- Home

- »

- Consumer F&B

- »

-

Cassava Flour Market Size & Share, Industry Report, 2030GVR Report cover

![Cassava Flour Market Size, Share & Trends Report]()

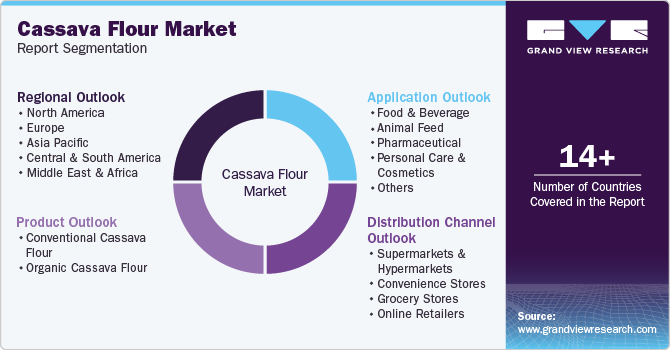

Cassava Flour Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Conventional Cassava Flour, Organic Cassava Flour), By Application, By Distribution Channel (Supermarkets & Hypermarkets), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-493-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cassava Flour Market Summary

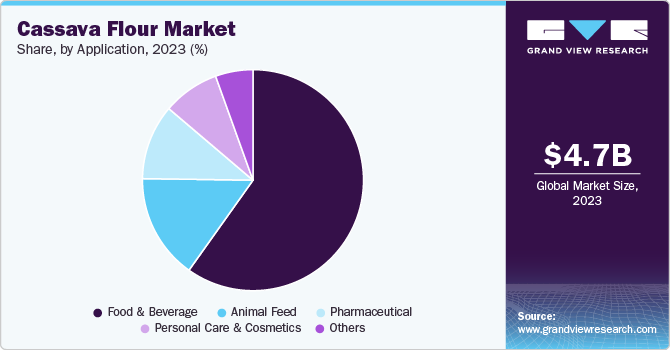

The global cassava flour market size was estimated at USD 4.74 billion in 2023 and is projected to reach USD 7.24 billion by 2030, growing at a CAGR of 6.3% from 2024 to 2030. The market is experiencing significant growth driven by various factors that cater to changing consumer preferences and market dynamics.

Key Market Trends & Insights

- Asia Pacific cassava flour market held the largest revenue share of 57.3% in 2023.

- The U.S. cassava flour market was valued at USD 780 million in 2023 and is expected to grow at a CAGR of 6.1% from 2024 to 2030.

- By product, the conventional cassava flour segment held the largest revenue of USD 3.03 billion in 2023

- By distribution channel, the supermarkets and hypermarkets held the largest revenue of 2.28 billion in 2023

- By application, the food & beverage held the largest revenue of USD 2.84 billion in 2023.

Market Size & Forecast

- 2023 Market Size: USD 4.74 Billion

- 2030 Projected Market Size: USD 7.24 Billion

- CAGR (2024-2030): 6.3%

- Asia Pacific: Largest market in 2023

One of the primary drivers is the increasing demand for functional foods. As consumers become more health-conscious, there is a notable shift towards foods that offer health benefits, such as higher fiber content and gluten-free options. Cassava flour meets these demands effectively, being naturally gluten-free and rich in carbohydrates and fiber, which supports digestive health and provides sustained energy. This trend is fostering innovation in product development, leading to a broader acceptance of cassava flour in health-oriented food products.Another critical factor propelling the industry is the expansion of the food and beverage industry. With urbanization and a growing working population, particularly in emerging economies like India and China, there is an escalating need for convenient food options. Cassava flour's versatility makes it an attractive ingredient for various applications, including baked goods, snacks, and gluten-free products. Its ability to align with the rising trend of plant-based diets further enhances its appeal, allowing manufacturers to cater to a diverse consumer base seeking healthier alternatives.

Another critical factor propelling the industry is the expansion of the food and beverage industry. With urbanization and a growing working population, particularly in emerging economies like India and China, there is an escalating need for convenient food options. Cassava flour's versatility makes it an attractive ingredient for various applications, including baked goods, snacks, and gluten-free products. Its ability to align with the rising trend of plant-based diets further enhances its appeal, allowing manufacturers to cater to a diverse consumer base seeking healthier alternatives.

The growing awareness of nutritional benefits associated with cassava flour is also a significant driver. As consumers become more informed about the foods they consume, there is an increasing preference for ingredients that provide health benefits. Cassava flour's higher fiber content compared to other gluten-free flours positions it as a nutritious alternative that not only meets dietary restrictions but also contributes positively to overall health. This awareness is leading to greater consumer demand for products containing cassava flour, thereby boosting market growth.

