Catalyst Handling Services Market Size, Share & Trends Analysis Report By Service Type (Catalyst Loading/Unloading, Catalyst Screening, Segregation & Storage), By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-381-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Catalyst Handling Services Market Trends

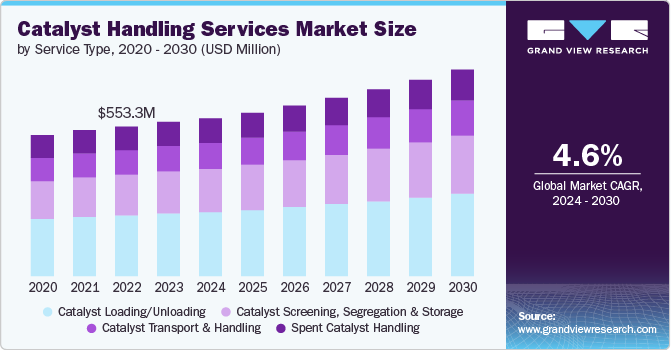

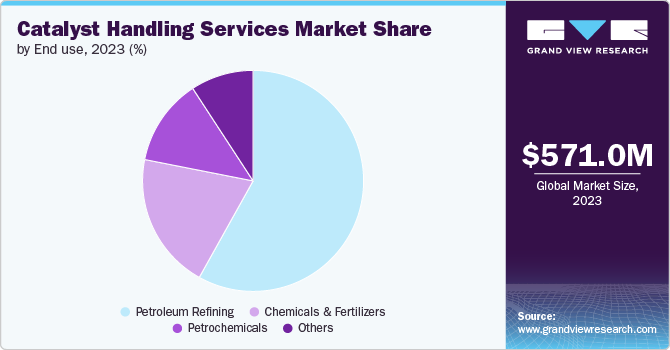

The global catalyst handling services market size was estimated at USD 571.0 million in 2023 and is projected to grow at a CAGR of 4.6% from 2024 to 2030. Industries, such as petrochemicals and refining, are subject to stringent environmental regulations. Catalysts aid in reducing emissions and meeting regulatory standards. Regular maintenance and replacement of catalysts are essential to ensure compliance, a significant factor driving market growth.

Catalysts are central to achieving operational optimization and efficiency within industrial processes. To maintain optimal performance, industries are increasingly relying on specialized catalyst handling services that offer expert installation, monitoring, and periodic replacement of catalysts. These services ensure that industrial processes remain efficient and competitive in a global market driven by technological advancements and evolving consumer demands.

Drivers, Opportunities & Restraints

The comprehensive lifecycle management of catalysts-from installation and periodic inspections to regeneration and environmentally responsible disposal-demands specialized expertise and equipment that many industries lack in-house. Catalyst handling services provide vital solutions throughout this lifecycle, ensuring operational continuity, reducing downtime, and maximizing resource efficiency. This holistic approach drives market growth by offering industries reliable and compliant management of critical catalyst assets, essential for sustaining competitive advantage and meeting regulatory standards effectively. Top of FormBottom of Form

Despite the critical role catalyst handling services play in industrial operations, the high initial costs associated with outsourcing these specialized services stands as a significant barrier. Additionally, the complexity and specificity of catalyst handling requirements pose a challenge. Each industry and even each catalyst type can require unique handling procedures and equipment, which necessitates tailored solutions from service providers. This specialization limits the scalability of catalyst handling services across different sectors and applications.

Despite the challenges a significant opportunity for market growth is the increasing emphasis on sustainability and environmental responsibility. As industries face a growing pressure to reduce their environmental footprint, there is a lucrative opportunity for catalyst handling service providers foster market growth by optimizing resource use, minimizing waste generation, and ensuring compliance with stringent environmental regulations.

