Cell-free Protein Expression Market Size, Share & Trends Analysis Report By Product (Expression Systems, Reagents), By Application (Enzyme Engineering), By Method, By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-972-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Cell-free Protein Expression Market Trends

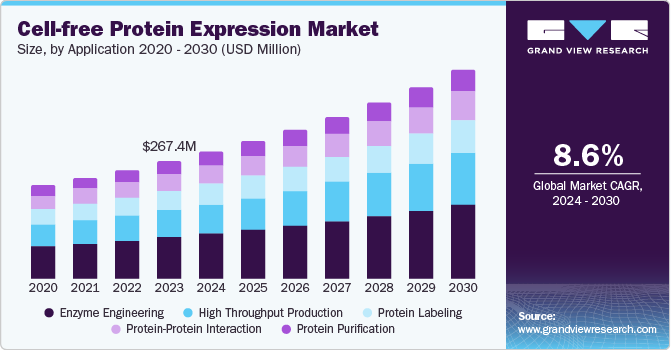

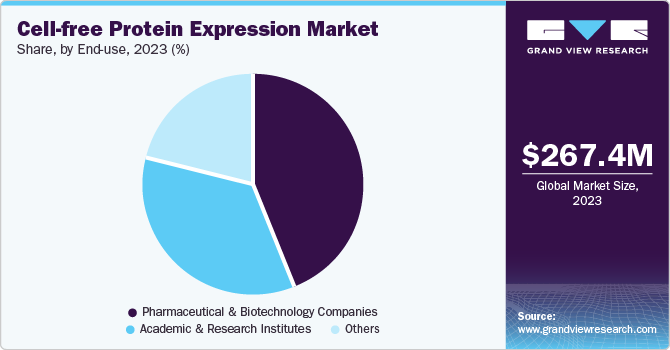

The global cell-free protein expression market size reached a value of USD 267.4 million in 2023 and is projected to grow at a CAGR of 8.6% from 2024 to 2030. Cell-free protein synthesis (CFPS) enables the rapid production of functional proteins without cell culture, purification, or gene transfection, making it significantly faster than in-vivo methods. The market for CFPS is growing due to advancements in genomics and proteomics, the high incidence of infectious diseases and cancer, and the need for structural modifications and shorter-expression times.

Advancements in genomics and proteomics are driving the cell-free protein expression market by enabling precise and rapid production of proteins. This technology supports high-throughput screening and personalized medicine, addressing the increasing demand for efficient and customizable protein synthesis solutions. For instance, in April 2024, MGI Tech Co. Ltd. (MGI) launched a customer experience center (CEC) in Brazil to advance genomics in Latin America. This facility aimed to support clinical and research labs, hospitals, and universities in utilizing genetic sequencing technology for precision medicine, oncology, agrigenomics, and metagenomics, among other fields.

The high incidence of infectious diseases and cancer drives the cell-free protein expression market. This technology enables rapid and efficient production of proteins for research and therapeutic development, meeting the urgent demand for novel diagnostics and treatments. Its speed and flexibility make it crucial for addressing the growing need for targeted medical interventions. According to the National Cancer Institute, in 2024, the U.S. was expected to see an estimated 2,001,140 new cancer cases and 611,720 cancer-related deaths. The most common cancers were breast, prostate, lung, colorectal, melanoma, bladder, kidney, non-Hodgkin lymphoma, endometrial, pancreatic, leukemia, thyroid, and liver cancers. Prostate, lung, and colorectal cancers made up 48% of diagnoses in men, while breast, lung, and colorectal cancers accounted for 51% of diagnoses in women.

The need for structural modifications and shorter-expression times is driving the cell-free protein expression market. This technology allows for rapid and precise protein synthesis, essential for advanced research and therapeutic applications. Its efficiency and flexibility address critical demands in the biotechnology and medical fields. According to the Fraunhofer Institute for Molecular Biology and Applied Ecology IME, Cell-free protein synthesis (CFPS) offers shorter process times and direct control over reaction conditions than cell-based expression. It enables the simultaneous expression of multiple proteins from PCR products without needing cloning and transformation, allows the addition of factors for protein folding or unnatural amino acids incorporation, and facilitates the production of cytotoxic proteins not possible in living cells.

