- Home

- »

- Biotechnology

- »

-

Cell Culture Media Market Size, Share, Industry Report, 2033GVR Report cover

![Cell Culture Media Market Size, Share & Trends Report]()

Cell Culture Media Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Serum-free Media, Classical Media), By Type (Liquid Media, Semi-solid And Solid Media), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-957-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cell Culture Media Market Summary

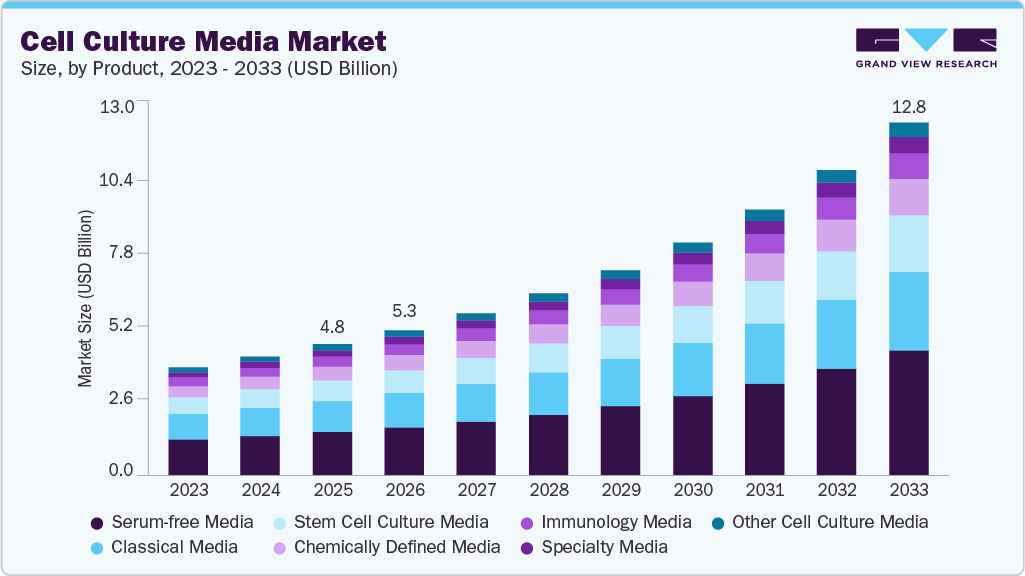

The global cell culture media market size was estimated at USD 4.75 billion in 2025 and is projected to reach USD 12.80 billion by 2033, growing at a CAGR of 13.54% from 2026 to 2033. Cell culture media are generally in a liquid or powdered format that includes compounds required to regulate and support the growth of cells or microorganisms used in the manufacturing of biopharmaceuticals.

