Cell Sorting Market Size, Share & Trends Analysis Report By Product (Cell Sorters, Reagents & Consumables), By Technology, By Application (Research, Clinical), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-990-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Cell Sorting Market Size & Trends

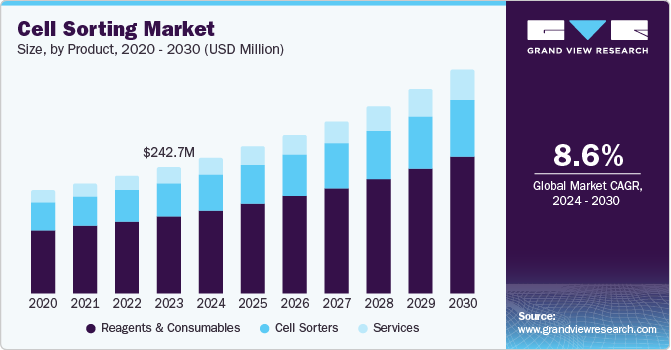

The global cell sorting market size was valued at USD 242.7 million in 2023 and is projected to grow at a CAGR of 8.6% from 2024 to 2030. The cell sorting industry has witnessed significant advancements, driven by innovations such as high-speed sorting. Four primary techniques, including Fluorescence-Based Droplet Sorting, Magnetic Activated Cell Sorting (MACS), and micro-fluidics, have enhanced the precision and effectiveness of cell sorting, thereby driving market growth.

Technological advancements are a primary driver for industry growth worldwide, with continuous innovations in cell sorting technologies, such as high-speed sorting and advanced detection capabilities, enhancing precision and efficiency. These advancements have made cell sorting tools essential in various fields, including research and clinical applications. Fluorescence-Activated Cell Sorting (FACS), in particular, is a significant contributor to the market’s growth due to its ability to provide quick and quantitative measurements of cell properties, making it an essential tool for sorting heterogeneous cell populations.

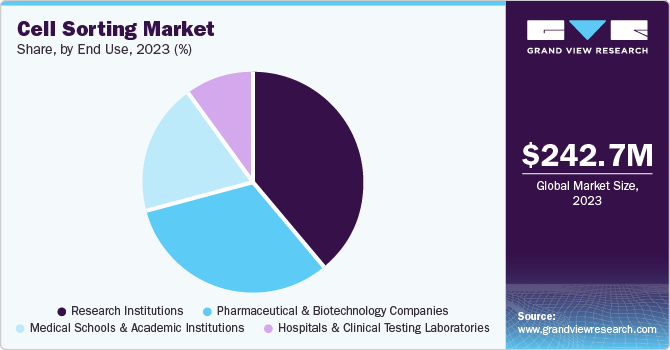

The biotechnology and pharmaceutical sectors’ expansion drives demand for advanced cell sorting technologies, essential for drug discovery, diagnostics, and research, with research institutions being the largest consumers. In addition, according to UNAIDS, nearly 40 million people are living with HIV in 2023 and around 1.3 million people are newly infected with HIV in 2023. The rising prevalence of chronic diseases, particularly HIV and cancer, is a major driver of market growth, as cell sorting technologies are essential for quantifying and characterizing infected cells.

Research and development initiatives are also driving the market’s growth, with a notable rise in research activities related to cellular analysis in fields such as immunology, stem cell research, and drug discovery. The increasing investment in cell-based therapies and applications is fueling the demand for cell sorting technologies, making them an essential tool for researchers and clinicians.

Product Insights

Reagents and consumables dominated the market with a revenue share of 61.3% in 2023. The reagents and consumables provide essential products for precise and efficient cell sorting. These products, including fluorescent dyes, antibodies, and specialized reagents, are crucial for labeling and identifying specific cell types. Growing demand for high-quality, application-specific reagents fuels market growth.

Cell sorting services are expected to register the fastest CAGR of 9.3% during the forecast period. The demand for technical support and training services is expected to rise as cell sorting technology advances, as research centers and laboratories require assistance in handling complex cell sorters. Regular maintenance services, including check-ups and calibrations, are essential to ensure optimal performance, prevent instrument breakdown, and increase durability, driving growth in the services segment.

