- Home

- »

- Biotechnology

- »

-

Cell Therapy Raw Materials Market, Industry Report, 2033GVR Report cover

![Cell Therapy Raw Materials Market Size, Share & Trends Report]()

Cell Therapy Raw Materials Market (2026 - 2033) Size, Share & Trends Analysis Report, By Product (Media, Sera, Antibodies, Reagents & Buffers), By End Use (CROs & CMOs, Biopharmaceutical & Pharmaceutical Companies), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-137-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cell Therapy Raw Materials Market Summary

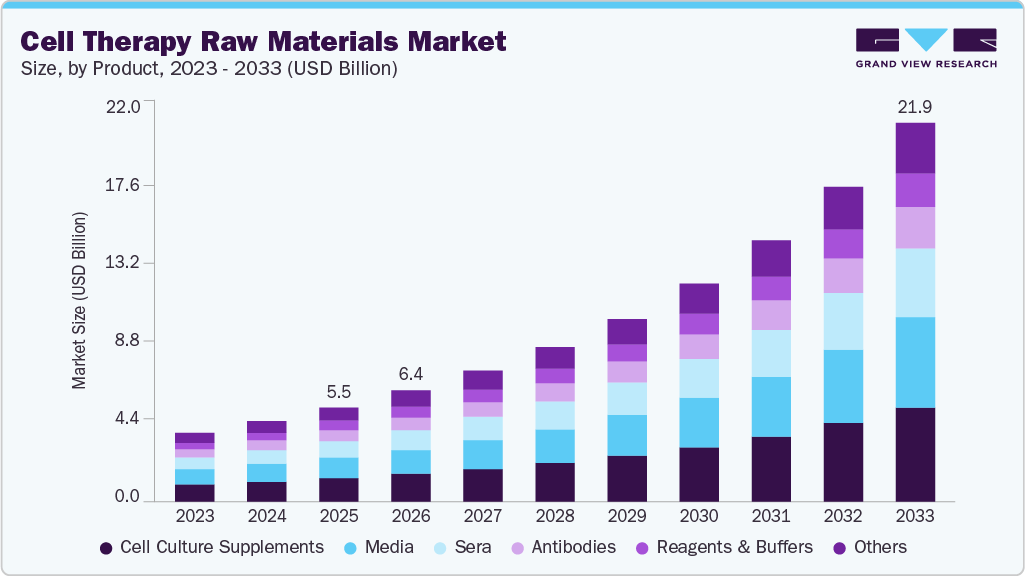

The global cell therapy raw materials market size was estimated at USD 5.47 billion in 2025 and is projected to reach USD 21.88 billion by 2033, growing at a CAGR of 19.15% from 2026 to 2033. Innovation in cell culture products, including media and sera, and the increasing prevalence of chronic diseases such as cancer, diabetes, and autoimmune disorders are expected to drive the market over the forecast period.

Key Market Trends & Insights

- The North America cell therapy raw materials industry held the largest share of 46.61% of the global market in 2025.

- The cell therapy raw materials industry in the U.S. is expected to grow significantly over the forecast period.

- By product, the cell culture supplements segment held the largest market share of 25.18% in 2025.