Service Type Insights

“The demand for the catalyst transport & handling segment is expected to grow at a notable CAGR of 5.2% from 2024 to 2030 in terms of revenue”

The demand for catalyst transport & handling services is primarily driven by the necessity of strict adherence to safety protocols during transport and handling as catalysts can be hazardous. Industries rely on specialized transport services to ensure that catalysts are moved safely from storage facilities to reactors or regeneration units, minimizing the risk of accidents or environmental contamination. Moreover, the safe transportation and handling of catalysts helps companies avoid expensive lawsuits and protect their brand reputation in the market.

Catalyst loading/unloading accounted for 40.6% of the market share in 2023. Loading and unloading catalysts require specialized knowledge and skills to ensure that materials are handled safely and effectively, a key driver of demand for these services. Service providers offer trained personnel who understand the unique characteristics of different catalyst types and the specific requirements for their installation and removal.

End Use Insights

“The chemicals & fertilizers segment is expected to grow at a considerable CAGR of 5.4% from 2024 to 2030 in terms of revenue”

There is a growing trend toward process intensification in chemical and fertilizer manufacturing to improve resource efficiency and reduce environmental impact. Catalysts play a pivotal role in these intensified processes by enabling higher reaction rates, selectivity, and energy efficiency. Catalyst handling services support this trend by providing expertise in catalyst installation, monitoring, and replacement to maximize process intensification benefits while ensuring operational reliability.

The petroleum refining segment accounted for 58.1% of the market share in 2023. Catalysts in petroleum refining are essential for optimizing refining processes to maximize product yields and quality. They facilitate essential reactions such as cracking, reforming, and hydrotreating, which improve the efficiency of converting crude oil into valuable refined products. The demand for catalyst handling services from petroleum refineries is increasing to ensure that these catalysts are installed, monitored, and replaced optimally to maintain process efficiency and enhance yield performance.

Regional Insights

“Asia Pacific to witness fastest market growth at 5.0% CAGR”

North America catalyst handling services market is driven by a combination of factors centered around technological innovation, regulatory compliance, and operational efficiency. The region's diverse industrial landscape, including petroleum refining, chemicals, and pharmaceuticals, foster demand for catalysts to optimize processes and achieve competitive advantage. Moreover, continued investments in research and development stimulate growth opportunities, enabling service providers to offer cutting-edge solutions that meet evolving industry needs.

Asia Pacific Catalyst Handling Services Market Trends

The catalyst handling services market in Asia Pacific is experiencing robust growth driven by several factors. Rapid industrialization and urbanization across countries such as China, India, and Southeast Asia are fueling increased demand for chemicals, petrochemicals, and refined products. As these industries expand, there is a parallel rise in the need for efficient catalyst handling to ensure optimal production processes, regulatory compliance, and safety standards.

Technological advancements and innovations in automation play a significant role in driving the growth of the HIPPS market in China. The integration of smart sensors, data analytics, and real-time monitoring capabilities enhances the performance and reliability of HIPPS systems, enabling proactive management of operational risks and predictive maintenance practices. Chinese industries are increasingly adopting Industry 4.0 principles and digital transformation strategies to optimize production processes, reduce downtime, and improve overall operational efficiency. HIPPS equipped with advanced technologies contribute to these objectives by enhancing safety standards and supporting sustainable industrial development

Europe Catalyst Handling Services Market Trends

The catalyst handling services market in Europe is driven by stringent environmental regulations and a strong emphasis on sustainability in Europe. Industries in the region, particularly in chemical processing, refining, and environmental remediation, are mandated to adhere to rigorous standards aimed at reducing emissions and minimizing environmental impact. Catalyst handling services play a crucial role in helping industries comply with these regulations by providing expertise in safe handling, storage, and disposal of catalyst materials.

Key Catalyst Handling Services Company Insights

Some of the key players operating in the market include Mourik, ANABEEB, Dickinson Group of Companies, Nico Industrial Services s.r.l., CR3, among others.

-

Veolia is a French multinational company specializing in environmental services and solutions, including catalyst handling services. Its catalyst handling service portfolio includes vessels and reactor unloading/loading, catalyst sampling and particle measurement, catalyst handling under inert atmosphere, and other solutions.

