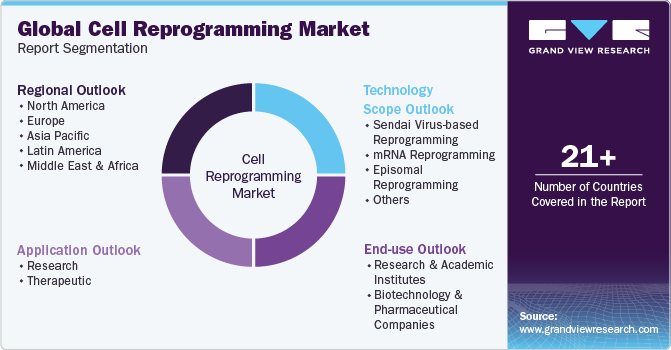

Cell Reprogramming Market Size, Share & Trends Analysis Report By Technology (Episomal Reprogramming, mRNA Reprogramming), By Application (Therapeutic, Research), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-966-2

- Number of Report Pages: 119

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Cell Reprogramming Market Size & Trends

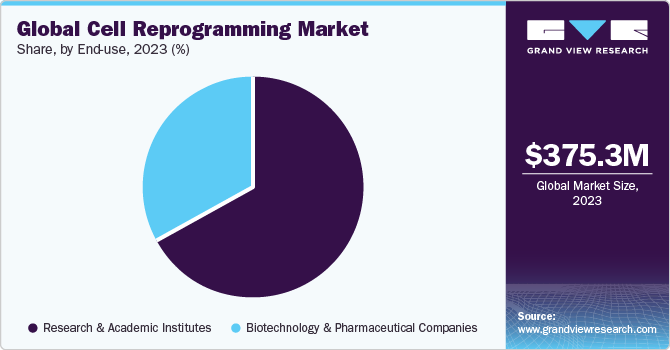

The global cell reprogramming market size was estimated to be USD 375.3 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 8.52% from 2024 to 2030. The global market growth can be attributed to the rising focus on cell reprogramming technology, increasing adoption of this technology in cancer research, and emphasis on collaboration & partnerships among key players in the market. The COVID-19 pandemic positively impacted the market growth. The pandemic increased interest in cell reprogramming R&D as this technology can potentially be used to develop new treatments for COVID-19 & its complications. For instance, in August 2020, the University of Minnesota initiated a clinical trial, treating the first patient with a new cell therapy to explore its efficacy against COVID-19.

The investigational cell therapy, FT516, originally being studied for Acute Myeloid Leukemia (AML) and lymphoma, is an engineered iPSC-derived Natural Killer (NK) cell product. This trial seeks to determine whether FT516 can effectively combat viral replication of the novel coronavirus. Even though NK cells are recognized for their role in defending the body against viral infections, the impact of COVID-19 is yet to be understood, making this trial a first-of-its-kind endeavor. Furthermore, according to the International Society for Stem Cell Research study published in December 2022, the implementation of cellular reprogramming techniques facilitates the creation of neural networks that replicate the unique characteristics of human cells, distinguishing them from those originating from rodent cells.

These reprogrammed human cell-based models showcase temporal dynamics similar to the developmental processes of the human brain. Hence, harnessing cellular models derived from reprogrammed human cells has the potential to expedite the development of effective therapies for neuropathies while concurrently playing a role in minimizing reliance on animal experimentation within laboratory environments. Moreover,companies are undertaking various business initiatives, such as collaborations and partnerships, to advance the cell reprogramming process. For instance, in January 2023, Automata, a robotics & automation company in the life sciences sector, announced a collaboration with bit.bio to automate a vital segment of the manufacturing process for their iPSC-derived human cell products.

Bit.bio's precise cellular reprogramming technology, opti-ox, is particularly suitable for automation as it ensures unprecedented consistency and scalability in manufacturing human cells from iPSCs. Leveraging Automata's expertise in large-scale lab automation, the custom-designed solution addresses a crucial step in bit.bio's production, enhancing efficiency through automation & establishing a reliable, standardized process while minimizing human errors. This collaboration aims to conserve scientists' time, optimize workflows, and improve batch-to-batch reliability.