Key Market Trends & Insights

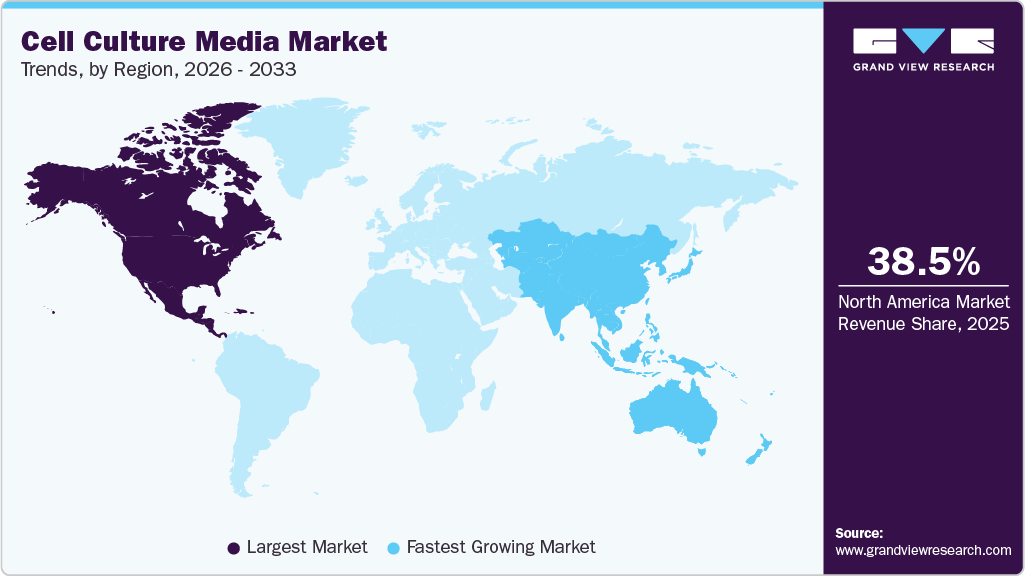

- North America dominated the cell culture media market with the largest revenue share of 38.47% in 2025.

- The cell culture media industry in the U.S. accounted for the largest market revenue share in North America in 2025.

- By product, the serum-free media segment led the market with the largest revenue share of 33.13% in 2025.

- Based on application, the biopharmaceutical production segment accounted for the largest market revenue share in 2025.

- Based on type, the semi-solid & solid media segment accounted for the largest market revenue share in 2025.

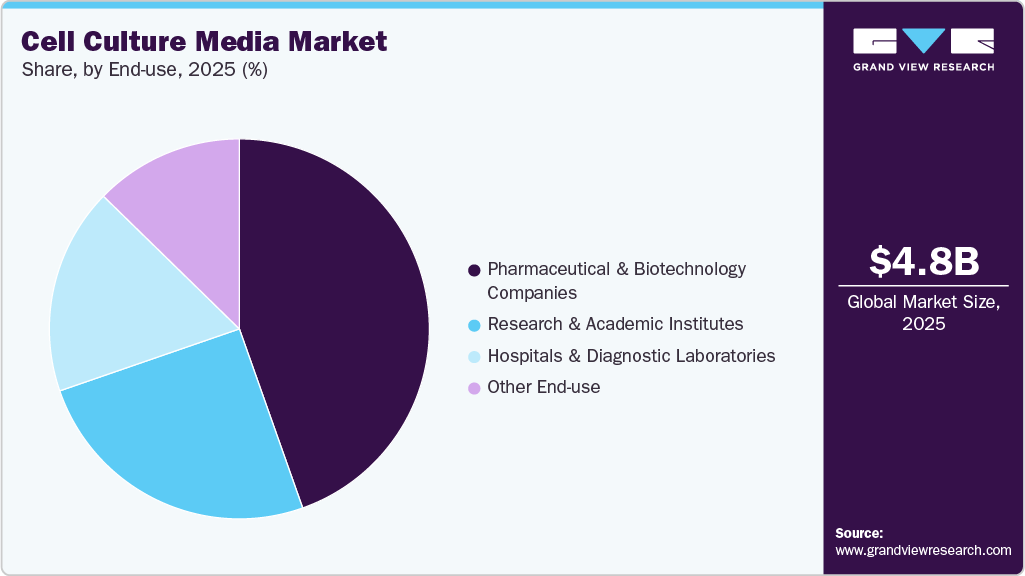

- By end use, the pharmaceutical & biotechnology companies segment accounted for the largest market revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 4.75 Billion

- 2033 Projected Market Size: USD 12.80 Billion

- CAGR (2026-2033): 13.54%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Market growth is driven by the rising production of biopharmaceuticals and cell-based vaccines, along with increasing adoption of cell-based research in cancer, regenerative medicine, and stem cell therapy. Advancements in bioprocessing technologies, including serum-free media and single-use systems, are further supporting demand and accelerating market expansion.Growth in Stem Cell Research

Stem cell therapy represents a new and highly promising area of scientific research that may revolutionize the field of regenerative medicine. Stem cells are essential for the healing of tissues and organs, and they also serve as a source of information about the complex processes of human development. Hence, the focus on stem cell culture methods upgrades as a supporting tool for basic research in stem cell biology, and a way to boost their therapeutic applicability is becoming increasingly popular. The trend of scientists and clinicians looking for more efficient and accurately defined culture environments to promote and differentiate the stem cells has resulted in a strong demand for high-quality and reliable cell culture media that are specifically designed for stem cells, which boosts the demand for media in the stem cell culture media industry.

