acetate market is driven by the increasing demand for sustainable and eco-friendly materials across various industries. As environmental consciousness grows, this product, derived from renewable resources, has gained prominence as a viable alternative to traditional plastics. The rising awareness about the adverse environmental impact of non-biodegradable materials has prompted industries to adopt it in the production of items such as eyewear, cigarette filters, and textiles.

For instance, many eyewear manufacturers are embracing cellulose acetate for its biodegradability and lightweight properties, catering to environmentally conscious consumers. Similarly, the use of the product in cigarette filters aligns with the tobacco industry's efforts to address the environmental concerns associated with non-biodegradable filter materials, thereby driving the demand for these products.

A major restraint for the global cellulose acetate market is the volatility of raw material prices. The production relies on the availability and cost of cellulose, which is derived from wood pulp or cotton linters. Fluctuations in the prices of these raw materials can significantly impact the overall production cost, affecting the market dynamics. For instance, disruptions in the supply chain due to natural disasters, trade policies, or seasonal variations can lead to price instabilities, posing challenges for manufacturers and impacting the pricing of cellulose acetate-based products.

With the increasing emphasis on sustainable fashion and eco-friendly textiles, these fibers have emerged as a preferred choice for clothing and home textiles. The material's ability to mimic the luxurious feel of natural fabrics like silk, coupled with its sustainable attributes, has propelled its usage in high-quality apparel and interior textiles. For example, leading fashion brands are incorporating its fibers into their collections, promoting sustainable and ethically sourced materials to cater to environmentally conscious consumers.

Product Insights

“Plastic emerged as the fastest growing product with a CAGR of 4.5%”

Fiber dominated the market and accounted for a revenue share of approximately 64.9% in 2023. Its inherent breathability, softness, and moisture-wicking capabilities make it a preferred choice for the production of clothing and home textiles. Additionally, cellulose acetate fiber offers enhanced dyeability, resulting in vibrant and long-lasting colors, which is a desirable trait for fashion and textile applications. Its inherent breathability, softness, and moisture-wicking capabilities make it a preferred choice for the production of clothing, lingerie, and home textiles. Additionally, this fiber offers enhanced dyeability, resulting in vibrant and long-lasting colors, which is a desirable trait for fashion and textile applications.

Cellulose acetate plastic is valued for its transparency, impact resistance, and moldability, making it an ideal material for various consumer products. Its excellent optical properties and UV resistance make it suitable for eyewear frames, where its lightweight nature and vibrant color options cater to the demands of the fashion-conscious consumer. Moreover, cellulose acetate plastic is widely used in the production of cigarette filters, leveraging its porous structure to effectively trap harmful particles while maintaining airflow. Additionally, the material's versatility in molding intricate shapes and designs has expanded its use to include items such as hair accessories and decorative products.

Application Insights

“Textiles & Apparels emerged as the fastest growing end-use with a CAGR of 4.2%”

Cigarette filters dominated the market and accounted for a revenue share of 37.8% in 2023. Cigarette filters utilize cellulose acetate's porous structure to effectively trap harmful particles while allowing the passage of air and smoke. The material's high wet strength and low ignition propensity make it an essential component in the production of safer and more efficient cigarette filters. Cellulose acetate filters offer a reduction in tar and nicotine levels without compromising the smoking experience, meeting regulatory requirements and consumer preferences for reduced harm products. Leading tobacco companies incorporate its filters into their cigarette products, demonstrating the widespread application and importance of this segment within the market.

In the LCD & photographic films segment, cellulose acetate's excellent optical properties, chemical resistance, and dimensional stability make it an ideal material for producing high-quality films in various imaging applications. The material's transparency and ability to withstand harsh chemical processes contribute to its use in the production of LCD polarizing films, enabling the vibrant display of colors and images. Furthermore, it is utilized in photographic films, where its fine grain structure and light sensitivity facilitate the capture of sharp and detailed images. Major electronics and imaging companies integrate cellulose acetate films into their products, showcasing their pivotal role in these technological applications.

In the textiles & apparels industry, these fibers are valued for their luxurious feel, breathability, and moisture-wicking properties, making them an ideal choice for high-quality clothing and home textiles. The material's ability to mimic the texture of natural fibers like silk, combined with its sustainable attributes, has positioned it as a preferred option for fashion and apparel. Cellulose acetate fibers are extensively used in the production of elegant and eco-friendly textiles, catering to the demand for sustainable fashion. Renowned fashion designers incorporate cellulose acetate fibers into their collections, highlighting the material's versatility and appeal in the textiles and apparels segment.

