- Home

- »

- Biotechnology

- »

-

Cell Analysis Market Size & Share, Industry Report, 2030GVR Report cover

![Cell Report]()

Cell Analysis Market (2025 - 2030) Size, Share & Trends Analysis Report By Product & Service (Reagents & Consumables, Instruments), By Technique (Flow Cytometry, Cell Microarrays), By Process (Cell Interaction, Single-cell Analysis), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-348-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cell Analysis Market Summary

The global cell analysis market size was estimated at USD 31.59 billion in 2024 and is projected to reach USD 55.3 billion by 2030, growing at a CAGR of 10.03% from 2025 to 2030. This growth can be attributed to the increasing prevalence of chronic diseases, advancements in cell analysis technologies, and the growing number of drug discovery activities.

Key Market Trends & Insights

- North America cell analysis market dominated the global market and accounted for a 40.13% share in 2024.

- The U.S. cell analysis market is anticipated to witness lucrative growth over the forecast period.

- By product & service, the reagents & consumables segment dominated the market with the largest revenue share of 48.33% in 2024.

- By technique, the flow cytometry segment dominated the market with the largest revenue share of 18.95% in 2024.

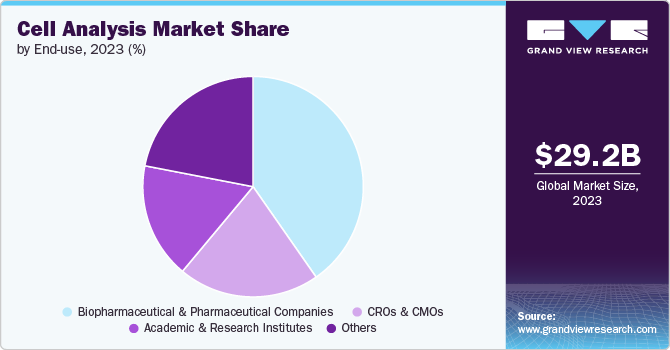

- end-use, the pharmaceutical and biotechnology companies segment dominated the market with the largest share of 39.99% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 31.59 Billion

- 2030 Projected Market Size: USD 55.3 Billion

- CAGR (2025-2030): 10.03%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Cell analysis has emerged as an important tool for the identification of potential therapies and treatments for chronic diseases. Thus, the increasing prevalence of chronic diseases such as cardiovascular diseases, cancer, autoimmune diseases, neurological disorders, and others can drive the demand for cell analysis. According to the American Cancer Society, over 2 million new cancer cases are expected to be diagnosed in the U.S. in 2024.

Cell analysis has witnessed an increase in its application, from early-stage cancer diagnostics to the development of cancer-associated therapies and tools, which has further increased its popularity in the oncology sector. The players operating in the oncology sector are increasing their efforts for advancements in cell analysis to develop advanced therapies and treatments. For instance, in March 2024, a cancer diagnostics company, Serum Detect, was set to launch the T-cell analysis approach for early cancer detection at the American Association for Cancer Research (AACR). Such increasing efforts by healthcare companies to increase the application of cell analysis are anticipated to drive market growth over the forecast period.

Moreover, technological advancements in cell analysis have enabled the development of automated cell analysis systems that offer results with better accuracy and efficiency. Similarly, the development of advanced technologies such as automated cell imaging, cell counting, and cell sorters allows researchers to study cells on a much larger scale. For instance, in July 2024. NanoCellect Biomedical announced the launch of VERLO, an image-guided cell sorter. This cell-sorter allows the researchers to distinguish & sort interacting cells, enabling precise characterization of cell subsets & validation of their functional phenotypes without disturbing the cell interactions. Such advancements in cell analysis technologies are anticipated to increase demand and drive market growth over the forecast period.

In addition to this, the adoption of cell cycle analysis has significantly increased in drug discovery to analyze the associated complexities. Similarly, the increasing advancements in cell biology, molecular biology, bioinformatics, proteomics, and genomics have increased the significance of utilizing cell-based assays in the drug development process. Cell-based assays offer an alternative approach to the conventional methods of toxicity and drug safety testing and allow researchers to identify problems with tested compounds in early screening through cytotoxicity and cell deaths. Thus, the increasing drug discovery activities owing to the rising need for advanced treatments are anticipated to increase the demand for cell-based assays, thereby driving the market growth.

Product & Service Insights

The reagents & consumables segment dominated the market with the largest revenue share of 48.33% in 2024. This can be attributed to the wide range of applications of reagents and consumables, frequent purchases, and increased demand for assay kits. Unlike other cell analysis products and services, reagents & consumables are used in different experiments and applications, increasing their purchase frequency. Similarly, the segment consists of a wide range of products addressing the different needs of researchers, which ensures the constant demand for these products throughout the research process, thereby contributing to the segment growth.

