- Home

- »

- Animal Health

- »

-

Cat Vaccine Market Size, Share, And Growth Report, 2030GVR Report cover

![Cat Vaccine Market Size, Share & Trends Report]()

Cat Vaccine Market Size, Share & Trends Analysis Report By Vaccine Type (Inactivated), By Disease Type, By Route of Administration, By Duration of Immunity, By Component, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-321-1

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Cat Vaccine Market Size & Trends

The global cat vaccine market size was estimated at USD 1.34 billion in 2023 and is anticipated to grow at a CAGR of 9.4% from 2024 to 2030. The rising trend of pet ownership, where cats are increasingly considered family members, has boosted the demand for cat vaccines. The increasing disposable income allows owners to invest more in their pets' healthcare, including regular vaccinations.

The emergence of new diseases in cats has created a heightened awareness among owners about the necessity of vaccinations. In addition, substantial investments from the pharmaceutical industry in the research and development of advanced cat vaccines have resulted in innovative and more effective products, stimulating market growth. These factors combined ensure the health and well-being of feline companions.

According to the data from the 2023-2024 American Pet Products Association (APPA) National Pet Owners Survey, pet ownership in the U.S. continues to grow, with approximately 66% of households, which equals to 86.9 million households, now welcoming pets into their homes. Among these households, a substantial 45.3 million own at least one cat. This upward trend in cat ownership is particularly noteworthy, having shown an impressive 8% increase since 2017.

The growth of the market is propelled by emerging diseases threatening feline health. Pet vaccination is prioritized through vaccine development and adaptation to new threats. For instance, in June 2023, Poland's IHR National Focal Point alerted WHO to an unusual spike in cat deaths nationwide. Subsequent testing of 47 samples from 46 cats and one captive caracal had revealed 29 cases positive for influenza A (H5N1). While 14 cats had been euthanized, and 11 had died, the source of their exposure had remained unknown, prompting ongoing investigations. Though sporadic A(H5N1) infections in cats had been reported previously, this had marked the first instance of widespread diseases nationwide.

Higher income levels translate to increased affordability and willingness to spend on preventive measures, fostering market growth to meet the rising demand for essential pet healthcare. The market is boosted by the growing disposable income of consumers, enabling more significant investment in animal healthcare, including vaccinations for cats. For instance, according to a 2023 American Pet Products Association report, the U.S. pet owners were expected to spend USD 143.6 billion on their pets in 2023, up from USD 108.9 billion in 2020.

Market Concentration & Characteristics

The market growth stage is medium with an accelerating pace of growth. The cat vaccine industry can be characterized by increasing investments by pharmaceutical companies and a high level of mergers and acquisition activities by leading market players. The increasing population of pets and, therefore, increasing demand for veterinary services has encouraged players to offer vaccination and other veterinary services.

The cat vaccines are subject to various regulations to ensure the safety and efficacy for the animals. The increasing prevalence of animal diseases and their impact on human and animal well-being are major contributors for animal vaccine-related regulations. Moreover, different countries have different regulations regarding pet vaccination, that may depend on the travel and vaccine duration.

Cat vaccines have no major or direct substitutes. Vaccine development requires a huge amount of investment and is time-consuming, making it difficult to develop an alternative for vaccines. In addition, vaccines play a huge role in protecting cats against various diseases, that is hardly found in any other preventive care option.

End-user concentration is a significant factor in the cat vaccine industry. There is increasing demand for end users in the market, such as veterinarians, clinics, and pet owners, due to increasing pet ownership and technological advancements. The emergence of new diseases and changing vaccine demand are further expected to affect market growth.

