Cell Processing Instruments Market Size, Share & Trends Analysis Report By Type (Cell Counters, Cell Imaging Systems, Flow Cytometers), By Application (Cell Isolation/Separation, Cell Viability & Proliferation), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-262-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Cell Processing Instruments Market Trends

The global cell processing instruments market size was estimated at USD 6.06 billion in 2023 and is projected to grow at a CAGR of 7.04% from 2024 to 2030. The market growth can be attributed to the rising prevalence of chronic diseases, increasing investments in research and development, and the growing number of clinical trials for cell-based therapies. Moreover, the increasing number of collaborations, and partnerships amongst market players is also expected to have a positive impact on market growth.

For instance, in February 2024, Thermo Fisher Scientific Inc. and Multiply Labs expanded their partnership. It aims to automate cell therapy production through a combination of robotics and automation of instruments. This is to reduce the amount of manufacturing space needed to produce cell therapies.

The market has a positive impact during the pandemic. Several factors such as the growing demand for vaccines and therapeutics accelerated the market growth over the COVID period. Moreover, the pandemic highlighted the potential of various cell-based therapies for treating infectious diseases, immune disorders, and many other conditions. Thus, increasing the awareness and intrest in cell therapies has further boosted the market growth. In addition, significant government investments were made towards the research and development of COVID-19 vaccines and treatment, thereby propelling the market growth.

Furthermore, the rise in clinical trials for cell-based therapies serves as a strong market driver for companies supplying cell processing instruments. This trend creates a demand for innovative solutions that can efficiently process and manipulate cells for therapeutic purposes. For instance, in May 2022,a team of researchers from the UBC Faculty of Medicine and Vancouver Coastal Health (VCH) was funded with USD 1 million by Canada's Stem Cell Network to undertake a clinical trial and research for a genetically engineered cell replacement therapy for type 1 diabetes - one of the first treatments of its kind in the world. Furthermore, companies in the cell processing instrument sector are experiencing increased opportunities for growth and expansion, driven by the need to meet the rising demands of the expanding cell therapy market.

Moreover, the market is expected to experience the significant growth in the coming years, driven by the increasing demand for personalized medicine. With the rise of cell-based therapies, medical practitioners are anticipated to develop treatments that are tailored to the unique biology of individual patients through the extraction and modification of cells from the individual's body as necessary. These therapies present a promising avenue for precisely targeted disease treatment. Thereby, the demand for cell processing instruments is predicted to grow exponentially with the increasing adoption of personalized medicine, creating significant opportunities for businesses operating in this market over the forecast period.

Market Concentration & Characteristics

The cell processing instruments industry has seen significant innovation in recent years, with the introduction of advanced technologies that have improved the efficiency and accuracy of cell processing. This has led to the development of more advanced instruments for cell processing, including automated systems that can perform multiple tasks simultaneously. The market is expected to continue to grow in the coming years as demand for cell therapies increases, and new technologies are developed to meet this demand.

In this industry, partnerships and collaboration activities are moderately prevalent, reflecting a medium level of engagement within the industry. Cell processing instruments are used across various industries such as pharmaceuticals, biotechnology, and research institutions. Collaborations allow companies to tailor their products to specific applications or industries, expanding their market reach. For instance, in February 2024, Danaher announced their strategic collaboration with Cincinnati Children’s Hospital Medical Center anticipating to enhance patient safety through early drug development. Thus, boosting the demand for cell processing instruments for the drug development process.

The cell processing instruments industry is heavily regulated, with strict guidelines and standards in place to ensure the safety and efficacy of cell-based therapies. Regulations can have a significant impact on the market growth, as they can increase the time and cost of developing and manufacturing cell processing instruments. In addition, strict regulations can limit the number of companies that can enter the market, as they need more resources to meet regulatory requirements. On the other hand, regulations can also provide a level of assurance to customers and investors, as they can ensure that products are safe and effective.

The industry has seen significant growth in recent years, driven by the increasing demand for cell-based therapies and personalized medicine. Many companies in the industry are expanding their product portfolios to offer a wider range of instruments and services. These expansions include the development of new instruments, such as automated cell sorters.

The industry is experiencing a high level of regional expansion, indicating rapid growth and increasing market presence across different geographic regions. This expansion is driven by several factors, including the growing adoption of cell-based therapies, regenerative medicine approaches, and immunotherapies worldwide. For instance, in May 2023, Aurigene Pharmaceutical Services a subsidiary of Dr. Reddy announced an investment of USD 40 million for the expansion of a production facilty for therapeutic areas.

