- Home

- »

- Medical Devices

- »

-

Cell And Gene Therapy Bioanalytical Testing Services Market, 2030GVR Report cover

![Cell And Gene Therapy Bioanalytical Testing Services Market Size, Share & Trends Report]()

Cell And Gene Therapy Bioanalytical Testing Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Test Type (Bioavailability & Bioequivalence Studies, Pharmacokinetics), By Stage Of Development, By Product Type, By Indication, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-078-3

- Number of Report Pages: 261

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

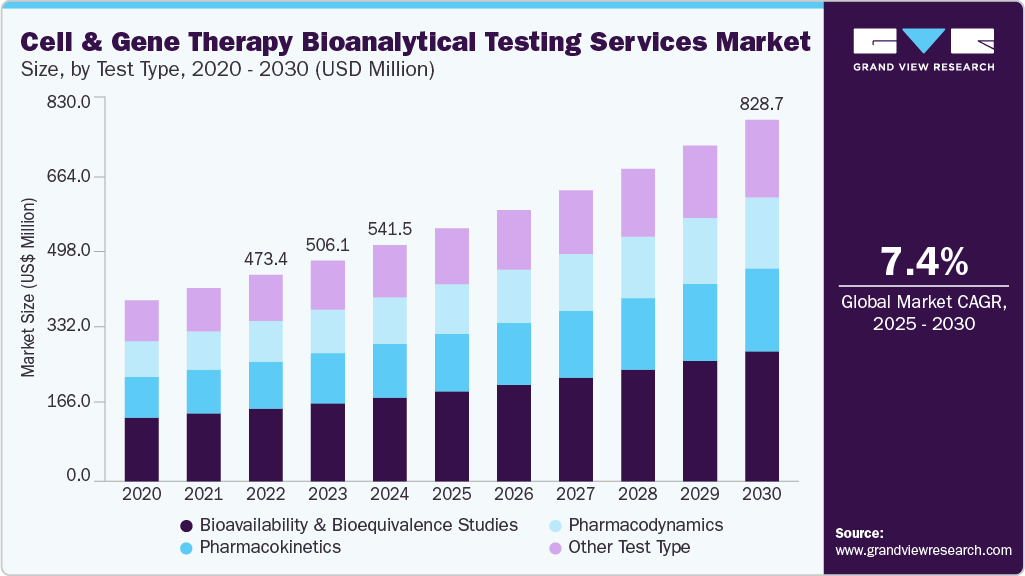

The global cell and gene therapy bioanalytical testing services market size was valued at USD 541.5 million in 2024 and is expected to grow at a CAGR of 7.40% from 2025 to 2030. Capitalization of the untapped potential of cell & gene therapies in treating life-threatening diseases and rare diseases is one of the significant factors that is driving the demand for cell & gene therapy bioanalytical testing services.

Key Highlights:

- North America dominated the cell & gene therapy bioanalytical testing services market and accounted for the largest revenue share of 41.57% in 2024.

- The cell and gene therapy bioanalytical testing services market in the U.S. is anticipated to witness significant growth over the forecast period.

- By test type, the bioavailability & bioequivalence studies dominated with a market share of 35.44% in 2024 and are also expected to witness the fastest growth over the forecast period.

- By stage of development by product type, the non-clinical segment dominated the market in 2024.

- By product type, the cell therapy segment dominated the product segment in 2024.

Moreover, rising research activities coupled with the rising funding for clinical research in cell & gene therapy, and the significant rise in the number of cell and gene therapy drug candidates undergoing clinical trials, present a key driver for the cell & gene therapy bioanalytical testing services industry.

Cell & gene therapies have been widely used in cancer, autoimmune diseases, rare diseases, and others. CAR-T therapies are one of the most advanced therapies, capable of detecting and killing cancer cells more effectively. CAR-T cell therapies hold most of the gene-modified cell therapies, and around 90% are currently under preclinical testing for oncology-related diseases. Hence, the aforementioned factors are anticipated to boost market growth

The development of cell & gene therapy is expensive. Therapy costs range from around USD 400,000 to over USD 2 million per dose. The high cost of the treatment is due to the high cost involved in drug development and manufacturing. There is a growing need to reduce the in-house costs of manufacturers in developing cell & gene therapy; therefore, outsourcing clinical research services such as bioanalytical testing and drug manufacturing to contract developers reduces the overall cost of cell & gene therapy drugs. This is expected to support market growth.