Technological advancements in food processing and production are enhancing the industry landscape as well. Innovations in processing methods have improved the quality and functionality of cassava flour, making it more appealing to manufacturers and consumers alike. The development of clean-label products-those free from artificial additives-has become a priority for many food producers. Cassava flour fits well into this category, offering a natural ingredient that aligns with consumer preferences for transparency and healthfulness in food products.

The rise of e-commerce has transformed how consumers access food products, including cassava flour. Online retail platforms provide convenience and a wider selection of products, enabling consumers to explore various brands and types of cassava flour easily. This shift towards digital shopping is particularly pronounced among younger consumers who prioritize convenience and variety in their purchasing decisions. As online sales channels continue to grow, they are expected to significantly contribute to the overall expansion of the cassava flour industry.

The increasing demand for gluten-free options across various demographics has created substantial opportunities for cassava flour. With rising incidences of gluten intolerance and celiac disease, more consumers are seeking gluten-free alternatives in their diets. Cassava flour's inherent properties make it an ideal substitute for wheat flour in many recipes, further solidifying its position in both home cooking and commercial food production. The trend towards gluten-free diets is expected to continue driving demand for cassava flour as a staple ingredient in gluten-free formulations.

The cassava flour industry faces several challenges that could hinder its growth and stability. One major issue is raw material scarcity and price volatility. The production of cassava flour relies heavily on the availability of high-quality cassava roots, which can be affected by various factors such as climate change, pests, and diseases. These variables lead to inconsistent yields, making it difficult for producers to maintain a steady supply chain. Additionally, fluctuations in raw material prices can significantly impact production costs, ultimately affecting the pricing of cassava flour in the market. This unpredictability can deter investment and limit the profitability of cassava flour businesses, creating a challenging environment for both small-scale farmers and larger manufacturers.

Another significant challenge is related to post-harvest losses and processing inefficiencies. Many regions lack adequate infrastructure for the storage and processing of cassava, leading to substantial waste after harvesting. Insufficient facilities can compromise the quality of cassava flour and increase operational costs for producers. Moreover, cassava contains naturally occurring cyanogenic compounds that can be toxic if not processed correctly. Ensuring safe processing methods is crucial but can be resource-intensive and complex, posing additional barriers for producers. The combination of these factors not only affects supply but also contributes to a lack of consumer confidence in cassava flour products, further complicating market expansion efforts.

Product Insights

The conventional cassava flour segment held the largest revenue of USD 3.03 billion in 2023. The preference for conventional cassava flour is primarily driven by cost-effectiveness and availability. Conventional cassava flour typically has a lower production cost compared to its organic counterpart, making it more accessible to a broader range of consumers and food manufacturers. The cultivation of cassava under conventional farming practices often yields higher quantities, allowing for greater supply and lower prices in the market. This affordability is particularly significant in developing regions where cassava serves as a staple food source. As a result, many consumers and businesses opt for conventional cassava flour to meet their dietary needs without incurring higher costs associated with organic products.

In addition, the widespread acceptance and versatility of conventional cassava flour contribute to its dominance in the market. Conventional cassava flour is recognized for its neutral flavor and texture, making it an ideal substitute for wheat flour in various culinary applications, including baking, frying, and thickening. This versatility allows it to cater to diverse consumer preferences, particularly among those seeking gluten-free options. Furthermore, the established infrastructure for processing and distributing conventional cassava flour supports its availability in supermarkets and food service establishments, reinforcing its position as a preferred choice among consumers who prioritize practicality and convenience.

The demand for organic cassava flour is significantly driven by increasing consumer awareness and preference for health-conscious products. As consumers become more informed about the benefits of organic foods, there is a growing inclination towards products that are free from synthetic pesticides and fertilizers. Organic cassava flour, derived from cassava roots grown without these chemicals, appeals to health-conscious individuals seeking cleaner, more natural food options. This trend is particularly strong among those with dietary restrictions, such as gluten intolerance or celiac disease, as organic cassava flour serves as an excellent gluten-free alternative. Its nutritional profile, which includes beneficial carbohydrates and fiber, further enhances its attractiveness as a healthful ingredient in various culinary applications.

Distribution Channel Insights

Supermarkets and hypermarkets held the largest revenue of 2.28 billion in 2023. Supermarkets and hypermarkets typically have established supply chains that ensure consistent availability of cassava flour, catering to the rising demand for gluten-free and health-conscious alternatives. This convenience is particularly appealing in regions where consumers prefer in-person shopping experiences, allowing them to physically assess the product before purchase. The ability to browse various brands and types of cassava flour in one location enhances consumer confidence and encourages trial among those unfamiliar with the product.

