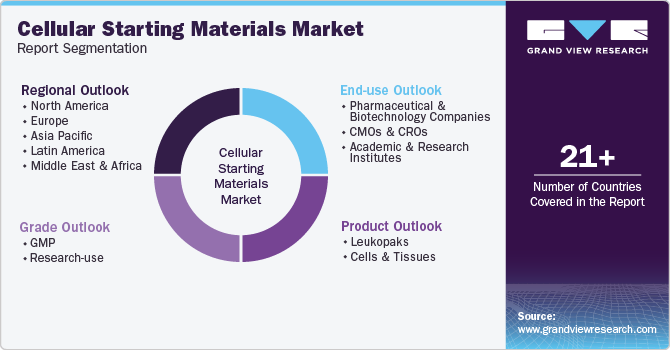

Cellular Starting Materials Market Size, Share & Trends Analysis Report By Product (Leukopaks, Cells & Tissues), By Grade (GMP, Research-use), By End U-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-323-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Cellular Starting Materials Market Trends

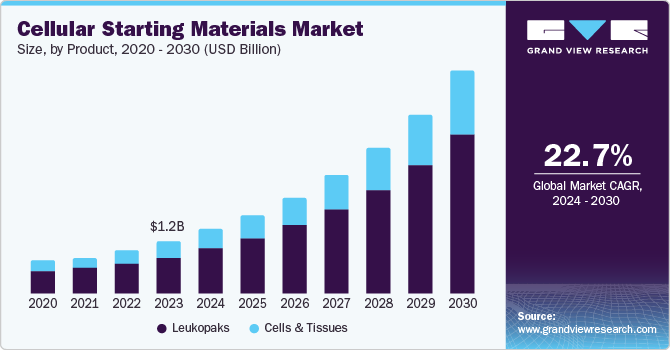

The global cellular starting materials market size was estimated at USD 1.16 billion in 2023 and is projected to grow at a CAGR of 22.74% from 2024 to 2030. The rising prevalence of chronic diseases such as cancer, diabetes, & autoimmune disorders, increasing investments & growing demand for cell & gene-based therapies, and technological innovations are anticipated to boost the market over the forecast period. In 2022, cancer was one of the leading causes of death worldwide, with 20 million new cases and 9.7 million deaths, according to the National Cancer Institute. By 2040, it is projected that cancer cases will reach 29.9 million, with 15.3 million cancer-related deaths.

Cell & Gene therapy represents a pioneering approach to cancer treatment, involving the modification of immune cells' or cancer cells' DNA and genetic function to effectively target and address the disease. Leukopaks, cells, and tissues are starting materials in cell therapy applications. The ability to isolate specific subsets of white blood cells (WBCs) from leukopaks enables researchers to explore novel treatment modalities, including chimeric antigen receptor (CAR) T-cell therapy and other immunotherapies.

CAR-T cell therapy is a form of immunotherapy that involves modifying a patient’s own T cells to recognize and attack cancer cells. In this cell therapy, a patient’s T cells are extracted and genetically engineered in the lab to express CARs specific to the cancer cell antigen. This modification enables the CAR-T cells to target and destroy cancer cells effectively. Leukopaks are essential tools in research and therapy due to their high concentration of white blood cells obtained through leukapheresis. They also act as cellular starting materials in cell therapy, thus propelling market growth.

Moreover, researchers are actively exploring the use of adult-derived hematopoietic stem cells in clinical and basic science applications due to their diverse feasibility and importance in stem cell biology. Hematopoietic stem cells (HSCs) and their derived progenitors are important cell sources in regenerative medicine, offering potential treatments for various pathophysiologic conditions, including non-hematopoietic tissue regeneration and blood disorders. Furthermore, increasing investments and research & development in the field of cell & gene therapeutics are expected to boost market growth. For instance, in November 2023, AstraZeneca, in a deal with Cellectis, invested USD 245 million to develop cell and gene therapy products. Moreover, in October 2023, Bayer opened its new cell therapy manufacturing facility in California with an investment of USD 250 million.

