- Home

- »

- Consumer F&B

- »

-

Cassava Market Size, Share & Growth, Industry Report 2030GVR Report cover

![Cassava Market Size, Share & Trends Report]()

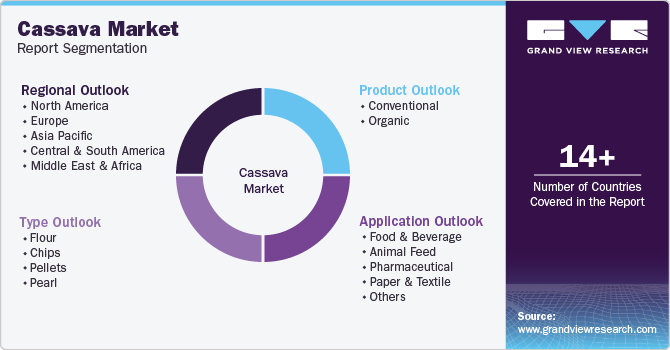

Cassava Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Conventional, Organic), By Type (Flour, Chips), By Application (Animal Feed, Pharmaceutical), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-498-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cassava Market Summary

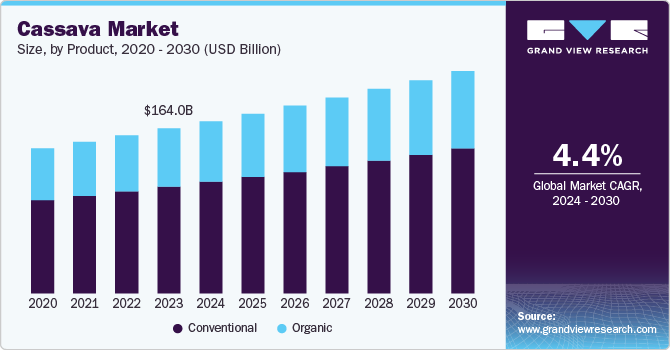

The global cassava market size was estimated at USD 171.1 billion in 2024 and is anticipated to reach USD 220.9 billion by 2030, growing at a CAGR of 4.3% from 2025 to 2030. One of the primary reasons for this growth is the increasing demand for gluten-free products.

Key Market Trends & Insights

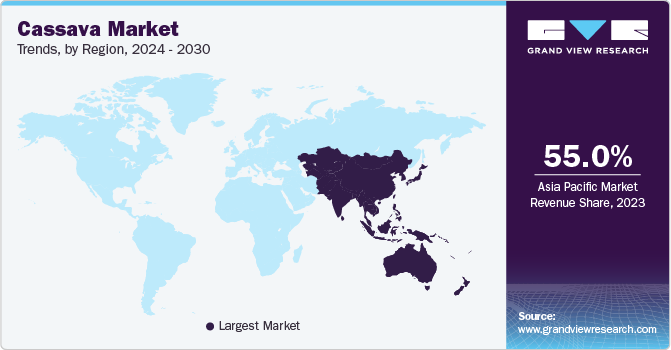

- Asia Pacific cassava market accounted for over 55% of the global market in 2023.

- The cassava market in North America is expected to grow at a CAGR of 4.1% from 2024 to 2030.

- In terms of product, conventional cassava accounted for a revenue of USD 105 billion in 2023.

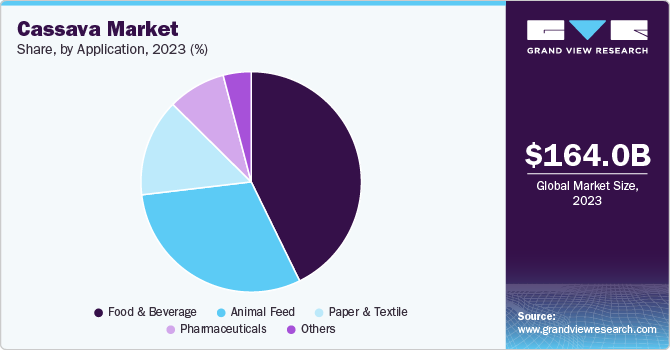

- By application, the food & beverage applications of cassava was valued at USD 70 billion in 2023.

- By type, cassava’s use as cassava flour is expected to grow at a CAGR of 4.50%.