In addition, in-store promotions and education play a crucial role in boosting sales of cassava flour in these retail environments. Supermarkets and hypermarkets often engage in marketing strategies that highlight the health benefits and versatility of cassava flour, positioning it as a desirable ingredient for gluten-free baking and cooking. By providing recipe suggestions and nutritional information, these retailers can effectively educate consumers about the uses of cassava flour, driving interest and encouraging purchases. As more consumers become aware of dietary restrictions and seek healthier food options, the strategic placement of cassava flour within these stores helps to capitalize on this trend, further contributing to its sales growth in the food market.

Online distribution of cassava flour is expected to grow at a CAGR of 6.6% from 2024 to 2030. The growth of sales of cassava flour through online channels is largely driven by increased consumer convenience and the expanding e-commerce landscape. As more consumers turn to online shopping for their grocery needs, the ability to purchase cassava flour from the comfort of home has significantly boosted its accessibility. Online platforms offer a wide variety of brands and types of cassava flour, allowing consumers to compare products easily, read reviews, and make informed choices. This convenience is particularly appealing to health-conscious consumers who may be seeking specific dietary options, such as gluten-free or organic cassava flour, which might not be as readily available in local stores. The rise of mobile shopping apps and delivery services further enhances this convenience, encouraging more consumers to explore and purchase cassava flour online.

Application Insights

Food & beverage held the largest revenue of USD 2.84 billion in 2023. The segment’s growth is significantly driven by the rising demand for gluten-free and health-conscious products. As more consumers adopt gluten-free diets due to health concerns such as celiac disease or gluten sensitivity, cassava flour has emerged as a preferred alternative to traditional wheat flour. Its versatility allows it to be used in a variety of applications, including gluten-free breads, pastries, and snacks, catering to the needs of a growing demographic seeking nutritious and allergen-friendly options. Furthermore, cassava flour's high fiber content and low calorie density make it an attractive ingredient for health-focused consumers, contributing to its increasing adoption in the production of functional foods that promote better digestion and overall well-being.

Another key driver is the shift towards clean-label and sustainable food ingredients. Consumers are increasingly prioritizing transparency in food sourcing and production methods, leading to a preference for natural ingredients like cassava flour that do not contain artificial additives. The sustainability of cassava as a drought-resistant crop also appeals to environmentally conscious consumers and manufacturers alike. This trend encourages food producers to innovate and diversify their product offerings, incorporating cassava flour into ready-to-eat meals, snacks, and beverages. As the food and beverage industry continues to expand globally, the adaptability of cassava flour positions it as a valuable ingredient that meets evolving dietary trends and consumer preferences for healthier, plant-based options.

The animal feed segment is expected to grow at a CAGR of 5.8% from 2024 to 2030. The segment’s growth is primarily driven by its high energy content and cost-effectiveness. Cassava flour is rich in carbohydrates, making it an excellent energy source for livestock. Its high starch content provides a readily digestible form of energy, which is particularly beneficial in animal diets, especially for poultry and swine. As the demand for affordable feed options increases, especially in regions where traditional feed ingredients like maize are becoming more expensive or less accessible, cassava flour presents a viable alternative to help reduce overall feed costs while maintaining nutritional value.

Regional Insights

The North America casava market is expected to reach USD 1400 million by 2023. The market's growth is predominantly due to the increased demand in the U.S. and Canada. The rising awareness of the nutritional benefits of cassava flour-such as its high fiber content and potential health advantages-has further propelled its popularity among health-conscious consumers looking for clean-label products that align with their dietary preferences.

U.S. Cassava Flour Market Trends

The U.S. cassava flour market was valued at USD 780 million in 2023 and is expected to grow at a CAGR of 6.1% from 2024 to 2030. The growth of the cassava flour market in the U.S. is primarily driven by the increasing demand for gluten-free and health-conscious food options. As more consumers adopt gluten-free, paleo, and plant-based diets due to health concerns such as celiac disease and gluten intolerance, cassava flour has emerged as a versatile alternative to traditional wheat flour. Its ability to mimic the texture of wheat flour while being naturally gluten-free makes it an attractive choice for a variety of baked goods, snacks, and other culinary applications

Asia Pacific Cassava Flour Market Trends

Asia Pacific cassava flour marketheld the largest revenue share of 57.3% in 2023. The region’s growth, particularly in countries like China, Japan, and India, is significantly influenced by the increasing demand for cassava as a staple food and its versatility in various applications. In China, for instance, the rising population and urbanization have led to a greater reliance on cassava as an essential source of carbohydrates. The country has also seen a surge in the consumption of cassava-based products such as flour and starch, which are utilized in both food and industrial applications.

