- Home

- »

- Pharmaceuticals

- »

-

Celiac Disease Treatment Market Size, Industry Report 2030GVR Report cover

![Celiac Disease Treatment Market Size, Share & Trends Report]()

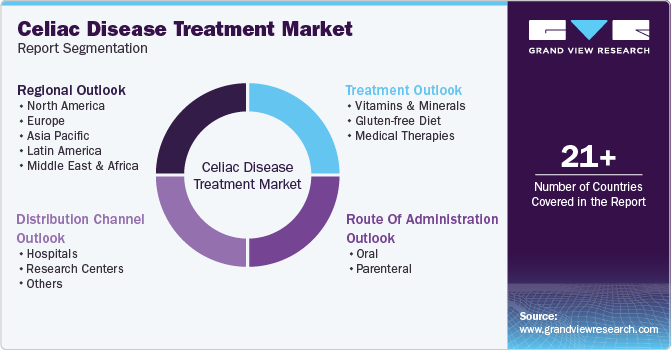

Celiac Disease Treatment Market (2025 - 2030) Size, Share & Trends Analysis Report By Treatment (Vitamins & Minerals, Gluten Degrading Enzymes), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-488-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Celiac Disease Treatment Market Summary

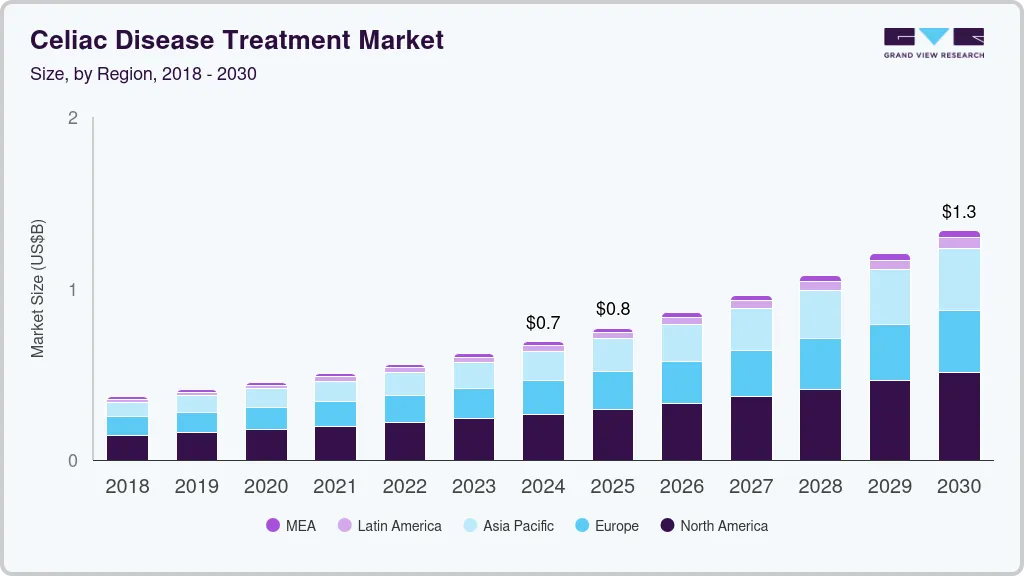

The global celiac disease treatment market size was estimated at USD 690.2 million in 2024 and is projected to reach USD 1,337.4 million by 2030, growing at a CAGR of 11.7% from 2025 to 2030. Foremost among these is the escalating prevalence of diagnosed celiac disease cases globally.

Key Market Trends & Insights

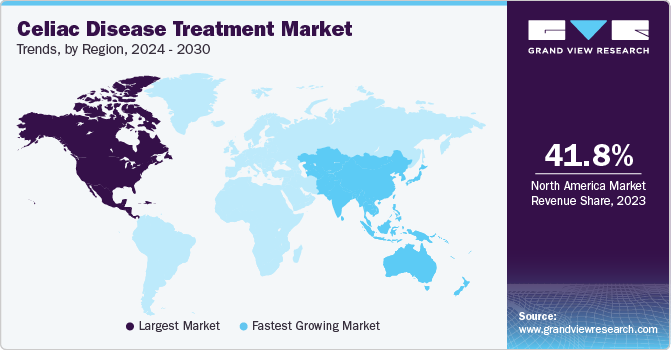

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, vitamins & minerals accounted for a revenue of USD 275.3 million in 2024.

