CBD Skin Care Market Size, Share & Trends Analysis Report By Product (Facial Oils, Creams, Moisturizers, Lotions, Serums, Masks), By Source (Hemp), By Distribution Channel (Specialty Stores, Pharmacies, Online), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-3-68038-470-3

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

CBD Skin Care Market Size & Trends

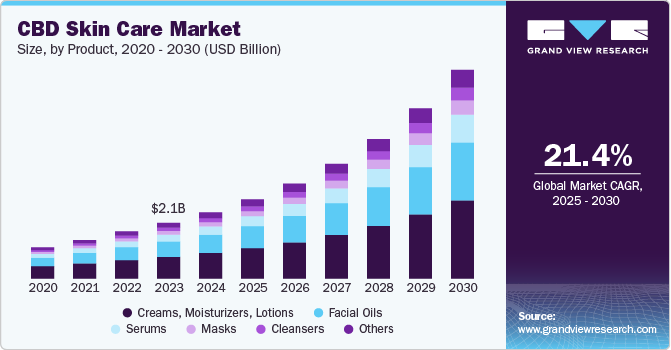

The global CBD skin care market size was estimated at USD 2,486.0 million in 2024 and is projected to grow at a CAGR of 21.4% from 2025 to 2030.This rapid growth is driven by increasing consumer awareness of the therapeutic benefits of CBD in treating skin conditions such as acne, inflammation, and aging. In addition, the rising demand for natural and organic products, along with the ongoing legalization of CBD across various regions, is further fueling market expansion. Innovations in product formulations and growing acceptance in the wellness and beauty sectors also contribute to the market's upward trajectory.

The FDA’s position on cannabis and cannabis-derived ingredients in cosmetics plays a key role in this market's regulation. While cosmetic products and ingredients, including cannabis-derived ones, are not subject to FDA premarket approval, they must comply with safety standards under the FD&C Act. Ingredients such as CBD are permitted, provided they do not adulterate or misbrand the product, making consumer safety paramount. This regulatory framework allows for the continued growth of hemp-derived CBD products, but manufacturers must ensure compliance with FDA guidelines to avoid legal issues or unsafe formulations.

Consumer preferences are significantly driving the market growth as more individuals seek natural and organic solutions for their skin care needs. As consumers become increasingly aware of the benefits of CBD, including its anti-inflammatory and antioxidant properties, they are opting for products that promote holistic wellness and overall skin health. For instance, brands like Lord Jones and Herbivore Botanicals are tapping into this trend by offering premium CBD-infused formulations that cater to health-conscious consumers. The growing preference for clean beauty products that are free from synthetic ingredients and harmful chemicals has also led to a surge in demand for CBD skincare, with consumers actively seeking vegan, cruelty-free, and sustainable options.

The market for CBD skin care is poised for substantial growth and presents numerous opportunities for brands looking to innovate and expand their offerings. With a projected CAGR of 21.2% in the forecast period in the U.S. alone, the market is at a high growth stage for new entrants and product development. For example, the launch of specialized CBD products targeting specific skin concerns, such as acne or aging, is gaining traction, with companies like Kimirica introducing tailored formulations that appeal to diverse consumer needs. In addition, the integration of CBD into luxury skincare lines, such as Estée Lauder’s recent introduction of CBD-infused products, reflects the increasing acceptance of CBD in mainstream beauty. As e-commerce continues to thrive, brands have the opportunity to reach a broader audience through online platforms, utilizing social media marketing and influencer partnerships to drive awareness and engagement.

Product Insights

The creams, moisturizer, and lotions segment led the market with the largest revenue share of 38.61% in 2024.This significant market share is attributed to the growing popularity of topical applications for targeted relief and skin benefits such as hydration, anti-inflammatory properties, and anti-aging effects. Consumers are increasingly seeking CBD-infused products for everyday skin care routines, particularly for their ability to soothe and nourish sensitive or irritated skin. In addition, the wide availability of these products across retail and online platforms has boosted their accessibility and demand.

The serum segment is projected to grow at the fastest CAGR of 22.7% from 2025 to 2030, driven byrising consumer demand for potent, concentrated skin care solutions that target specific concerns such as wrinkles, fine lines, and hyperpigmentation. The increasing adoption of CBD serums is also linked to their enhanced absorption properties, allowing for deeper skin penetration and more effective delivery of CBD's anti-inflammatory and antioxidant benefits. In addition, the growing trend towards personalized and high-performance skin care, along with expanding product innovation in CBD formulations, is further boosting the demand for CBD-infused serums.