A significant number of cell & gene therapy-related drugs are under clinical studies. For instance, in a remarkable development, a six-month-old patient named KJ received a custom CRISPR-based gene editing therapy aimed at correcting a mutation responsible for CPS1 deficiency, a rare and potentially fatal liver condition. This innovative treatment, created by scientists at the Children's Hospital of Philadelphia and the University of Pennsylvania, is the first in vivo gene editing therapy explicitly designed for an individual patient. Moreover, according to a leading publisher, Pharma Intelligence, Asia Pacific has witnessed a boom in the cell & gene therapy research industry over the past few years. The majority of cell & gene therapy-related pipelines are in Asia Pacific owing to high awareness about the potential of cell & gene therapy in treating life-threatening diseases. A significant number of trials conducted in cell & gene therapy are expected to support market growth.

Opportunity Analysis

The cell and gene therapy (CGT) sector offers significant opportunities for bioanalytical testing service providers, fueled by a growing pipeline of complex biologics. As regulatory agencies enhance their requirements relating to potency, vector copy number, immunogenicity, and biodistribution evaluations, the demand for specialized bioanalytical skills is increasing. Besides, there are significant prospects in developing validated assays for viral vectors such as AAV and lentivirus, CAR-T cells, and gene-edited products. Service providers with expertise in qPCR, ddPCR, flow cytometry, and ELISA-based immunoassays are strategically placed to support studies from preclinical phases to post-market evaluations. The need for companion diagnostics and ongoing patient follow-up testing further accelerates this growth. Many emerging CGT sponsors may not have in-house testing capabilities and are turning to bioanalytical contract research organizations (CROs) for support. Moreover, the key differentiators will include the establishment of GLP-compliant laboratories, expedited turnaround times, and the provision of regulatory support services. Overall, CGT products' intricate nature and stringent regulatory requirements position bioanalytical testing as a vital and high-value area for specialized CROs and laboratories worldwide.

Funding/Investment Analysis

Investment in cell therapies has surged due to their immense market potential, driven by successful clinical trials and regulatory approvals. Technological advancements like CRISPR-Cas9 have enhanced the efficacy & safety of cell-based treatments, attracting investors seeking high-growth opportunities in the biotechnology sector. Strategic partnerships and regulatory support further accelerate development timelines and mitigate risks. Global investment trends show a diversification of portfolios, with the U.S., Europe, and Asia all witnessing increased funding in this space. Despite promising prospects, challenges such as manufacturing scalability and reimbursement hurdles highlight the need for cautious investment strategies. On the other hand, start-ups play a crucial role in driving innovation and expanding the landscape of cell therapies. These companies often pioneer novel approaches and technologies, capitalizing on scientific breakthroughs to develop cutting-edge therapies for various diseases.

Impact of U.S. Tariffs on the Global Cell & Gene Therapy Bioanalytical Testing Services Market

U.S. tariffs on imported scientific equipment, reagents, and laboratory supplies have considerably impacted the global cell & gene therapy bioanalytical testing services industry. These tariffs have increased the operational costs for cell & gene therapy bioanalytical testing Services. The increased costs are primarily due to the tariffs directly affecting the prices of high-precision instruments, chromatographic columns, reagents, and bioanalytical kits, many of which are sourced from international suppliers, including those in China and the European Union. Thus, due to these rising expenses, biotech companies, especially small and medium-sized enterprises, face financial strain that could lead to reduced research and development budgets. This economic pressure may ultimately delay innovation and the rollout of new therapies. To address these challenges, some companies seek to relocate clinical trials to regions with lower operating costs, such as Europe, which is known for its established infrastructure and favorable regulatory conditions.

Moreover, major pharmaceutical companies like Roche have declared substantial investments in U.S. manufacturing. Roche intends to allocate USD 50 billion over the next five years to construct new facilities, including a gene therapy manufacturing plant in Pennsylvania, to decrease dependency on imports & sidestep tariff-related expenses. Furthermore, U.S. tariffs have disrupted supply chains, raised costs, and prompted strategic adjustments in the CGT bioanalytical testing services sector, affecting global business operations and investment decisions.