Key Stem Cell Therapy Clinical Trials

NCT Number

Conditions

Sponsor

Completion Year

NCT01413100

Systemic Scleroderma

Fred Hutchinson Cancer Center

2024

NCT00554788

Extraocular Retinoblastoma

Children's Oncology Group

2024

NCT01798004

Ganglioneuroblastoma

Children's Oncology Group

2024

NCT01729091

Plasma Cell Leukemia

M.D. Anderson Cancer Center

2024

NCT02375555

Multiple Myeloma

Dana-Farber Cancer Institute

2024

NCT02566304

Acute Myeloid Leukemia

Sidney Kimmel Cancer Center at Thomas Jefferson University

2024

NCT05116540

Multiple Sclerosis

Hope Biosciences Stem Cell Research Foundation

2024

NCT02136797

CMV Infection

Memorial Sloan Kettering Cancer Center

2024

NCT01527149

Mantle Cell Lymphoma

Roswell Park Cancer Institute

2024

NCT02396134

Accelerated Phase Chronic Myelogenous Leukemia

City of Hope Medical Center

2024

NCT01701986

Hematopoietic Cell Transplantation Recipient

M.D. Anderson Cancer Center

2024

NCT01326104

Medulloblastoma

University of Florida

2025

NCT00653068

Childhood Atypical Teratoid/Rhabdoid Tumor

Children's Oncology Group

2024

NCT03755414

Acute Myelogenous Leukemia

Washington University School of Medicine

2024

NCT01919619

B-Cell Non-Hodgkin Lymphoma

M.D. Anderson Cancer Center

2024

NCT02140554

Sickle Cell Disease

bluebird bio

2024

NCT02759731

Chronic Graft vs Host Disease|Chronic Graft-Versus-Host Disease

National Cancer Institute (NCI)

2024

NCT03332667

Neuroblastoma

New Approaches to Neuroblastoma Therapy Consortium

2024

NCT02763319

Diffuse Large B-cell Lymphoma

Incyte Corporation

2024

NCT04503616

Graft-versus-host Disease

NYU Langone Health

2024

NCT03623373

Mantle Cell Lymphoma

Washington University School of Medicine

2025

NCT05673876

Acute Graft-versus-host Disease

Genentech, Inc.

2024

Source: Clinical trial.gov.in, Secondary Research, Grand View Research

To meet this rising demand, several key manufacturers have introduced innovative products to advance stem cell research. For instance, in July 2024, Bioserve India launched a range of new stem cell products, including cell culture solutions and reprogramming tools, to support scientific research and drug development in the country. Similarly, in December 2024, BioCentriq, a leading cell therapy CDMO, secured a long-term lease for a new headquarters in Princeton, New Jersey, with a USD 12 million investment dedicated to enhancing its development, manufacturing, and quality control services in cell therapy. These strategic developments reflect the growing momentum in the stem cell field and highlight the increasing importance of advanced cell culture media in supporting research and clinical applications.

Research Emerging Cell Culture Technologies for Cell-Based Vaccines

Cell culture-based viral vaccines have become a crucial component of global immunization strategies, providing a safer and more efficient method for producing vaccines compared to traditional egg-based approaches. The continuous development of cell culture substrates enables the reliable and scalable production of vaccines, meeting the rising global demand while adhering to stringent safety and regulatory requirements.

According to the CDC, from 2020 to 2021, the viruses used for flu vaccine production were cell-derived rather than egg-derived, due to the potential for egg-based cultivation to introduce antigenic changes. Such changes can reduce vaccine effectiveness by creating mismatches between vaccine strains and circulating viruses. Moreover, the FDA’s approval of cell-based candidate vaccine viruses (CVVs) has strengthened the pathway for more consistent and potentially more effective flu vaccines.