Source Insights

Based on source, the hemp-derived CBD segment led the market with the largest revenue share of 84.65% in 2024, reflecting strong consumer demand for natural, plant-based ingredients. The growing preference for hemp-derived CBD products is closely tied to their association with wellness, anti-inflammatory properties, and overall skin health.

The marijuana-derived CBD segment is projected to grow at the fastest CAGR of 22.2% from 2025 to 2030, driven by the expanding legalization of marijuana in various regions and growing awareness of its potential therapeutic benefits. Marijuana-derived CBD is often viewed as more potent, which appeals to consumers looking for stronger effects in skin care treatments, such as for chronic inflammation or other skin conditions. As regulations continue to evolve, more brands are entering this segment, offering innovative formulations that combine the benefits of both CBD and other cannabinoids, further fueling market growth.

Distribution Channel Insights

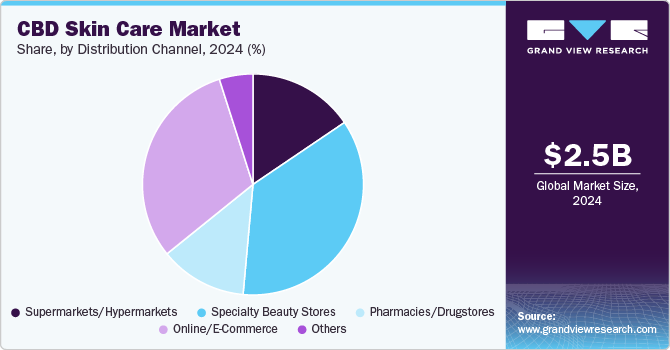

Based on distribution channel, the specialty beauty store segment led the market with the largest revenue share of 35.90% in 2024, driven by the stores' ability to offer curated, premium products alongside personalized customer experiences. Consumers are increasingly seeking high-quality, niche CBD-infused skin care products that are not widely available in mass-market retail outlets. Specialty beauty stores, such as Sephora and Ulta, have capitalized on this demand by partnering with luxury and indie CBD brands, offering exclusive product lines and in-store education to enhance consumer trust and knowledge. These stores also cater to a clientele that values wellness, clean beauty, and ingredient transparency, which has bolstered CBD product adoption through targeted marketing and expert consultations.

The online segment is projected to grow at the fastest CAGR of 22.6% from 2025 to 2030, driven by the increasing consumer shift toward digital shopping platforms. This growth is fueled by the convenience of e-commerce, the ability to access a wider range of products, and the rise of direct-to-consumer (DTC) CBD brands. Many CBD skin care companies are leveraging social media, influencer marketing, and targeted online ads to reach tech-savvy consumer while providing detailed product information and customer reviews that build trust. In addition, the growing acceptance of CBD has encouraged major online retailers like Amazon and specialty beauty e-tailers to expand their CBD product offerings, further accelerating the market shift toward online channels.

Regional Insights

North America dominated the CBD skin care market with the largest revenue share of 41.19% in 2024, driven by evolving regulatory frameworks across the U.S. and Canada. In the U.S., while the 2018 Farm Bill legalized hemp-derived CBD with less than 0.3% THC at the federal level, the FDA has not yet established clear regulations for its use in cosmetics, leading to a patchwork of state-specific rules. Some states allow CBD in skin care without restrictions, while others impose stricter guidelines. In Canada, CBD is regulated under the Cannabis Act, and cosmetic products containing CBD require licensing and adherence to specific THC content limits. The region's regulatory complexity requires manufacturers to navigate varying legal landscapes, ensuring compliance while capitalizing on growing consumer demand for CBD skin care products.

U.S. CBD Skin Care Market Trends

The CBD skin care market in the U.S. is expected to grow at the fastest CAGR of 21.2% from 2025 to 2030, driven by expanding consumer awareness of CBD's therapeutic benefits for skin conditions like acne, eczema, and aging. U.S. growth is further supported by the increasing availability of premium CBD skin care brands through both specialty retailers and e-commerce platforms. Regulatory challenges persist due to the FDA’s slow development of comprehensive guidelines, but consumer demand remains robust, with brands leveraging influencer marketing and wellness trends to accelerate market penetration. The popularity of clean beauty and natural ingredients continues to drive the U.S. market forward.

Europe CBD Skin Care Market Trends

The CBD skin care market in Europe accounted for the revenue share of 30.11% of the global market in 2024. European consumers are particularly drawn to the anti-inflammatory and antioxidant properties of CBD for skin care, which aligns with their preference for natural wellness products. The regulatory environment in Europe, guided by the European Commission’s classification of CBD as a novel food and cosmetic ingredient, varies by country but is generally more structured compared to the U.S., offering clearer pathways for product launches. Key markets such as the UK, Germany, and France are leading in both demand and innovation within the CBD skin care segment.