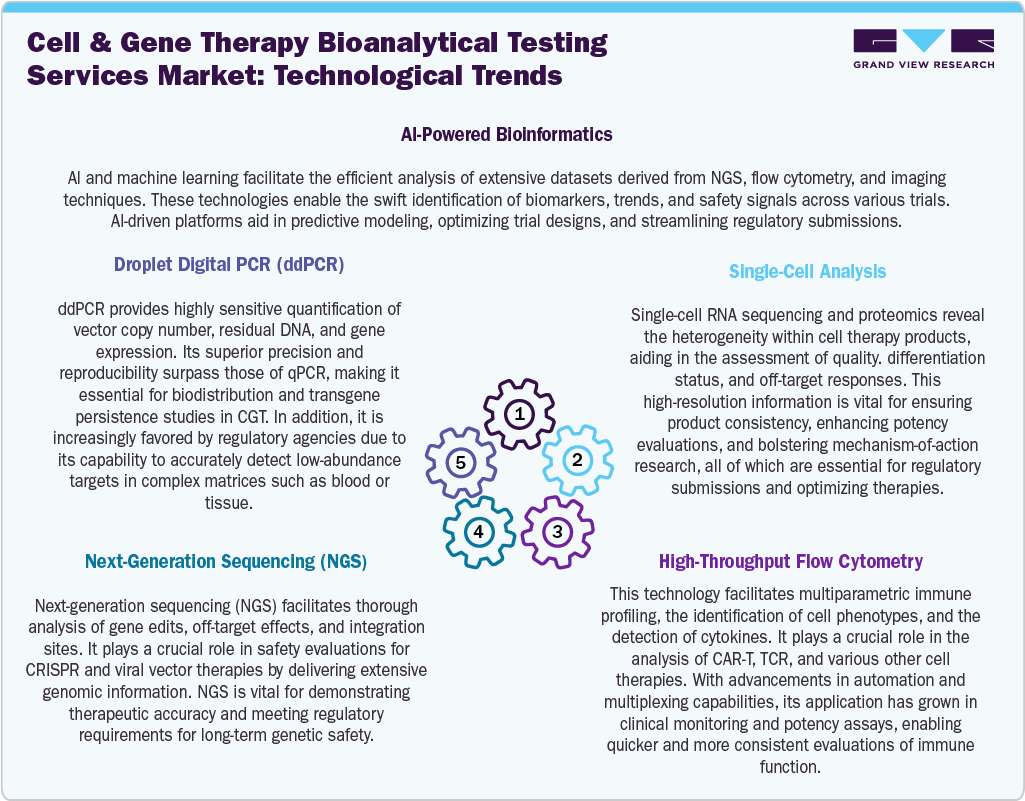

Technological Advancements

Technological innovations are transforming bioanalytical testing services for cell and gene therapies, providing solutions that are more accurate, scalable, and compliant with regulatory standards. Advances in droplet digital PCR (ddPCR) and next-generation sequencing (NGS) have significantly improved sensitivity and accuracy in determining vector copy numbers, analyzing biodistribution, and conducting off-target assessments. High-throughput flow cytometry and single-cell analysis enable in-depth immune profiling and cell identity testing for CAR-T and TCR therapies. Furthermore, automation and robotics are increasing the throughput of assays while minimizing variability in potency and immunogenicity testing. AI-driven analytics and bioinformatics tools enhance the interpretation of extensive and complex datasets, delivering real-time insights throughout clinical phases. The incorporation of lab-on-a-chip and microfluidics technologies is facilitating rapid, point-of-care assessments for CGT trials. These technological advancements are expected to address the rising regulatory demands and scalability of CGT programs, providing contract research organizations (CROs) with a competitive advantage in serving biotech and biopharma end-users across the globe.

