- Home

- »

- Advanced Interior Materials

- »

-

Cathode Materials Market Size, Share, Industry Report, 2030GVR Report cover

![Cathode Materials Market Size, Share & Trends Report]()

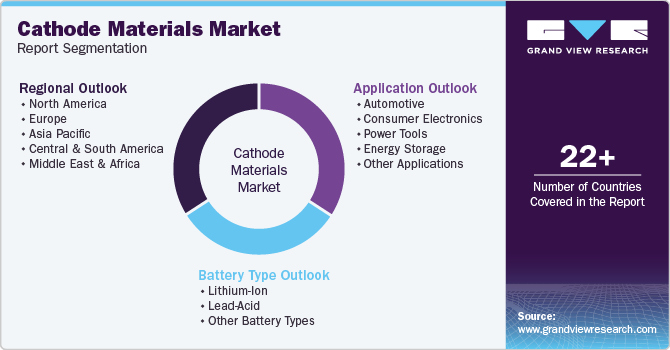

Cathode Materials Market (2024 - 2030) Size, Share & Trends Analysis Report By Battery Type (Lithium-Ion, Lead-Acid), By Application (Automotive, Consumer Electronics, Power Tools, Energy Storage), And By Segment Forecasts

- Report ID: GVR-4-68040-455-8

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cathode Materials Market Summary

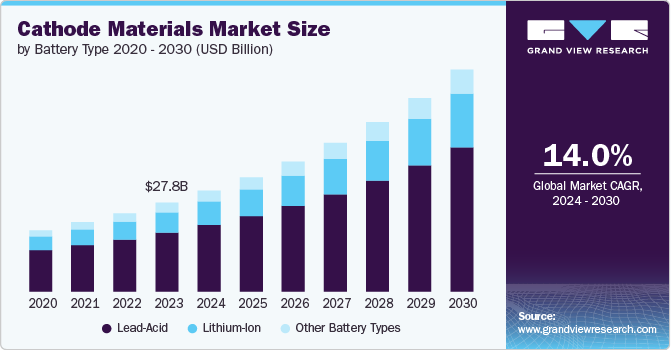

The global cathode materials market was estimated at USD 27.83 billion in 2023 and is projected to reach USD 69.33 billion by 2030, growing at a CAGR of 14.0% from 2024 to 2030. This growth is attributed to the rapid growth of the electric vehicle (EV) market and the global shift towards renewable energy which has increased the demand for cathode materials for battery manufacturing.

Key Market Trends & Insights

- North America cathode materials market dominated with a share of 23.5% in 2023.

- The cathode materials market in the U.S. is growing at a CAGR of 14.4% over the forecast period.

- By battery type, the lead-acid segment dominated the market in 2023 with a revenue share of 66.6%.

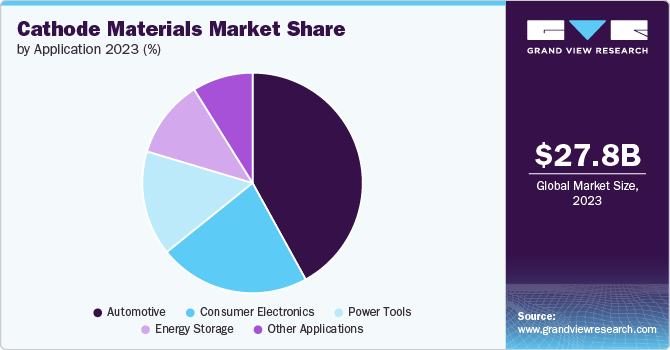

- By application, automotive accounted for the largest revenue share of 42.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 27.83 Billion

- 2030 Projected Market Size: USD 69.33 Billion

- CAGR (2024-2030):14.0%

- North America: Largest market in 2023

Cathode materials are essential in lithium-ion batteries which play a vital role in determining the energy density, performance, and lifespan of these batteries. With rising push for carbon neutrality, the adoption of EVs, energy storage systems, and renewable energy infrastructure is expected to increase sharply. This surge in battery demand will directly drive the need for high-performance cathode materials like lithium iron phosphate (LFP) and nickel-cobalt-manganese (NCM) combinations in the coming years.

Advancements in battery technology are focusing on improving energy efficiency and reducing costs, further fueling demand for advanced cathode materials. Industries are optimizing battery performance for longer range and faster charging which is expected to increase requirement for materials with enhanced stability, energy capacity, and sustainability. Moreover, supply chain concerns around critical materials like cobalt are spurring innovation and increased investment in alternative cathode materials, all contributing to the overall rise in demand.