The COVID-19 pandemic had a negative impact on the market. The pandemic resulted in lockdowns, travel restrictions, and social distancing measures, which disrupted the transportation of raw materials, leading to shortages and delays in the production of cell-based therapies. Many research and clinical trials related to cell therapies were temporarily halted or slowed down due to the diversion of resources toward pandemic response efforts. However, leukopaks were used in various studies and clinical trials to understand the immune response to the SARS-CoV-2 virus. In 2020, the National Institute of Allergy and Infectious Diseases (NIAID) initiated a clinical study using leukapheresis techniques to collect white blood cells from recovered COVID-19 patients. This study investigates how SARS-CoV-2 affects lymphocytes, the immune system, and blood clotting mechanisms.

Industry Concentration & Characteristics

The global market is characterized by a high degree of innovation driven by technological advancements and an increasing demand for more reliable cellular models in biomedical research. The biomedical industry is experiencing remarkable progress due to ongoing advancements in cell isolation techniques, preservation methods, and quality control measures. For instance, in January 2023, Curate Biosciences launched the Curate Cell Processing System that separates WBCs by microfluidic processing.

The industry is also characterized by a high level of merger and acquisition activities undertaken by several key players. This is due to several factors, including the desire to gain a competitive advantage in the industry and the need to consolidate in a rapidly growing market. However, market players are engaged in collaboration and partnerships to expand their manufacturing capabilities & distribution network. For instance, in September 2022, Cryoport, Inc. entered a strategic relationship with Takeda's BioLife Plasma Services to provide cellular starting material for manufacturing cellular therapies.

The market is characterized by a high impact of regulations. GMP leukopaks are subject to stringent regulations to ensure high quality and safety standards throughout their production and collection processes. These regulations ensure consistency, reliability, and safety in downstream applications such as cell therapy, immunotherapy research, and pharmaceutical development.

Key players are adopting the strategy of increasing production capacity and expanding their market reach to improve the availability of their products in diverse geographic areas. In addition, companies are launching new products to strengthen their product portfolio. For instance, NMDP BioTherapies launched enhanced cellular materials for allogeneic cell therapy development in April 2024.

The industry is witnessing significant regional expansion, driven by an increasing customer base for cellular starting materials. Furthermore, as scientific awareness of cell and gene therapy continues to grow globally and access to biotechnological tools improves in emerging markets, major market players are expected to enhance their regional expansion efforts.

Product Insights

Leukopaks dominated the market with the largest revenue share of 70.80% in 2023 and is expected to grow at the fastest CAGR over the forecast period. Leukopaks are considered essential components in the development of cell therapies, as they contain a diverse range of immune cells, including T cells, B cells, NK cells, monocytes, and others. These cells play crucial roles in the immune system and are often studied for their potential therapeutic applications. Researchers and pharmaceutical companies use leukopaks for experimental purposes and as sources of cells for cell-based therapies. For instance, T cells are used in cancer immunotherapies and adoptive cell transfer therapies, where they are isolated, expanded, and genetically modified before being reintroduced into patients to enhance their immune response against cancer cells. Leukopaks also contribute to vaccine development by studying the adaptive immune response to vaccines and vaccine adjuvants. Leukopaks can be customized or mobilized to contain specific subsets of immune cells, making them ideal for studying particular diseases or immune responses. For instance, mobilized leukopaks with higher concentrations of stem cells are valuable for regenerative medicine and transplant therapies.

Primary cells, a part of cellular starting materials, provide more dependable tissue-specific reactions in a biologically pertinent microenvironment, leading to more precise outcomes in drug response studies. In addition, they are cost-effective and help minimize the necessity for animal models in research. Consequently, they are a preferred choice for pharmaceutical, biotechnology companies, and Contract Research Organizations (CROs).