The service segment is expected to witness the fastest growth from 2025 to 2030 owing to the growing complexity of cell analysis techniques, which might require specialized expertise and solutions. The labs or research institutes may lack the availability of these resources thereby increasing the demand for specialized services. Similarly, the increasing number of CROs offering a wide range of cell analysis services offer alternatives for researchers to outsource specific services as per their requirements.

Technique Insights

The flow cytometry segment dominated the market with the largest revenue share of 18.95% in 2024. This can be attributed to the ability of the flow cytometry process to allow researchers to analyse a large number of cells simultaneously with multiple parameters such as size, shape, granularity, and the presence of specific molecules in or outside the cell surface. Moreover, several market players are developing solutions to enhance the flow cytometry results, which is further contributing to its growth. For instance, in November 2022, Sony Corporation announced the launch of SFA - Life Sciences Cloud Platform. This platform is a flow cytometry data analysis solution which can identify rare cells from a wide variety of cell populations with better efficiency using data obtained from flow cytometers.

The high-content screening segment is expected to grow at the fastest CAGR of 12.06% over the forecast period. High-content screening goes beyond traditional cell analysis techniques by using automated image analysis, artificial intelligence (AI), and machine learning, enabling researchers to extract better insights. Moreover, the ability of high-content screening to analyze a large number of compound and cellular features simultaneously is anticipated to drive its demand over the forecast period.

End-use Insights

The pharmaceutical and biotechnology companies segment dominated the market with the largest share of 39.99% in 2024. This can be attributed to the increasing drug discovery efforts, high R&D investment capacity, and increasing focus on personalized medicine by these companies. Pharmaceutical and biotechnology companies account for significantly high drug discovery activities. Cell analysis, being a crucial part of drug discovery, is utilized by these companies for various purposes, increasing the segment share of pharmaceutical and biotechnology companies.

Hospitals and clinical testing laboratories are expected to witness the fastest growth from 2025 to 2030. The fast growth can be attributed to the increasing demand for biomarker identification, early disease diagnostics, and disease progression. Cell analysis can help identify specific molecules or cellular characteristics, allowing hospitals to predict a patient's response to a particular treatment. This allows healthcare providers to personalize treatment plans for each patient, improving patient outcomes. Similarly, advanced cell analysis techniques can allow healthcare providers to diagnose diseases more accurately and effectively, further increasing their importance for hospitals and clinical testing laboratories.

Process Insights

The cell interaction segment dominated the market, with the largest revenue share of 16.44% in 2024. Cell analysis products facilitate the investigation of how cells communicate and interact with one another, which is crucial for understanding various biological processes, tissue formation, immune responses, and disease progression. Advanced cell analysis methods, including high-throughput microscopy, have been developed to study interactions within complex tissue microenvironments. These techniques allow for the examination of numerous interactions simultaneously, providing a comprehensive understanding of cellular behavior.

Single-cell analysis is expected to witness the fastest growth over the forecast period. Single-cell analysis allows researchers to analyze individual cells, revealing the remarkable heterogeneity within a seemingly homogenous group of cells. This hidden diversity can be crucial for cellular function, disease development, and drug response. Moreover, several market players are developing advanced solutions for single-cell analysis, further contributing to the segment growth. For instance, in October 2021, PerkinElmer and Honeycomb Biotechnologies launched the HIVE scRNAseq Solution. This solution advances single-cell analysis by allowing the researchers to capture, store, and analyze fragile cell types.

Regional Insights

North America cell analysis market dominated the global market and accounted for a 40.13% share in 2024 owing to the large number of drug discovery activities, better access to advanced cell analysis technologies, and presence of key market players, and the high prevalence of chronic diseases in the region. According to the Statistics Canada data, approximately 45.1% of Canadians in 2021 suffered from at least one major chronic disease. Such a high chronic disease prevalence increases the need for advanced and effective treatments, thereby driving market growth.

U.S. Cell Analysis Market Trends

The U.S. cell analysis market is anticipated to witness lucrative growth over the forecast period. This growth can be attributed to the presence of key market players, a supportive regulatory framework, and increasing R&D efforts by pharmaceutical and biotechnology companies. Moreover, the U.S. is home to several leading market players, which increases access to cell analysis technology for the country’s pharmaceutical and biotechnology industry. Similarly, these market players launch their advanced technologies in the country, further increasing their adoption and driving the market growth. For instance, in May 2023, Deepcell announced the launch of its REM-I Platform. This platform offers unprecedented insights into cell biology through high-dimensional analysis, scalable single-cell imaging, and cell sorting.