The cathode materials market is extremely competitive in nature and characterized by the presence of several regional and international players. Prominent players are adopting various strategies to gain market share, such as investing in research and development to create more efficient and cost-effective materials. These players are also exploring alternative materials with less reliance on expensive and scarce elements such as cobalt and are focusing on nickel-rich and lithium iron phosphate (LFP) chemistries. Furthermore, market players are expanding their production capacities and forming strategic partnerships with battery manufacturers and automobile manufacturers to secure long-term supply agreements.

Battery Type Insights

Lead-acid dominated the market with a revenue share of 66.6% in 2023 and is further expected to grow at a significant rate over forecast period. The rising use of these batteries in traditional automotive markets, backup power supplies, and industrial applications is anticipated to increase the demand for lead-acid batteries. Lead-acid batteries are cost-effective and widely used in vehicles with internal combustion engines (ICE), uninterruptible power supplies (UPS), and grid energy storage in developing regions. Despite the rise of lithium-ion technology, lead-acid batteries remain a reliable and low-cost option for many applications, especially in markets where affordability and durability are prioritized over energy density, thus increasing the demand for cathode materials such as lead dioxide over the forecast period.

Demand for lithium-ion battery cathode materials is expected to grow at a significant rate over the period of 2024-2030. This attributed to the rising adoption of electric vehicles (EVs), renewable energy storage systems, and portable electronics globally. Lithium-ion batteries are known for their high energy density and longer lifespan, and are the preferred choice for these applications, making materials such as nickel, cobalt, manganese, and lithium increasingly crucial. With the expanding demand for EVs due to stricter emission regulations leading to the need for high-performance cathode materials, which is fueling the market growth.

Application Insights

Automotive application accounted for the largest revenue share of 42.0% in 2023. Rapid expansion of electric vehicles (EVs) is likely to boost the demand for cathode materials. Governments’ initiatives for stricter emissions regulations and the transition to clean energy, automobile manufacturers are ramping up EV production. Lithium-ion batteries, which rely on high-performance cathode materials like nickel, cobalt, and manganese, are critical to achieving the long driving ranges, fast charging times, and durability needed for EVs. As a result, the surge in EV adoption is likely to drive significant growth in the demand for cathode materials.

Consumer electronics applications are anticipated to grow at a significant rate over the forecast period. The increasing use of portable devices such as smartphones, laptops, tablets, and wearables, all of which rely on lithium-ion batteries for long-lasting performance is predicted to fuel the demand for cathode materials. With rising consumers demand for more powerful, lightweight, and energy-efficient devices, manufacturers are continuously improving battery technology, which in turn is likely to drive the need for advanced cathode materials. Moreover, the growing trend towards connected devices and the Internet of Things (IoT) is further expected to increase the need for compact, high-capacity batteries, boosting the demand for cathode materials in the consumer electronics sector.

Regional Insights

North America cathode materials market accounted for a revenue share of 23.5% in 2023. Expansion of the EV market and the region’s focus on clean energy transition is likely to increase the demand for the product in the coming years. Canada’s abundance of raw materials like nickel and lithium is probably to result in the increased battery production, while Mexico’s growing automotive manufacturing sector is gearing up to supply EVs. This region is also seeing significant investment in battery production facilities, boosting the demand for cathode materials.

U.S. Cathode Materials Market Trends

The cathode materials market in the U.S. is growing at a CAGR of 14.4% over the forecast period. The demand for cathode materials is anticipated to rise due increase due to the country’s push for domestic electric vehicle (EV) production and clean energy initiatives. Federal incentives, like tax credits for EV buyers and funding for renewable energy projects, are boosting the growth of EVs and energy storage systems, which require advanced battery technologies.

Europe Cathode Materials Market Trends

Europe cathode materials market is growing at a CAGR of 13.5% from 2024-2030. Stringent carbon emission regulations and ambitious goals for carbon neutrality are some of the key drivers of demand for cathode materials in the region. The European Union has set aggressive targets for phasing out internal combustion engine vehicles and transitioning to electric mobility. European countries are also investing heavily in renewable energy and energy storage systems, further driving the need for advanced battery solutions.