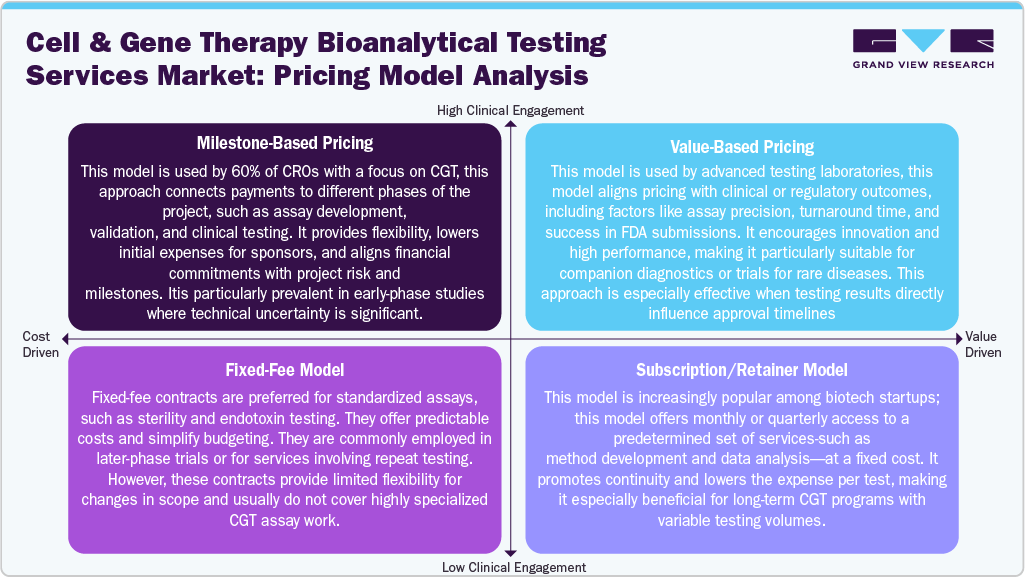

Pricing Model Analysis

In cell and gene therapy bioanalytical testing services, pricing structures adapt to reflect the complexities and risks associated with advanced treatments. A milestone-based pricing approach is commonly implemented and utilized by around 60% of CGT-focused CROs. This model links payment to project milestones, including assay development, validation, and clinical trial support. It helps reduce financial risk for sponsors and aligns payment with the project's progress. In addition, value-based pricing is becoming increasingly popular for critical assays, particularly when testing significantly affects regulatory approvals or patient outcomes. In this model, compensation is tied to performance metrics such as assay accuracy, turnaround time, or regulatory acceptance, promoting innovation and accountability. A fixed-fee structure is often preferred for standardized assays or repeated testing in later-stage trials. This model provides cost predictability and is straightforward to budget, although it can be inflexible regarding changes in scope. Furthermore, a subscription or retainer model emerges among early-stage CGT developers, allowing consistent access to a range of testing services for a fixed monthly fee, ideal for ongoing, adaptable projects.

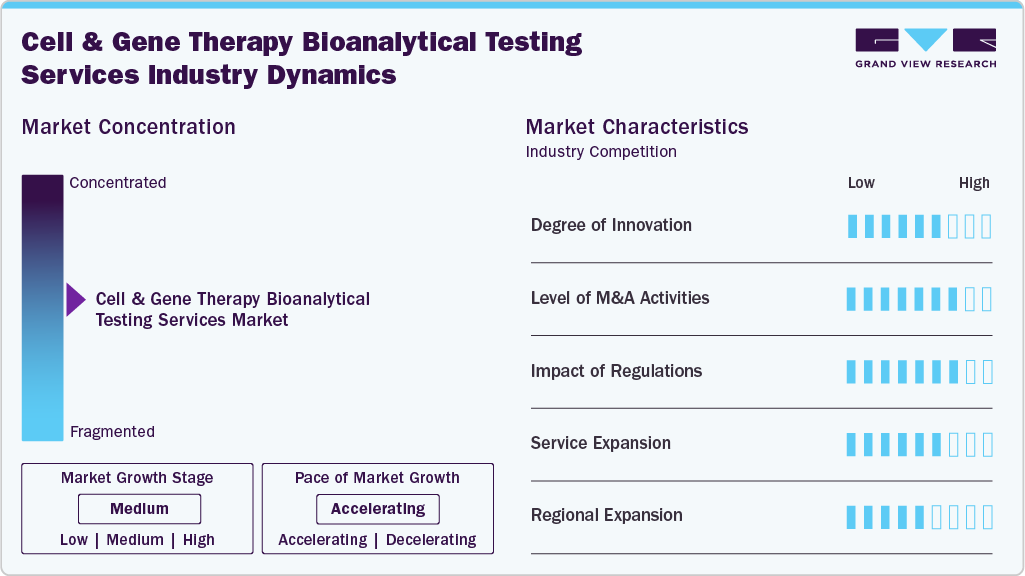

Market Concentration & Characteristics

The market is characterized by a moderate-to-high level of innovation, including the rapid advancements in cell and gene therapy technologies, like the development of biosimilars, combination products, and other innovative medicines, which define the market. Industry participants are investing in innovative techniques and technologies to meet the global demand of the market.

The market is also characterized by the leading players with moderate levels of merger and acquisition (M&A) activity and product launches. Market players like Syneos Health, Labcorp, Thermo Fischer Scientific Inc., Bayer, and others are involved in research expenditures, new product launches, and merger and acquisition activities. For instance, In March 2025, Labcorp announced an agreement to acquire assets of BioReference Health, a subsidiary of OPKO Health. The acquisition focuses on BioReference's laboratory testing businesses, particularly in oncology and related clinical testing services across the U.S., aiming to strengthen Labcorp's presence in specialized bioanalytical testing. Such strategic activities as M&A, expansions, partnerships, and collaborations increase companies' competitiveness, expand their geographic reach, help to enter new territories.

Regulatory control and increasing awareness regarding bioanalytical testing of CGT are paramount in ensuring the safety, efficacy, and quality of these advanced treatments. Regulatory agencies such as the U.S. FDA and EMA have established stringent guidelines to govern the development and approval of cell and gene therapies, mandating thorough bioanalytical testing throughout the product lifecycle. This heightened regulatory scrutiny underscores the critical importance of comprehensive testing to mitigate risks and ensure patient safety. Global regulatory standards are being standardized to accelerate the approval process for cell and gene therapy bioanalytical testing services.