Regional Insights

North America cellulose acetate market is characterized by a focus on sustainable and eco-friendly materials, driving the demand in various applications. The region's emphasis on reducing environmental impact has led to the adoption in products such as cigarette filters, where its biodegradability aligns with the growing preference for sustainable alternatives. Additionally, the market in North America is influenced by the pharmaceutical industry, where it finds applications in drug delivery systems and pharmaceutical packaging.

U.S. Cellulose Acetate Market Trends

The cellulose acetate market in the U.S. is characterized by a focus on technological advancements and innovation. Research institutions and manufacturers in the U.S. are taking initiatives and making significant investments to develop effective cigarette filters made of this product and to improve the material's properties for various applications.

Middle East & Africa Cellulose Acetate Market Trends

“Middle East & Africa emerged as the fastest growing market with a CAGR of 5.1% from 2024 - 2030”

In the Middle East and Africa, the market for cellulose acetate is influenced by the growth in end-user industries, particularly in applications such as textiles, apparel, and cigarette filters. The region's emerging market status presents opportunities for the expansion of this product usage, with a focus on sustainable and environmentally friendly materials.

Asia Pacific Cellulose Acetate Market Trends

Asia Pacific dominated the market and accounted for a 48.8% share in 2023. The region's rapid industrialization, particularly in emerging economies such as India and China, has led to a surge in the consumption of cellulose acetate. The growing demand in applications such as cigarette filters, textiles, and apparel is a key driver of market growth in the Asia Pacific region. The increasing number of smokers in developing economies like India and China has contributed to the expansion of the cigarette filters segment.

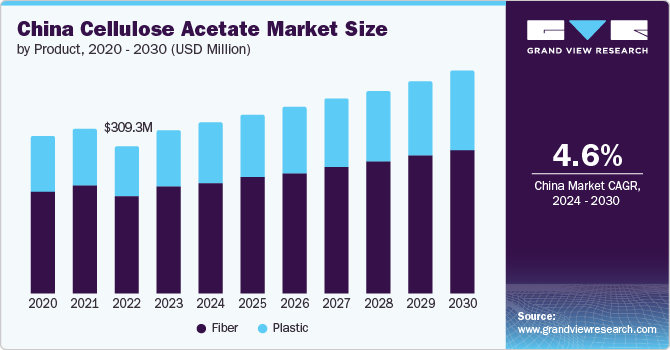

China cellulose acetate market exhibits distinct characteristics and trends that influence its position in the global landscape. The country's significant contribution to the market is driven by factors such as increased technological and infrastructural developments, particularly in the cigarette manufacturing industry. The growing demand in China is closely linked to the expansion of end-use industries, including textiles, apparel, and cigarette filters.

Europe Cellulose Acetate Market Trends

The cellulose acetate market in Europe reflects a growing awareness of the harmful effects of smoking and the need for sustainable materials. The region's stringent regulations on tobacco products have driven the demand in cigarette filters, where its filtration qualities and biodegradability are valued. Moreover, the textile and apparel industry in Europe has embraced these fibers for their luxurious feel and sustainable attributes, catering to the demand for eco-friendly textiles.

Central & South America Cellulose Acetate Market Trends

In Central and South America, the textile and cigarette industries are key end users of cellulose acetate, with applications ranging from apparel linings to cigarette filters. The region's growing textile industry and the demand for sustainable materials have propelled the adoption of these fibers.

Key Cellulose Acetate Company Insights

The competitive landscape of the cellulose acetate market is characterized by the presence of key players focusing on innovation, expansion, and strategic initiatives to enhance their market presence. Major players are increasing production capacity and expanding manufacturing plants to cater to the augmented demand for these products. Leading market players are investing heavily in research and development to expand their product lines, driving the growth of the market. This strategic focus on innovation and product diversification is aimed at meeting the evolving needs of end users and enhancing the market competitiveness of the industry players.

Some of the key players operating in the global cellulose acetate market include Eastman Chemical Company, Cerdia International, among others.