Vaccine Type Insights

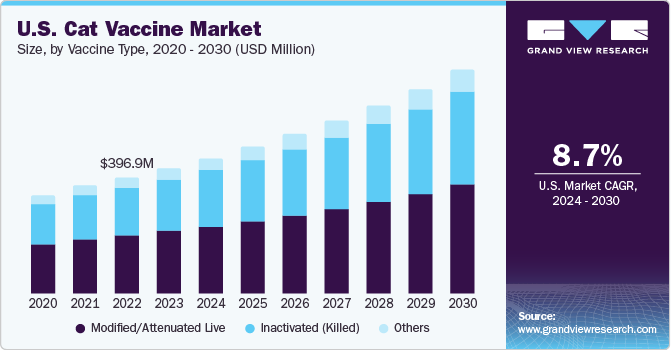

Based on vaccine type, the market is segmented into modified/attenuated live, inactivated (killed), and others. The modified/attenuated live segment dominated the market with the largest revenue share of 50.1% in 2023. The proven effectiveness of modified/attenuated live vaccines, particularly against feline panleukopenia, calicivirus, and herpesvirus, has instilled confidence among pet owners and veterinarians, driving higher adoption rates. For instance, according to the American Animal Hospital Association, attenuated live or modified-live vaccines contain microorganisms intentionally altered to reduce their virulence, often achieved through repeated passage in cell culture or naturally occurring low-virulence strains. These vaccines replicate within the host, prompting an immune response closely mimicking natural infection protection. They typically offer quicker immunity onset than inactivated vaccines and may require only one dose for protection when maternal antibodies are absent.

The other vaccines segment is anticipated to grow at the fastest CAGR over the forecast period. Heightened interest and the quest for more comprehensive and advanced vaccination options drive the segment growth. The exclusive recombinant vaccines available for cats in North America employ canarypox viruses as vectors. These vaccines incorporate the genetic material of a pathogen, including an antigen that prompts an immune response, into the canarypox virus genome.

Disease Type Insights

Based on disease type, the market is segmented into feline leukemia, feline panleukopenia (feline distemper), feline respiratory diseases, feline rabies, and other diseases. The feline respiratory diseases segment held the largest revenue share in 2023. The driving factors for the feline respiratory diseases (FRDs) segment stem from the increasing prevalence of FRDs worldwide. For instance, according to the Cornell University College of Veterinary Medicine, feline herpes virus infection predominantly affected young and adolescent cats, posing the highest risk to this age group. It was estimated that as many as 97% of cats encountered the feline herpes virus at some point in their lives, and the virus established a lifelong infection in approximately 80% of exposed cats. Among these, up to 45% intermittently shed the virus, often occurring during periods of stress.

The feline leukemia segment is anticipated to grow at the fastest CAGR over the forecast period. For kittens and adult cats with a higher risk of Feline Leukemia (FeLV) exposure, the American Association of Feline Practitioners (AAFP) recommends an initial FeLV vaccination series consisting of two doses given with a 3 to 4-week gap, commencing at 8 weeks of age. Subsequently, a single booster dose is advised in the following year. Annual revaccination is recommended, unless specific product licensure suggests a longer interval, for high-risk cats. Low-risk cats can be revaccinated every 2 to 3 years, while cats at minimal risk typically do not require further revaccination. These guidelines aim to ensure appropriate FeLV protection tailored to the individual cat's risk factors, age, and overall health status.

Route of Administration Insights

Based on route of administration, the market is segmented into injectables, intranasal, and oral. The injectables segment held the largest market revenue share in 2023. Ongoing research and development in vaccine technology are driving the injectables segment by continually producing more effective and safer vaccines. For instance, in January 2022, Zoetis announced that the U.S. Food and Drug Administration (FDA) approved Solensia for controlling the pain associated with osteoarthritis (O.A.) in cats, that helped improve their mobility, comfort, and overall well-being. Administered as a once-monthly injection in the veterinary clinic, Solensia kept O.A. pain from disrupting the unique bond cats shared with their humans.

The oral segment is expected to grow at the fastest CAGR over the forecast period. Ongoing research and development efforts are propelling the oral vaccine segment by continuously improving their efficacy and safety. Developing new and more effective oral vaccines addresses cat owners' demands for convenient and reliable vaccination options, encouraging greater acceptance and adoption among veterinarians and pet owners. For instance, researchers worked on developing an oral vaccine to manage a prevalent gastrointestinal virus that could transform into lethal feline infectious peritonitis (FIP) in cats. Funded by the Morris Animal Foundation, researchers at Colorado State University constructed a vaccine targeting the feline enteric coronavirus (FECV), that could mutate into the FIP virus. The vaccine is aimed at controlling the widespread FECV infections in shelters and other multi-cat environments, simultaneously offering protection to individual cats against FIP.