Technology Insights

Fluorescence-based droplet cell sorting (FACS) technology accounted for the largest revenue share of 41.4% in 2023 is its highly accurate and efficient method, utilizing fluorescent tags to identify and sort cells. This technique is particularly relevant in research and diagnostic fields, offering a versatile platform for various applications. With its ability to be easily modified, fluorescence-based droplet sorting is suitable for diverse biological fields, including regenerative medicine and vaccine development.

Magnetic-activated cell sorting (MACS) technology is expected to register the fastest CAGR of 9.4% during the forecast period. The MACS technology utilizes magnetic beads coated with antibodies targeting specific cells, enabling high selectivity and minimal contamination of non-target cells. This technology is versatile, applicable to various cell types, including stem cells, immune cells, and tumor cells, making it a valuable tool across diverse fields. The MACS procedure is also straightforward to perform, differing from more complex methods.

Application Insights

Research applications held the largest share of 62.6% in 2023, leading market revenue worldwide. Substantial investments in biomedical research by government and private organizations have yielded significant advancements. The National Institutes of Health (NIH) has reported increased funding, enabling researchers to tackle complex biological questions. Collaborations between academia and industry have also flourished, leveraging cell sorting technologies to drive research goals forward.

Clinical applications are expected to register significant growth with a CAGR of 8.1% over the forecast period. The demand for cell sorting technologies has increased due to the growing prevalence of chronic diseases, such as cancer, diabetes, and autoimmunity. Healthcare professionals require advanced diagnostic methods to identify disease causes and develop effective treatments. Technologies such as FACS and microfluidics have improved the efficiency of cell sorting systems, making them a valuable tool in clinical laboratories and daily diagnostics.

End Use Insights

Research institutions led the market with a revenue share of 38.6% in 2023. Leading research institutions drive scientific innovation in fields such as cancer biology, immunology, and stem cell biology. The demand for precise and efficient cell sorting technologies fuels advancements in devices and bio-reagents. Skilled researchers, trained in operating advanced equipment, are well-equipped to adopt and innovate using these technologies, making them more likely to pioneer new developments compared to other users.

The medical schools and academic institutions segment is expected to register the fastest CAGR of 9.1% during the forecast period. Medical colleges and academic institutions often secure funding from government, private, and industry-backed grants, enabling them to invest in cutting-edge technologies such as cell sorting systems. These institutions provide intensive training sessions, allowing students to work with advanced equipment such as flow cytometry and cell sorting. This combination of education and access to technology fosters innovation and develops the next generation of scientists.

Regional Insights

North America cell sorting market is projected to grow significantly over the forecast period. The growth of the cell sorting market can be attributed to various factors, including a well-established healthcare industry, rising incidence of chronic diseases, increased R&D spending, and technological innovation driven by key players. Moreover, North America’s significant R&D expenditure, involving pharmaceutical, biotech, and university research centers, contributes to market growth.

U.S. Cell Sorting Market Trends

The cell sorting market in the U.S. dominated the North America cell sorting market with a revenue share of 85.6% in 2023. The U.S. maintains its position as a leader in cell sorting technologies, with commercially available platforms such as FACS and MACS. The country’s robust research ecosystem, comprising esteemed universities, research centers, and biotechnology organizations, fosters extensive research and innovation in cell sorting applications, including cancer, immunology, and stem cell research.

Asia Pacific Cell Sorting Market Trends

Asia Pacific cell sorting market dominated the global cell sorting market with a revenue share of 30.9% in 2023. The region is witnessing a surge in advancements in cell sorting technologies, including FACS and MACS. The region has seen significant research activities in biotechnology and pharmaceutical industries over the past decade. Developing countries such as China and India are prioritizing research and development, driving growth in the market for cell sorting systems and creating opportunities for investment.

The cell sorting market in China is expected to grow rapidly over the coming years, driven by escalating research and development in biotechnology and pharmaceuticals, as well as expanding healthcare infrastructure and investments in medical research. The prevalence of chronic diseases, such as cancer and HIV, necessitates advanced diagnostic tools, propelling demand for efficient cell sorting methods. As China prioritizes healthcare access and research capabilities, it solidifies its position as a leader in the Asia-Pacific cell sorting market.