The utility of cell culture technology extends beyond influenza to include vaccines for diseases such as smallpox, rotavirus, rubella, hepatitis, chickenpox, and polio. Notably, in December 2024, Mesoblast received FDA approval for Ryoncil (remestemcel-L), a mesenchymal stromal cell (MSC) therapy, for treating steroid-refractory acute graft-versus-host disease (SR-aGvHD) in pediatric patients, marking the first and only MSC therapy approved in the U.S. Ryoncil is also under development for other inflammatory conditions, including biologic-resistant inflammatory bowel disease. The ongoing advancement in biological models, refinement of cell culture media, and reduced reliance on animal-derived components continue to fuel innovation in cell-based vaccine development.

Moreover, the growing adoption of cell culture media bags in vaccine manufacturing is boosting the cell culture media industry, as they provide a sterile, scalable, and contamination-free environment for high-yield cell expansion. Their ease of integration with bioreactors, reduced cleaning needs, and faster turnaround times make them ideal for cell-based vaccine production, directly accelerating market demand for media.

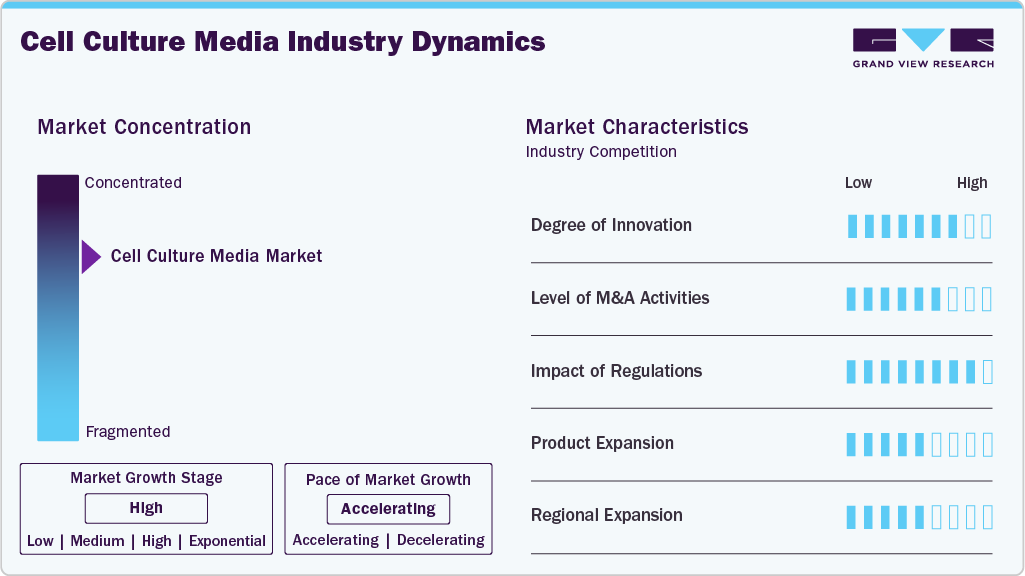

Market Concentration & Characteristics

The cell culture media industry is in a high-growth stage, driven by increasing demand from the biopharmaceutical, diagnostic, and research sectors. The market is characterized by rapid advancements in media formulations, increased investments in biotechnological research, and expanding applications in drug development, regenerative medicine, and personalized therapies. Competitive dynamics and innovation drive new product launches and collaborations among key players. For instance, in December 2024, Creative Biolabs, based in the U.S., introduced cutting-edge iPSC and FGF2 solutions the accelerate research in stem cell therapy, offering custom scientific support for worldwide regenerative medicine projects.

The cell culture media industry is experiencing a high level of mergers and acquisitions (M&A) activity, driven by the need for market consolidation and the expansion of product portfolios. Key players are acquiring smaller companies to enhance their capabilities, gain access to advanced technologies, and expand their global reach. For instance, in March 2022, Fujifilm, through its Life Sciences subsidiaries in Japan and the United States, completed the acquisition of Shenandoah Biotechnology in Pennsylvania, expanding its global capabilities in recombinant protein and cell culture. These strategic moves are also helping companies address increasing demand from the biopharma, diagnostics, and research sectors while staying competitive in a rapidly growing market.