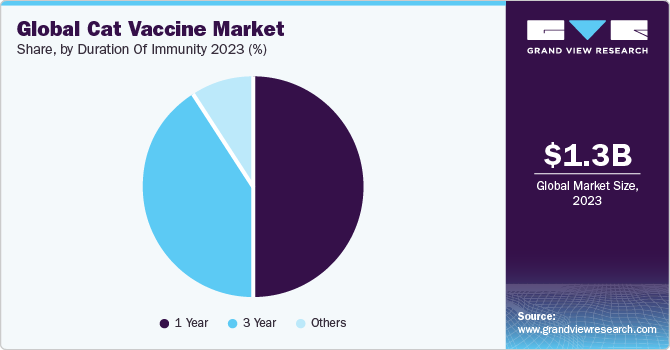

Duration of Immunity Insights

Based on duration of immunity, the market is segmented into 1 year, 3 years, and others. The 1-year segment held the largest market share in 2023. The 1-year duration of immunity (DOI) segment is driven by the rigorous and evidence-based approach of veterinary organizations and advisory bodies such as the American Association of Feline Practitioners (AAFP). These organizations regularly evaluate scientific data to ensure the safety and efficacy of vaccines. For instance, per the guidelines provided by the American Association of Feline Practitioners (AAFP), cats should receive the FVRCP vaccine annually if they are deemed to be at a sustained risk of exposure to the associated diseases.

The guidelines suggest that subsequent vaccinations can be administered based on the level of risk: yearly for cats with a high risk of exposure and every two years for those at lower risk. During the initial vaccination series, it is recommended to wait at least 2 weeks but no longer than 4 weeks between doses. Kittens presented for vaccination at 6 weeks or later following the previous vaccine dose should receive a minimum of two vaccine doses, spaced 3 to 4 weeks apart.

Regional Insights

The North America cat vaccine market held the largest global revenue share of 38.1% in 2023, which is attributed to rigorous regulatory framework governing animal vaccines. These stringent standards guarantee the safety and efficacy of products, fostering trust among consumers and veterinarians, promoting widespread adoption, and ensuring high-quality feline healthcare.

U.S. Cat Vaccine Market Trends

The cat vaccine market in the U.S. is anticipated to grow at a lucrative CAGR. The American Association of Feline Practitioners (AAFP) offers detailed vaccination recommendations for cats, covering diseases such as Feline panleukopenia (FPL), Feline calicivirus (FCV), Feline herpesvirus (FHV-1), Rabies, and Feline leukemia virus (FeLV) for at-risk cats. These guidelines, grounded in current scientific understanding, enable veterinarians to design personalized vaccination schedules, emphasizing the necessity of consulting a vet to determine the most suitable plan based on each cat's unique requirements.

Asia Pacific Cat Vaccine Market Trends

The Asia Pacific cat vaccine market is anticipated to exhibit the fastest CAGR during the forecast period. Rabies, a highly contagious and often fatal disease, poses a significant threat to human and animal health, especially in Asia Pacific. The awareness of its zoonotic nature, transmitted from cats to humans, has led to a rising emphasis on cat vaccination among governments, veterinary groups, and pet owners, driving the demand for cat vaccines as a crucial measure to combat this deadly disease. For instance, Asia and Africa account for more than 95% of reported rabies cases, with one death occurring approximately every 9 minutes, disproportionately affecting children under 15 years, underscoring the vulnerability of this age group to the disease.

The cat vaccine market in China is expected to grow over the forecast period due to Chinese government implementing regulations and programs to control and prevent the spread of zoonotic diseases such as rabies through comprehensive vaccination campaigns for both cats and dogs. These initiatives aim to ensure public health safety while prioritizing the well-being of pets. Government-backed efforts, including awareness campaigns, subsidized vaccination programs, and stringent legal requirements, have significantly increased the demand for cat vaccines in the country, fostering a culture of responsible pet ownership and preventive healthcare for feline companions. For instance, in January 2024, the launch event for RINVAC F RCP, a triple vaccine for felines manufactured in China, was successfully conducted in Tianjin. Ringpu and its national distributors observed the introduction of Ringpu's latest vaccine product.