Similarly, India is experiencing a growing interest in cassava due to its adaptability as a drought-resistant crop that can thrive in diverse climatic conditions. This adaptability is crucial for food security in regions facing challenges related to climate change and agricultural sustainability. Japan, while not a major producer, benefits from imports of cassava products for use in traditional dishes and processed foods, further driving market demand.

In addition, the expansion of the food processing industry and changing dietary preferences are key factors propelling the market's growth in these Asian nations. The increasing popularity of gluten-free diets and health-conscious eating habits has led to a higher demand for cassava flour as a substitute for wheat flour. In India and China, there is a notable trend towards convenience foods that incorporate cassava starch due to its functional properties, such as thickening and stabilizing agents in sauces and snacks.

Furthermore, innovations in processing technologies are enhancing the quality and range of cassava-based products available in the market, making them more appealing to consumers. As these countries continue to invest in modernizing their food production systems and addressing nutritional needs, the cassava market is expected to see sustained growth driven by both domestic consumption and export opportunities within the region.

Key Cassava Flour Company Insights

Companies in the industry are leveraging the increasing consumer preference for gluten-free and health-oriented products, which has significantly boosted the demand for cassava flour in food and beverage applications. The industry also sees participation from companies focused on sustainability and clean-label products, which resonate with health-conscious consumers. For instance, firms like Psaltry International and MHOGO Foods emphasize sustainable practices in their cassava processing operations, catering to the rising interest in organic and natural food ingredients.

Key Cassava Flour Companies:

The following are the leading companies in the cassava flour market. These companies collectively hold the largest market share and dictate industry trends.

- DADTCO Rivers Cassava Processing Company

- Psaltry International

- PT Agromoda Solution Indonesia

- Green Hills Natural Foods

- MHOGO Foods

- Mocaf Factory

- Cargill

- Archer Daniels Midland Company (ADM)

- Grain Millers, Inc.

- Tereos Group

- Thai Wah Public Company Limited

- Roquette Frères

- Emsland Group

- Ingredion Incorporated

- Otto's Naturals

Cassava Flour Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.03 billion

Revenue forecast in 2030

USD 7.24 billion

Growth rate

CAGR of 6.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; Nigeria

Key companies profiled

DADTCO Rivers Cassava Processing Company; Psaltry International; PT Agromoda Solution Indonesia; Green Hills Natural Foods; MHOGO Foods; Mocaf Factory; Cargill; Archer Daniels Midland Company (ADM); Grain Millers, Inc.; Tereos Group; Thai Wah Public Company Limited; Roquette Frères; Emsland Group; Ingredion Incorporated; Otto's Naturals

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cassava Flour Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cassava flour market report based on the product, application, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Conventional Cassava Flour

-

Organic Cassava Flour

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Animal Feed

-

Pharmaceutical

-

Personal Care & Cosmetics

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Grocery Stores

-

Online Retailers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Nigeria

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the cassava flour market include DADTCO Rivers Cassava Processing Company; Psaltry International; PT Agromoda Solution Indonesia; Green Hills Natural Foods; MHOGO Foods; Mocaf Factory; Cargill; Archer Daniels Midland Company (ADM); Grain Millers, Inc.; Tereos Group; Thai Wah Public Company Limited; Roquette Frères; Emsland Group; Ingredion Incorporated; Otto's Naturals

b. The cassava flour market is experiencing significant growth driven by various factors that cater to changing consumer preferences and market dynamics. One of the primary drivers is the increasing demand for functional foods. As consumers become more health-conscious, there is a notable shift towards foods that offer health benefits, such as higher fiber content and gluten-free options. Cassava flour meets these demands effectively, being naturally gluten-free and rich in carbohydrates and fiber, which supports digestive health and provides sustained energy. This trend is fostering innovation in product development, leading to a broader acceptance of cassava flour in health-oriented food products.

b. The global cassava flour market was valued at USD 4.74 billion in 2023 and is expected to reach USD 5.03 billion in 2024.

b. The global cassava flour market is expected to grow at a CAGR of 6.3% from 2024 to 2030 to reach USD 7.24 billion by 2030.

b. Conventional cassava flour was the largest product category for the market with revenue of USD 3,032 million in 2023. The preference for conventional cassava flour is primarily driven by cost-effectiveness and availability. Conventional cassava flour typically has a lower production cost compared to its organic counterpart, making it more accessible to a broader range of consumers and food manufacturers. The cultivation of cassava under conventional farming practices often yields higher quantities, allowing for greater supply and lower prices in the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.