- Home

- »

- Animal Feed and Feed Additives

- »

-

Cat Food Market Size, Share, Trends & Growth Report, 2030GVR Report cover

![Cat Food Market Size, Share & Trends Report]()

Cat Food Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Wet Food, Dry Food, Treats), By Distribution Channel (Online, Supermarkets & Hypermarkets), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-113-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cat Food Market Summary

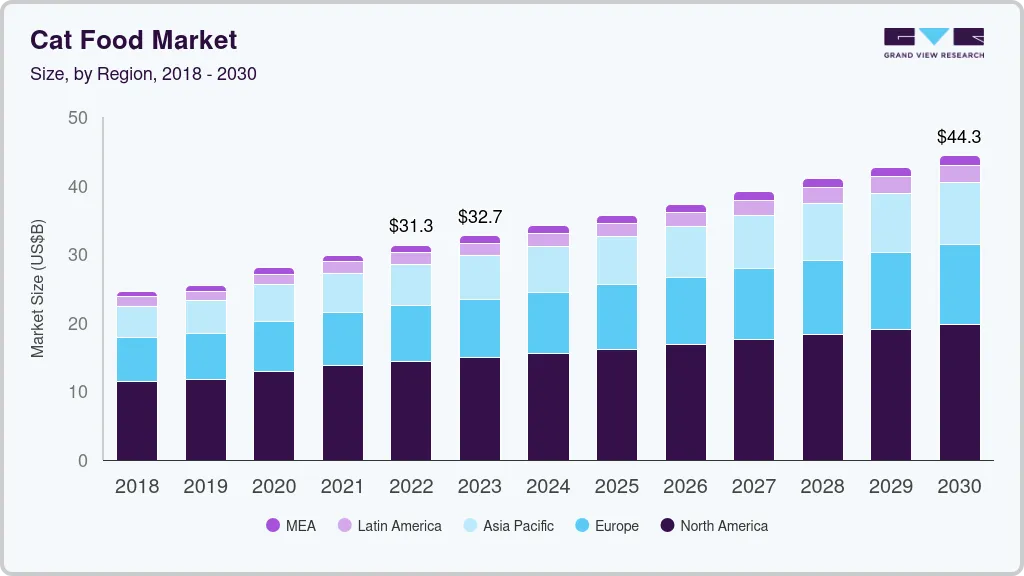

The global cat food market size was estimated at USD 31.28 billion in 2022 and is projected to reach USD 44.32 billion by 2030, growing at a CAGR of 4.4% from 2023 to 2030. The growth of the product market is attributed to the growing ownership of cats, the humanization of pets, and a growing awareness of the importance of pet nutrition worldwide.

Key Market Trends & Insights

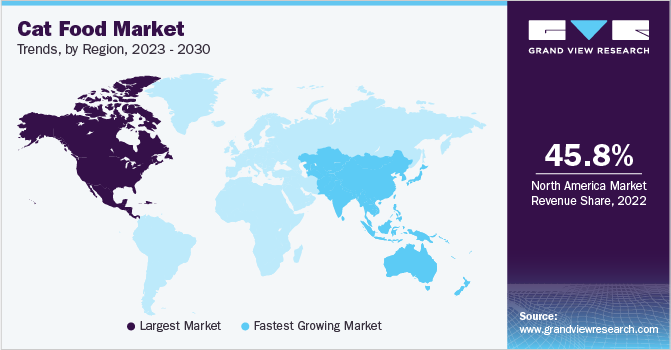

- North America dominated the market with a revenue share of 45.8% in 2022.

- Europe is another region anticipated to witness growth over the forecast period.

- By type, the wet food segment dominated the market with a revenue share of 50.7% in 2022.

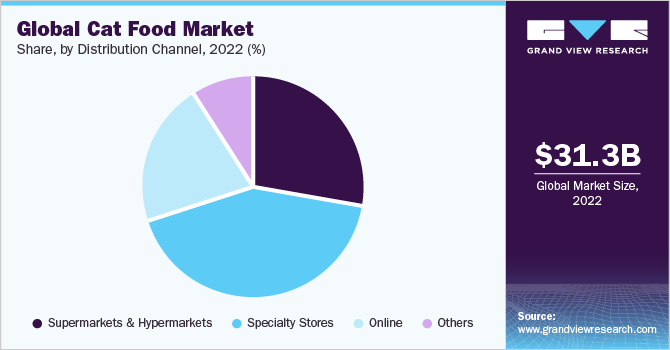

- By distribution channel, the supermarkets and hypermarkets segment dominated the market with a revenue share of more than 42%.