The cell culture media industry is heavily regulated, which determines the occurrence of events in product development, manufacturing, and market sales. By implementing strict rules, the safety and effectiveness of cell culture media used in biopharma, diagnostics, and research have been guaranteed. All the players in the market must comply with these regulations, which include the GMP and ISO standards. Furthermore, changes in rules as well as the differences between regions can not only influence the product's timeline but also the strategies to enter the cell culture media industry, thus making it a must for the companies to observe the regulations to achieve continuous growth.

The cell culture media industry has experienced exponential growth, driven by the rising demand for more effective treatments. This growth is attributed to advancements in biology, increasing adoption of cell-based therapies, and growing research in regenerative medicine and drug discovery. The need for high-quality media to support cell viability and functionality, as well as to expand biopharma and healthcare applications, further accelerates market expansion. For instance, in March 2021, Thermo Fisher Scientific in the United States launched Gibco Human Plasma-like Medium (HPLM), introducing the first cell culture medium that mimics human plasma to enhance physiological relevance in research.

The cell culture media industry is experiencing significant regional expansion as service providers strategically establish their presence in new geographic areas. This growth is attributed to increasing demand for cell culture products in emerging markets, growing biopharma activities, and expanding healthcare infrastructure. Companies are targeting regions with rising research investments and favorable regulatory environments to capitalize on new opportunities and expand their global footprint.

Product Insights

The serum-free media segment led the market with the largest revenue share of 33.13% in 2025. The use of SFM signifies a significant tool, which allows the researchers to perform specific applications or grow a particular type of cell without using serum. Advantages of using SFM include increased growth and/or productivity, more consistent performance, better control over physiological sensitivity, and diminishing the risk of infection by serum-borne adventitious agents in the culture. Moreover, the gene and cell therapy field is rapidly growing, and the Food and Drug Administration regulatory guidelines demand more control of raw materials to sustain the reliable and safe manufacturing of drug products. Using SFM offers an opportunity to produce additional reproducible formulations and lower batch-to-batch variability.

The stem cell culture media segment is expected to grow at the fastest CAGR during the forecast period, due to increasing investments in stem cell research and its expanding applications in regenerative medicine, drug discovery, and personalized medicine. For instance, in March 2025, groundbreaking stem cell therapy research from the United States reported a 78% success rate, signaling major advancements in regenerative medicine and improved outcomes across multiple clinical conditions. Moreover, advancements in media formulations to enhance stem cell viability and functionality, and rising demand from research institutions and biopharma companies are driving this growth.

Application Insights

The biopharmaceutical production segment led the market with the largest revenue share of 50.18% in 2025. The industry’s demand for more reproducible and better-defined media to meet expanding production levels while reducing the risk of contamination in the downstream processes has significantly increased the demand for this market. Moreover, strategic activities by key biopharmaceutical companies also drive the segment growth. For instance, in July 2023, Sartorius AG announced an investment of USD 33 million to expand its new cell culture media manufacturing facility at its Yauco, Puerto Rico, site.

The tissue engineering & regenerative medicine segment is expected to grow at the fastest CAGR during the forecast period, driven by the increasing adoption of stem cell-based therapies, 3D bioprinting innovations, and engineered scaffolds for organ and tissue regeneration. Rising clinical success rates in reconstructive procedures, wound healing, and cartilage/bone regeneration are accelerating demand.

Type Insights

The semi-solid and solid media segment accounted for the largest market revenue share in 2025, mainly due to its increasing usage in microbial culture, stem cell research, and drug development. Moreover, the advancements in media formulations coupled with the growing demand for tools that offer efficiency in cell-based assays and biopharma applications are the factors that will further drive the growth of the segment.

The liquid media segment is expected to grow at the fastest CAGR throughout the forecast period. An increasing number of biologics and biosimilars manufacturers, both downstream and upstream, are switching from premixed powders to liquid media owing to rapid mycobacterial growth and high isolation rate. Moreover, the manufacturers' strategic activities are also driving the segment. For instance, in June 2023, Gold Standard Diagnostics launched BACGroM Culture Media, designed to identify pathogenic microorganisms in the food, environmental, and pharmaceutical industries. The BACGro line includes premium dehydrated and liquid media products that meet global standards.