Asia Pacific Cathode Materials Market Trends

The cathode materials market in Asia Pacific is expected to grow at the highest CAGR over the forecast period. The demand for cathode materials is rising due to the dominance of countries like China, South Korea, and Japan in the EV and consumer electronics markets. China, in particular, is the world’s largest EV market and has a well-established battery manufacturing industry, making it a major consumer of cathode materials. South Korea and Japan are home to leading battery manufacturers, and their technological advancements in battery efficiency are driving the need for high-quality cathode materials.

Key Cathode Materials Company Insights

Some of the key players operating in the market include Nichia Corporation and Targray.

-

Nichia Corporation is a Japan-based manufacturer and distributor of fine chemicals, especially phosphors, such as battery materials, light-emitting diodes (LEDs), calcium chloride, and laser diodes. The company has a presence in various countries, including Japan, the U.S., China, Taiwan, South Korea, Malaysia, Singapore, Indonesia, Thailand, and India.

-

Targray is engaged in the sourcing, storage, transportation, and supply of sustainable materials for solar, renewable fuels, battery, agricultural commodity industry, and carbon trading.

JFE Chemical Corporation and NEI Corporation are some of the emerging participants in market.

-

JFE Chemical Corporation operates in several product categories including chemical products, battery materials, fine chemicals and inorganic materials. In battery materials, this company is involved in the production of hard carbon, natural graphite anode materials and MCMB graphite anode materials.

-

NEI Corporation is a U.S.-based producer and supplier of advanced materials for a wide range of industries. The company’s product portfolio includes battery materials, protective clothing, electrospun mats, heat transfer fluids.

Key Cathode Materials Companies:

The following are the leading companies in the cathode materials market. These companies collectively hold the largest market share and dictate industry trends.

- Nichia Corporation

- JFE Chemical Corporation

- NEI Corporation

- Targray

- BASF Catalysts LLC

- Hitachi, Ltd.

- Mitsubishi Chemical Group Corporation

- Celgard LLC

- Umicore N.V.

- Sumitomo Metal Mining Co., Ltd.

Recent Developments

-

In February 2023, ENTEK, a U.S.-based manufacturer of lithium-ion battery separator materials, partnered with Brückner Group USA to expand its production line for battery separator film to support the growing demand for electric vehicles and energy storage systems in the U.S.

Cathode Materials Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 31.55 billion

Revenue forecast in 2030

USD 69.33 billion

Growth rate

CAGR of 14.0% from 2023 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Battery type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina

Key companies profiled

Nichia Corporation; JFE Chemical Corporation; NEI Corporation; Targray; BASF Catalysts LLC; Hitachi, Ltd.; Mitsubishi Chemical Group Corporation; Celgard LLC; Umicore N.V.; Sumitomo Metal Mining Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cathode Materials Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the segments from 2018 to 2030. For this study, Grand View Research has segmented the cathode materials market based on battery type, application, and region:

-

Battery Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Lithium-Ion

-

Lithium Iron Phosphate

-

Lithium Cobalt Oxide

-

Lithium-Nickel Manganese Cobalt

-

Lithium Nickel Cobalt Aluminium Oxide

-

Lithium Manganese Oxide

-

-

Lead-Acid

-

Other Battery Types

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Consumer Electronics

-

Power Tools

-

Energy Storage

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global cathode materials market size was estimated at USD 27.83 billion in 2023 and is expected to reach USD 31.55 billion in 2024.

b. The global cathode materials market is expected to grow at a compound annual growth rate (CAGR) of 14.0% from 2024 to 2030 to reach USD 69.33 billion by 2030.

b. Lead-acid segment accounted for the largest revenue share of over 66.6% in 2023. The rising use of these batteries in traditional automotive markets, backup power supplies, and industrial applications is anticipated to increase its demand. Lead-acid batteries are cost-effective and widely used in vehicles with internal combustion engines (ICE), uninterruptible power supplies (UPS), and grid energy storage in developing regions.

b. Some key players operating in the cathode materials market include Nichia Corporation, JFE Chemical Corporation, NEI Corporation, Targray, BASF Catalysts LLC, Hitachi, Ltd., Mitsubishi Chemical Group Corporation, Celgard LLC, Umicore N.V., and Sumitomo Metal Mining Co., Ltd.

b. The key factors that are driving the market growth are the rapid growth of the electric vehicle (EV) market and the global shift towards renewable energy, which has increased the demand for cathode materials for battery manufacturing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.