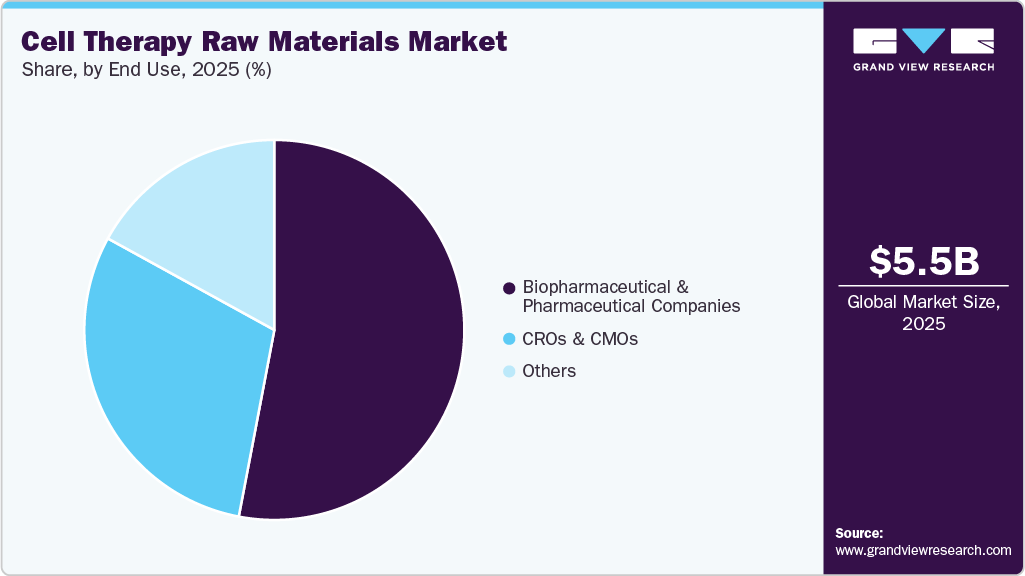

- Based on end use, the biopharmaceutical & pharmaceutical companies segment held the largest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 5.47Billion

- 2033 Projected Market Size: USD 21.88 Billion

- CAGR (2026-2033): 19.15%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

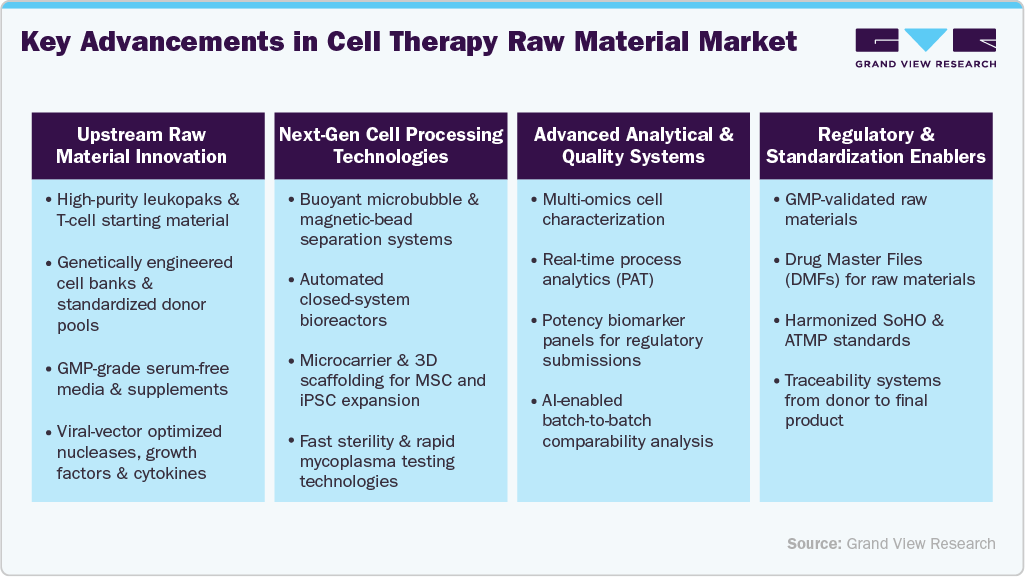

Technological InnovationThe rapid progress made in biotherapeutics, and bioprocessing is significantly boosting the raw materials used in cell therapy production. The application of techniques such as 3D cell culture, gene-edited cell lines, automated bioreactors, and cryopreservation, particularly, has made the production of therapeutic cells safer, more efficient, and easier to scale up. Consequently, the development of cells for therapy has become reliable and large-scale. Therefore, the demand for raw materials of the highest quality, such as specialized culture media, growth factors, sera, and supplements to assure cell viability and productivity at an optimum level, is also increasing.

Moreover, the growing adoption of advanced cell therapy modalities such as off-the-shelf allogeneic therapies, CAR-T/TCR immunotherapies, and iPSC-based treatments further increases the requirement for precision-engineered and regulatory-compliant raw materials. The rise of automated closed-system manufacturing platforms has also created demand for GMP-grade inputs with superior sterility and batch consistency. The expansion of pipelines and progress towards commercialization of biopharmaceutical companies, which is constantly reinforced by the strong demand for specialized raw materials, is being done through the use of innovations that are making cell therapy production more scalable and less expensive and rising demand in cell therapy market.