The market is characterized by a moderate level of service expansion with the help of specialized expertise and advanced equipment used for accurate testing. The expansion of bioanalytical testing facilities for CGT reflects a growing recognition of the importance of rigorous testing in ensuring the safety and efficacy of these advanced therapies. New novel methods might act as a key factor for expansion. However, widespread adoption of these technologies would depend on regulatory approval and acceptance by industry. Such advances in the near future might keep service expansion at a moderate level.

The regional expansion is crucial for any manufacturer in the market space. Bioanalytical testing facilities are expanding to accommodate this demand, equipped with state-of-the-art technology and expertise to characterize these complex therapies accurately.

Test Type Insights

The bioavailability & bioequivalence studies dominated with a market share of 35.44% in 2024 and are also expected to witness the fastest growth over the forecast period. Bioavailability & bioequivalence studies are conducted for drug development. It is used to test the safety and efficacy of the drug during all stages of the trials. Drugs with low bioavailability do not provide therapeutic action. Bioequivalence studies are used to compare the pharmacokinetic profile of a generic drug; a significant number of biosimilar versions of cell & gene drugs entering the pipeline support the demand for bioequivalence studies in the market.

The pharmacokinetic segment is expected to grow at a considerable CAGR over the forecast period. Pharmacokinetics (PK) studies determine the extent of absorption, distribution, metabolism, and excretion of drugs in the body. This type of study is essential during drug development. These studies help identify the drug's safety and efficacy in the body. Optibrium company recently launched one such software in February 2024, Semeta software, which uses AI to predict drug metabolism to increase the clinical success of the drugs under investigation. This tool is helpful for Drug Metabolism and Pharmacokinetics (DMPK) scientists. Hence, the ever-increasing pipeline of cell & gene products supports the demand for pharmacokinetics services, thereby supporting segmental growth.

Stage of Development by Product Type Insights

The non-clinical segment dominated the market in 2024. The stage of development segment has been further classified based on the product type, which includes gene therapy, gene-modified cell therapy, and cell therapy. The large cell and gene therapeutics pipeline in the nonclinical developmental stage further demonstrates the segment's growth potential. For instance, in February 2024, data published by Cell & Gene, 10% of all U.S. FDA-registered novel drug pipelines were cell & gene therapy related. Furthermore, a 2023 report from the American Society of Gene and Cell Therapy highlighted a significant expansion in the gene, cell, and RNA therapy pipeline, including various therapeutic interventions in different developmental stages. The high demand among researchers for therapy in the clinical stage further supports the demand for non-clinical bioanalytical testing services, thus promoting the segment's market growth.

The clinical segment is expected to grow at the second-fastest CAGR over the analysis timeframe. Assay-based studies, reagent selection, stability monitoring and quantification, pharmacokinetics studies, and method validation are key bioanalytical services offered in the clinical stage. Across all the clinical phases, bioanalytical testing is conducted to analyze the safety and efficacy of the drug. In the clinical phase, human urine, plasma, and serum samples are used for bioanalytical testing. This type of analysis on humans is essential for drug approval from the regulatory authority. Moreover, it also gives the researchers better insights into drug safety. These factors support the demand for bioanalytical testing services at the clinical stage. For instance, as per the American Society of Cell & Gene Therapy, there was a significant increase in Phase I clinical trials in gene therapy from 270 therapies in 2023 to 301 in 2024. Such factors are anticipated to drive the segment’s growth.

Product Type Insights

The cell therapy segment dominated the product segment in 2024. Cell therapy is the transplantation of human cells to repair or replace damaged tissue or cells. Cell therapies have great potential in treating autoimmune diseases, cancers, urinary problems, infectious diseases, neurological disorders, and other diseases. Many clinical research studies have been conducted globally in cell therapy. For instance, according to the American Society of Cell & Gene Therapy, as of April 2024, over 885 studies were focused on cell therapy only. Further, the market is expected to be propelled by collaborative initiatives among biotechnology enterprises, pharmaceutical companies, and CDMOs to optimize development efforts. For instance, in January 2024, Israel-based biotech company Pluri announced the launch of a new business segment, PluriCDMO, aiming to provide comprehensive cell and gene therapy bioanalytical testing services.

The gene-modified cell therapy segment is expected to register the fastest growth during the forecast period. Gene-modified cell therapy includes CAR-NK cell therapy, CAR T-cell therapies, TCR-T cell therapy, and others. CAR T-cell therapies have gained much traction in the last five years. CAR T-cell therapies are considered very effective against some types of cancer; when other treatments are not working, CAR T therapy has shown remarkable results in treating Leukemia and Lymphoma. CAR-NK cell therapy is considered a promising cancer therapy and safer than CAR T-cell therapies for treating cancer. Such factors are expected to drive the demand for clinical research for gene-modified cell therapy.