Market Size & Forecast

- 2022 Market Size: USD 31.28 Billion

- 2030 Projected Market Size: USD 44.32 Billion

- CAGR (2023-2030): 4.4%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Additionally, the rise of e-commerce and the availability of cat food online has made it easier for pet owners to find and purchase products that cater to their pet's specific needs. Cat food is a specially formulated type of pet food designed specifically for the dietary needs of cats. They are obligate carnivores, and thus require a diet that is high in protein and fats from animal sources. Therefore, it typically includes meat-based protein sources such as chicken, turkey, fish, or beef. In addition to protein, it also contains other essential nutrients such as minerals, vitamins, and fats to maintain good overall health and meet cats' dietary needs. These nutrients are particularly important for the growth and development of kittens and the maintenance of adult’s health.

The trend of humanization, where pets are treated as family members, has been gaining momentum. Pet owners are increasingly seeking high-quality, nutritious, and premium pet food products, including cat food, that mirror the type of food they would eat themselves. The growing need for owners to provide their pets with the best possible nutrition and care has led to a rise in demand for premium and specialized cat food options.

The U.S. emerged as the largest consumer of the product in North America. This is attributed to the increasing adoption of pets including cats. According to the North American Pet Health Insurance Association (NAPHIA), in 2021, 46.5 million households, which accounts for approximately 29% of the total pet owner population, had cats as their pets, making them the second most popular pets in the U.S. Additionally, according to the American Veterinary Medical Association, individuals in the U.S. spent approximately USD 653 annually on their cats in 2020, with USD 310 allocated towards their food. Thus, all these factors are anticipated to drive the product demand over the forecast period.

Type Insights

The wet food segment dominated the market with a revenue share of 50.7% in 2022. This share can be attributed to the fact that it has high moisture content and proper nutrition required by the pet. Cats are natural carnivores and get most of their hydration from what they eat. Thus, by feeding them a wet diet, pet owners can ensure they are providing them with adequate hydration, which is essential for maintaining their overall health. The high moisture content also helps to prevent any urinary tract infections.

A wet diet is often considered to be more palatable than a dry alternative. This is because it has a more appealing aroma and texture, and is more flavorful. As a result, pets tend to enjoy eating it more than dry alternatives. Moreover, it also offers a wide variety of flavors and textures to choose from. There are numerous brands and formulations of wet cat food available, including organic, grain-free, and limited ingredient options. This variety allows pet owners to find the perfect match to meet their pets’ nutritional needs and preferences.

Dry food also known as kibble is another segment anticipated to witness growth over the forecast period. One of the primary advantages of kibble is its convenience. It can be left out for cats to feed on throughout the day, which is ideal for busy pet owners who may not have time to feed their pets multiple times per day. Additionally, it is typically more affordable than wet alternatives, making it an attractive option for pet owners with low budgets.

Distribution Channel Insights

The supermarkets and hypermarkets segment dominated the market with a revenue share of more than 42%. This can be attributed to the availability of specialized and unique products. One of the main advantages of shopping for cat food in a supermarket or hypermarket is convenience. These types of retailers are typically located in easily accessible areas, providing pet owners with a quick and easy option to purchase their required cat food products. Moreover, these stores offer customers the opportunity to compare various brands and prices and make informed decisions based on their budget and quality preferences.

Specialty stores include small, locally-owned pet stores or larger chains focused specifically on pet supplies, such as Petco or Petsmart. Many of these stores focus on providing a premium shopping experience for customers and their pets, offering a wide selection of high-quality foods and other pet products.

The online channels segment is anticipated to witness significant growth during the forecast period. Online stores have become increasingly popular in recent years, providing pet owners with a convenient, simple, and efficient way to access high-quality products. Online stores offer a range of options for cat owners, including premium and specialty food brands that may not be available in traditional retail stores. Moreover, the onset of COVID-19 has further contributed to the increased usage of online platforms. According to the data released by Amazon U.S., in 2022, there was an increase in online cat food demand, with 13,902 shoppers compared to 10,405 shoppers in 2021.

