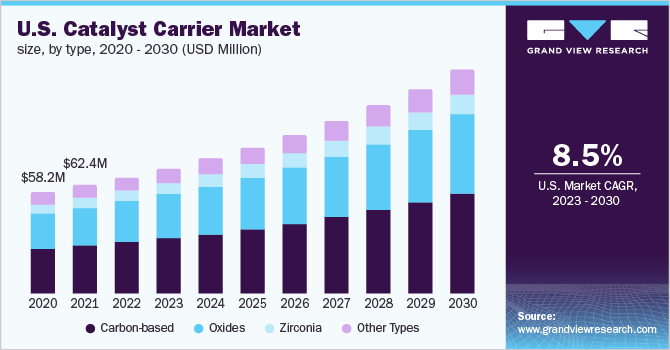

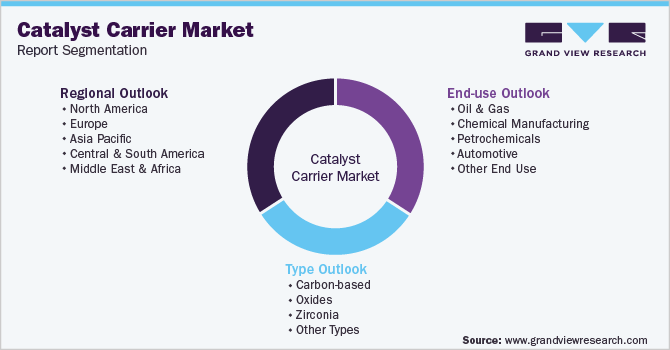

Catalyst Carrier Market Size, Share & Trends Analysis Report By Type (Carbon-based, Oxides, Zirconia), By End-use (Oil & Gas, Chemical Manufacturing), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-009-2

- Number of Report Pages: 105

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

Report Overview

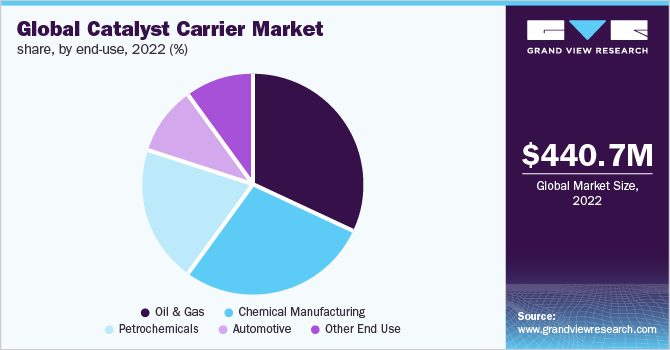

The global catalyst carrier market size was valued at USD 440.7 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 7.7% from 2023 to 2030. This is attributable to the rising demand for catalyst carriers from numerous end-use applications such as refining and chemical manufacturing, and their application in the refining process of liquids and gases. Catalyst carriers are chemical substances that are utilized to assist the production of catalysts during catalytic processes. The majority of these catalysts are solids, necessitating a vast surface area to bind the catalysts to them. Typically, these types of products are activated carbons, ceramics, and metals among other items.

One of the key factors propelling the growth of the market is an increase in demand for ceramic catalysts on a global scale. In addition, the demand continues to grow more quickly as a result of the rising consumption of petroleum derivatives to fulfill the high demand for energy coupled with the rising demand for efficient catalysis across all industrial sectors. Furthermore, the high usage of catalysts including zeolites, enzymes, chemicals, and metals in industries like oil & gas, construction, and automotive, as well as the increase in industrial activity brought on by the global expansion of various sectors, further influence the product demand.

Catalyst carriers’ expanding adaptability and application have created new opportunities in the petrochemical and pharmaceutical sectors. In addition, the increase in government spending in the pharmaceutical and petrochemical sectors has fueled market expansion. Moreover, in the petrochemical industry, carriers are employed as a key component in the catalytic process to refine products made from crude. Such factors are responsible for the overall growth in the global product market.

Additionally, manufacturers can refine various mixtures into exceedingly pure chemicals using catalyst carriers in the refining process. The pharmaceutical industry's requirements for very pure grades of chemicals have fueled the market growth exponentially. Moreover, over the past few years, continued demand for the pharmaceutical industry is anticipated to drive the market globally.

On the contrary, the production & manufacturing of catalyst carriers requires technical expertise. The process entails numerous challenging phases, as a result, increasing the end product's overall cost. This high price of the end-products may serve as a roadblock for the industry globally. Additionally, the application of cutting-edge technology, over the past few years, in chemical synthesis lowers the need for catalysts which eventually restrains growth.

Type Insights

Carbon-based type dominated the global catalyst carrier industry with the highest revenue share of 44.8% in 2022. This is attributable to its predominant usage in industries like petrochemicals and chemicals to refine liquids and gases into end-use products as well as intermediaries.

Generally, among carbon-based products, activated carbon finds its vast application in the market. Activated carbon, when compared to other catalyst carriers like alumina and silica has greater advantages. Increased internal surface area, lower cost per cubic meter, stable inertness, and availability in a variety of forms such as powder, extruded shapes, and granules are some of the advantages of activated carbon when used as a catalyst carrier.

Apart from carbon-based and oxides, zirconia is also a promising catalyst carrier used in the global market. The application of zirconium as a support offered superior results when compared to other products such as oxides. In addition, the use of zirconia boosts the process of hydrogenation. Moreover, it also helps to support a large surface area and provides excellent mechanical strength. These factors promise robust growth for the zirconia segment.