- Gluten Degrading Enzymes is the most lucrative grade segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 690.2 million

- 2030 Projected Market Size: USD 1,337.4 million

- CAGR (2025-2030): 11.7%

- North America: Largest market in 2024

According to recent estimates, approximately 1 in 100 Americans suffers from celiac disease, although a significant proportion of cases remain undiagnosed. This rise in diagnosed instances, attributed to increased awareness and improved diagnostic capabilities, directly translates into a greater demand for effective treatments and diagnostic methodologies. The market benefits from this increasing patient base, driving pharmaceutical innovation and expanding the need for specialized dietary management.

As public knowledge about celiac disease symptoms and the crucial role of early diagnosis continues to grow, individuals are increasingly proactively seeking medical consultations and testing, thereby contributing to the increased identification of cases. Notably, a 2023 survey by Beyond Celiac revealed that only approximately 50% of Americans know anything about celiac disease or gluten sensitivity, indicating a growing awareness gap that needs to be bridged. However, the expanding gluten-free food industry offers a diverse range of dietary options for individuals managing the disease. The availability of these products plays a significant role in patient adherence to dietary restrictions, thereby improving health outcomes and contributing to market growth.

Improvements in detection methods, such as advancements in point-of-care testing (POCT), have facilitated earlier identification and intervention, leading to quicker and more effective treatment. Government initiatives across numerous nations, including screening programs targeting high-risk demographics, further bolster market development. These proactive measures increase the number of diagnosed cases and provide patients with timely access to diagnostics and treatment options, thereby promoting a more comprehensive and proactive healthcare approach. Notably, various countries have implemented programs to raise awareness about celiac disease and enhance access to diagnostics and treatment, underscoring the commitment to addressing this growing health concern.

Ongoing research into new therapeutic modalities assures novel developments in the treatment of celiac disease in the coming years. The development of anti-inflammatory drugs and therapeutic vaccines is expected to enhance treatment options and expand market opportunities. Furthermore, increasing healthcare expenditure and robust R&D activities, particularly in novel treatment alternatives, are poised to drive market expansion. Key players are increasingly investing in drugs and gluten-free products, indicating an emphasis on improving patient health, driving market penetration, and catering to an expanding consumer base.

Treatment Insights

Vitamins and minerals dominated the market and accounted for the largest revenue share of 39.9% in 2024, driven by individuals with celiac disease, who often experience nutrient deficiencies due to the malabsorption of essential vitamins and minerals caused by intestinal damage. Supplementation with targeted vitamins and minerals helps address these deficiencies and supports overall health. Furthermore, the increasing availability of specialized vitamin and mineral supplements formulated for celiac patients has expanded treatment options. Rising awareness of the importance of proper nutrition in celiac disease management further contributes to the segment’s growth.

Gluten degrading enzymes are projected to grow at a CAGR of 13.9% over the forecast period. Individuals with celiac disease require a strict gluten-free diet to manage their symptoms. However, there is a growing demand for gluten-free products worldwide because of the increasing prevalence of celiac disease and other food allergies. Celiac disease is an autoimmune disorder caused by gluten-containing food consumption, leading to gut inflammation and other health issues. Moreover, individuals are increasingly focused on health and wellness, leading to a shift in dietary preferences. The increased consumption of gluten-free products such as bread, cookies, and other bakery items in restaurants, cafés, and home-cooked meals has aided segment growth.

