- Home

- »

- IT Services & Applications

- »

-

Catalog Management System Market Size Report, 2030GVR Report cover

![Catalog Management System Market Size, Share & Trends Report]()

Catalog Management System Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Product Catalog), By Component (Solution, Service), By Deployment Type, By Organization Size, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-678-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Catalog Management System Market Trends

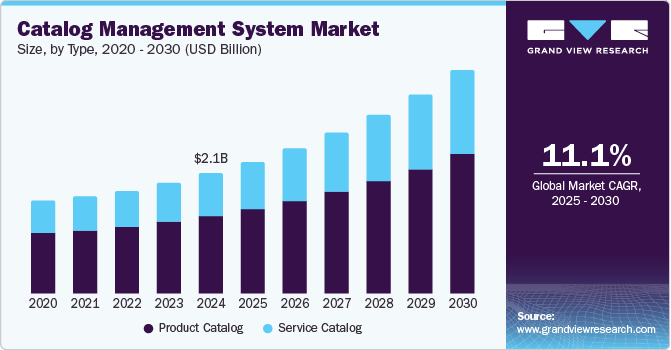

The global catalog management system market size was valued at USD 2.14 billion in 2024 and is expected to grow at a CAGR of 11.1% from 2025 to 2030. This growth is attributed to the increasing digital transformation, particularly in the e-commerce and retail sectors, where businesses require centralized systems to streamline operations and enhance customer experience. In addition, rising internet penetration, smartphone adoption, and the affordability of catalog management software further fuel demand. Furthermore, advancements in AI and machine learning enable automation and personalization, improving efficiency. The rapid adoption of cloud-based technologies and the expansion of SMEs in emerging markets such as Asia-Pacific also contribute significantly to market growth.

A catalog management system is a software solution designed to organize, maintain, and update product information such as descriptions, images, pricing, and availability. The market for these systems is expanding rapidly due to technological advancements such as Artificial Intelligence (AI) and Machine Learning (ML). These technologies streamline processes by automating tasks such as product categorization, tagging, and content creation while enabling personalized recommendations. By analyzing vast datasets, AI and ML improve product organization and customer engagement, driving sales and operational efficiency.

The growth of e-commerce and digital transformation initiatives further accelerates the demand for catalog management systems. With businesses increasingly transitioning to online platforms, these systems offer efficient tools to manage product listings across multiple channels. In addition, the adoption of cloud-based solutions has surged due to their scalability, adaptability, and cost-effectiveness. Furthermore, personalized shopping experiences are another significant driver of this market. Modern consumers prefer tailored interactions, prompting businesses to invest in catalog management systems that leverage AI to deliver relevant recommendations based on customer behavior. This not only enhances customer satisfaction but also fosters loyalty and repeat purchases.

Moreover, the integration of AI and ML into catalog management systems marks a transformative shift in the industry. These technologies automate repetitive tasks such as labeling and inventory updates while providing actionable insights from data analysis. By enabling businesses to offer personalized shopping experiences and maintain accurate product information across platforms, AI-driven catalog management solutions are becoming indispensable in today’s competitive e-commerce landscape.

Type Insights

The product catalogs led the market and accounted for the largest revenue share of 64.3% in 2024, primarily driven by the rapid expansion of e-commerce and the increasing complexity of managing diverse product information. Businesses require robust systems to efficiently organize, update, and distribute product data across multiple online platforms. In addition, the demand for personalized shopping experiences further fuels this growth, as companies leverage advanced technologies such as AI to tailor product recommendations. Furthermore, cloud-based solutions offer scalability and real-time updates, enhancing operational efficiency and customer satisfaction.

The service catalogs are expected to grow at a CAGR of 12.1% over the forecast period, propelled by the rising adoption of digital transformation across industries such as IT, telecom, and BFSI. Businesses increasingly rely on service catalogs to streamline service offerings, improve resource allocation, and enhance user experience. In addition, the integration of AI and automation enables faster service delivery and better customization based on user preferences. Furthermore, the shift to cloud-based service catalog systems ensures scalability and accessibility, allowing enterprises to manage services efficiently while meeting the growing demand for digital-first operations.

Component Insights

The solution segment dominated the global catalog management system industry and held the largest revenue share of 64.3% in 2024, attributed to the increasing need for robust tools to manage product and service data efficiently across industries such as retail, IT, and telecom. Furthermore, these solutions streamline operations by centralizing catalog data, enhancing accuracy, and improving accessibility across multiple channels. Moreover, the integration of advanced features such as AI-driven analytics, real-time updates, and seamless platform integration enables businesses to adapt quickly to market changes, optimize decision-making, and enhance customer satisfaction.