Technology Insights

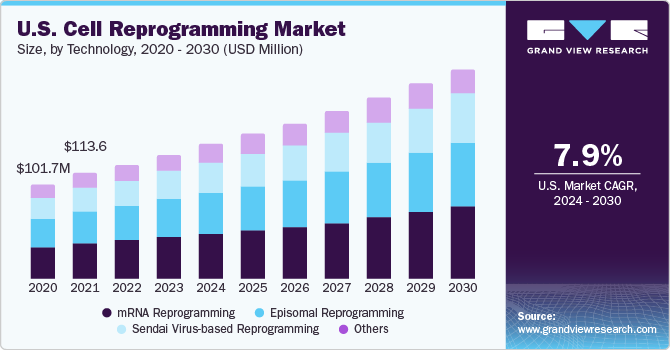

The mRNA reprogramming technology segment accounted for the highest share of 32.67% in 2023. The advancements in the mRNA reprogramming technique allow rapid, safe, and efficient generation of clinical-grade human iPS cells using somatic tissue.mRNA-based reprogramming has appeared to be the only nonviral, nonintegrating technique for producing therapeutically relevant human iPS cell lines that are reliable, safe, and efficient. As a result, this approach is commonly regarded as the most productive and well-suited footprint-free reprogramming technology for clinical generation of iPSCs. For instance, in October 2022, REPROCELL stated that its StemRNA 4th Generation Reprogramming Technologies could be used to deliver the power of mRNA reprogramming across the healthcare sector.

Hence, this will increase the demand for mRNA reprogramming and further propel market growth. The sendai virus-based reprogramming segment is expected to grow at a significant CAGR of 8.59% from 2024 to 2030. The Sendai viral vector has considerable promise for use in cell therapy, regenerative medicine, and cell engineering. For instance, according to a 2019 Europe PMC article, SeV-based cytoplasmic RNA vector is a novel platform for long-term expression of MicroRNAs. The SeVdp vector can transfer embryonic stem cell-enriched miRNAs as well as several transcription factors into fibroblasts at the same time, resulting in successful reprogramming into Induced Pluripotent Stem Cells (iPSCs).

Application Insights

On the basis of application, the research segment dominated the market with the highest share of 67.41% in 2023. Cell reprogramming is the quickest and most efficient approach to producing cell cultures from patient tissue samples. This allows researchers to identify whether cancers are susceptible to immunotherapies or anticancer drugs. For instance, researchers of National Cancer Institutes conducted a lung tumor biopsy using reprogrammed cells and developed a therapeutic treatment for the patient using the grown cells within a week. Similarly, in August 2020, researchers at Stanford Institute reprogrammed the cancer cells back to their pre-cancer identity. This paved the way for early diagnosis of cancer and the development of preventive treatments.

The therapeutic segment is projected to exhibit the fastest CAGR of 9.44% from 2024 to 2030. Along with the current rise in scientific research surrounding cell reprogramming therapeutics, there have been several noteworthy advancements by businesses attempting to commercialize the technology. For instance, Asgard Therapeutics AB reports that the U.S. Patent & Trademark Office approved Asgard's core patent for reprogramming cells to take on the characteristics of dendritic cells. Until 2038, the patent guarantees protection and commercial exclusivity for goods based on this technology. These factors are expected to increase demand for cell reprogramming technology and boost overall market growth.

End-use Insights

The research & academic institutes segment captured the largest share of 67.41% in 2023. The development of innovative approaches to safely reprogram cells has aided biotechnology companies in increasing the clinical efficacy and safety of standard stem cell therapies. For instance, in March 2020, as per an article published by Science Advances, cell reprogramming offers various opportunities for an effective and quicker way to generate new pluripotent stem cells. Furthermore, industry players and the research community are focusing on iPSCs to produce a wide range of human cell types with therapeutic potential as a result of the persistent research for alternative sources of cell types for regenerative therapies, boosting market growth.

However, the biotechnology & pharmaceutical companies segment is projected to register the fastest CAGR of 9.44% from 2024 to 2030. New competitors are entering the market with advanced technology to meet rising demand and seize previously undiscovered market opportunities. For instance, in January 2020, Allele Biotechnology & Pharmaceuticals, Inc. and Astellas Pharma, Inc. entered into a licensing agreement through its subsidiary Astellas Institute for Regenerative Medicine (AIRM) to increase focus on expanding its core competency in reprogramming somatic cells into iPSCs. Allele's researchers and cGMP team are also committed to developing & validating cell assays for product quality control, genome analysis workflows, & closed-system technologies for reprogramming, including machine learning in iPSC-related sectors to fully capitalize on unmatched potential of iPSC.