Type Insights

Based on type, the market is segmented into cell counters, cell imaging systems, flow cytometers, cell separator systems, automated cell processing systems, and other instruments. The cell separator systems segment led the market with the largest revenue share of 22.25% in 2023. This is attributed to the continuous advancements in cell separator technology. Modern cell separator systems feature automation, real-time monitoring, and integration with advanced analytical techniques, enabling high-throughput processing and precise cell isolation. For instance, in February 2024, Multiply Labs and Thermo Fisher Scientific extended their partnership to automate cell expansion and separation in cell therapy manufacturing. The utilization of Multiply Labs' robotic technology to automate Thermo Fisher's state-of-the-art, GMP-ready instruments aims to decrease expenses and expedite timelines, thereby enhancing the scalability and accessibility of cell therapy. Thus, this collaboration is further anticipated to boost the market growth over the forecast period.

The cell imaging systems segment is expected to grow at the fastest CAGR over the forecast period. Single-cell analysis has emerged as a powerful tool in various fields, including cancer research, neuroscience, and drug discovery. Cell imaging systems capable of analyzing individual cells with high throughput and resolution are essential for studying cellular heterogeneity and understanding complex biological systems at the single-cell level and thus are expected to boost market growth over the forecast years. For instance, in March 2024, Deepcell announced the final beta testing instruments, the REM-I platform's full launch. This platform integrates single-cell imaging, sorting, and high-dimensional analysis, promising innovative discoveries in fields like cancer biology, stem cell biology, and gene therapy.

Application Insights

Based on application, the market is segmented into cell separation/isolation, cell imaging & counting, cell viability & proliferation, and other applications. The cell isolation/separation segment led the market with the largest revenue share of 35.30% in 2023. Advances in cell isolation and separation technologies have led to the development of more sophisticated and efficient instruments. These advancements include the introduction of microfluidic systems, magnetic cell sorting technologies, and automated platforms, which offer higher throughput, improved purity, and reduced processing times. For instance, in October 2023, Akadeum Life Sciences announced the preview of their Alerion cell separation system, leveraging Buoyancy Activated Cell Sorting (BACS) microbubble technology to efficiently isolate T-cells from leukopaks. This innovative system promises accelerated separation, increased recovery, automated processes, and reduced errors. Thus, anticipated to boost the market growth over the forecast period.

The cell viability and proliferation segment is expected to grow at the fastest CAGR over the forecast period. There is a growing emphasis on understanding cellular behavior, including viability and proliferation, across various fields such as drug discovery, regenerative medicine, and cancer research. For instance, according to a press release published by Genetic Engineering & Biotechnology News in September 2023, Xheme's Multifunctional Additive (XMA), developed at the University of Massachusetts Amherst Innovation Institute, significantly boosts cell viability and proliferation. Integration into plastics increases viability by about 15%, while direct addition to cell cultures enhances it by 50%. Partner analyses at O2M Technologies and the UMass Institute for Applied Life Sciences confirm these effects, with separate experiments showing minimal leaching of XMA into solutions over 50 days. Thus, it is projected to propel the market growth over the forecast period.

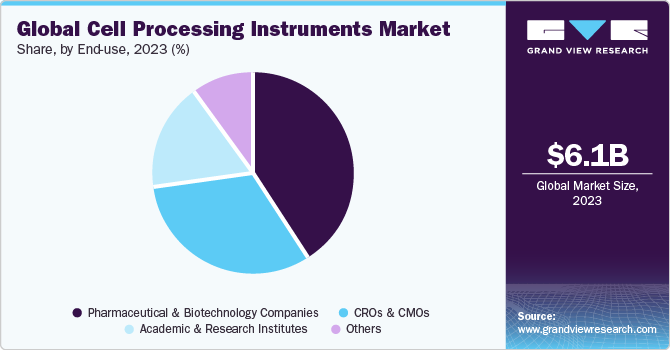

End-use Insights

Based on end-use, the market is segmented into pharmaceutical & biotechnology companies, CROs & CMOs, academic & research institutes, and others. The pharmaceutical & biotechnology companies segment led the market with the largest revenue share of 41.13% in 2023. This is attributed to the rising focus on R&D for the development of novel drugs, growing demand for personalized medicines, and advancements in cell-based therapies such as stem cell therapy and gene therapy. For instance, in June 2023, Quell entered into a collaborative agreement with AstraZeneca, specifically targeting autoimmune diseases through cell therapy. Such collaborations are expected to propel the market growth over the forecast period.