Product Insights

The expression systems segment dominated the market with 76.1% revenue share in 2023 and is expected to grow at the fastest CAGR over the forecast period. Cell-Free Protein Expression (CFPE) systems drive growth through their ability to rapidly synthesize proteins without the need for cell culture, thereby streamlining workflows and enhancing efficiency. By eliminating the time-consuming steps of cell growth and maintenance, CFPE accelerates protein production timelines and enables quicker access to proteins for various research, drug development, and biotechnology applications.

This efficiency reduces production costs and supports agile research and development processes, fostering innovation in protein engineering and biopharmaceuticals. According to the National Center for Biotechnology Information (NCBI), Escherichia coli is the preferred heterologous host for recombinant protein expression due to its simplicity, rapid growth, and cost-effective cell cultivation and protein extraction methods. These advantages make E. coli ideal for efficient and economical protein production and purification.

The reagents segment is expected to grow at the significant rate over the forecast period. The reagent segment is propelled by technological advancements that improve protein yield, stability, and functionality, fostering market expansion. In addition, the growing need for customized reagents to optimize specific protein expression conditions increases their demand across various research and industrial applications. For instance, in September 2023, GenScript, a provider of life-science research tools, enhanced its IVT mRNA synthesis portfolio by introducing customized lipid nanoparticle (LNP) and circular RNA (circRNA) formulation services. These new offerings, now available, demonstrate GenScript's commitment to providing advanced reagents that support research in protein replacement therapies, vaccine development, and gene and cell therapy.

Application Insights

The enzyme engineering segment dominated the market in terms of revenue share in 2023. Its important role in bio-manufacturing, synthetic biology, and medicine has led to its dominance. In addition, utilizing cell-free synthetic biology methods has gained popularity as an alternative to enzyme engineering. This approach prevents the limitations imposed by cell membranes and the need for cell durability while offering remarkable flexibility in biosynthetic pathways.

According to the Chinese Journal of Chemical Engineering, enzyme engineering has gained prominence in synthetic biology, medicine, and biological manufacturing in the 20th and 21st centuries. However, the intrinsic fragility of enzymes' allosteric regulation and the complexity of host metabolism pose challenges. Operating multiple enzyme pathways in vivo often results in low yields due to substrate diversion and potential cell toxicity.

Furthermore, the high throughput production system is anticipated to exhibit the most rapid compound annual growth rate (CAGR) over the forecast period. Cell-free protein expression in high-throughput enzyme screening has shown its results. It has become a skillful technique for discovering enzyme variants and ideal biocatalysts. By using new high-throughput technologies, applying a cell-free protein expression system helps in smooth prototyping, speeding the screening procedure for enzymes with enhanced characteristics. For instance, in August 2021 Ginkgo Bioworks, specializing in cell programming, partnered with Antheia, Inc., a synthetic biology company focused on plant-inspired medicines. This collaboration aims to accelerate the development and production of essential medicines. By partnering with Ginkgo, Antheia aimed to boost its production of essential medicine components (APIs and KSMs). Ginkgo's expertise in rapidly designing and testing enzymes would give Antheia a wider range of these ingredients, which are often sourced from nature and can be difficult to produce efficiently.

Method Insights

The transcription and translation systems segment dominated the market in terms of revenue share in 2023 and is expected to grow at the fastest CAGR over the forecast period. Coupled translation and transcription systems combine the steps of making RNA from DNA and translating that RNA into proteins in one test tube. This saves researchers time and simplifies the process. These systems are popular tools for studying all sorts of proteins, from a few at a time to large-scale studies of entire genomes.

According to the Deutsches Krebsforschungszentrum, the widespread adoption of large-scale genomic sequencing spurred considerable interest in comprehensively understanding the functional implications of DNA-encoded information. However, many cellular modulation and regulation aspects extend beyond nucleic acids and necessitate a focus on the proteome. Processes such as post-transcriptional control of protein translation, post-translational modifications, and protein degradation through proteolysis significantly influence cellular function. Estimates indicated the existence of over 200 types of protein modifications, underscoring their substantial role, with 5% to 10% of mammalian genes dedicated to encoding proteins involved in modifying other proteins.