Rising Demand for Cell Therapies

The increasing global focus on treating complex and chronic diseases such as cancer, neurological disorders, autoimmune conditions, and rare genetic disorders has significantly intensified the demand for cell therapies. Unlike conventional treatments, cell therapies offer long-term or potentially curative outcomes by repairing, replacing, or regenerating damaged tissues at the cellular level. The expression of the medical world's preference for personalized and regenerative medicine is vividly manifested in the multitude of new treatments offered, such as CAR-T cells, NK cell therapies, and stem cell-based interventions since healthcare providers and patients are more and more looking for effective and precise therapeutic solutions, cell therapies' clinical acceptance and selling continue to grow, thus supporting market expansion.

In addition, the growing number of approved cell therapy products, along with the rising volume of ongoing clinical trials worldwide, further accelerates this trend. Cell-based treatments are receiving strong support from governments and healthcare organizations in major regions such as North America, Europe, and the Asia Pacific in the form of investment and reimbursement, which will ultimately lead to their widespread clinical application. Moreover, the expansion of specialized treatment centers and improved manufacturing capabilities is enhancing accessibility and lowering therapy timelines. As a result, the sustained rise in demand for cell therapies is creating substantial growth opportunities across the entire value chain, particularly for suppliers of raw materials, production equipment, and bioprocessing solutions needed for scalable therapeutic manufacturing.

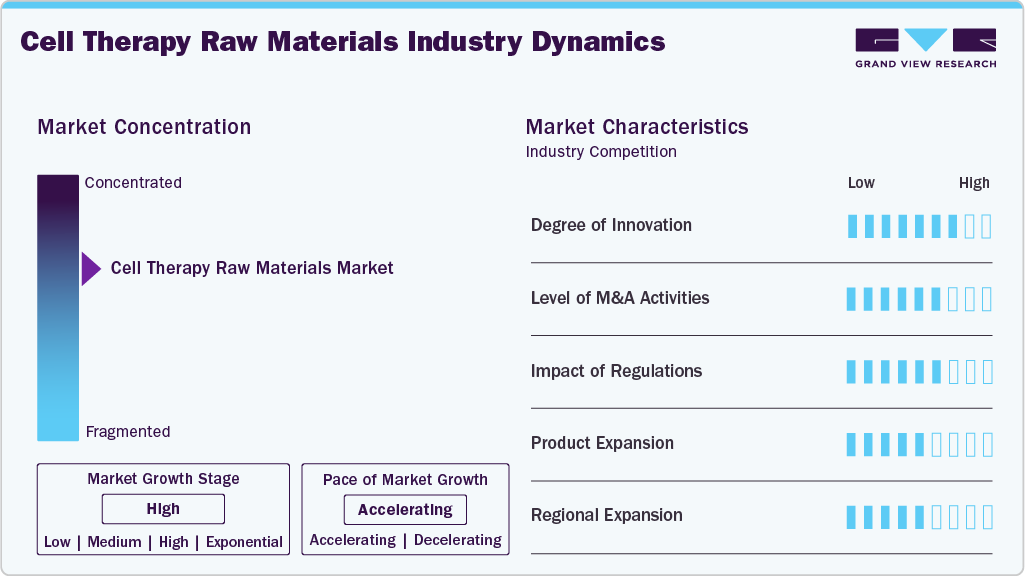

Market Concentration & Characteristics

The degree of innovation in the cell therapy raw material industry is high, driven by rapidly advancing bioprocessing technologies and the evolving needs of next-generation therapies. Suppliers in the cell therapy human raw materials market are developing specialized GMP-grade raw materials such as defined media, growth factors, viral vectors, and cryopreservation reagents to enhance safety, consistency, and scalability in cell manufacturing. The rise of automated and closed production systems further accelerates the demand for sterile, traceable, and regulation-compliant inputs, reinforcing an innovative-driven competitive landscape.