Market Size & Forecast

- 2024 Market Size: USD 171.1 Billion

- 2030 Projected Market Size: USD 220.9 Billion

- CAGR (2025-2030): 4.3%

- Asia Pacific: Largest market in 2023

With rising health consciousness among consumers, particularly in Western markets, cassava has gained recognition as a nutritious alternative to wheat and other gluten-containing grains. This trend is reflected in the growing popularity of cassava-based foods, such as flour, snacks, and noodles, which cater to individuals with gluten intolerance or those pursuing gluten-free diets.Technological advancements in cassava processing also play a crucial role in market expansion. Innovations in processing techniques have improved the efficiency and quality of cassava-derived products. For instance, advancements in extraction methods for cassava starch have led to higher yields and better product characteristics, making it more appealing for use in food and industrial applications. Developing value-added products, such as cassava flour and biodegradable packaging materials, has further broadened the scope of cassava's market potential.

Another significant driver is the growing awareness of cassava's nutritional benefits. As consumers become more informed about their dietary choices, there is an increasing recognition of cassava's role as a source of carbohydrates and dietary fiber. This shift towards healthier eating habits has prompted manufacturers to explore cassava's applications beyond traditional uses, leading to innovations in food products that highlight its nutritional profile.

Governmental support for cassava production is also instrumental in fostering market growth. Many countries recognize cassava's potential for enhancing food security and rural livelihoods, prompting initiatives that promote its cultivation and processing. Such support includes farmers' subsidies, research and development investment, and infrastructure improvements to enhance supply chains. These efforts boost local economies and facilitate increased production capacity to meet global demand.

The expanding applications of cassava across various industries further contribute to its market growth. Beyond food products, cassava is increasingly utilized in animal feed, biofuels, and bioplastics. The rise of eco-friendly packaging solutions has opened new avenues for cassava starch, positioning it as a sustainable alternative to petroleum-based plastics. This diversification into multiple sectors enhances its market resilience and attractiveness to investors.

The cassava industry faces several challenges that hinder its growth and development, particularly in regions where it is a staple crop. One of the most significant issues is post-harvest losses. Cassava is a highly perishable crop; improper handling and storage can lead to substantial waste. In many producing countries, inadequate infrastructure for transportation and storage exacerbates this problem, resulting in a loss of both quantity and quality of the crop before it reaches consumers or processing facilities. This inefficiency affects food security and diminishes the income potential for farmers who rely on cassava as their primary source of livelihood.

Another challenge is the limited access to markets for smallholder farmers. Many cassava producers operate on subsistence and lack the resources to engage in larger, more profitable markets. Marketing cassava can be particularly difficult due to its bulky nature and perishability, which increase transportation costs. In addition, small-scale farmers often receive a lower share of the market price due to the lack of organized marketing channels and bargaining power, which prevents them from maximizing their profits.

Product Insights

Conventional cassava was the leading segment and accounted for a market value of USD 105 billion in 2023. The growth of the conventional cassava industry is primarily driven by its versatility and cost-effectiveness as a staple food source. With increasing urbanization and a growing global population, there is a rising demand for affordable and accessible food products. Conventional cassava, often produced on a larger scale using established agricultural practices, can meet this demand efficiently. Moreover, conventional cassava products, such as starch and flour, are widely used in various food applications, including snacks, baked goods, and sauces, further propelling market growth. The affordability and availability of conventional cassava make it an attractive option for consumers and manufacturers looking to capitalize on its culinary applications.

Organic is expected to grow at a CAGR of 4.1% from 2024 to 2030 due to heightened consumer awareness regarding health and sustainability. As more people seek clean-label foods free from synthetic pesticides and fertilizers, organic cassava products have gained popularity among health-conscious consumers. This segment benefits from the increasing trend toward gluten-free diets and the demand for natural ingredients in the food industry. Moreover, government initiatives supporting organic farming practices have also contributed to expanding organic cassava cultivation. The appeal of organic products often lies in their perceived higher quality and safety standards, which resonate with consumers looking for healthier alternatives.

When comparing the two, conventional cassava is often preferred for its lower price point and widespread availability, making it a staple in many households, particularly in developing regions where affordability is crucial. Its established supply chains ensure consistent access to products used in everyday cooking. On the other hand, organic cassava is favored by consumers who prioritize health benefits and environmental sustainability over cost. Organic products are perceived as healthier options that support sustainable agricultural practices, appealing to those willing to pay a premium for quality and ethical sourcing. This dichotomy highlights the diverse consumer preferences that drive both segments of the cassava industry.