The Japan cat vaccines market is expected to grow over the forecast period due to the rising expenditure on pets in Japan, being a driving factor behind the growth of the market. As pet owners increasingly prioritize the health and well-being of their feline companions, they are more willing to invest in preventive measures like vaccination, propelling the demand for cat vaccines in the country. For instance, in 2021, a survey conducted in Japan by ipet Insurance involved 1,018 dog and cat owners who were asked about their annual pet expenditure in 2021. The most frequent spending bracket for dog owners, representing 29.6%, fell between USD 333 and USD 666, whereas for cat owners, 36.9% spent less than USD 333. There was a 4.3-point increase from the previous year, with 40% of respondents stating that they spent more than USD 666 over the year.

Europe Cat Vaccine Market Trends

The cat vaccine market in Europe is driven by the increasing pet ownership trend in Europe, driven by the COVID-19 pandemic, associated lockdowns, and remote working arrangements. For instance, according to the FEDIAF European Pet Food, there were approximately 340 million pets in Europe, whereas around 26% (127 million) households had a cat, making them the most popular pets in Europe. This shift towards pet ownership, particularly of cats, is expected to have a lasting impact on the cat vaccine market in Europe. This signifies a substantial and consistent demand for vaccines to ensure the health and well-being of these feline companions across the continent.

The cat vaccine market in the UK is expected to grow over the forecast period due to high rate of cat ownership in the UK, with 89% of cat owners having their pets registered with a veterinarian, forms a substantial driver. Furthermore, 60% of cat owners routinely take their cats to the vet for annual check-ups, demonstrating a proactive approach to maintaining their pets' health. Regular interaction with veterinarians allows these professionals to recommend and administer cat vaccines, that are essential for preventing feline diseases.

However, approximately 36% of cat owners only visit the vet when they believe it is necessary. This suggests potential untapped demand, as more cat owners could be encouraged to follow recommended vaccination schedules and protocols to ensure the well-being of their feline companions. It offers an opportunity for veterinary clinics and vaccine manufacturers to raise awareness about the importance of regular vaccinations, ultimately contributing to the growth of the cat vaccine market.

The Germany cat vaccine market held a considerable share in 2023 owing to the advancements in veterinary medicine and the development of innovative vaccines with improved efficacy and safety profiles are also driving market expansion in Germany. For instance, in January 2024, TheraVet SA, a company specializing in managing pet osteoarticular diseases, launched its BIOCERA-VET products in Germany. Germany stands out as Europe's predominant companion animal market, with 16.7 million cats and 10.3 million dogs, a pet population of 27 million, and a pet ownership rate of 47%.

MEA Cat Vaccine Market Trends

The cat vaccine market in the MEA is driven by the major factors of increasing trend of pet humanization and growing concerns over pet health. In addition, the growing prevalence of diseases such as Feline Infectious Peritonitis (FIP) in the region is further expected to drive the demand for cat vaccines. For instance, by July 2023, a severe outbreak of feline infectious peritonitis (FIP) has claimed the lives of around 300,000 domestic and stray cats in Cyprus, as reported by the Cat Protection and Welfare Society (PAWS) Cyprus. This is likely to increase awareness regarding cat vaccines in the region and drive market growth.

The Saudi Arabia cat vaccines market held a significant share in 2023 owing to the growing initiatives aimed at enhancing the welfare of companion animals, which is playing a pivotal role in driving the cat vaccine market forward. With a growing recognition of the importance of preventive healthcare measures for pets, including vaccination, various governmental and non-governmental organizations are actively promoting initiatives to improve the overall health and well-being of companion animals across the country. For instance, in September 2023, Saudi Arabia's AlUla inaugurated a new animal care facility. The AlUla Animal Welfare Centre, established by the Royal Commission for AlUla (RCU), serves as the core of this initiative, offering vital veterinary services to the community's free-roaming cat and dog population. The center's primary focus is on promoting responsible pet care practices, including implementing a Trap-Neuter-Vaccinate-Return (TNVR) clinic and fostering pet adoption, aiming to improve the overall well-being of domestic animals in AlUla County.