End Use Insights

The pharmaceutical & biotechnology companies segment led the market with the largest revenue share of 44.59% in 2025 and is expected to grow at the fastest CAGR throughout the forecast period. Expanding the current manufacturing capacities for biopharmaceuticals drives the demand for cell culture products. Moreover, an increase in clinical trials on treatments for life-threatening diseases by pharmaceutical and biotechnology companies is further driving the demand for cell culture media. Furthermore, these companies are investing significantly in R&D activities, further boosting the demand for cultural media. Thus, the growth of the biopharmaceutical industry, the rise in the number of clinical trials, and initiatives for developing novel drugs are factors expected to boost market growth.

The hospital and diagnostic laboratory segment is projected to grow at a significant CAGR during the forecast period. This growth is driven by the rising use of cell culture media in diagnostic testing, the increasing prevalence of chronic diseases, and the growing adoption of advanced diagnostic technologies. The need for hospitals with advanced facilities has increased with ongoing changes in the healthcare industry. The rise in hospitals and diagnostic laboratories has also led to high segment growth. With the increase in the prevalence of chronic diseases, such as cancer and infectious and autoimmune diseases, the need for hospitals and diagnostic centers to detect antigens in cancer cells is increasing, thus driving the cell culture media industry.

Regional Insights

North America dominated the global cell culture media market with the largest revenue share of 38.47% in 2025. This major share can be attributed to the growth in the pharmaceutical and biotechnology industries, mounting approvals for cell culture-based vaccines, and rising incidence of diseases such as cancer, coupled with investments and funding in cell-based research.

U.S Cell Culture Media Market Trends

The cell culture media market in U.S. accounted for the largest market revenue share in North America in 2025. Government investments and leading players in the pharmaceutical and biotechnology industries are growing. For instance, in April 2023, the California Institute for Regenerative Medicine in the United States invested nearly USD 89 million in stem cell and gene therapy research, funding clinical and translational projects to accelerate treatment development, further supporting the need for cell culture media products in the gene therapy cell culture media industry.

Europe Cell Culture Media Market Trends

The cell culture media market in Europe is undergoing a phase of rapid growth, primarily driven by the increasing demand for advanced treatments, such as cancer therapies, which in turn is stimulating the cancer research and biopharmaceutical industries. Even though stem cell therapy is encountering difficulties with regulations in some nations, for example, Italy, where there are fears of unproven medical treatments, the area is still enjoying the backing of strong investments. Moreover, prominent investors like Sofinnova Partners are playing the role of an active contributor in financing gene and cell therapy startups, which in turn speeds up innovation and market growth.

The UK cell culture media market is anticipated to grow at a significant CAGR over the forecast period. Increasing investments in developing innovative cell culture solutions, alongside emerging regional players offering advanced technologies, are poised to significantly boost the UK’s cell culture vessels market growth.

The cell culture media market in Germany is expected to grow exponentially. Extensive research efforts by regional players and academic institutions aim to develop novel vaccines and therapeutics, significantly boosting demand for cell culture solutions in both research and clinical applications.

Asia Pacific Cell Culture Media Market Trends

The cell culture media market in Asia Pacific is expected to grow at the fastest CAGR of 15.72% from 2026 to 2033, owing to the increase in awareness associated with using the cell culture technique. Moreover, strategic activities by key market players to expand their presence in the Asia-Pacific countries to capture a high market share are expected to offer lucrative opportunities. For instance, in February 2023, Inventia Life Science in Australia partnered with MSD (Merck & Co., Inc., USA) to develop advanced 3D in vitro brain cell models for preclinical drug discovery in neurodegenerative diseases.

The China cell culture media market held a significant share in Europe in 2025. The advancement in gene therapy for deafness in China can profoundly impact the country's market. For instance, in November 2024, China launched pilot programs across major cities and free-trade zones, allowing foreign investment in cell therapy and wholly foreign-owned hospitals to expand its healthcare sector. This move reflects China's ongoing efforts to attract more foreign capital and open its economy.