The major players in the biopharmaceutical industry join hands with the suppliers of the basic materials, and together they develop specialized reagents, culture media, and growth factors that will be used for cell therapy applications. Likewise, the academic world and research institutions work together with the raw materials companies to bring about improvements in cell culture media, biomaterials, and cell expansion methods.

The raw materials that are most important for cell-based therapies manufacturing are made safe, good, and consistent by the regulatory environment. The regulators require that, with no exception, all materials for the manufacture of cell therapy products meet GMP standards. This techs up the manufacturing process and requires more GMP-grade reagents, culture media, cytokines, and growth factors.

Product expansion is a key growth driver in the cell therapy raw material industry, with suppliers continuously broadening their portfolios to meet the evolving needs of advanced cell manufacturing. Companies are introducing specialized materials such as xeno-free media, recombinant supplements, cytokines, and high-purity reagents to support a wide range of cell therapy platforms, including CAR-T, NK, MSC, and iPSC therapies. This ongoing expansion enables end-to-end solutions, improves production compatibility and efficiency, and aligns with the growing number of clinical and commercial cell therapy programs worldwide. For instance, in June 2023, FUJIFILM Corporation launched human iPSC-derived iCell Blood-Brain Barrier Isogenic Kit. The kit replicates the human barrier between the blood and the brain and can help with drug discovery, medication development, and the study of diseases of the central nervous system.

The cell therapy raw materials industry is experiencing significant regional expansion, indicating rapid growth and increasing market presence across different geographic regions. For instance, in July 2023, Merck invested USD 24.38 million to boost cell culture media production in the U.S. It expanded the production capacity of the Lenexa facility to manufacture cell culture media.

Product Insights

The cell culture supplements segment held the largest market share of 25.18% in 2025. Due to the rising demand for animal-free cell-based therapies, the segment is anticipated to grow during the forecast period. Numerous market participants are actively exploring untapped opportunities in the market through initiatives such as the development of new products & business expansion.

The media segment is expected to register the fastest CAGR during the forecast period, driven by advancements in cell therapy R&D that require specialized media to support the growth and expansion of therapeutic cells. Increasing product development focused on stem cell-based therapies is further contributing to segment growth. For instance, in May 2023, Lonza introduced TheraPEAK T-VIVO Cell Culture Medium, a chemically defined solution made specifically to increase the production of CAR T-cells with better consistency, process control, and quicker regulatory approval.

End use Insights

The biopharmaceutical & pharmaceutical companies segment holds the largest share of 53.38% in 2025. These firms are acknowledging more and more revolutionary capability of cell therapies to cure cancer, autoimmune diseases, and degenerative conditions, which has led them to make huge contributions to the areas of research, development, and release of the respective products. The large number of activities has greatly amplified the need for top-notch raw materials required for the production of cell therapy. For instance, in September 2023, Novo Nordisk A/S announced a USD 136 million investment to establish a cell therapy manufacturing facility at Cellerator in Denmark, located at the Technical University of Denmark (DTU), to produce stem cell therapies for early clinical studies.

The CMOs & CROs segment is projected to register the fastest CAGR over the forecast period, driven by the rising trend of outsourcing in the cell therapy industry as biopharmaceutical companies increasingly rely on specialized expertise for efficient production. By offering end-to-end services from R&D to manufacturing, CROs and CMOs help reduce operational costs and risks while allowing companies to focus on core activities. This outsourcing momentum has increased demand for raw materials such as culture media and growth factors required for outsourced cell therapy manufacturing. With continued investment in cell therapy R&D, the need for these raw materials is expected to grow further, reinforcing the role of CMOs and CROs in market expansion.

Regional Insights

North America cell therapy raw materials industry dominated the global market in 2025 with a share of 46.61%, driven by the rising prevalence of chronic diseases such as cancer, diabetes, and cardiovascular disorders, which has increased demand for innovative cell-based therapies. The healthcare infrastructure of the region has been quite solid, coupled with the support of a well-established regulatory framework; all these have contributed to the development and commercialization of such therapies, thus making the region attractive for considerable government and private investment and stimulating the R&D activities.