The service segment is expected to grow at a CAGR of 12.1% over the forecast period. The segment is expected to witness significant growth owing to the managed and professional services offered by various catalog management systems providers. The increasing need for cloud-based managed services and the growing dependence of organizations on IT assets to improve their business productivity are the major factors contributing to the growth of the managed services segment.

Deployment Insights

The cloud deployment held the largest revenue share of 65.1% in 2024. This growth is attributed to its flexibility, scalability, and cost-effectiveness, making it an ideal choice for businesses of all sizes. Cloud-based catalog management systems enable real-time updates, seamless integration across platforms, and centralized data management. Furthermore, these features are particularly appealing to small and medium-sized enterprises (SMEs) seeking affordable solutions to streamline operations. Moreover, cloud deployment supports digital transformation initiatives by offering enhanced security, interactive dashboards, and improved accessibility, catering to the dynamic needs of modern businesses.

The on premise deployment segment is expected to grow at a lucrative CAGR of 8.4% over the forecast period, driven by its ability to provide enhanced data security and greater control over sensitive information. In addition, large enterprises with substantial budgets prefer on-premise solutions to ensure compliance with industry-specific regulations and maintain transparency in data handling. Furthermore, on-premise deployment offers reliability and minimizes dependency on external networks, making it a preferred choice for businesses prioritizing data confidentiality.

Organization Size Insights

Large enterprises dominated the market and accounted for the highest share of 50.0% in 2024. Large enterprises have an extensive business network and diverse revenue streams. Hence, large enterprises opt for innovative and new technologies and solutions to expand their business operations. Furthermore, the increasing role of government authorities in the provision of capital to large enterprises for adopting digitization is anticipated to propel the growth of this segment.

The small & medium enterprises are projected to grow at the fastest CAGR of 14.4% from 2025 to 2030. The segment growth can be attributed to the growing number of small and medium enterprises in several countries across the globe, including India, the U.S., and China. SMEs mainly adopt cloud-based catalog management system solutions owing to benefits such as lower deployment costs. SMEs are also opting for cloud-based catalog management systems to opt for the digitization of their products.

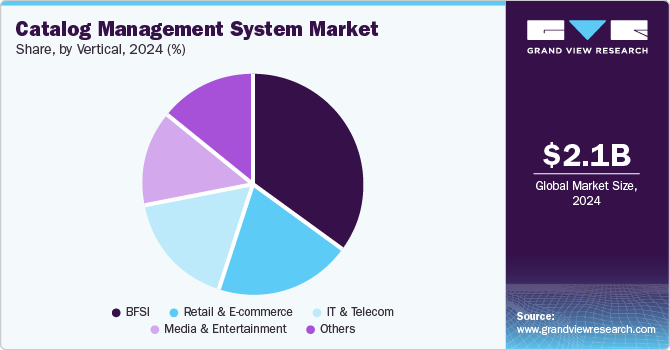

Vertical Insights

The BFSI sector held the dominant position in the global catalog management systems industry, with the largest revenue share of 35.5% in 2024, primarily driven by the need for accurate, secure, and compliant data management. Financial institutions rely on these systems to streamline complex product and service offerings, ensuring consistency across platforms. In addition, the increasing adoption of digital banking and fintech innovations has heightened demand for systems that support rapid product deployment and personalized customer interactions. Furthermore, stringent regulatory requirements necessitate robust catalog management solutions to maintain data integrity, reduce compliance risks, and enhance operational efficiency.

The retail and e-commerce segment is expected to grow at a significant CAGR of 12.3% over the forecast period, owing to its need for centralized data management and seamless omnichannel operations. Businesses require these systems to handle large volumes of product information efficiently while delivering personalized shopping experiences. The rise of digital transformation and AI-driven technologies enables retailers to automate catalog updates, improve product discoverability, and tailor recommendations to consumer preferences. Furthermore, the growing shift toward online shopping has intensified the demand for scalable catalog solutions to meet evolving customer expectations.

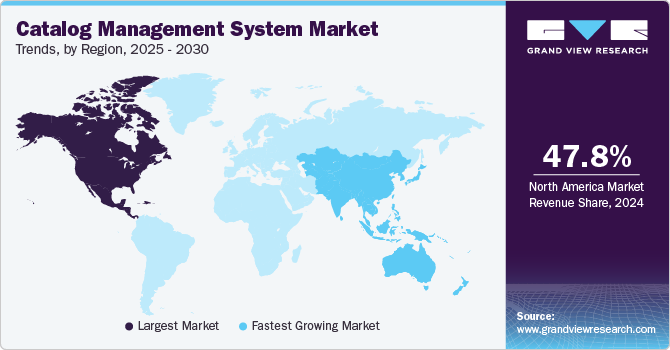

Regional Insights

North America's catalog management system market dominated the global market and accounted for the largest revenue share of 47.8% in 2024. This growth is attributed to the region’s early adoption of advanced technologies such as AI and cloud computing. In addition, businesses across industries, including retail and IT, are leveraging these systems to manage extensive product catalogs efficiently. Furthermore, the strong presence of major technology companies and e-commerce giants further accelerates adoption. Moreover, the increasing focus on data security and regulatory compliance, combined with consumer demand for personalized shopping experiences, fosters widespread implementation of catalog management solutions.