The cell culture media market in Japan is expected to grow at a substantial CAGR over the forecast period. Moreover, the high prevalence of chronic diseases and the COVID-19 pandemic have led to increased R&D activities for developing novel therapies and vaccines, thus creating a high demand for cell culture media solutions.

MEA Cell Culture Media Market Trends

The cell culture media market in the Middle East and Africa is expected to grow at a significant CAGR throughout the forecast period. The presence of organizations, such as the Centre for Proteomic and Genomic Research (CPGR), is enabling the availability of cell culture-based screening for a faster drug development process, which creates a demand for cell culture media. Moreover, increased interest by global players in setting up manufacturing units for vaccines in the country is expected to contribute to market growth.

The Kuwait cell culture media market held a significant share in Middle East & Africa in 2025. Kuwait’s advancements in stem cell therapy contribute to a growing demand for cell culture media in the Gulf region. Since the launch of its pediatric stem cell transplant program in 2020, Kuwait has completed 33 transplant procedures, positioning it as a leader in the field. As the use of stem cells expands in clinical applications, research, and therapeutic programs, the need for high-quality stem cell culture media is expected to rise, driving significant growth in the regional cell culture media industry.

Key Cell Culture Media Company Insights

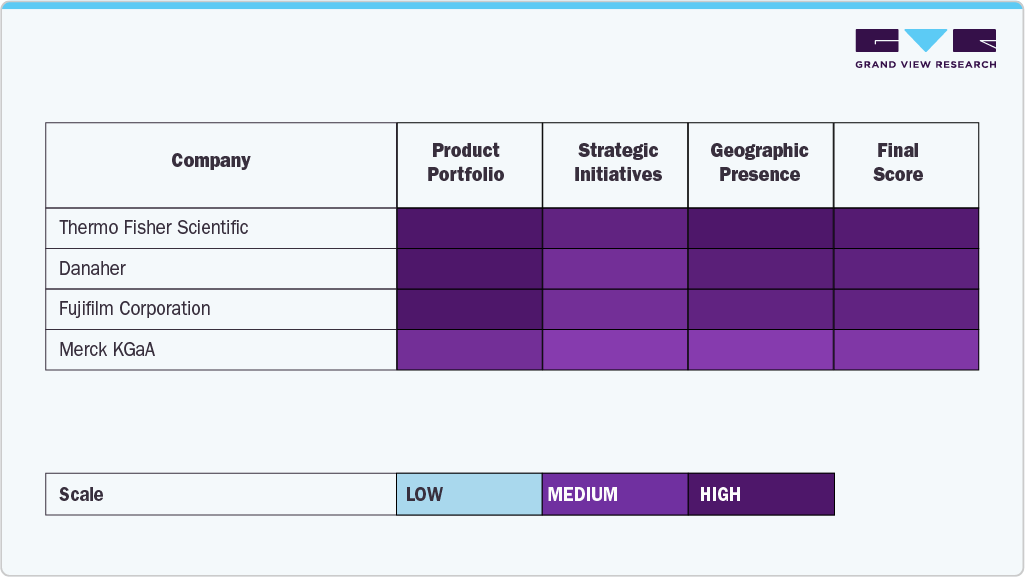

The cell culture media industry is defined by a blend of well-established industry leaders and emerging innovators competing to meet the growing demands of biotechnology, pharmaceutical, and regenerative medicine sectors. Major players such as Sartorius AG, Danaher, Merck KGaA, Thermo Fisher Scientific, Inc., FUJIFILM Corporation, and Lonza have solidified their positions through robust product portfolios, global distribution capabilities, and sustained investments in research and development. These companies offer various cell culture media formulations from classical and serum-free media to highly specialized solutions supporting applications in vaccine production, biopharmaceuticals, stem cell research, and cancer biology.

Meanwhile, companies like BD, STEMCELL Technologies, Cell Biologics, Inc., and PromoCell GmbH are expanding their presence by focusing on niche offerings and customized media solutions that cater to the evolving needs of researchers and clinical developers. Their emphasis on high-performance, animal-origin-free, and chemically defined media helping address regulatory and reproducibility challenges across applications.