End-use Insights

Oil & gas end-use dominated the global catalyst carrier industry with the highest revenue share of 32.4% in 2022. Its high share is attributable to the vast application of the product in the oil & gas industry to increase the product performance and mechanical resistance. In addition, the growing demand from the oil & gas industry around the world is further anticipated to boost the product market in the coming years.

The UAE, Oman, Qatar, Saudi Arabia, and other GCC nations are major producers of oil, gas, and petrochemicals. Additionally, the GCC market is under pressure to meet demand because of the drop in demand in the Russian and Iranian oil & gas industry as a result of the Russian invasion of Ukraine and the sanctions imposed on Iran. In addition, China's 2022 shutdown put more pressure on GCC nations to meet strict oil and gas demands. Because of this rising demand, catalysts with broader application scopes are now more readily available. Through catalyst induction, catalyst carriers are directly used in the refinement of oil, gasoline, and other materials. Such factors prove to have a positive impact on the global product market.

Apart from the oil & gas industry, catalyst carriers find application in the chemical industry as well, especially in the production of chemicals. Out of the numerous catalyst carriers present, ceramic types are an important part of the heterogeneous catalysis process. These products are highly used in selective oxidation processes. Such factors are some of the key drivers for market growth worldwide.

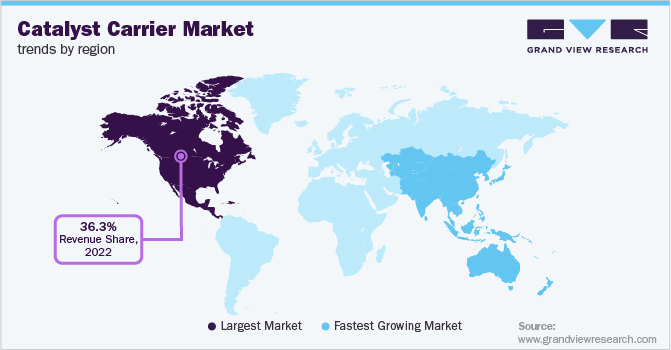

Regional Insights

North America dominated the market with the highest revenue share of 36.3% in 2022. This is attributed to the presence of numerous multinational companies engaged in the production of the product. Companies such as Cabot Corporation, W.R. Grace & Co., Calgon Carbon Corporation, and CoorsTek, Inc. are engaged in the production of the product in the region.

Asia Pacific region is one of the fastest growing regions for the catalyst carrier market due to the availability of cheap labor force, raw materials, and the presence of manufacturing companies. Countries like China, and Japan are some of the major producing countries in the region.

Europe is expected to witness a major growth potential for the product, due to the rise in the demand from end-use industries such as chemical manufacturing on the account of the presence of chemical manufacturing companies in Europe. In addition, the regional demand for catalyst carriers is expected to be driven by the presence of manufacturing corporations like Evonik Industries AG, Clariant AG, Exacer s.r.l., Almatis GmbH, and Saint-Gobain Group.

Key Companies & Market Share Insights

The competition in the market is highly dependent on the quality of the product, the number of manufacturers and distributors, and their geographical locations. The top producers and companies operating in the global market are using a variety of corporate growth strategies, such as mergers and acquisitions, stepping up their R&D efforts targeted at creating novel and inventive goods and solutions, among other things. A number of participants and stakeholders in the market for the product on a global scale are also concentrating on increasing their manufacturing capacities. Some prominent players in the global catalyst carrier market include:

-

Clariant

-

Cabot Corporation

-

Saint Gobain Group

-

NORITAKE CO., LIMITED

-

CeramTec GmbH

-

Almatis B.V.

-

CoorsTek, Inc.

-

Sasol Limited

-

Petrogas International

-

Calgon Carbon Corporation

-

Ultramet

-

SINOCATA

-

JGC C&C

-

Devson Catalyst

-

Porocel

-

C&CS

Catalyst Carrier Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 470.87 million |

|

Revenue forecast in 2030 |

USD 798.9 million |

|

Growth Rate |

CAGR of 7.7% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD million, volume in kilotons, and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia |

|

Key companies profiled |

Clariant; Cabot Corporation; Saint Gobain Group; NORITAKE CO., LIMITED; CeramTec GmbH; Almatis B.V.; CoorsTek Inc.; Sasol Limited; Petrogas International; Calgon Carbon Corporation; Ultramet, SINOCATA; JGC C&C; Devson Catalyst; Porocel, C&CS |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase option |

Global Catalyst Carrier Market Segmentation

This report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global catalyst carrier market report based on type, end-use, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Carbon-based

-

Oxides

-

Zirconia

-

Other Types

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Oil & Gas

-

Chemical Manufacturing

-

Petrochemicals

-

Automotive

-

Other End Use

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global catalyst carriers market size was estimated at USD 440.7 million in 2022 and is expected to reach USD 470.87 million in 2023.

b. The global catalyst carriers market is expected to grow at a compound annual growth rate of 7.7% from 2023 to 2030 to reach USD 798.9 million by 2030.

b. North America dominated the catalyst carriers market with a share of 36.28% in 2022. This is attributable to the presence of numerous multinational companies engaged in the production as well as distribution of the product.

b. Some key players operating in the catalyst carriers market include Clariant, Cabot Corporation, Saint Gobain Group, NORITAKE CO., LIMITED, CeramTec GmbH, Almatis B.V., CoorsTek, Inc., Sasol Limited, Petrogas International, Calgon Carbon Corporation, Ultramet, SINOCATA, JGC C&C, Devson Catalyst, Porocel, C&CS.

b. Key factors that are driving the market growth include rising demand for catalyst carriers from numerous end-use applications such as refining, chemical manufacturing, and in the refining process of liquids and gases.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."