Type Insights

Cassava’s use as cassava flour is expected to grow at a CAGR of 4.50%. The rise in demand for gluten-free products is a primary factor driving this growth, as consumers seek alternatives to wheat flour due to health concerns related to gluten intolerance. Furthermore, cassava flour's versatility in various culinary applications—from baking to thickening sauces—makes it a popular choice among health-conscious consumers and food manufacturers.

Cassava chips are also gaining traction as a popular snack option. The increasing consumer preference for healthier snacks and the growing trend toward plant-based diets have contributed to the demand for cassava chips. These chips are often marketed as a gluten-free and lower-calorie alternative to traditional potato chips, appealing to health-conscious consumers looking for nutritious snack options. The expansion of retail channels and online sales platforms further supports the growth of this segment.

The cassava pellets segment is witnessing growth due to their use as an animal feed ingredient. As livestock producers seek cost-effective and nutritious feed options, cassava pellets have gained popularity for their high energy content and digestibility. The increasing global demand for meat and dairy products drives the need for efficient animal feed solutions, positioning cassava pellets favorably within the agricultural sector. In addition, their availability and affordability compared to other feed sources contribute to their market expansion.

Cassava pearls, often used in beverages and desserts, are also experiencing growth driven by the rising popularity of bubble tea and similar drinks. Their unique texture and versatility make them an attractive ingredient for food manufacturers looking to innovate within the beverage sector. As consumer interest in exotic and novel food experiences grows, cassava pearls are becoming more mainstream, increasing demand across various markets.

Application Insights

Food & beverage applications of cassava was valued at USD 70 billion in 2023. The food industry represents one of the largest applications for cassava, driven by the increasing demand for gluten-free and alternative starches. As health-conscious consumers seek natural and gluten-free options, cassava flour and starch have become substitutes for wheat flour in baking and cooking. The versatility of cassava allows it to be used in a wide range of food products, including snacks, sauces, and baked goods. Furthermore, the rise of plant-based diets and clean-label products has further fueled the demand for cassava-based ingredients in food manufacturing. This trend is expected to continue as more consumers prioritize health and wellness in their dietary choices.

Animal feed application of cassava is expected to grow at a CAGR of 4.6% from 2024 to 2030. The use of cassava in animal feed is another significant application experiencing growth. Cassava is recognized for its high energy content and digestibility, making it an attractive feed option for livestock. As global meat consumption rises, livestock producers are increasingly looking for cost-effective and nutritious feed alternatives. Cassava pellets and chips are often incorporated into animal diets to enhance energy levels while maintaining nutritional balance. The growing demand for meat and dairy products globally drives the need for efficient animal feed solutions, positioning cassava favorably within this sector.

The textile industry is another application where cassava starch is seeing increased utilization. Cassava starch serves as a sizing agent in textile manufacturing, providing strength and durability to fabrics. The growth of the textile industry, particularly in developing regions where cassava is abundantly produced, supports the demand for natural starches as eco-friendly alternatives to synthetic chemicals. As sustainability becomes a priority in textile production, the appeal of cassava starch as a biodegradable option is likely to drive further growth in this application.

The pharmaceutical sector utilizes cassava starch as an excipient in drug formulations. Its properties as a binder and disintegrant make it valuable in tablet manufacturing. The growing pharmaceutical industry, particularly in emerging markets where access to medications is expanding, drives demand for reliable excipients like cassava starch. As healthcare systems evolve and focus on improving drug delivery systems, the role of cassava in pharmaceuticals is expected to grow.

Regional Insights

Asia Pacific cassava market accounted for over 55% of the global market in 2023. The market growth in Asia is primarily driven by increasing demand for cassava-based products across various sectors, including food, pharmaceuticals, and textiles. As consumers become more health-conscious and seek gluten-free options, cassava flour and starch have gained popularity as versatile alternatives to traditional ingredients. Innovations in processing technology have further enhanced the quality and functionality of cassava products, making them more appealing to manufacturers. Moreover, the rising trend of veganism and vegetarianism in the region has contributed to the growth of cassava as a key ingredient in plant-based diets, positioning it as a staple food source that meets evolving consumer preferences.

Countries like Thailand, Vietnam, and Indonesia lead cassava production and innovation in Southeast Asia. Thailand is recognized as the largest exporter of raw cassava globally, benefiting from its efficient processing methods and established supply chains. Vietnam has also seen significant growth in cassava cultivation, mainly for animal feed, as farmers increasingly incorporate cassava into their livestock diets to enhance energy levels. Indonesia stands out for its diverse applications of cassava at the household level, with innovations in processing that cater to local markets. These countries are capitalizing on their favorable climatic conditions for cassava cultivation while investing in research and development to improve yields and processing techniques. Combining rising domestic consumption and export opportunities drives robust market growth in Southeast Asia.