Regional Insights

North America dominated the market with a share of 38.65% in 2023. The presence of key players in this region supports its highest revenue share. Moreover, companies are undertaking numerous business initiatives that help fuel regional industry growth. For instance, in July 2023, Stem Genomics SAS and Pluristyx, Inc. announced an equity investment and partnership in Stem Genomics. This collaboration aims to provide a streamlined approach, enabling customers to assess the genomic strength of Pluripotent Stem Cell (PSC) lines of Pluristyx by leveraging iCS-digital PSC assay of Stem Genomics. Asia Pacific region is expected to grow at a significant CAGR of 9.03% from 2024 to 2030 due to factors high prevalence of chronic conditions, widespread product adoption for analysis & visualization, technological advances, and rising R&D investments.

Moreover, various companies are introducing studies based on multiomics. For instance,in February 2023, Novo Nordisk A/S and Heartseed, Inc. achieved a significant milestone by administering the first dose to a patient in the phase 1/2 clinical study, known as the LAPiS Study, for HS-001—an investigational cell therapy targeting heart failure. HS-001 comprises purified heart muscle cell clusters, or cardiomyocyte spheroids, derived from iPSCs. The therapy aims to rejuvenate heart muscle and restore heart function in individuals with advanced heart failure. Preclinical studies have demonstrated the potential of iPSC-derived cardiomyocytes to enhance heart function. Thus, the increasing focus of players in Asia Pacific also highlights the regional market's growth.

Key Companies & Market Share Insights

Key players are undertaking various strategic initiatives to maintain their market presence. In addition, numerous strategic initiatives enable market players to strengthen their business avenues. For instance, in July 2023, Pluristyx, Inc. entered into an agreement with the Advanced Regenerative Manufacturing Institute (ARMI) | BioFabUSA to manufacture and market clinical-grade Pluristyx’s reprogrammed iPSCs. This collaboration aims to expedite the scalable, consistent, and cost-effective production of stem cell-derived products for patient use. The agreement facilitates ARMI | BioFabUSA, its affiliates, and members to efficiently access high-quality clinical-grade iPSCs for manufacturing cell & gene therapies.

Key Cell Reprogramming Companies:

- Thermo Fisher Scientific, Inc.

- Allele Biotech

- ALSTEM

- STEMCELL Technologies Inc.

- Merck KGaA

- Bio-Techne

- REPROCELL

- Lonza

- FUJIFILM Corporation (Fujifilm Cellular Dynamics)

- Mogrify Limited

Cell Reprogramming Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 406.6 million |

|

Revenue forecast in 2030 |

USD 664.2 million |

|

Growth rate |

CAGR of 8.52% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

November 2023 |

|

Quantitative units |

Revenue in USD million, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Technology, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait |

|

Key companies profiled |

Thermo Fisher Scientific, Inc.; Allele Biotech; Alstem; Stemcell Technologies Inc.; Merck KGaA; Bio-Techne; REPROCELL; Lonza; FUJIFILM Corp. (Fujifilm Cellular Dynamics); Mogrify Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Cell Reprogramming Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cell reprogramming market report on the basis of technology, application, end-use, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Sendai Virus-based Reprogramming

-

mRNA Reprogramming

-

Episomal Reprogramming

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Research

-

Therapeutic

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Research & Academic Institutes

-

Biotechnology & Pharmaceutical Companies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cell reprogramming market size was estimated at USD 375.3 million in 2023 and is expected to reach USD 406.6 million in 2024.

b. The global cell reprogramming market is expected to grow at a compound annual growth rate of 8.52% from 2024-2030 to reach USD 664.2 million by 2030.

b. North America dominated the cell reprogramming market with a share of 38.65% in 2023. This major share can be supported by ongoing iPSC technology advancements and the availability of functional cells for pre-clinical drug testing.

b. Some key players operating in the cell reprogramming market include Thermo Fisher Scientific, Inc., Allele Biotech, ALSTEM, STEMCELL Technologies Inc., Merck KGaA, Bio-Techne, REPROCELL, Lonza, FUJIFILM Corporation (Fujifilm Cellular Dynamics), and Mogrify Limited, among others

b. The growth of the cell reprogramming market can be attributed to the growing focus on cell reprogramming technology, increasing adoption of cell reprogramming in cancer research, and emphasis on collaboration and partnerships among key players in the market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."