Asia Pacific CBD Skin Care Market Trends

The CBD skin care market in Asia Pacific is expected to grow at the fastest CAGR of 22.8% from 2025 to 2030, fueled by growing awareness of CBD’s skin benefits and the increasing acceptance of cannabis-derived products in countries like Japan, South Korea, and Australia. Although regulatory restrictions on cannabis remain strict in some parts of the region, markets such as Hong Kong have relaxed rules on CBD, creating opportunities for brands to introduce high-end, CBD-infused skin care lines. The region’s demand for premium beauty products, combined with the rise of e-commerce and cross-border shopping, is contributing to the rapid expansion of CBD skin care in Asia Pacific.

Key CBD Skin Care Company Insights

The market is highly fragmented, with a mix of established cosmetic brands, indie companies, and emerging CBD-focused startups competing for market share. Key players include major beauty brands like Estée Lauder and Sephora, which have introduced CBD-infused products through their premium lines, alongside dedicated CBD companies such as Cannuka, Lord Jones, and Vertly. These brands are differentiating themselves through unique formulations, organic certifications, and targeted marketing efforts that emphasize the wellness and therapeutic benefits of CBD.

Key CBD Skin Care Companies:

The following are the leading companies in the cbd skin care market. These companies collectively hold the largest market share and dictate industry trends.

- L’Oréal (Kiehl’s)

- 707 Flora, LLC

- CBD For Life

- Charlotte's Web, Inc.

- Elixinol

- Sweet Earth LLC

- The CBD Skincare Co

- Cannabliss Organic LLC

- Herbivore Botanicals

- Lab To Beauty

View a comprehensive list of companies in the CBD Skin Care Market

Recent Developments

-

In June 2024, Samson Extracts, an Alabama-based manufacturer of bulk CBD products and one of the top ten hemp processors in the U.S., has launched its premier CBD skincare brand, Wiregrass Wellness. The brand offers a range of six high-quality, vegan-friendly products designed for all skin types, emphasizing sustainability and natural ingredients, including formulations that are gluten-free, sulfate-free, and paraben-free.Wiregrass Wellness products are available for nationwide shipping and will soon be introduced in stores across Alabama and other Southern states in the U.S.

-

In June 2024, NOW Health Group has launched a new line of THC-free CBD topical products under its NOW Solutions brand, including a CBD Joint & Muscle Cream, CBD Balm, and CBD Massage Oil, formulated with broad-spectrum hemp and various botanical ingredients to support muscles, joints, and skin. NOW's decision to enter the CBD market reflects a commitment to delivering safe, effective products backed by growing research on the benefits of CBD in topical applications, with the assurance that these products comply with legal requirements across all 50 states in the U.S.

-

In February 2023, Kenneth Cole launched CBD skincare collection aligned with The 95th Academy Awards 2023.

CBD Skin Care Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 2,968.3 million |

|

Revenue forecast in 2030 |

USD 7,834.6 million |

|

Growth rate |

CAGR of 21.4% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, source, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; and Middle East & Africa |

|

Country scope |

U.S; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia; Brazil; South Africa; UAE |

|

Key companies profiled |

L’Oréal (Kiehl’s); 707 Flora, LLC; CBD For Life; Charlotte's Web, Inc.; Elixinol; Sweet Earth LLC; The CBD Skincare Co; Cannabliss Organic LLC; Herbivore Botanicals; Lab To Beauty |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global CBD Skin Care Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global CBD skin care market report based on product, source, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Facial Oils

-

Creams, Moisturizer, and Lotions

-

Serums

-

Masks

-

Cleansers

-

Others

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Hemp-derived CBD

-

Marijuana-derived CBD

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets/Hypermarkets

-

Specialty Beauty Stores

-

Pharmacies/Drugstores

-

Online/E-Commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global CBD skin care market size was estimated at USD 2,486.0 million in 2024 and is expected to reach USD 2,968.3 million in 2025.

b. The global CBD skin care market is expected to grow at a compound annual growth rate of 21.4% from 2025 to 2030 to reach USD 7,834.6 million by 2030.

b. The CBD skin care market in North America accounted for a share of 41% of the global market revenue in 2024, driven by evolving regulatory frameworks across the U.S. and Canada.

b. Some key players operating in the CBD skin care market include L’Oréal (Kiehl’s), 707 Flora, LLC, CBD For Life, Charlotte's Web, Inc., Elixinol, Sweet Earth LLC, The CBD Skincare Co, Cannabliss Organic LLC, Herbivore Botanicals, and Lab To Beauty.

b. Key factors that are driving the market growth include growing awareness with respect to the benefits of CBD infused personal care products.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."