U.SCell Therapy Raw Materials Market Trends

The U.S. cell therapy raw materials industry is experiencing significant growth due to the increasing demand for advanced therapies in areas like cancer treatment, autoimmune diseases, and regenerative medicine. For instance, in June 2023, StemCyte signed a collaboration agreement with a state-of-the-art US immune cell therapy business, to provide raw materials for drug preparation in allogeneic modified cell therapy.

Europe Cell Therapy Raw Materials Market Trends

Europe's cell therapy raw materials industry was identified as a lucrative region in this industry. The rising demand for advanced therapy medicinal products and cell biology research in Europe has shown significant development in the past few years.

The industry for raw materials used in cell therapy in the UK is experiencing significant growth, which is mainly attributed to the rising usage of cell-based therapies in the medical field for treating various ailments, including cancer, autoimmune diseases, and genetic disorders. Besides, the progress made in regenerative medicine and the trend toward personalized medication are at the same time increasing the need for top-shelf quality raw materials such as growth factors, cytokines, and cell culture media. These raw materials are at the core of cell therapy development and production, thus their quality is essential.

The cell therapy raw materials industry in Germany is experiencing significant growth, driven by the increasing demand for innovative therapies in regenerative medicine and cancer treatment.

Asia Pacific Cell Therapy Raw Materials Market Trends

Asia Pacific cell therapy raw materials industry is expected to register the fastest CAGR of 19.60% during 2026-2033, driven by the rising prevalence of chronic and degenerative diseases, including cancer, cardiovascular, and neurological disorders. The growing adoption of innovative cell therapies, along with supportive regulatory frameworks in countries like China and India, is boosting demand for raw materials needed for their production.

The cell therapy raw materials industry in China is under rapid expansion, driven by continuous innovations and investments in healthcare and biotechnology by the country. With the rise in demand for advanced treatments, like gene therapies, stem cell applications, and cancer immunotherapies, there is also a high-quality raw material that corresponds to the different culture media, growth factors, and reagents needed.

Japan’s cell therapy raw materials industry is experiencing significant growth, driven by the country’s strong focus on medical innovation and regenerative medicine. The advanced therapy demand in the areas of cancer treatment, stem cell therapy, and tissue regeneration has increased the need for high-quality raw materials like culture media, growth factors, and scaffolds.

MEA Cell Therapy Raw Materials Market Trends

The MEA cell therapy raw materials industry is driven by the rising demand for advanced therapies, leading to the increasing adoption of cell and gene therapies. These treatments can cure long-term illnesses such as cancer, autoimmune disease, and rare genetic disorders, among others. Moreover, the establishment of cell therapy labs by biopharma companies and CDMOs located in the region is accelerating the demand for top-grade raw materials such as growth factors, cytokines, and culture media.

Kuwait’s cell therapy raw materials industry is emerging, driven by growing biotech investments, research initiatives, and government support for advanced therapies.