Europe Cell Sorting Market Trends

Europe cell sorting market was identified as a lucrative region in the global cell sorting market in 2023. Europe is facing a growing burden of chronic diseases, including cancer and diabetes. To address this, the region has invested heavily in biotechnology and pharmaceutical sectors. This influx of funding has enabled increased research spending and initiatives, including those involving cell sorting technologies, which are crucial in the development of new drugs.

Germany’s cell sorting market maintained a significant market share in 2023. The country’s rigorous regulatory standards guarantee high-quality products in the biotechnology sector. Global players, headquartered in Germany, have established a strong presence, fostering innovation and attracting international collaborations, solidifying Germany’s position as a leading player in the global cell sorting market.

Latin America Cell Sorting Market Trends

Latin America cell sorting market is expected to register the second-fastest CAGR of 8.9% between 2024 and 2030. Governments and private entities in Latin America are investing significantly in healthcare infrastructure and biotechnology research. Brazil and Argentina are leading this initiative, prioritizing scientific research capabilities. Notably, Brazil’s National Health System has augmented funding for biomedical studies, fostering a conducive environment for innovation and growth in the region.

Key Cell Sorting Company Insights

Some key companies in the cell sorting market include BD; Bio-Rad Laboratories, Inc.; Danaher Corporation; and Sony Group Corporation; among others. Owing to increasing competition, market participants have been implementing tactics and strategies such as new product launches, enhanced distribution, new product launches, geographical expansion and more.

-

Miltenyi Biotecfocuses on developing innovative products and technologies for biomedical research and medical applications, particularly in the field of molecular biology. The company’s mission is to provide cutting-edge solutions that enable researchers and clinicians to advance their work in the life sciences, driving breakthroughs in scientific discovery and medical treatment.

-

On-chip Biotechnologies Co., Ltd develops advanced microfluidic technology for various applications in biotechnology, with a focus on cellular sorting. By combining cutting-edge engineering and organic sciences, the company creates innovative solutions to address complex challenges in cell analysis and manipulation, enabling researchers to gain insights and advance their work in the life sciences.

Key Cell Sorting Companies:

The following are the leading companies in the cell sorting market. These companies collectively hold the largest market share and dictate industry trends.

- BD

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- Sony Group Corporation

- Miltenyi Biotec

- On-chip Biotechnologies Co., Ltd.

- Cytonome/ST, LLC

- Union Biometrica, Inc.

- Thermo Fisher Scientific Inc.

- uFluidix

Recent Developments

-

In August 2024, Bio-Rad Laboratories, Inc. appointed Jon DiVincenzo as President and Chief Operating Officer, replacing Andy Last, who retired, bringing over three decades of industry experience in life science and clinical diagnostics.

-

In April 2024, BD launched the BD FACSDiscover S8 Cell Sorter, enabling researchers to confirm complex biological insights and isolate desired cells with ease, globally.

-

In October 2023, Sony launched the FP7000 Spectral Cell Sorter, a high-parameter sorter that supports up to 6 lasers and 182 detectors, enabling researchers to detect and sort cell populations with complex panels and multiple nozzle sizes, globally.

Cell Sorting Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 261.1 million |

|

Revenue forecast in 2030 |

USD 427.9 million |

|

Growth rate |

CAGR of 8.6% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, technology, application, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

BD; Bio-Rad Laboratories, Inc.; Danaher Corporation; Sony Group Corporation; Miltenyi Biotec; On-chip Biotechnologies Co., Ltd.; Cytonome/ST, LLC; Union Biometrica, Inc.; Thermo Fisher Scientific Inc.; uFluidix |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Cell Sorting Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cell sorting market report based on product, technology, application, end use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Cell Sorters

-

Reagents and Consumables

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Fluorescence-based Droplet Cell Sorting

-

Jet-in-air Cell Sorting

-

Cuvette-based Cell Sorting

-

-

Magnetic-activated Cell Sorting

-

MEMS - Microfluidics

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Research Applications

-

Immunology & Cancer Research

-

Stem Cell Research

-

Drug Discovery

-

Other Research Applications

-

-

Clinical Applications

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Research Institutions

-

Medical Schools and Academic Institutions

-

Pharmaceutical and Biotechnology Companies

-

Hospitals and Clinical Testing Laboratories

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."