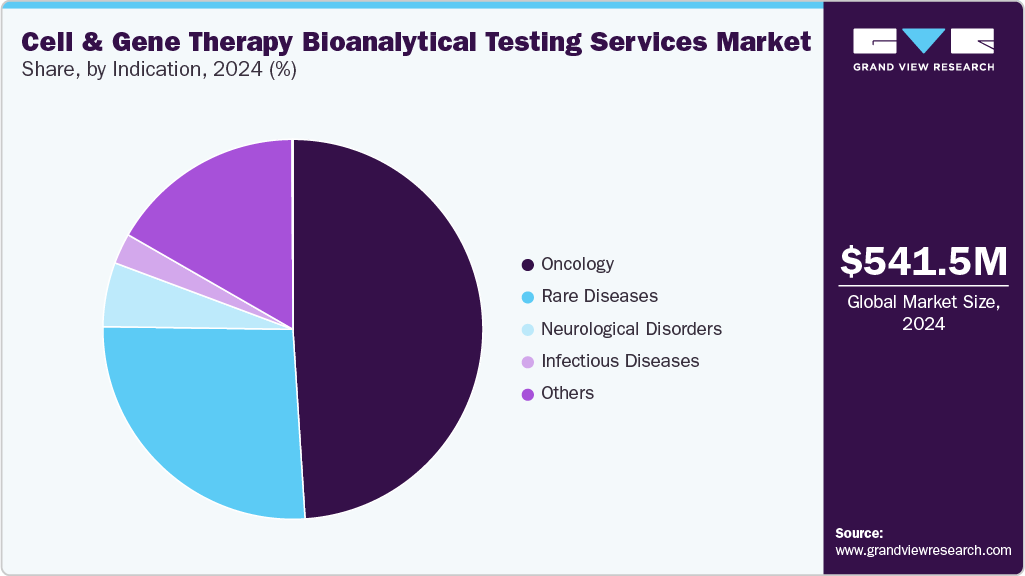

Indication Insight

The oncology segment dominated the market and accounted for the largest revenue share in 2024. This is attributable to the high burden of cancer worldwide, and the growing demand for an effective treatment option for cancer is one of the major reasons for the segment's market growth. The demand for outsourced development services in oncology has increased due to the emergence of innovative cell and gene therapies designed for cancer treatment. For instance, a report published by the American Cancer Society in December 2024 estimated 2,001,140 new cancer cases with 611,720 related deaths in the U.S. As the incidence of cancer continues to rise globally, there is an increasing demand for innovative and effective treatment options.

The rare diseases segment is expected to register the fastest CAGR during the forecast period. This is attributable to the remarkable progress in cell and gene therapy, including targeted and personalized treatment modalities for previously incurable conditions. CDMOs dedicated to this sector have been pivotal in translating scientific discoveries into viable therapeutic solutions. Their services include process development, manufacturing scale-up, quality assurance, and adherence to regulatory compliance. For instance, in February 2024, Andelyn Biosciences, Inc., a CDMO specializing in cell and gene therapy, was chosen as the manufacturing partner for AAV therapies using its suspension platform by the Foundation for the National Institutes of Health (FNIH). This selection was part of collaborative efforts to accelerate the medicinal partnership, the Bespoke Gene Therapy Consortium (BGTC).

Regional Insight

North America dominated the cell and gene therapy bioanalytical testing services market and accounted for the largest revenue share of 41.57% in 2024. This can be attributed to numerous cell and gene therapy clinical trials across the U.S. The growing need for personalized medicine, rising investment in cell & gene therapy Research & Development (R&D), and increasing incidence of genetic & chronic diseases are among the factors contributing to the market growth in the region. Investments in cell and gene therapy R&D have significantly increased in the region. In addition, the presence of major players such as IQVIA, Laboratory Corporation of America Holdings, Charles River Laboratories, and a few others in the U.S., providing quality services in the region, has further boosted the revenue shares of the region in the market.

U.S. Cell And Gene Therapy Bioanalytical Testing Services Market Trends

The cell and gene therapy bioanalytical testing services market in the U.S. is anticipated to witness significant growth over the forecast period, as several pharmaceutical and biotechnology companies operate in this country. Increasing R&D investments and growing partnerships and collaborations among academic institutions, biopharmaceutical corporations, and CROs are contributing to the growth of cell and gene therapy bioanalytical testing services. These partnerships promote innovation and market growth by facilitating information sharing, resource access, and common infrastructure for bioanalytical testing. Such factors are anticipated to drive the market growth.

The Canada cell and gene therapy bioanalytical testing services market is growing due to increasing investments, collaborations, and other strategic initiatives undertaken by global biopharmaceutical companies conducting research in healthcare illness domains. Canada's well-established biotechnology industry is projected to drive the market for cell and gene therapy bioanalytical testing services in this country.