Europe Cell Analysis Market Trends

Europe cell analysis market is projected to witness significant growth driven by factors such as the rising government initiatives and funding for the life science sector, increasing prevalence of cancers, and developing healthcare sector. In May 2023, the UK Chancellor announced USD 808.45 million in funding for the country’s life science industry for various purposes such as improving commercial clinical trials, scientific innovation, increasing the capacity of biological data banks, and incentivizing pension schemes. Such increasing funding and efforts for the development of the region's life science industry are anticipated to drive the market in the region.

Asia Pacific Cell Analysis Market Trends

The cell analysis market in Asia Pacific is anticipated to witness the fastest growth at a CAGR of 10.87% from 2024 to 2030. The region is expected to witness substantial growth in the market, driven by factors such as increasing investments in healthcare infrastructure, high prevalence of chronic diseases, and increasing clinical trials. According to the American College of Cardiology Foundation data published in June 2021, cardiovascular disease-associated deaths in Asia rose from 5.6 million to 10.8 million from 1990 to 2019 in Asia. Such increasing prevalence of chronic disease. Such increasing prevalence of chronic diseases is expected to drive the demand for cell analysis technologies over the forecast period.

Key Cell Analysis Company Insights

Key players operating in the cell analysis industry are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are playing a key role in propelling market growth.

Key Cell Analysis Companies:

The following are the leading companies in the cell analysis market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific, Inc.

- Danaher

- BD

- Merck KGaA

- Agilent Technologies, Inc.

- Bio-Rad Laboratories, Inc.

- Miltenyl Biotech

- Revvity

- New England Biolabs

- Avantor, Inc.

Recent Developments

-

In February 2024, Cell Microsystems & OMNI Life Science announced a partnership to launch three innovative cell analysis solutions in North America. The products are expected to accelerate innovation and enhance research capabilities.

-

In February 2024, 10X Genomics announced the launch of GEM-X, comprising two single-cell gene assays-Chromium Single Cell Gene Expression 3'v4 and Chromium Single Cell Immune Profiling 5'v3, helping 10X Genomics to expand its single-cell technology products portfolio.

-

In February 2024, Takara Bio USA, Inc. announced the launch of two single-cell solutions, Shasta Total RNA-Seq Kit and Shasta Whole-Genome Amplification Kit.

-

In February 2024, Singleron Biotechnologies announced the opening of its labs in Ann Arbor, Michigan, U.S. The company planned to offer single-cell analysis service, comprehensive solutions from tissue dissociation, single-cell multi-omic analysis, single cell reagent kits, automation instruments, to bioinformatics support.

-

In August 2023, Cell Microsystems acquired Fluxion Biosciences to enhance its cell analysis product and service portfolio. This acquisition adds Fluxion Biosciences’s BioFlux, IonFlux, and IsoFlux products to Cell Microsystems’s portfolio to offer innovative cell analysis solutions to life science professionals and researchers.

Cell Analysis Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 34.3 billion

Revenue forecast in 2030

USD 55.3 billion

Growth rate

CAGR of 10.03% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & service, technique, process, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE,; Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc.; Danaher; BD; Merck KGaA; Agilent Technologies, Inc.; Bio-Rad Laboratories, Inc.; Miltenyl Biotech; Revvity; New England Biolabs; Avantor, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cell Analysis Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cell analysis market report based on product & service, technique, process, end-use, and region.

-

Product & Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Reagents & Consumables

-

Instruments

-

Accessories

-

Software

-

Service

-

-

Technique Outlook (Revenue, USD Million, 2018 - 2030)

-

Flow Cytometry

-

PCR

-

Cell Microarrays

-

Microscopy

-

Spectrophotometry

-

High Content-Screening

-

Other Techniques

-

-

Process Outlook (Revenue, USD Million, 2018 - 2030)

-

Cell Identification

-

Cell Viability

-

Cell Signaling Pathways

-

Cell Proliferation

-

Cell Counting

-

Cell Interaction

-

Cell Structure Study

-

Single-cell Analysis

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biotechnology Companies

-

Hospitals & Clinical Testing Laboratories

-

Academic & Research Institutes

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Some of the key players operating in the market include Thermo Fisher Scientific, Inc., Danaher, BD, Merck KGaA, Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Miltenyl Biotech, Revvity, New England Biolabs, and Avantor, Inc.

b. The growth of the market can be attributed to the increasing prevalence of chronic diseases, advancements in cell analysis technologies, and the growing number of drug discovery activities.

b. The global cell analysis market size was estimated at USD 31.59 billion in 2024 and is expected to reach USD 37.32 billion in 2025.

b. The global cell analysis market is expected to grow at a compound annual growth rate of 10.03% from 2025 to 2030 to reach USD 55.3 billion by 2030.

b. The reagents & consumables segment dominated the market with the largest revenue share of 48.33% in 2024. This can be attributed to the wide range of applications of reagents and consumables, frequent purchases, and increased demand for assay kits.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.