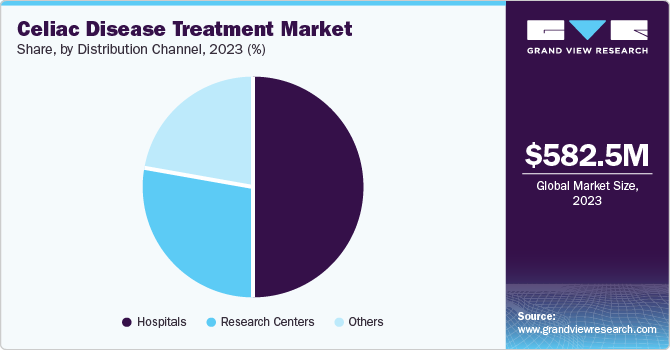

Distribution Channel Insights

Retail pharmacies held the largest revenue share of 39.9% in 2024. Retail pharmacies include independent and chain establishments and are crucial in ensuring accessible access to medications, vitamins, and over-the-counter products for individuals with celiac disease. This sector is anticipated to experience substantial growth fueled by the increasing demand for gluten-free items, nutritional supplements, and essential medicines required for effective management of the condition.

The healthcare sector is projected to grow at the fastest CAGR of 5.6% over the forecast period. Alternative distribution channels for celiac disease treatment encompass online pharmacies, research centers, homecare services, and specialty clinics. Online pharmacies are experiencing growth due to the convenience of home delivery of gluten-free products and medications, particularly benefiting those in remote areas. Research centers are becoming vital for distributing investigational drugs, leading to increased collaboration with pharmaceutical companies. Moreover, the expertise of clinical research organizations in managing trials supports therapy development. Homecare services are in demand for personalized patient support, while specialty clinics enhance treatment relevance through targeted management strategies.

Regional Insights

North America celiac disease treatment market dominated the global market with a revenue share of 38.7% in 2024. This growth is attributed to the rising prevalence of celiac diseases, rising awareness among citizens, the presence of major companies, and a strong supply channel of medications in the region. In addition, with the consumption of gluten-containing foods, the prevalence of the disease is growing in the region, resulting in advanced and timely diagnosis of celiac diseases with the requirement of improved treatment options.

U.S. Celiac Disease Treatment Market Trends

The celiac disease treatment market in U.S. dominated the North America market with a revenue share of 90.1% in 2024, owing to the consumption of alcoholic beverages, and fast food increasing in the region, which is a major risk factor for all age groups, giving rise to celiac disease. In addition, packaged food with gluten and irregular dietary patterns are due to hectic work life, and an increasing preference for ready-to-eat food results in increasing diseases. Therefore, the high consumption of gluten-containing food and the prevalence of celiac diseases result in the need for celiac disease treatment, fueling the market during the forecast period.

Europe Celiac Disease Treatment Market Trends

Europe celiac disease treatment market held substantial market share in 2024. This growth is driven by the rising number of geriatrics, more active lifestyles in European countries, and technological developments in healthcare. Furthermore, advancements in diagnostic technologies and a growing gluten-free food industry support market expansion. Increased healthcare expenditures further facilitate the development of new treatment options and improved patient care.

The celiac disease treatment market in Germany is expected to grow rapidly over the forecast period. The rise in recognition and diagnosis of celiac disease in Germany is driving treatment demand. A 2025 study published in Therapeutic Advances in Gastroenterology analyzed data from 8,243 celiac disease patients, representing approximately 4.8% of the German population. This confirms that the prevalence of celiac disease in Germany averages 1%-2%. Increased healthcare resource utilization reveals higher costs for diagnosed patients. Advancements in therapeutic options, a growing gluten-free food market, and supportive government initiatives further enhance access to treatment and management strategies for celiac disease, promoting market growth.

Asia Pacific Celiac Disease Treatment Market Trends

Asia Pacific celiac disease treatment market is expected to register the fastest CAGR of 13.3% in the forecast period. The increasing awareness of celiac disease and the increasing elderly population in countries such as India, China, Japan, and South Korea. Furthermore, the expanding gluten-free food industry also contributes significantly, alongside growing healthcare expenditures that support better treatment options and patient care.