Europe Cell And Gene Therapy Bioanalytical Testing Services Market Trends

Europe cell and gene therapy bioanalytical testing services marketare driven by regulatory agencies, such as the European Medicines Agency (EMA), offer possibilities for fast approval and limited marketing authorization for novel therapies. This favorable regulatory environment promotes investment and innovation in cell & gene therapies. The EMA, the medical regulatory body for the European Union, has been a global leader in evaluating advanced therapy medicinal products, a class of novel biological products that include gene therapy.

The cell and gene therapy bioanalytical testing services market in the UK is anticipated to witness significant growth over the forecast period. Since the presence of an independent institute that focuses on therapeutics and leading-edge expertise in cell and gene technologies, such as Stevenage Bioscience Catalyst and The Cell and Gene Therapy Catapult (CGT Catapult). For instance, CGT Catapult is an independent innovation and technology organization dedicated to making a difference in the UK's cell and gene therapy companies. Furthermore, the UK is home to numerous prosperous businesses, top-notch academic institutions, and CGT Catapult, which is well-positioned to support market growth.

Germany cell and gene therapy bioanalytical testing services market is expected to grow over the forecast period. The country's increased requirement for improved product designs, consulting, product maintenance, and related services is expected to be a crucial factor driving market growth in the coming years. Advancements in technology & quality clinical resources are some of the primary factors expected to propel this market over the forecast period. In addition, government initiatives for clinical research activities have accelerated the growth of the cell & gene therapy bioanalytical testing services market.

The cell and gene therapy bioanalytical testing services market in France is anticipated to witness significant growth over the forecast period. In France, the French Society for Cell and Gene Therapy is a nonprofit organization representing the demands of scientists working on developing innovative cell and gene therapies. Besides, a growing demand for biologics, such as gene therapies, cell-based therapies, and monoclonal antibodies, is expected to drive market growth.

Asia Pacific Cell And Gene Therapy Bioanalytical Testing Services Market Trends

Asia Pacific cell and gene therapy bioanalytical testing services is anticipated to witness the fastest CAGR over the forecast period, owing to the growing pharmaceutical & biotechnology activities, rising healthcare costs, growing investments by key global players in improving regional healthcare, and regulatory body amendments changing clinical trial evaluation standards according to international standards. Furthermore, conducting clinical trials in countries like India is less expensive than in Western countries. This has encouraged companies to relocate their production facilities to this region.

China cell and gene therapy bioanalytical testing services market is expected to grow over the forecast period due to the country’s active investments and advancement of its cell & gene therapy capabilities. The country has a rapidly growing biotechnology & pharmaceutical sector, and it has shown significant interest and progress in this field. Gene therapies, such as Chimeric Antigen Receptor (CAR) T-cell immunotherapy, have been reported to be effective treatments for diseases such as cancer and HIV infection. China is home to the third-highest number of gene therapy clinical trials worldwide. China's rapidly evolving healthcare landscape and patient needs played a significant role in driving the cell & gene therapy bioanalytical testing services market.

The cell and gene therapy bioanalytical testing services market in Japan is expected to grow over the forecast period due to the rising demand for biopharmaceutical drugs to diagnose and treat various chronic diseases. Japan is one of the world’s largest pharmaceutical markets, actively involved in improving access to biopharmaceutical drugs. Several key players have expanded their contract manufacturing offerings in Japan to increase their product capacity to produce highly potent pharmaceutical dosage forms.

Indiacell and gene therapy bioanalytical testing services market is emerging as one of the lucrative markets for bioanalytical testing worldwide. This can be attributed to low costs, the availability of industry experts, and the presence of WHO-cGMP-compliant facilities. Besides, the country's relatively high burden of genetic disorders is expected to boost the demand for diagnostic tests. Thus, the market for cell and gene therapy bioanalytical testing services is anticipated to grow significantly in India.

Latin America Cell And Gene Therapy Bioanalytical Testing Service Market Trends

The increasing demand for pharmaceutical drugs is fueling the Latin America cell and gene therapy bioanalytical testing services market as pharmaceutical companies are investing in R&D. Furthermore, the presence of research training institutes in the region, the growing number of clinical trials, and the rising burden of diseases drive expansion in the Latin America market.

The cell and gene therapy bioanalytical testing services market in Brazil is expected to grow over the forecast period, as Brazil is currently the first Latin American country to authorize gene therapy product marketing. Moreover, bioanalytical testing services for cell and gene therapy are growing in the country due to the strong growth and innovation in the biologics industry and the expanding biopharmaceutical market.