North America Cassava Market Trends

The cassava market in North America is expected to grow at a CAGR of 4.1% from 2024 to 2030. The market growth in North America is driven by increasing consumer awareness regarding health and nutrition, coupled with rising demand for gluten-free and alternative food products. As consumers become more health-conscious, they seek natural and nutritious ingredients to incorporate into their diets. Cassava, known for its high starch content and versatility, has become popular in various food applications, including snacks, baked goods, and gluten-free flour. The trend towards clean-label products has also contributed to the market's expansion, as consumers prefer minimally processed foods free from artificial additives.

The U.S. cassava market is expected to reach USD 34 billion by 2030. The largest segment within this market is the food and beverage sector, which accounted for over 60% of the revenue share in 2024. This growth is fueled by the increasing popularity of cassava flour as a gluten-free alternative among consumers with dietary restrictions and those looking to diversify their carbohydrate sources. In addition, the rise of plant-based diets and innovations in product formulations are further boosting the demand for cassava-based ingredients in various culinary applications across the United States.

Key Cassava Company Insights

The key players are Grain Millers, Inc., Woodland Foods, Mhogo Foods Ltd., Otto's Naturals, Venus Starch Industries, and Cargill. These companies leverage strategies such as product launches, acquisitions, and partnerships to enhance their market presence and adapt to changing consumer demands. Technological advancements also influence the competitive landscape, with many companies investing in research and development to improve processing efficiency and product quality. This focus on innovation is essential for maintaining competitiveness in a market that increasingly values health-conscious and natural food products.

Key Cassava Companies:

The following are the leading companies in the cassava market. These companies collectively hold the largest market share and dictate industry trends.

- Agrideco Vietnam Co., Ltd.

- American Key Food Products Inc.

- Archer Daniels Midland Company

- Cargill, Incorporated

- Grain Millers Inc.

- Ingredion Inc.

- Parchem Fine and Specialty Chemicals

- Psaltry International Ltd.

- Tate & Lyle Plc

- Venus Starch Suppliers

Cassava Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 178.6 billion

Revenue forecast in 2030

USD 220.9 billion

Growth rate (revenue)

CAGR of 4.3% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Indonesia; Thailand; Brazil; Saudi Arabia

Key companies profiled

Agrideco Vietnam Co., Ltd.; American Key Food Products Inc.; Archer Daniels Midland Company; Cargill, Incorporated; Grain Millers Inc.; Ingredion Inc.; Parchem Fine and Specialty Chemicals; Psaltry International Ltd.; Tate & Lyle Plc; Venus Starch Suppliers

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cassava Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and analyzes the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cassava market report based on product, application, type, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Conventional

-

Organic

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Flour

-

Chips

-

Pellets

-

Pearl

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Food & Beverage

-

Animal Feed

-

Pharmaceutical

-

Paper & Textile

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Thailand

-

Indonesia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global cassava market was valued at USD 164 billion in 2023.

b. The global cassava market is expected to grow at a CAGR of 4.4% from 2024 to 2030.

b. Cassava use as cassava flour is expected to grow at a CAGR of 4.50%. The rise in demand for gluten-free products is a primary factor driving this growth, as consumers seek alternatives to wheat flour due to health concerns related to gluten intolerance. Additionally, cassava flour's versatility in various culinary applications—from baking to thickening sauces—makes it a popular choice among health-conscious consumers and food manufacturers.

b. • Agrideco Vietnam Co., Ltd. • American Key Food Products Inc. • Archer Daniels Midland Company • Cargill, Incorporated • Grain Millers Inc. • Ingredion Inc. • Parchem Fine and Specialty Chemicals • Psaltry International Ltd. • Tate & Lyle Plc • Venus Starch Suppliers

b. One of the primary reasons for this growth is the increasing demand for gluten-free products. With rising health consciousness among consumers, particularly in Western markets, cassava has gained recognition as a nutritious alternative to wheat and other gluten-containing grains. This trend is reflected in the growing popularity of cassava-based foods, such as flour, snacks, and noodles, which cater to individuals with gluten intolerance or those pursuing gluten-free diets.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.