The celiac disease treatment market in China dominated the Asia Pacific market in 2024, fueled by the increased awareness of celiac disease and its timely treatment, rising healthcare expenditures, suitable and strong economic conditions, and technical enhancements that drive the market. The major factor that propels the growth of the celiac disease treatment market in the country is the awareness of celiac disease among the citizens and the increasing elderly population. As more people become aware of celiac disease, they are likely to prefer early diagnostics and treatment, which is leading to increased demand for celiac disease treatment.

Key Celiac Disease Treatment Company Insights

Some key companies in the celiac disease treatment market include Teva Pharmaceutical Industries Ltd.; Amgen Inc.; Amneal Pharmaceuticals LLC.; and GLENMARK PHARMACEUTICALS LTD. Key market players are focusing on continuous development and innovation to gain a competitive edge in the industry.

-

Amneal Pharmaceuticals LLC manufactures and distributes generic pharmaceuticals and serves the healthcare sector worldwide. The company offers prescription pharmaceutical products in several forms, including hormonal, potency formulations, soft gelatin capsules, tablets, liquids, and oral solids. They specialize in delivering medical products for central nervous system disorders, parasitic infections, and other therapeutic categories.

-

Zydus Pharmaceuticals, Inc. provides pharmaceutical products and manufactures pharmaceutical ingredients and animal healthcare products. They market, package, and distribute tablets, capsules, soft gel, sterile liquids, and inhalers worldwide. The company also manufactures and markets healthcare solutions, including formulations, active pharmaceutical ingredients, vaccines, diagnostics, health and dietetic foods, cosmeceuticals, and animal healthcare.

Key Celiac Disease Treatment Companies:

The following are the leading companies in the celiac disease treatment market. These companies collectively hold the largest market share and dictate industry trends.

- Teva Pharmaceutical Industries Ltd.

- Amgen Inc.

- Amneal Pharmaceuticals LLC.

- GLENMARK PHARMACEUTICALS LTD.

- Takeda Pharmaceutical Company Limited.

- Hikma Pharmaceuticals PLC

- Viatris Inc.

- Zydus Pharmaceuticals, Inc.

- Novartis Pharmaceuticals Corporation

- BioLineRx Ltd.

Recent Developments

-

In February 2025, AliveDx submitted a 510(k) application to the U.S. FDA for the MosaiQ AiPlex Celiac Disease microarray, aimed at enhancing diagnostic accuracy and efficiency in celiac disease detection.

-

In July 2024, Tampere University, Finlandreported promising progress with ZED1227, a drug designed to manage celiac disease. The clinical trial demonstrated ZED1227’s ability to block harmful immune reactions to gluten, offering hope for enhanced treatment options alongside a gluten-free diet. Continued research was deemed essential for clinical application.

-

In February 2024, Novartis received the FDA approval of Xolair (omalizumab) as the first and only medication for reducing allergic reactions in individuals aged one and older with IgE-mediated food allergies. This approval followed the successful Phase III OUtMATCH study, demonstrating that Xolair significantly helps patients tolerate small amounts of allergens including peanuts and milk.

Celiac Disease Treatment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 769.2 million

Revenue forecast in 2030

USD 1.34 billion

Growth rate

CAGR of 11.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Treatment, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Teva Pharmaceutical Industries Ltd.; Amgen Inc.; Amneal Pharmaceuticals LLC.; GLENMARK PHARMACEUTICALS LTD.; Takeda Pharmaceutical Company Limited; Hikma Pharmaceuticals PLC; Viatris Inc.; Zydus Pharmaceuticals, Inc.; Novartis Pharmaceuticals Corporation; BioLineRx

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Celiac Disease Treatment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global celiac disease treatment market report based on treatment, distribution channel, and region:

-

Treatment Outlook (Revenue, USD Million, 2018 - 2030)

-

Vitamins & Minerals

-

Gluten Degrading Enzymes

-

Symptomatic Treatment (Anti-inflammatory Drugs, Antihistamines, Others)

-

Other Treatments

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Other Distribution Channels

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.