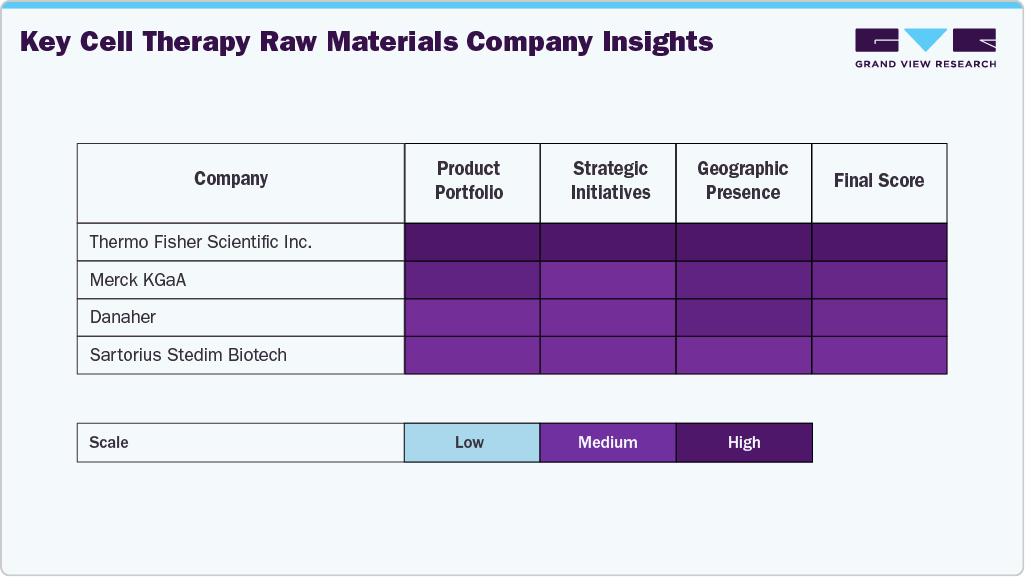

Key Cell Therapy Raw Materials Company Insights

The market for raw materials used in cell therapy is controlled by a few well-established players who use extensive product portfolios, strategic partnerships, and continuous investments in R&D to maintain their leadership positions. Major firms like Thermo Fisher Scientific Inc., Merck KGaA, Danaher, among others capture considerable market shares with their premium raw materials, diverse application areas, and worldwide distribution networks.

Companies in the market are also expanding their presence by offering innovative solutions and customized products, including culture media, growth factors, sera, and supplements, to meet the evolving needs of biopharmaceutical companies, CMOs, CROs, and research institutions involved in cell therapy development. Mergers, acquisitions, strategic partnerships, and innovations in raw material development are intensifying competition, with companies that integrate scientific advancement with customer-centric solutions best positioned to drive sustained growth in this evolving sector.

Key Cell Therapy Raw Materials Companies:

The following are the leading companies in the cell therapy raw materials market. These companies collectively hold the largest Market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Danaher

- Sartorius Stedim Biotech

- Actylis.

- ACROBiosystems

- STEMCELL Technologies.

- Grifols, S.A.

- Charles River Laboratories

- RoosterBio, Inc.

- PromoCell GmbH

Recent Developments

-

In October 2025, Akadeum Life Sciences and BioIVT in the U.S. collaborated to supply higher-quality leukopaks and T cells, enhancing starting materials for consistent, efficient cell therapy product development.

-

In December 2024, BioCentriq signed a long-term lease for a new manufacturing facility in Princeton, NJ, which will serve as its headquarters. The USD 12M investment will enhance its capabilities in cell therapy development and production

-

In October 2024, Thermo Fisher Scientific established a bioprocess design center in Genome Valley, Hyderabad. This move reflects the growing demand in the market.

Cell Therapy Raw Materials Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 6.42 billion

Revenue forecast in 2033

USD 21.88 billion

Growth rate

CAGR of 19.15% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Thermo Fisher Scientific Inc.; Merck KGaA; Danaher; Sartorius Stedim Biotech; Actylis; ACROBiosystems; STEMCELL Technologies; Grifols, S.A.; Charles River Laboratories; RoosterBio, Inc.; PromoCell GmbH

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Cell Therapy Raw Materials Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global cell therapy raw materials market report based on product, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Media

-

Sera

-

Cell Culture Supplements

-

Antibodies

-

Reagents & Buffers

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Biopharmaceutical & Pharmaceutical Companies

-

CROs & CMOs

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021- 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Innovation in cell culture products, including media, and sera, and the increasing prevalence of chronic diseases such as cancer, diabetes, and autoimmune disorders are expected to drive the market over the forecast period.

b. The global cell therapy raw materials market size was estimated at USD 5.47 billion in 2025 and is expected to reach USD 6.42 billion in 2026.

b. The global cell therapy raw materials market is expected to grow at a compound annual growth rate of 19.15% from 2026 to 2033 to reach USD 21.88 billion by 2033.

b. Based on product, the cell culture supplements segment held the largest market share of 25.18% in 2024. This is attributed to advancements in cell therapy research and development that have driven the need for specialized supplements supporting the growth and expansion of therapeutic cells.

b. Some of the key players operating in the market are Thermo Fisher Scientific, Inc., Merck KGaA, Danaher, Sartorius Stedim Biotech, Actylis, ACROBiosystems, STEMCELLS Technologies, Grifols, S.A., Charles River Laboratories, RoosterBio, Inc., and PromoCell GmbH, among other market players.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.