Key Cell And Gene Therapy Bioanalytical Testing Services Company Insights

Key players operating in the market include BioAgilytix Labs, KCAS Bioanalytical Services, Inc., Laboratory Corporation of America Holdings, Pharmaceutical Product Development, Inc. (Thermo Fisher Scientific Inc.), and Prolytix. The major players operating across the cell & gene therapy bioanalytical testing services market are focused on the adoption of inorganic strategic initiatives such as mergers, partnerships, acquisitions, etc. For instance, in January 2024, Pharmaceutical Product Development, Inc. (Thermo Fisher Scientific, Inc.) launched the Gibco Cell Therapy Systems Cellmation Software to automate cell therapy manufacturing workflows.

Key Cell And Gene Therapy Bioanalytical Testing Services Companies:

The following are the leading companies in the cell and gene therapy bioanalytical testing services market. These companies collectively hold the largest market share and dictate industry trends.

- BioAgilytix Labs

- KCAS Bioanalytical Services

- IQVIA, Inc.

- Laboratory Corporation of America Holdings

- Pharmaceutical Product Development, Inc. (Thermo Fisher Scientific Inc.)

- Prolytix

- Pharmaron

- Charles River Laboratories

- Syneos Health

- SGS SA

- Intertek Group Plc

Recent Developments

-

In March 2024, Allumiqs and Prolytix entered into a strategic partnership aimed at offering integrated solutions to streamline drug development pipelines. By combining expertise in multiomics and LC-MS/MS solutions with large-molecule drug product lifecycle management, the collaboration aimed to provide customers with cohesive solutions, reducing complexities and risks in the R&D process.

-

In February 2024, Thermo Fisher Scientific’s PPD clinical research division expanded its GMP lab in Middleton, Wisconsin, to offer mycoplasma and biosafety testing services, aiding biopharmaceutical companies in ensuring product purity and patient safety. These new capabilities addressed the growing global demand for pathogen testing, particularly with the rise in chronic diseases, and utilized advanced nucleic acid analysis techniques for faster and more accurate results.

-

In January 2024, Pharmaceutical Product Development, Inc. (Thermo Fisher Scientific, Inc.) launched the Gibco Cell Therapy Systems Cellmation Software to automate cell therapy manufacturing workflows.

Cell And Gene Therapy Bioanalytical Testing Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 579.9 million

Revenue forecast in 2030

USD 828.7 million

Growth Rate

CAGR of 7.40% from 2025 to 2030

Historical Year

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Test type, product type, stage of development by product type, indication, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; Australia; Thailand; South Korea; Brazil; Argentina; South Africa, Saudi Arabia; UAE; Kuwait

Key companies profiled

BioAgilytix Labs; KCAS Bioanalytical Services; IQVIA, Inc.; Laboratory Corporation of America Holdings; Pharmaceutical Product Development, Inc. (Thermo Fisher Scientific Inc.); Prolytix; Pharmaron; Charles River Laboratories; Syneos Health; SGS SA; Intertek Group Plc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cell And Gene Therapy Bioanalytical Testing Services Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global cell and gene therapy bioanalytical testing services market on the basis of test type, product type, stage of development by product type, indication and region:

-

Test Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Bioavailability & Bioequivalence Studies

-

Pharmacokinetics

-

Pharmacodynamics

-

Other Test Type

-

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Gene Therapy

-

Ex-vivo

-

In-vivo

-

-

Gene-Modified Cell Therapy

-

CAR T-cell therapies

-

CAR-NK cell therapy

-

TCR-T cell therapy

-

Other

-

-

Cell Therapy

-

-

Stage of Development by Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Non-Clinical

-

Gene Therapy

-

Gene-Modified Cell Therapy

-

Cell Therapy

-

-

Clinical

-

Gene Therapy

-

Gene-Modified Cell Therapy

-

Cell Therapy

-

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Infectious Diseases

-

Neurological disorders

-

Rare Diseases

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cell and gene therapy bioanalytical testing services market size was estimated at USD 541.5 million in 2024 and is expected to reach USD 579.9 million in 2025.

b. The global cell and gene therapy bioanalytical testing services market is expected to grow at a compound annual growth rate of 7.4% from 2025 to 2030 to reach USD 828.7 million in 2030.

b. By test type, the bioavailability & bioequivalence studies segment held a market share of 35.44% in 2024. The increasing pipeline of novel cell & gene-based therapeutics is one of the prominent factors supporting the segment's high shares.

b. Some key players operating in the market include BioAgilytix Labs, KCAS Bioanalytical Services, IQVIA, Inc., Laboratory Corporation of America Holdings and a few others.

b. A significant number of cell and gene therapy drug candidates under clinical trials, high public and private investments across research and development of novel cell & gene products are a few factors supporting the demand for bioanalytical testing services, thus supporting the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.