Grade Insights

Good Manufacturing Practices (GMP) grade cellular starting material dominated the market with the largest revenue share and is expected to grow at the fastest CAGR of 22.8% from 2024 to 2030. GMP-grade leukopaks are essential products collected via leukapheresis from healthy donors under strict quality and safety standards following FDA regulations. GMP leukopaks adhere to stringent guidelines, ensuring they are processed, handled, and documented according to regulatory standards, reducing the risk of contamination or adverse effects. Biotechnology and pharmaceutical companies, clinical trials, and research institutions use GMP leukopaks for novel therapies like adoptive T cell therapy, immuno-oncology, and personalized immunotherapies, which require regulatory approval before they are released for market sale.

Cellular starting materials are extensively used for research in the field of cancer biology and regenerative medicine. Research on CAR-T cell therapy is progressing rapidly, with over 900 clinical trials currently being conducted worldwide. This expansion can be largely credited to discovering antigens on tumor cells that show promise as targets for CAR-T cell therapy. Moreover, primary cells are significant in oncology R&D due to their physiological relevance, genetic diversity, and tumor microenvironment representation offered by them, and are also preferred over cell lines in R&D as they provide more accurate and reliable results, allowing researchers to study disease mechanisms and drug responses and develop targeted therapies for various types of cancer.

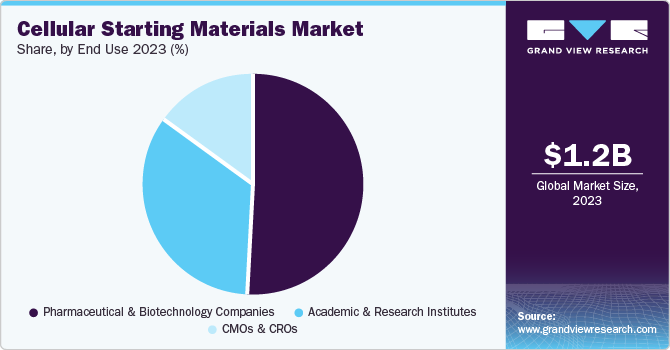

End Use Insights

The pharmaceutical and biotechnology companies segment dominated the market with the largest share of 44.87%. Cellular starting material is used in pharmaceutical and biotechnology companies for drug discovery, disease modeling, toxicology studies, high-throughput screening projects, and personalized medicine initiatives, along with the production of cell therapy products. In addition, they are utilized in screening compounds for efficacy and safety profiles before advancing to clinical trials. They are also used to assess the safety profiles of new drugs by studying their effects on human tissues without relying solely on animal models. Their physiological relevance helps identify potential drug candidates with higher success rates. For instance, in February, AstraZeneca announced a USD 300 million investment in a U.S.-based manufacturing facility to focus on T-cell therapy and cancer biology.

The CMOs & CROs segment is expected to grow at the highest CAGR over the forecast period. CMOs play a crucial role in providing manufacturing capacity and expertise for producing cellular therapies, while CROs contribute to research and development activities that bolster the advancement of these therapies. CMOs facilitate the transition from research to commercial production by providing specialized facilities and capabilities and ensuring compliance with cellular therapy requirements. In addition, several companies are venturing into the cell and gene therapy CDMO space, which is expected to impact the market positively. For instance, in January 2022, Excellos launched a new cell and gene therapy CDMO in California, U.S., with $15 million in funding and backing from the San Diego Blood Bank.

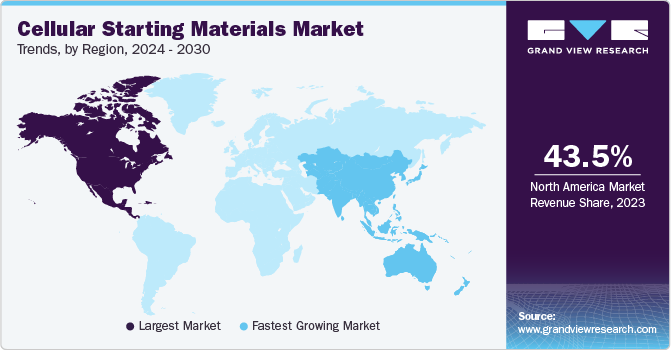

Regional Insights

North America dominated the cellular starting materials market and accounted for the largest revenue market share of 43.48% in 2023, owing to growing investments in cancer R&D. Due to the presence of several biotechnology and pharmaceutical companies working on developing new therapies for cancer and chronic diseases; the region is projected to maintain its dominance over the projected period.