The CROs & CMOs segment is expected to register the fastest CAGR over the forecast period. This is attributed to the increasing outsourcing of research and manufacturing activities by pharmaceutical and biotechnology companies. Moreover, it offers various services such as drug discovery, preclinical and clinical trials, and manufacturing of cell-based therapies, thus, increasing the demand for cell processing instruments. For instance, in April 2023, Lotte Biologics, the biopharmaceutical contract development and manufacturing organization (CDMO) company of South Korea, announced that it had entered into a memorandum of understanding (MOU) with Swiss-based cell line development company Excellgene for collaboration on contract development organization (CDO) services.

Regional Insights

North America dominated the cell processing instruments market with a revenue share of 36.22% in 2023. The market is driven by factors such as the presence of prominent biotechnology & pharmaceutical companies, strong research & academic infrastructure, and early adoption of advanced technologies. Furthermore, significant resources to R&D initiatives in the biotechnology sector are further anticipated to boost the demand for cell processing instruments in the region. For instance, in December 2023,Beckman Coulter Life Sciences got FDA approval for the distribution of the AQUIOS STEM System in the U.S. This is anticipated to provide researchers with precise hematopoietic stem cell enumeration thereby boosting the market growth in the segment.

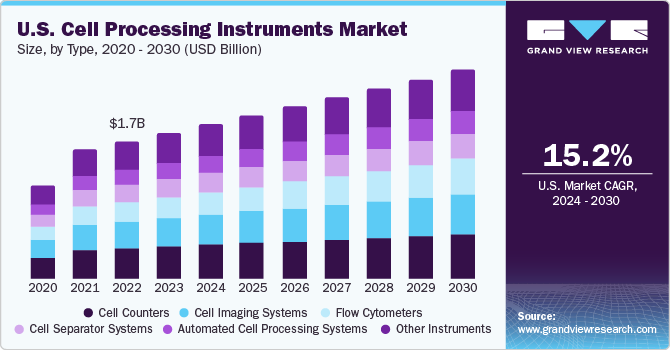

U.S. Cell Processing Instruments Market Trends

The cell processing instruments market in the U.S. is expected to grow at the fastest CAGR over the forecast period, due to presence of large number of market players in the U.S., undergoing various strategic initiatives such as collaborations and partnerships.

Europe Cell Processing Instruments Market Trends

The cell processing instruments market in Europe was identified as a lucrative region in this industry. This can be attributed to the strong biotechnology & pharmaceutical sectors. Several biotechnology & pharmaceutical companies are getting established, and rising startups, and many research institutions collaborating are anticipating boosting the market growth.

The UK cell processing instruments market held a significant share in 2023. In August 2023, Lightcast Discovery Ltd., a UK-based startup completed a USD 49 million (£38M) Series B funding round led by M Ventures, with participation from existing investors ARCH Venture Partners, Illumina Ventures, OMX Ventures, +ND Capital, and Longwall Ventures. This growing investment is anticipated to boost the demand for cell processing instruments over the forecast period.

The cell processing instruments market in France is expected to grow at the fastest CAGR over the forecast period. In November 2023, AstraZeneca announced an investment of USD 245 million in a France-based biotech organization Cellectis. This investment is anticipated to boost the development of therapeutic areas across immunology, oncology, and rare diseases.

The Germany cell processing instruments market is anticipated to grow at a significant CAGR over the forecast period. In June 2023, Singleron announced the launch of two instruments, i.e., NEO and Python Junior which are expected to standardize single-cell analysis workflow.

Asia Pacific Cell Processing Instruments Market Trends

The cell processing instruments market in Asia Pacific is anticipated to grow at the fastest CAGR of 10.00% over the forecast period. This upsurge is attributed to the growing biotechnology & pharmaceutical sectors within the region, propelled by factors such as heightened healthcare spending, rising incidences of chronic disorders, and the expansion of research & development activities. As companies in these sectors are seeking to strengthen their capabilities in drug discovery, personalized medicine, and diagnostics, there is an increasing demand for cutting-edge technologies.

The China cell processing instruments market is expected to grow at the fastest CAGR over the forecast period. This is attributed to rising chronic diseases such as cancer diabetes, and cardiovascular diseases which are anticipated to increase the demand for various drugs thereby boosting the market growth.