-

CR3 is a company that specializes in providing solutions for the energy production, chemical processing, and power industries. The company has a strong presence in Asia and offers services such as catalyst handling services, industrial cleaning services, pipeline & process services, and others.

-

Technivac. (Cakasa (Nig.) Company Limited.) is a UK-based company specializing in providing services to the oil and gas sector. It is headquartered in Bridgend, Wales, and focuses on providing catalyst handling services. It has operations in Asia Pacific, the Middle East, and North Africa.

Key Catalyst Handling Services Companies:

The following are the leading companies in the catalyst handling services market. These companies collectively hold the largest market share and dictate industry trends.

- Mourik

- ANABEEB

- Dickinson Group of Companies

- Nico Industrial Services s.r.l.

- CR3

- Catalyst Handling Resources

- Technivac. (Cakasa (Nig.) Company Limited.)

- Buchen-ics (REMONDIS SE & Co. KG)

- Cat Tech.

- Group Peeters

- Contract Resources

- Plant-Tech Services.

Recent Developments

-

In November 2022, Veolia launched a new industrial catalyst management service in the UK to improve productivity and reduce downtime for manufacturers in sectors such as petrochemicals, ammonia, hydrogen, and steel. This service employs advanced catalyst loading technology to enhance plant efficiency and safety. The company’s teams manage catalyst change-outs for various reactors, ensuring safe unloading of spent catalysts and precise loading of new materials. Utilizing patented technologies, they achieve uniform catalyst distribution and increased density, which helps prevent operational issues.

-

In June 2023, CR3 finished a project for a Sustainable Aviation Fuel (SAF) producer which was a part of their significant expansion efforts that have doubled their production capacity for SAF. CR3 managed the initial catalyst loading for 33 new vessels at the client's facility, handling all associated mechanical tasks.

Catalyst Handling Services Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 584.1 million |

|

Revenue forecast in 2030 |

USD 764.1 million |

|

Growth Rate |

CAGR of 4.6% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends |

|

Segments covered |

Service type, end use, and region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Country Scope |

U.S., Canada, Mexico, Germany, France, Italy, UK, Spain, China, Japan, India, South Korea, Australia, Brazil, Argentina, South Africa, Saudi Arabia, UAE |

|

Key companies profiled |

Mourik, ANABEEB, Dickinson Group of Companies, Nico Industrial Services s.r.l., CR3, Catalyst Handling Resources, Technivac., Buchen-ics (REMONDIS SE & Co. KG), Cat Tech., Group Peeters, Contract Resources, Plant-Tech Services., and Veolia. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Catalyst Handling Services Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global catalyst handling services market report on the basis of service type, end use, and region:

-

Service Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Catalyst Loading/Unloading

-

Catalyst Screening, Segregation & Storage

-

Catalyst Transport & Handling

-

Spent Catalyst Handling

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Petroleum Refining

-

Chemicals & Fertilizers

-

Petrochemicals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global catalyst handling services market size was estimated at USD 571.0 million in 2023 and is expected to reach USD 584.1 million in 2024.

b. The catalyst handling services market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.6% from 2024 to 2030, reaching USD 764.1 million by 2030.

b. Asia Pacific accounted for the largest revenue share in 2023 fueled by the growing industrialization in China, India, and Southeast Asia. Technological advancements and infrastructure investments enhance catalyst manufacturing and handling capabilities, supporting sustainable industrial operations amidst economic growth and evolving environmental regulations.

b. Some of the key players operating in the catalyst handling services market include Mourik, ANABEEB, Dickinson Group of Companies, Nico Industrial Services s.r.l., CR3, Catalyst Handling Resources, Technivac., Buchen-ics (REMONDIS SE & Co. KG), Cat Tech., Group Peeters, Contract Resources, Plant-Tech Services., and Veolia.

b. The global catalyst handling services market is driven by the increasing demand for chemicals, petrochemicals, and refined products worldwide. Technological advancements and infrastructure investments are enhancing efficiency and safety standards in catalyst handling, crucial for optimizing production processes and meeting stringent regulatory requirements.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."