The competitive cell culture media industry is gradually having its shape molded by the trio of strategic partnerships, technological breakthroughs, and the trend towards automation and scale in bioprocessing. The demand for cell-based therapies, vaccine production, and precision medicine is persistent and has led the major players to synchronize their plans with the universal concerns of being accessible, cost-effective, and practicing environmentally friendly production. Innovativeness, responsible sourcing, and customized client solutions will be the main factors that will shape the future path of the cell culture media industry, putting it at the center of the development of high-tech healthcare solutions.

Key Cell Culture Media Companies:

The following are the leading companies in the cell culture media market. These companies collectively hold the largest Market share and dictate industry trends.

- Sartorius AG

- Danaher

- Merck KGaA

- Thermo Fisher Scientific, Inc.

- FUJIFILM Corporation

- Lonza

- BD

- STEMCELL Technologies

- Cell Biologics, Inc.

- PromoCell GmbH

Recent Developments

-

In May 2025, PL BioScience in Germany partnered with South Korea’s DewCell Biotherapeutics to launch scalable artificial human platelet lysate, delivering a fully animal‑free cell culture medium for global cell therapy markets.

-

In April 2025, Capricorn Scientific partnered with florabio AS of Turkey to launch animal‑free, high‑yield cell culture media. The collaboration combined expertise in scalable, defined formulations to support biotech and vaccine R&D globally.

Cell Culture Media Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 5.26 billion

Revenue forecast in 2033

USD 12.80 billion

Growth rate

CAGR of 13.54% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Sartorius AG; Danaher; Merck KGaA; Thermo Fisher Scientific, Inc.; FUJIFILM Corporation; Lonza; BD; STEMCELL Technologies; Cell Biologics, Inc.; PromoCell GmbH

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cell Culture Media Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For the purpose of this report, Grand View Research has segmented the global cell culture media market report based on the product, application, type, end use, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Serum-free Media

-

CHO Media

-

BHK Medium

-

Vero Medium

-

HEK 293 Media

-

Other Serum-free media

-

-

Classical Media

-

Stem Cell Culture Media

-

Mesenchymal Stem Cells (MSCs)

-

Hematopoietic Stem Cells (HSCs)

-

Induced Pluripotent Stem Cells (iPSCs)

-

Other Stem Cells

-

-

Immunology Media

-

T Cells

-

B Cells

-

Natural Killer (NK) Cells

-

Other Immune Cells

-

-

Specialty Media

-

Chemically Defined Media

-

Other Cell Culture Media

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Biopharmaceutical Production

-

Monoclonal Antibodies

-

Vaccines Production

-

Other Therapeutic Proteins

-

-

Diagnostics

-

Drug Screening and Development

-

Tissue Engineering and Regenerative Medicine

-

Cell and Gene Therapy

-

Other Tissue Engineering and Regenerative Medicine Applications

-

-

Other Applications

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Liquid Media

-

Semi-solid and Solid Media

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical and Biotechnology Companies

-

Hospitals and Diagnostic Laboratories

-

Research and Academic Institutes

-

Other End Uses

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cell culture media market size was estimated at USD 4.75 billion in 2025 and is expected to reach USD 5.26 billion in 2026.

b. The global cell culture media market is expected to witness a compound annual growth rate of 13.54% from 2026 to 2033 to reach USD 12.80 billion in 2033.

b. The serum-free media segment held the largest share of the cell culture media market. This is attributed to the increasing gene and cell therapy research along with advantages offered by SFM, which in turn is likely to increase the adoption and anticipate the market growth.

b. The key players competing in the cell culture media market include Danaher Corporation (CYTIVA), Sartorius Stedim Biotech, Thermo Fisher Scientific, Inc, and Merck KGaA.

b. Expansion of biosimilars and biologics, growth in stem cell research, and emerging bio manufacturing technologies for cell-based vaccines are the major factors which are likely to drive the cell culture media market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.