The translation systems segment is expected to grow at the significant rate over the forecast period. Translation systems segment is driven by their capability to deliver high protein yields and scalable production, effectively accommodating both small-scale research needs and large-scale industrial requirements. This scalability is essential for meeting the varied demands of the market, ensuring flexibility and efficiency in protein synthesis for applications ranging from basic research to biopharmaceutical production.

End Use Insights

In 2023, the pharmaceutical & biotechnology companies dominated the market in terms of revenue share. These companies regularly require personalized protein production to support their research and development activities. Cell-free systems are adaptable and expandable, making customized protein expression an essential part of the field of drug development. For instance, in February 2022, Takara Bio Inc. inaugurated an expansion of its manufacturing facility, the Center for Gene and Cell Processing, located in Shiga, Japan. This growth aims to cater to rising demands from contract development and manufacturing sectors, enhancing capabilities to accommodate a wider range of raw materials and manufacturing methods. The facility was expected to focus on producing regenerative medicines, RNA and DNA vaccines, cancer immunotherapy treatments, and gene therapy products, aligning with the increasing global need for advanced biopharmaceutical solutions.

The others segment is expected to grow at the fastest CAGR over the forecast period. Growing investment in pharmaceutical R&D and a rising number of Antibody-Drug Conjugates clinical trials are some of the factors driving the market growth. For instance, in May 2024, Enhertu (trastuzumab deruxtecan) achieved a milestone by becoming the first antibody-drug conjugate (ADC) approved in the U.S. for cancer treatment based on the tumor's molecular characteristics rather than its anatomical site. This approval follows successful clinical trials demonstrating efficacy in treating various cancers that express human epidermal growth factor receptor 2 (HER2), marking a significant advancement in targeted cancer therapy.

Regional Insights

North America cell-free protein expression market dominated the market 36.05% in 2023. This significant portion is due to reasons such as the presence of big pharmaceutical players, the expansion of the biotechnology and pharmaceutical sectors, the introduction of advanced products, the increasing presence of diseases such as cancer, and the support of investments in drug discovery research.

In April 2021, Promega Corporation announced the Kornberg Center, a new research and development facility. This state-of-the-art building is dedicated to advancing technology and product development in genetic identity, cellular and life science research, molecular biology, clinical diagnostics, scientific applications, and training. The center underscores Promega's commitment to innovation and excellence in serving the scientific community with cutting-edge solutions and resources.

U.S. Cell-free Protein Expression Market Trends

The cell-free protein expression market in the U.S. dominated North America in 2023 owing to the significant presence of pharmaceutical companies and research centers in various parts of the U.S. In addition, the availability of venture capital, government grants and policies, and funding agencies supporting biotechnology research and development in North America, the U.S. has played a very important role in establishing itself as a dominant player across North America.

In March 2024, Tierra Biosciences, a startup based in California, has secured USD 11.4 million in Series A funding led by Material Impact, supplementing its USD 6 million in seed funding and more than USD 7 million from grants. The round garnered support from new and existing investors such as In-Q-Tel (IQT), Prosus Ventures, Freeflow Ventures, Hillspire, Creative Ventures, and Social Capital. This funding was expected to bolster Tierra Biosciences' efforts in developing AI-driven cell-free technology for customized, high-throughput protein synthesis, highlighting strong investor confidence in its innovative approach and potential impact in the biotechnology sector.

Asia Pacific Cell-free Protein Expression Market Trends

Asia Pacific cell-free protein expression market is expected to grow at the fastest CAGR of 11.13% over the forecast period. This is attributed primarily to the increase in research and development expenditures, investment in technology, increase in the number of clinics, and strategic partnerships among the top market players helping to increase the pace of growth in this region. For instance, in July 2021, CellFree Sciences Co., Ltd., a Japanese firm, was granted funding by Ehime Prefecture to advance new drug concepts and targets using its proprietary protein technology. This initiative underscores Ehime Prefecture's dedication to fostering biotechnology and drug discovery growth within their region, supporting local innovation and economic development in these critical fields.