The cell processing instruments market in Japan is expected to witness a rapid CAGR during the forecast period, due to the presence of several pharmaceutical & biotechnology companies, rising health consciousness, and growing demand for preventive healthcare is anticipated to boost the demand for cell processing instruments for various research and clinical purposes.

Middle East & Africa Cell Processing Instruments Market Trends

The cell processing instruments market in Middle East & Africa is expected to grow at an exponential CAGR over the forecast period, due to several key factors. Various factors are contributing to the growth of the healthcare sector such as growing investments in healthcare infrastructure and research, a surge in the incidence of chronic disorders, the widespread adoption of advanced diagnostic technologies, governmental efforts to enhance healthcare standards, and the expansion of international collaborations with partners and corporations.

The Saudi Arabia cell processing instruments market is expected to grow at the fastest CAGR over the forecast period. The growing collaborations among research & academic institutes for biotechnology-related research are anticipated to boost the market growth.

The cell processing instruments market in Kuwait is anticipated to grow at the fastest CAGR over the forecast period, owing to the increasing healthcare expenditure to improve healthcare infrastructure, services, and technology adoption.

Key Cell Processing Instruments Company Insights

The players operating in the global market are adopting product approval to increase the reach of their products in the market and improve the availability of their products in diverse geographical areas, along with expansion as a strategy to enhance production/research activities. In addition, several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

Key Cell Processing Instruments Companies:

The following are the leading companies in the cell processing instruments market. These companies collectively hold the largest market share and dictate industry trends.

- Danaher

- Merck KGaA

- Thermo Fisher Scientific Inc.

- Agilent Technologies Inc.

- BD

- Bio-Rad Laboratories, Inc

- Sartorius AG

- Bio-Techne.

- Revvity Inc.

- Miltenyi Biotec

Recent Development

-

In May 2023, BD announced the commercial launch of BD FACSDiscover S8 Cell Sorter, a first-of-its-kind that uses a high-speed cell imaging system. Thus, this instrument features two technologies, which would enable researchers to understand cells more precisely and effectively

-

In June 2023, BD announced the launch of a novel robotic system BD FACSDuet to automate clinical flow cytometry, which would anticipate better standardization in sample preparation

-

In October 2023, Molecular Devices, LLC., announced the launch of CellXpress.ai Automated Cell Culture System. This product is anticipated to increase drug discovery faster, thereby boosting the market growth

-

In January 2023, Curate Biosciences announced the launch of, the Curate Cell Processing System, which is a one-of-a-kind system designed to produce high-quality starting materials for various cell therapies, including CAR-T cancer therapies. This new system is expected to offer better results and improved outcomes in the field of cell therapy

Cell Processing Instruments Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 6.47 billion |

|

Revenue forecast in 2030 |

USD 9.74 billion |

|

Growth rate |

CAGR of 7.04% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait |

|

Key companies profiled |

Danaher; Merck KGaA; Thermo Fisher Scientific Inc.; Agilent Technologies Inc.; BD; Bio-Rad Laboratories, Inc; Sartorius AG; Bio-Techne.; Revvity Inc.; Miltenyi Biotec |

|

Customization scope |

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Cell Processing Instruments Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global cell processing instruments market report based on type, application, end-use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Cell Counters

-

Cell Imaging Systems

-

Flow Cytometers

-

Cell Separator Systems

-

Automated Cell Processing Systems

-

Other Instruments

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cell Isolation/Separation

-

Cell Imaging & Counting

-

Cell Viability & Proliferation

-

Other Applications

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biotechnology Companies

-

CROs & CMOs

-

Academic & Research Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cell processing instruments market size was estimated at USD 6.06 billion in 2023 and is expected to reach USD 6.47 billion in 2024.

b. The global cell processing instruments market is expected to grow at a compound annual growth rate of 7.04% from 2024 to 2030 to reach USD 9.74 billion by 2030.

b. Based on type, the cell separator systems segment dominated the market with a share of 22.25% in 2023. This is attributed to the continuous advancements in cell separator technology.

b. Some key players operating in the cell processing instruments market include Danaher; Merck KGaA; Thermo Fisher Scientific Inc.; Agilent Technologies Inc.; BD; Bio-Rad Laboratories, Inc; Sartorius AG; Bio-Techne.; Revvity Inc.; Miltenyi Biotec

b. Key factors that are driving the cell processing instruments market growth include the rising prevalence of chronic diseases, increasing investments in research and development, and the growing number of clinical trials for cell-based therapies.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."