The cat vaccines market in Kuwait is expected to grow at a significant rate over the forecast period due to the rising prevalence of infectious diseases among cats, coupled with a growing cat population. These factors necessitate the need for vaccination to control and prevent the spread of diseases.

Key Cat Vaccine Company Insights

Some of the key players operating in the market include Virbac, C.H. Boehringer Sohn AG & Co. KG., Elanco, Zoetis.

-

Virbac is an animal health company operating in over 100 countries worldwide. It offers various diagnostic, preventive care, and treatment solutions for a number of pathologies to improve animal health.

-

C.H. Boehringer Sohn AG & Co. KG is a global research-driven biopharmaceutical company focusing on innovative therapies for diseases with high unmet medical needs. The Animal Health business unit of the company develops and markets vaccines, parasiticides, and therapeutics for livestock and companion animals.

Bioveta, a.s. is one of the emerging participants in the cat vaccine market.

-

Bioveta, a.s., produces various veterinary products, including vaccines, antibiotics, antiparasitics, and other therapeutics. The company is committed to innovation and is constantly working to develop new and improved products for veterinarians and their animal patients.

Key Cat Vaccine Companies:

The following are the leading companies in the cat vaccine market. These companies collectively hold the largest market share and dictate industry trends.

- Virbac

- C.H. Boehringer Sohn AG & Co. KG.

- Elanco

- Zoetis

- Merck & Co.

- Bioveta, a.s.

- Indian Immunologicals Ltd.

Recent Developments

-

In September 2023, Elanco commenced the initial deliveries of Varenzin-CA1 (molidustat oral suspension) to veterinary clinics across the U.S. This treatment received conditional approval from the U.S. Food and Drug Administration (FDA) as the first and sole therapy for managing non-regenerative anemia in cats with chronic kidney disease (CKD).

-

In September 2022, Zoetis Services LLC commercially launched the Solensia (frunevetmab injection) in the U.S., which marked the introduction of the monoclonal antibody treatment sanctioned in the U.S. for managing osteoarthritis pain in cats.

Cat Vaccine Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.5 billion

Revenue forecast in 2030

USD 2.5 billion

Growth rate

CAGR of 9.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Vaccine type, disease type, route of administration, duration of immunity, component, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan, China; India; Australia; Thailand; South Korea; Mexico; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Virbac; C.H. Boehringer Sohn AG & Co. KG.; Elanco; Zoetis; Merck & Co.; Bioveta, a.s.; Indian Immunologicals Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cat Vaccine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cat vaccine market report based on vaccine type, disease type, route of administration, duration of immunity, component, and region.

-

Vaccine Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Modified/Attenuated Live

-

Inactivated (Killed)

-

Others

-

-

Disease Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Feline Leukemia

-

Feline Panleukopenia (Feline Distemper)

-

Feline Respiratory Diseases

-

Feline Rabies

-

Other Diseases

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Injectables

-

Intranasal

-

Oral

-

-

Duration of Immunity Outlook (Revenue, USD Million, 2018 - 2030)

-

1 Year

-

3 Year

-

Others

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Combined Vaccines

-

Mono Vaccines

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cat vaccine market size was estimated at USD 1.34 billion in 2023 and is expected to reach USD 1.5 billion in 2024.

b. The global cat vaccine market is expected to grow at a compound annual growth rate of 9.3% from 2024 to 2030 to reach USD 2.5 billion by 2030.

b. North America dominated the cat vaccine market with a share of 38.1% in 2023 and is attributed rigorous regulatory framework governing animal vaccines. These stringent standards guarantee the safety and efficacy of products, fostering trust among consumers and veterinarians, promoting widespread adoption, and ensuring high-quality feline healthcare.

b. Some key players operating in the cat vaccine market include Virbac; C.H. Boehringer Sohn AG & Co. KG.; Elanco; Zoetis; Merck & Co.; Bioveta, a.s. and Indian Immunologicals Ltd.

b. Key factors that are driving the market growth include rising trend of pet ownership, the emergence of new diseases in cats, ongoing research & development in vaccine technology, and increasing rigorous evidence-based approach of veterinary organizations and advisory bodies.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."