Key Cell-free Protein Expression Company Insights

Some of the key companies in the cell-free protein expression market include Thermo Fisher Scientific, Inc., Takara Bio Inc., Merck KGaA, New England Biolabs, Promega Corporation, Jena Bioscience GmbH, GeneCopoeia, Inc., biotechrabbit, and CellFree Sciences Co., Ltd. Vendors in the market are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Thermo Fisher Scientific, Inc., is known globally for its extensive array of scientific products and services, catering to diverse disciplines, including cell-free protein expression. The company offers specialized technologies and kits designed to optimize protein synthesis outside of cellular environments, supporting research, development, and production in the biotechnology and pharmaceutical sectors.

-

Takara Bio Inc. specializes in advanced technologies for cell-free protein expression, enabling protein synthesis outside living cells. Their comprehensive range of products includes kits that provide all essential components for efficiently transcribing and translating target genes into proteins, suitable for both research and industrial use. Committed to innovation, Takara Bio Inc. continually refines these systems through rigorous research and development efforts, optimizing reaction conditions, improving protein yield and quality, and exploring novel applications to meet evolving biotechnological needs.

Key Cell-free Protein Expression Companies:

The following are the leading companies in the Cell-free Protein Expression Market. These companies collectively hold the largest market share and dictate industry trends:

- Thermo Fisher Scientific, Inc.

- Takara Bio Inc.

- Merck KGaA

- New England Biolabs

- Promega Corporation

- Jena Bioscience GmbH

- GeneCopoeia, Inc.

- biotechrabbit

- CellFree Sciences Co., Ltd.

Recent Developments

-

In June 2024, Daicel Arbor Biosciences launched an advanced version of its myTXTL kits, tailored for cell-free protein expression, to streamline antibody discovery and protein engineering processes. The new offerings, myTXTL Pro Kit and myTXTL Antibody/DS Kit offer researchers versatile tools to optimize the throughput of protein expression platforms, marking a significant advancement in biotechnology research capabilities.

-

In July 2023, Liberumbio secured USD 1.8 million in seed funding to advance its technology, known as "protein synthesis as a service" TechU Ventures led the funding round, which was joined by SOSV and Savantus Ventures. Utilizing E.coli bacteria and derived materials, Liberumbio offers customized protein creation through both cell-free and cell-based platforms. By submitting digital protein sequences, companies can anticipate receiving purified proteins within a rapid turnaround time of approximately two weeks.

-

In February 2022, Merck KGaA, finalized its acquisition of Exelead for approximately USD 780 million after obtaining regulatory approvals and meeting standard closing requirements. This acquisition was set to bolster Merck’s Life Science division by enhancing its ability to offer complete contract development and manufacturing organization (CDMO) services throughout the mRNA production process, thereby better serving its customer base.

Cell-free Protein Expression Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 288.9 million |

|

Revenue forecast in 2030 |

USD 475.1 million |

|

Growth rate |

CAGR of 8.6% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, method, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico, UK; Germany; France, Italy, Spain, Denmark, Sweden, Norway, Japan; China; India, Australia; South Korea; Thailand; Brazil; Argentina, South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Thermo Fisher Scientific, Inc.; Takara Bio Inc.; Merck KGaA; New England Biolabs; Promega Corporation; Jena Bioscience GmbH; GeneCopoeia, Inc.; biotechrabbit; CellFree Sciences Co., Ltd. |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Cell-free Protein Expression Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cell-free protein experience market report based on product, application, method, end use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Expression Systems

-

E. coli Cell-free Protein Expression System

-

Wheat Germ Cell-free Protein Expression System

-

Rabbit Reticulocytes Cell-free Protein Expression System

-

Insect Cells Cell-free Protein Expression System

-

Human Cell-free Protein Expression System

-

Others

-

-

Reagents

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Enzyme Engineering

-

High Throughput Production

-

Protein Labeling

-

Protein-Protein Interaction

-

Protein Purification

-

-

Method Outlook (Revenue, USD Million, 2018 - 2030)

-

Transcription & Translation systems

-

Translation systems

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical and Biotechnology Companies

-

Academic and Research Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."