Regional Insights

North America dominated the market with a revenue share of 45.8% in 2022. This is attributed to the growing adoption of pets in the region. Pet ownership is increasing in North America due to a variety of factors, including an increase in disposable income, changing attitudes toward pets and their role in the family, and improvements in pet care and nutrition. According to the American Pet Products Association (APPA), as of 2023, 66% of U.S. households (86.9 million homes) own a pet, which is up from 56% in 1988. Dogs are the most popular pets in the U.S., followed by cats and freshwater fish. The increase in pet ownership is associated with rising urbanization, pet humanization, and a desire for companionship. Additionally, the COVID-19 pandemic also contributed to an increase in pet adoption and ownership with pet food spending growing by 11% in 2020 in the U.S.

Europe is another region anticipated to witness growth over the forecast period. According to the European Pet Food Organization, over 90 million households in Europe own a pet with 110 million cats followed by 90 million dogs in 2022. Additionally, the food industry for pets in the region accounted for USD 28.89 billion in 2021. Thus, factors such as the advancing pet food industry and the growing adoption of cats are anticipated to drive product demand over the forecast period.

Key Companies & Market Share Insights

The cat food industry is moderately fragmented with the presence of small and large players in the market. Key participants are investing in innovations, product launches, and mergers and acquisitions to improve their market share and gain a competitive edge. For instance, in February 2023, Mars Petcare announced the completion of the acquisition of Canadian pet food company, Champion Petfoods, to bolster its product portfolio. This acquisition will specifically add two high-quality brands, ACANA and ORIJEN, to Mars Petcare's offerings in the pet food industry. Some prominent players in the global cat food market include:

-

Mars Petcare

-

Nestle Purina PetCare Company

-

Hill's Pet Nutrition

-

J.M Smucker

-

Diamond Pet Foods

-

Affinity Petcare SA

-

Evanger’s Dog and Cat Food Company Inc.

-

Fromm Family Foods LLC

-

Nutro Products Inc.

Cat Food Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 32.66 billion

Revenue forecast in 2030

USD 44.32 billion

Growth rate

CAGR of 4.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, region

Key companies profiled

Mars Petcare; Nestle Purina PetCare Company; Hill's Pet Nutrition; J.M Smucker; Affinity Petcare SA; Diamond Pet Foods; Evanger’s Dog and Cat Food Company Inc.; Fromm Family Foods LLC; Nutro Products Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

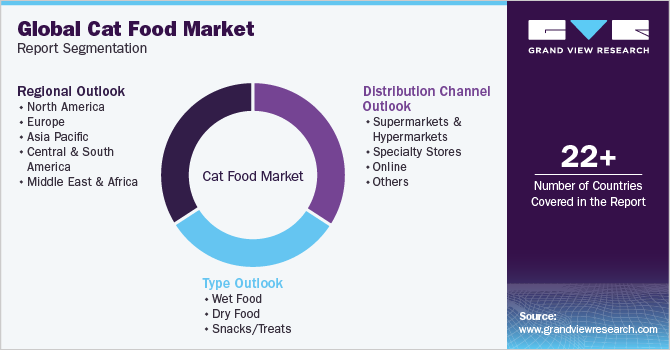

Global Cat Food Market Report Segmentation

This report forecasts revenue & volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cat food market report based on type, distribution channel, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Wet Food

-

Dry Food

-

Snacks/Treats

-

-

Distribution Channel Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Supermarkets and Hypermarkets

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

Australia

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cat food market size was estimated at USD 31.28 billion in 2022 and is expected to reach USD 32.66 billion in 2023

b. The global cat food market is expected to grow at a compound annual growth rate of 4.4% from 2023 to 2030 to reach USD 44.32 billion by 2030.

b. North America dominated the cat food market with a revenue share of 45.8% in 2022. This is attributed to the growing adoption of pets in the region.

b. Some key players operating in the cat food market include Mars Petcare, Nestle Purina PetCare Company, Hill's Pet Nutrition, J.M Smucker, Affinity Petcare SA, Rollover Pet Food Ltd., Evanger’s Dog and Cat Food Company Inc., Fromm Family Foods LLC, Nutro Products Inc.

b. Key factors that are driving the market growth include growing ownership of cats, humanization of pets, and a growing awareness of the importance of pet nutrition worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.