U.S. Catalog Management System Market Trends

The catalog management system market in the U.S. dominated the North American market and held the highest revenue share in 2024, primarily driven by the rapid expansion of e-commerce and omnichannel retailing. In addition, the integration of AI-driven analytics and automation enhances efficiency and customer engagement. Furthermore, the U.S. market benefits from a strong infrastructure for digital transformation, enabling enterprises to adopt scalable and innovative catalog management solutions to meet evolving consumer expectations.

Asia Pacific Catalog Management System Market Trends

The Asia Pacific catalog management system market is expected to be the fastest-growing region, with a CAGR of 13.1% over the forecast period, owing to the rapid digitalization of businesses and the booming e-commerce sector. Furthermore, countries in this region are increasingly adopting cloud-based solutions to streamline operations and reduce costs. The rise in smartphone penetration and internet usage has led to higher online shopping activity, necessitating efficient catalog systems. Moreover, small and medium enterprises in emerging economies are leveraging affordable solutions to enhance their competitiveness in a dynamic market landscape.

The catalog management system market in China led the Asia Pacific market with the largest revenue share in 2024, primarily due to its thriving e-commerce industry and the growing adoption of AI-powered technologies. In addition, the country’s focus on digital transformation and smart retailing drives demand for advanced catalog solutions. Furthermore, China’s large consumer base and fast-paced online retail growth create opportunities for businesses to optimize inventory management and improve operational efficiency through innovative catalog systems.

Europe Catalog Management System Market Trends

Europe catalog management system market is expected to grow significantly over the forecast period, driven by the increasing regulatory requirements for data accuracy and compliance across industries such as BFSI and retail. In addition, businesses are adopting these systems to ensure consistent product information while enhancing customer experience through personalization. Moreover, the region’s strong emphasis on sustainability and digital transformation further boosts demand for cloud-based catalog solutions.

Key Catalog Management System Company Insights

Key players in the global catalog management system industry include SAP, Oracle, Salsify, and others. These players employ strategies such as leveraging advanced technologies such as AI and machine learning to enhance automation and personalization. In addition, they focus on partnerships, acquisitions, and product innovation to expand their offerings and strengthen their market presence. Furthermore, these companies prioritize cloud-based solutions to improve scalability and accessibility while addressing evolving customer demands.

-

IBM offers a wide range of products and services, including catalog management systems. It specializes in providing advanced software solutions, such as the IBM Sterling Selling and Fulfillment Foundation, which focuses on managing product catalogs efficiently. IBM operates across various segments, including IT services, cloud computing, AI, and enterprise software.

-

Oracle manufactures enterprise software and hardware solutions, including catalog management systems. It offers comprehensive tools to manage product and service catalogs effectively, leveraging AI-driven workflows for enhanced automation and personalization.

Key Catalog Management System Companies:

The following are the leading companies in the catalog management system market. These companies collectively hold the largest market share and dictate industry trends.

- IBM

- SAP

- Oracle

- Salsify

- Coupa Software

- Proactis

- Broadcom

- Fujitsu

- Ericsson

- Amdocs

- Epirserver

- Hansen Technologies

- Vinculum

- Claritum

- eJeeva

- SunTec

- Plytix

- Mirakl

- Sellercloud

- Vroozi

- CatBase

- Contalog

- Sales Layer

Recent Developments

-

In August 2024, Oracle announced the availability of Oracle Communications Digital Business Experience, a solution designed to help Communications Service Providers (CSPs) automate the design, delivery, and monetization of customer experiences.

Catalog Management System Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.34 billion

Revenue forecast in 2030

USD 3.96 billion

Growth Rate

CAGR of 11.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, component, deployment type, organization size, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

IBM; SAP; Oracle; Salsify; Coupa Software; Proactis; Broadcom; Fujitsu; Ericsson; Amdocs; Epirserver; Hansen Technologies; Vinculum; Claritum; eJeeva; SunTec; Plytix; Mirakl; Sellercloud; Vroozi; CatBase; Contalog; Sales Layer.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Catalog Management System Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global catalog management system market report based on type, component, deployment type, organization size, vertical and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Product Catalog

-

Service Catalog

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Service

-

Professional Service

-

Managed Service

-

-

-

Deployment Type Outlook (Revenue, USD Million, 2018 - 2030)

-

On-Premise

-

Cloud

-

-

Organization Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small & Medium Enterprise

-

Large Enterprise

-

-

Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Retail & E-commerce

-

IT & Telecom

-

Media & Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.