-

Eastman Chemical Company is a significant player in the cellulose acetate market, known for its comprehensive product portfolio and innovative solutions. Eastman Chemical Company focuses on applications such as cigarette filters, textiles, apparel, LCD, photographic films, and more.

-

Cerdia International GmbH, headquartered in Basel, Switzerland, is a pioneer in cellulose acetate tow and a global quality and innovation leader in the field of tow for cigarette filter manufacture.

Borregaard AS and Rotuba are some of the emerging market participants in the global cellulose acetate market.

-

Sappi Ltd. is a significant supplier of dissolving pulp to manufacturers of various cellulose derivatives, including cellulose acetate and nitrocellulose, as well as other specialty cellulose applications. Sappi Ltd.’s products are highly suitable for various acetate applications, including acetate filters, yarn, film, and plastics.

-

Rotuba is a major provider of cellulose acetate fibers and has collaborated with Eastman Chemical Company to produce face shields for medical professionals during the coronavirus pandemic. The company's continuous investments in competence and technology enable it to supply a broad range of high-quality, tailor-made speciality cellulose grades, with a particular focus on purity, viscosity, and reactivity.

Key Cellulose Acetate Companies:

The following are the leading companies in the cellulose acetate market. These companies collectively hold the largest market share and dictate industry trends.

- Eastman Chemical Company

- Daicel corporation

- Celanese Corporation

- Mitsubishi Chemical Holdings Corporation

- Sappi Ltd.

- Rayonier Advanced Materials Inc.

- Sichuan Push Acetati Co., Ltd.

- Cerdia International GmbH

- Rotuba

- RYAM

Recent Developments

-

In February 2024, Karün Eyewear launched its frames produced from cellulose acetate, recovered from remains of cigarette butts. The company uses sustainable and scalable process developed by IMEKO to recover cellulose acetate to act as a sustainable feedstock, contributing towards a circular economy.

-

In October 2021, Daicel Corporation presented a new bioplastic product under the name of Cafblo-Cellulose Acetate for Blue Ocean. The product is made from biomass based cellulose acetate resin for extrusion and molding uses. This new version of the material is a transparent clear resin and is marine biodegradable.

Cellulose Acetate Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 6.20 billion |

|

Revenue forecast in 2030 |

USD 8.03 billion |

|

Growth Rate |

CAGR of 4.4% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in kilotons; revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Volume and revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Germany; UK; France; Italy; China; India; Japan; Brazil; Argentina; Saudi Arabia; South Africa |

|

Key companies profiled |

Eastman Chemical Company; Daicel corporation; Celanese Corporation; Mitsubishi Chemical Holdings Corporation; Sappi Ltd. ; Rayonier Advanced Materials Inc. ; Sichuan Push Acetati Co.,Ltd. ; Cerdia International GmbH; Rotuba; RYAM |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Cellulose Acetate Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cellulose acetate market report based on product, application and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Fiber

-

Plastic

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Cigarette Filters

-

LCD & Photographic Films

-

Textiles & Apparels

-

Tapes & Labels

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cellulose acetate market was valued at USD 5.95 billion in 2023 and is expected to reach USD 6.20 billion in 2024.

b. The global cellulose acetate market is anticipated to grow at a CAGR of 4.4% from 2024 to reach USD 8.03 billion by 2030.

b. Asia Pacific accounted for the largest revenue share of 48.8% in 2023. The region's rapid industrialization, particularly in emerging economies such as India and China, has led to a surge in the consumption of cellulose acetate. The growing demand in applications such as cigarette filters, textiles, and apparel is a key driver of market growth in the Asia Pacific region. The increasing number of smokers in developing economies like India and China has contributed to the expansion of the cigarette filters segment.

b. The competitive landscape of the cellulose acetate market is characterized by the presence of key players focusing on innovation, expansion, and strategic initiatives to enhance their market presence. Some of the key players operating in the global cellulose acetate market include Eastman Chemical Company, Cerdia International GmbH, Rotuba, Sappi Ltd., among others.

b. The global cellulose acetate market driven by the rising demand for cellulose acetate in applications like textiles and apparel, additionally, the material's increasing popularity in the production of eyewear frames and photographic films is another key driver, with eyewear manufacturers preferring it due to its lightweight, durable, and flexible nature. The growing consumer demand for low-tar cigarettes globally and properties that extend the shelf life of food products are enhancing the market growth, with the rise in cigarette usage expected to propel the market ahead.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."