U.S. Cellular Starting Material Market Trends

Cellular starting material market in the U.S. is experiencing significant trends shaping its growth and development. One of the key trends in the U.S. market is the increasing focus on personalized medicine and precision oncology. With advancements in technology and research, there is a growing emphasis on using leukopaks, cells & tissues to develop targeted therapies for individual patients based on their genetic makeup and specific disease characteristics. In addition, government initiatives in cell and gene therapy space further boost market growth. For instance, in October 2023, the government announced the establishment of two cell and gene therapy hubs in New York to support research and development of cell therapies.

Europe Cellular Starting Materials Market Trends

The cellular starting materials market in Europe is projected to witness significant growth driven by factors such as the increasing prevalence of chronic diseases due to lifestyle factors and advancements in cell therapy research for treating various conditions affecting human organ systems.

The UK cellular starting materials market is influenced by advancements in cell therapy technologies, regulatory changes impacting the use of cellular starting materials, collaborations between research institutions and industry players, and an increasing focus on personalized medicine approaches utilizing cell-based therapies.

The cellular starting materials market in France is likely influenced by advancements in biomedical research, increasing demand for personalized medicine, and the emphasis on using more biologically relevant models for drug discovery and toxicity testing.

The Germany cellular starting materials market is considered lucrative in the region owing to the rising technological advancements in cell therapy production, the country’s established biotechnology industry, and a strong emphasis on biomedical research and advancements in cancer treatment.

Asia Pacific Cellular Starting Material Market Trends

The cellular starting materials market in Asia Pacific is anticipated to witness the fastest growth at a CAGR of 23.5% from 2024 to 2030. The region is expected to witness substantial market growth, driven by factors such as increasing investments in healthcare infrastructure, rising cancer cases, and a growing focus on R&D activities related to cell-based therapeutics.

China cellular starting materials market is experiencing significant growth and development, especially in cell and gene therapies. The Chinese government is investing heavily in basic biomedical research, driving cell and gene therapy innovation. In addition, key market players are involved in the merger and acquisition activities to enhance the country's cell and gene therapy industry, which is likely to boost the cellular starting material market. For instance, AstraZeneca acquired China-based Gracell Biotechnologies to expand its CAR-T cell therapies portfolio.

The cellular starting materials market in Japan is expected to witness lucrative growth over the forecast period due to the country’s well-established biotechnology sector with a focus on innovation and research. New facility launches and investments in cell therapeutics contribute to market growth. For instance, in January 2024, the U.S.-based CDMO AGC announced its expansion in Japan by building its second facility in Yokohama. The facility will support preclinical trials through the commercial production of mammalian-based protein biologics, cell therapies, and messenger RNA therapies.

India cellular starting materials market is experiencing significant growth due to factors such as the significant presence of pharmaceutical companies in the country, rising investments in healthcare infrastructure, and a growing focus on R&D activities. Furthermore, the country's cell and gene therapy sector is experiencing foreign investments, with industries engaged in setting up new facilities in India. In February 2024, the Germany-based company Miltenyi Biotec opened its first office in Hyderabad. The company plans to establish the Miltenyi Innovation and Technology Center as the Center of Excellence (COE) for clinical development and manufacturing of cell and gene therapy.

Middle East And Africa Cellular Starting Materials Market Trends

The cellular starting materials industry in the MEA is projected to grow in the near future due to the increasing applications of biotechnology in healthcare. One of the key trends in the MEA market is the increasing focus on personalized medicine. With advancements in technology, researchers are now able to isolate primary cells from individual patients, allowing for more personalized treatment approaches. This trend is expected to drive their demand in the region as healthcare providers look for more effective and targeted therapies.

Saudi Arabia cellular starting materials market is expected to witness growth in the utilization of cellular starting materials for scientific research, drug discovery, and biotechnology. The Saudi Arabian healthcare sector continues to evolve and invest in advanced technologies. It is likely to experience a growing need for cells and tissues for applications ranging from disease modeling to personalized medicine initiatives

The cellular starting materials market in UAE is reflected by increasing investments in biotechnology research, oncology, and regenerative & personalized medicine. The government supports growth and innovation in the biotech industry by making significant investments in research and development, establishing biotechnology parks, and collaborating with global industry leaders, which is likely to enhance market growth.

Key Cellular Starting Materials Company Insights

Key players operating in the market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are playing a key role in propelling market growth.

Key Cellular Starting Materials Companies:

The following are the leading companies in the cellular starting materials market. These companies collectively hold the largest market share and dictate industry trends.

- AllCells

- Charles River Laboratories

- BioIVT

- NMDP BioTherapies.

- CGT GLOBAL

- Excellos

- Anthony Nolan

- STEMCELL Technologies.

- HumanCells Bio

- AcceGen

Recent Developments

-

In March 2024, Charles River Laboratories announced its collaboration with Navega Therapeutics, Inc. This collaboration aids Navega in accessing the established CDMO capabilities and advisory services to produce adeno-associated virus (AAV) - based gene therapy.

-

In February 2024, BioIVT expanded its UK and Europe market by increasing its capacity to deliver fresh, standard, and mobilized, human leukopaks.

-

In November 2023, Charles River Laboratories launched CliniPrime Cryopreserved Leukopaks to expand its suite of GMP-compliant offerings for cell therapy development and manufacturing.

-

In September 2023, Sanguine Biosciences opened a new qualified apheresis facility in Los Angeles, California, to collect concentrated white blood cell specimens.

-

In June 2023, StemCyte signed an agreement with a U.S.-based company specializing in immune cell therapy to provide raw materials for allogeneic modified cell therapy.

Cellular Starting Materials Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.42 billion |

|

Revenue forecast in 2030 |

USD 4.84 billion |

|

Growth rate |

CAGR of 22.74% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, grade, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

AllCells; Charles River Laboratories; BioIVT; NMDP BioTherapies.; CGT GLOBAL; Excellos; Anthony Nolan; STEMCELL Technologies; HumanCells Bio; AcceGen. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Cellular Starting Materials Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 - 2030. For this study, Grand View Research has segmented the global cellular starting materials market report based on product, grade, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Leukopaks

-

Cells & Tissues

-

-

Grade Outlook (Revenue, USD Million, 2018 - 2030)

-

GMP

-

Research-use

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biotechnology Companies

-

CMOs & CROs

-

Academic & Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cellular starting materials market size was estimated at USD 1.16 billion in 2023 and is expected to reach USD 1.41 billion in 2024.

b. The global cellular starting materials market is expected to grow at a compound annual growth rate of 22.74% from 2024 to 2030 to reach USD 4.84 billion by 2030.

b. The leukopaks segment dominated the market with the largest revenue share in 2023. Leukopaks are considered essential components in the development of cell therapies, as they contain a diverse range of immune cells, including T cells, B cells, NK cells, monocytes, and others.

b. Some of the key players operating in the market include AllCells; Charles River Laboratories; BioIVT; NMDP BioTherapies.; CGT GLOBAL; Excellos; Anthony Nolan; STEMCELL Technologies; HumanCells Bio; AcceGen.

b. The major driving factors of the market include the rising prevalence of chronic diseases such as cancer, diabetes, & autoimmune disorders, increasing investments & growing demand for cell & gene-based therapies, and technological innovations.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."